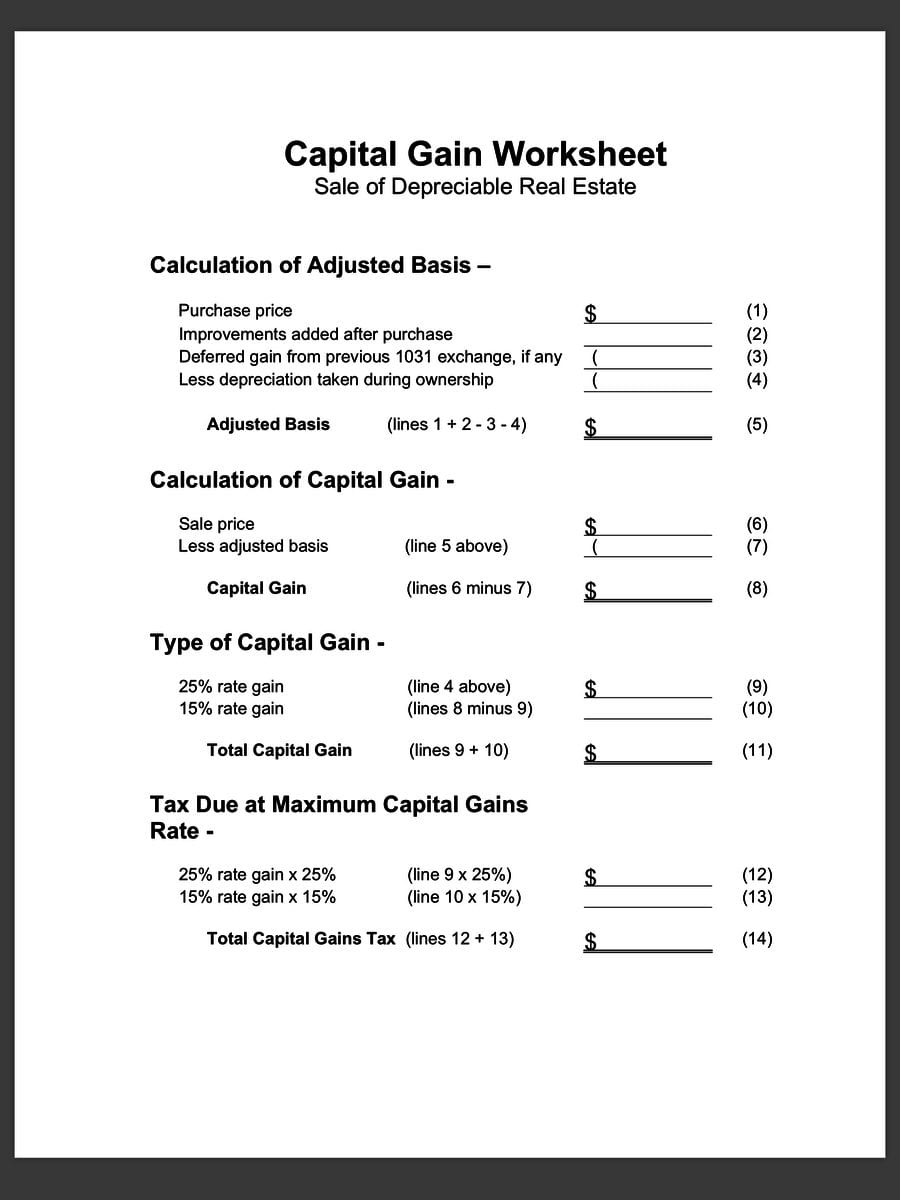

1031 Exchange Basis Worksheet

1031 Exchange Basis Worksheet - Noif both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. Ad own real estate without dealing with the tenants, toilets and trash. Web you can read the rules and details in irs publication 544, but here are some basics about how a 1031 exchange works and the steps involved. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. Web a 1031 exchange is a beneficial tool that can result in huge tax savings on the sale of real property. A taxpayer prepares to sell residential property a, which they’ve owned for 10 years, and which has an adjusted basis of $225,000. The taxpayer sells the property for. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. If both lines 9 and 10 are “no” and this is. Ad search for answers from across the web with searchresultsquickly.com. Noif both lines 9 and 10 are “no” and this is the year. Eligibility step 6—final determination of eligibility does your home qualify for a partial exclusion of gain? Discover the answers you need here! Noif both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax. Ad own real estate without dealing with the tenants, toilets and trash. But many taxpayers aren’t aware of the inner workings of a 1031. Noif both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Ad search for answers from across the web with searchresultsquickly.com. The general basis concept is that. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. The year of the exchange, stop here. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Enter the total of line 3.1 plus 3.2 to set. The taxpayer sells the property for. Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property sold.$ _____. See here for more details. A taxpayer prepares to sell residential property a, which they’ve owned for 10 years, and which has an adjusted basis of $225,000. The year. Noif both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Ad own real estate without dealing with the tenants, toilets and trash. Web the following is a worksheet to calculate basis in replacement property. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction. The year of the exchange, stop here. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property sold.$ _____. Discover the answers you need here! Web 1031 exchanges allow taxpayers. Discover the answers you need here! The taxpayer sells the property for. The general basis concept is that the new. Noif both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Ad search for answers from across the web with searchresultsquickly.com. Deferred exchanges are more complex but allow flexibility. Discover the answers you need here! Web 1031 exchanges allow taxpayers to defer capital gains. Noif both lines 9 and 10 are “no” and this is the year of the exchange, go to part iii. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. The general basis concept is that the new. Web 3.3 cost basis for unqualified property: Ad own real estate without dealing with the tenants, toilets and trash. Web you can. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Eligibility step 6—final determination of eligibility does your home qualify for a partial exclusion of gain? Enter the total of line 3.1 plus 3.2 to set the cost basis in the unqualified property received in exchange for the property sold.$ _____. A taxpayer prepares to sell residential property a, which they’ve owned for 10 years, and which has an adjusted basis of $225,000. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. The year of the exchange, stop here. But many taxpayers aren’t aware of the inner workings of a 1031. Ad own real estate without dealing with the tenants, toilets and trash. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. Web the following is a worksheet to calculate basis in replacement property. The general basis concept is that the new. Ad search for answers from across the web with searchresultsquickly.com. The taxpayer sells the property for. Web you can read the rules and details in irs publication 544, but here are some basics about how a 1031 exchange works and the steps involved. Web a 1031 exchange is a beneficial tool that can result in huge tax savings on the sale of real property. Web 1031 exchanges allow taxpayers to defer capital gains. Discover the answers you need here! Deferred exchanges are more complex but allow flexibility. In deferring those gains, your basis has to be recalculated. The year of the exchange, stop here. But many taxpayers aren’t aware of the inner workings of a 1031. In deferring those gains, your basis has to be recalculated. Eligibility step 6—final determination of eligibility does your home qualify for a partial exclusion of gain? Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Web 3.3 cost basis for unqualified property: See here for more details. Web a 1031 exchange is a beneficial tool that can result in huge tax savings on the sale of real property. The general basis concept is that the new. If both lines 9 and 10 are “no” and this is. Ad own real estate without dealing with the tenants, toilets and trash. Web 1031 exchanges allow taxpayers to defer capital gains. Web the following is a worksheet to calculate basis in replacement property. Ad search for answers from across the web with searchresultsquickly.com. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. Deferred exchanges are more complex but allow flexibility.1031 Exchange Calculation Worksheet CALCULATORVGW

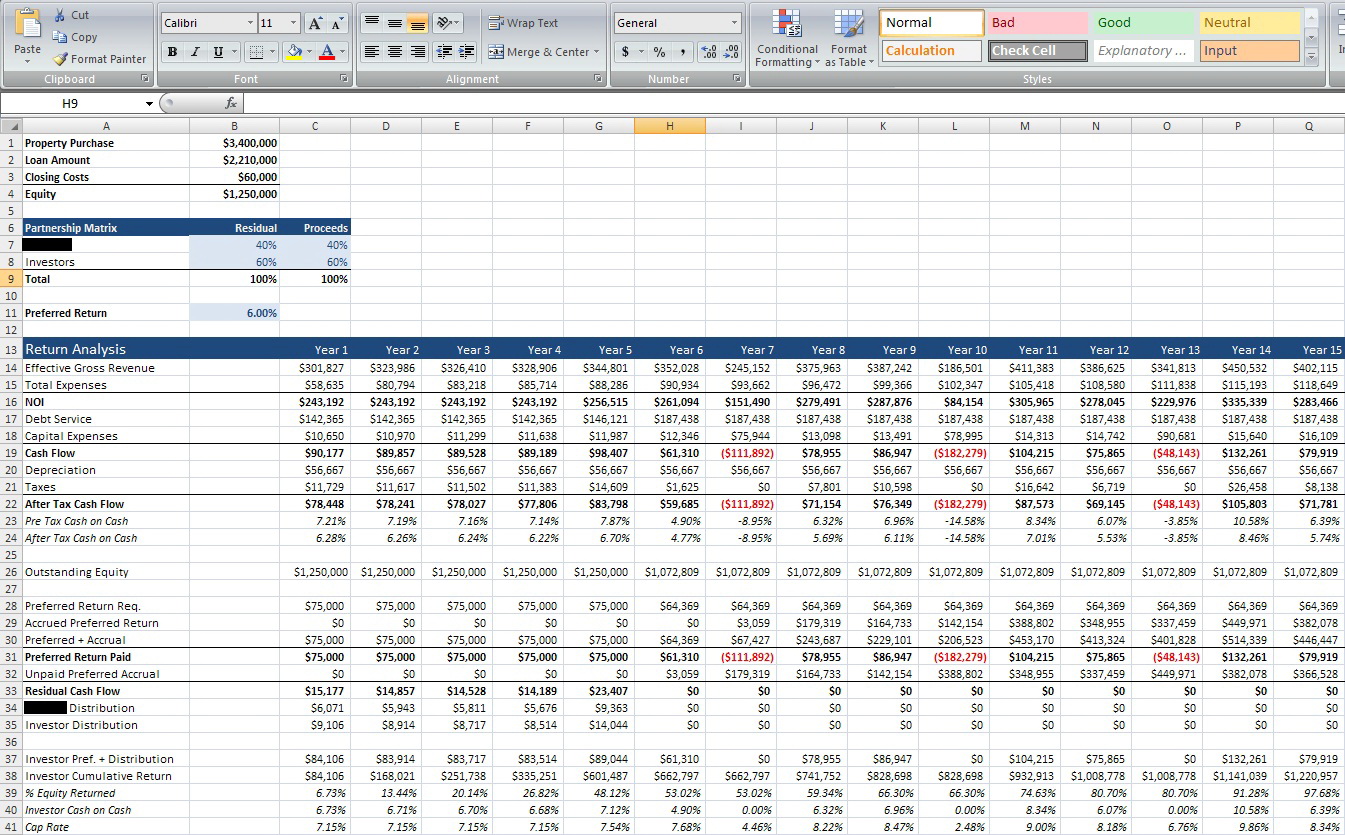

1031 Exchange Worksheet Excel Universal Network

1031 Exchange Worksheet

1031 Exchange Worksheet Excel Ivuyteq

1031 Exchange Worksheets Worksheets MTE5NzY Resume Examples

1031 Exchange Worksheet Strum Wiring

39 1031 like kind exchange worksheet Worksheet Live

1031 Exchange Agreement Form Universal Network

1031 Exchange Worksheet Excel Promotiontablecovers

1031 and 1033 EXERCISE In the following 1031

Web 2019 1031 Exchange Reporting Guide Helping To Simplify The Reporting Of Your 1031 Exchange Introduction In Our Ongoingcommitment To Provide Our Valued Clients With The.

Discover The Answers You Need Here!

The Taxpayer Sells The Property For.

Web The Simplest Type Of Section 1031 Exchange Is A Simultaneous Swap Of One Property For Another.

Related Post: