1031 Exchange Calculation Worksheet

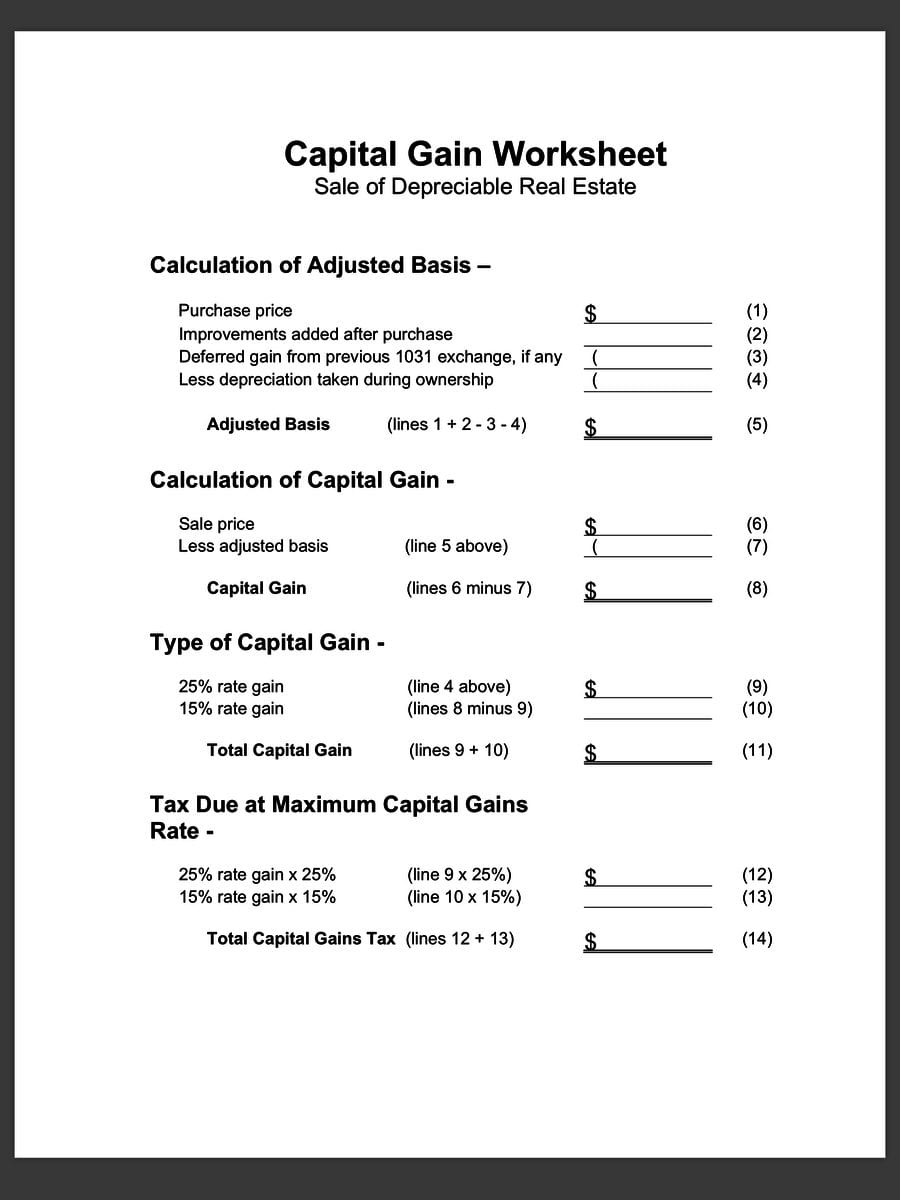

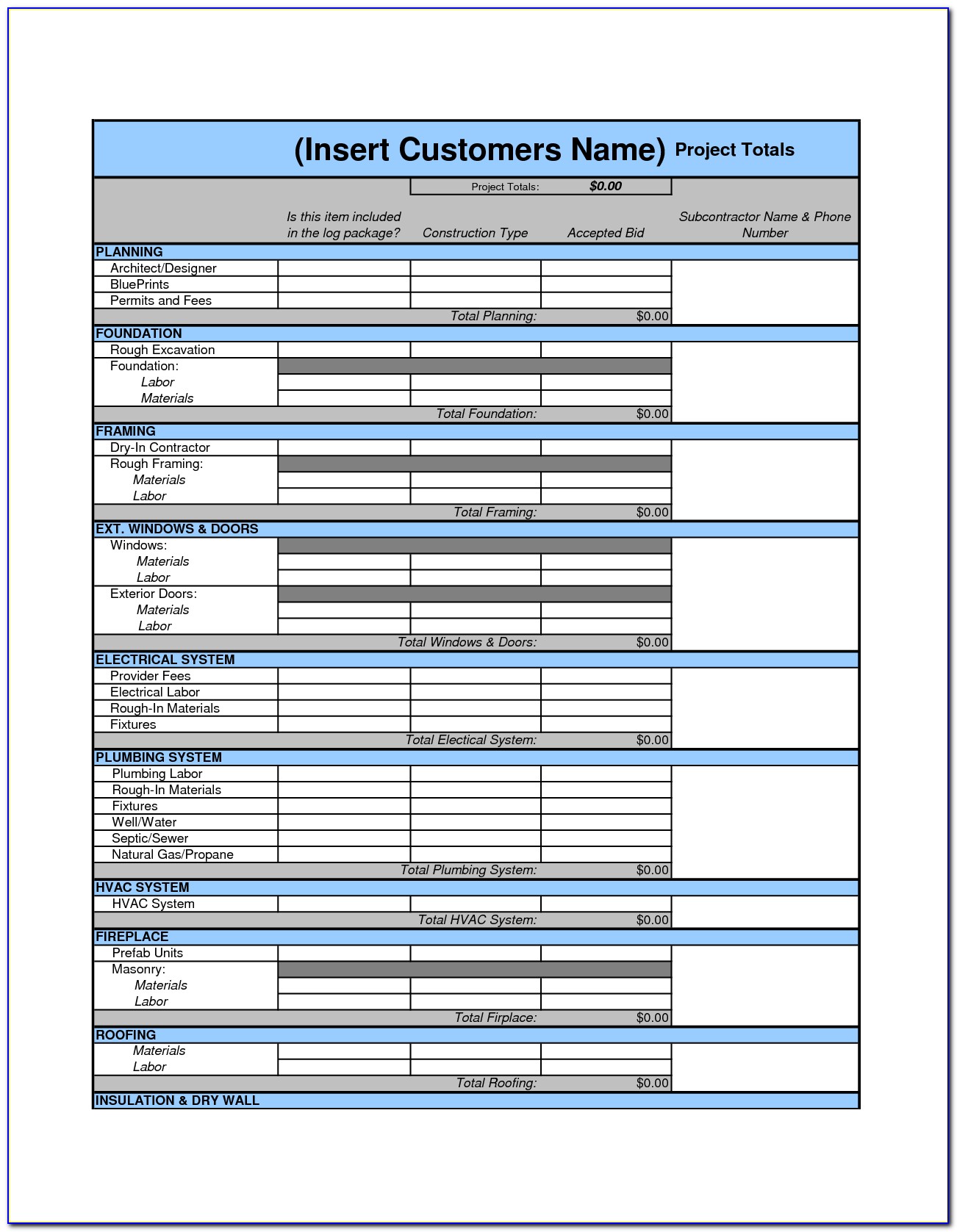

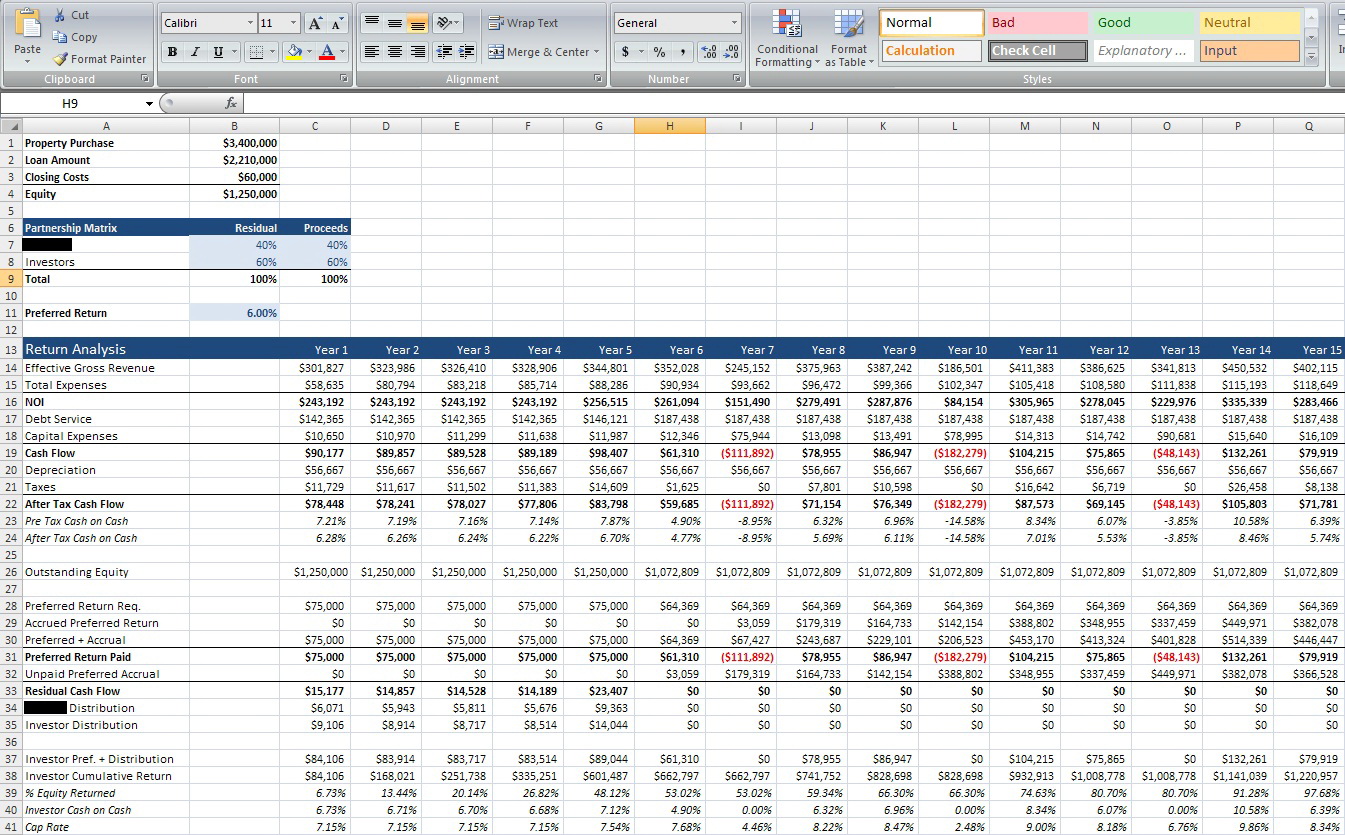

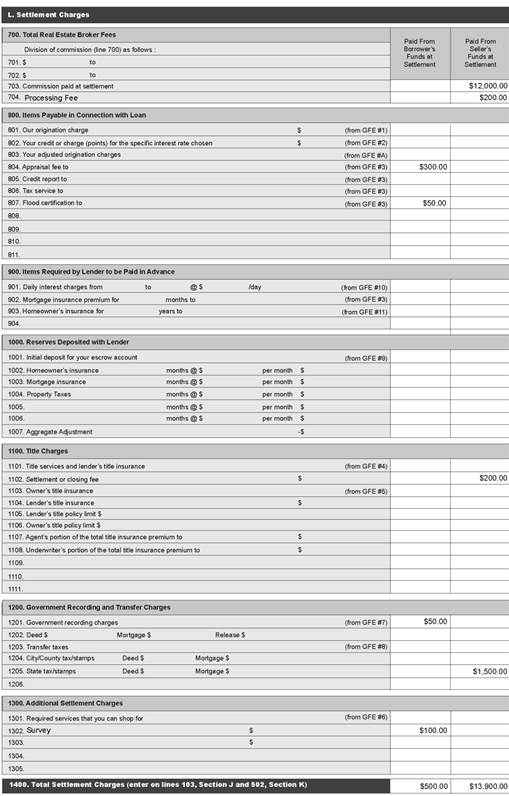

1031 Exchange Calculation Worksheet - Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Deferred exchanges are more complex but allow flexibility. Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. The $95,000 amount is the value. Ad delaware statutory trust 1031 exchange. However, the 1031 comes with many. Includes state taxes and depreciation recapture. First, there is a minimum value requirement. Get access to free 1031 exchange delaware statutory trust property listings Exchange expenses from sale of old property commissions $_____ 700. A 1031 exchange is a tax break. You can sell a property held for business or investment purposes and swap it for a new one that you purchase. Get access to free 1031 exchange delaware statutory trust property listings Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. Web realty exchange corporation has created this simple capital gains calculator and analysis form to. Get access to free 1031 exchange delaware statutory trust property listings The $95,000 amount is the value. Web requires only 10 inputs into a simple excel spreadsheet. A 1031 exchange is a tax break. Note that you can see all of the calculations so. Calculating taxes due upon sale vs 1031 exchange as a starting point, a taxpayer should always have a sense of his or her. Discover the answers you need here! Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web. A 1031 exchange can be a great way to defer taxes when selling real estate or other investments. Get access to free 1031 exchange delaware statutory trust property listings Ad search for answers from across the web with searchresultsquickly.com. Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. Web 1031 exchange savings calculator. Ad delaware statutory trust 1031 exchange. First, there is a minimum value requirement. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Ad own real estate without dealing with the tenants, toilets and trash. Web forbes advisor's capital gains tax calculator helps. Ad delaware statutory trust 1031 exchange. A 1031 exchange can be a great way to defer taxes when selling real estate or other investments. Web 1031 exchange savings calculator. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 replacement property. Web 1031 exchange examples. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Ad own real estate without dealing with the tenants, toilets and trash. Includes state taxes and depreciation recapture. The $95,000 amount is the value. $415,000 — cost basis of acquired property. You can sell a property held for business or investment purposes and swap it for a new one that you purchase. Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. A 1031 exchange is a tax break. $415,000 — cost basis of acquired property. Web purchase price, exchange property less depreciation taken to date. Includes state taxes and depreciation recapture. The $95,000 amount is the value. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. Ad search for answers from across the web with searchresultsquickly.com. A 1031 exchange requires you to fulfill two. Ad own real estate without dealing with the tenants, toilets and trash. A 1031 exchange can be a great way to defer taxes when selling real estate or other investments. A 1031 exchange requires you to fulfill two crucial rules. Web 1031 exchange savings calculator. Web allocation of the remaining cost basis to §1031 replacement prop erty: Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. Web each concept is discussed below. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Ad search for answers from across the web with searchresultsquickly.com. Get access to free 1031 exchange delaware statutory trust property listings Ad own real estate without dealing with the tenants, toilets and trash. Exchange expenses from sale of old property commissions $_____ 700. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. A 1031 exchange is a tax break. The $95,000 amount is the value. Ad delaware statutory trust 1031 exchange. Calculating taxes due upon sale vs 1031 exchange as a starting point, a taxpayer should always have a sense of his or her. Web 1031 exchange examples. Calculate the taxes you can defer when selling a property. Web purchase price, exchange property less depreciation taken to date of sale less deferred gain from previous 1031 exchange (if any) net cash paid (same as line 3 above) net. $415,000 — cost basis of acquired property. Web requires only 10 inputs into a simple excel spreadsheet. Web 1031 exchange savings calculator. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Ad how to maximize 1031 exchange tax savings & income potential with dst real estate. Web allocation of the remaining cost basis to §1031 replacement prop erty: Includes state taxes and depreciation recapture. A 1031 exchange requires you to fulfill two crucial rules. A 1031 exchange is a tax break. The $95,000 amount is the value. You can sell a property held for business or investment purposes and swap it for a new one that you purchase. Calculate the taxes you can defer when selling a property. Note that you can see all of the calculations so. Ad own real estate without dealing with the tenants, toilets and trash. Ad delaware statutory trust 1031 exchange.1031 Exchange Worksheet Strum Wiring

1031 Exchange Worksheet Excel Promotiontablecovers

39 1031 like kind exchange worksheet Worksheet Live

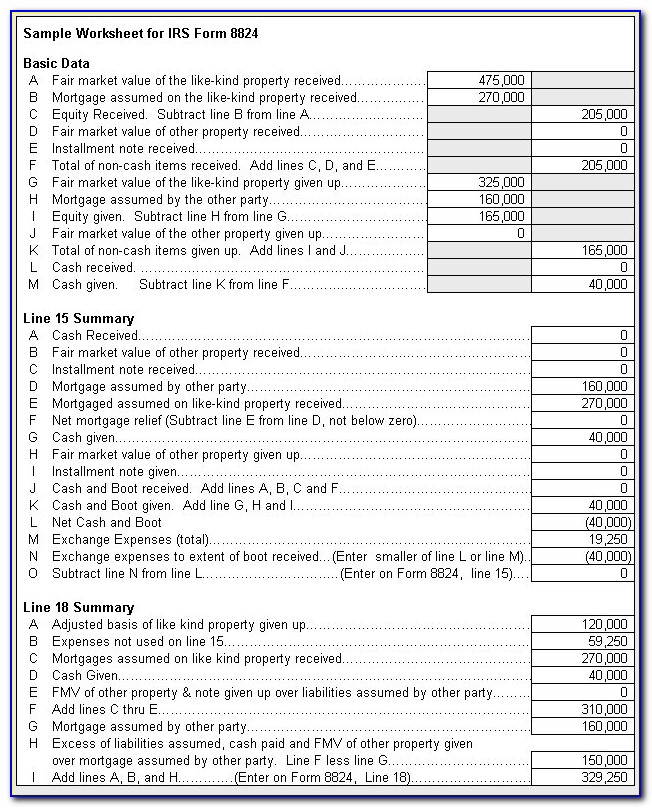

Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator

1031 Exchange Calculation Worksheet CALCULATORVGW

39 1031 like kind exchange worksheet Worksheet Live

1031 Exchange Worksheet Strum Wiring

1031 Exchange Calculation Worksheet Ivuyteq

Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator Form

1031 and 1033 EXERCISE In the following 1031

Web Here Are The Steps:

Ad Own Real Estate Without Dealing With The Tenants, Toilets And Trash.

Discover The Answers You Need Here!

Web Under The Tax Cuts And Jobs Act, Section 1031 Now Applies Only To Exchanges Of Real Property And Not To Exchanges Of Personal Or Intangible Property.

Related Post: