1031 Exchange Worksheet Excel

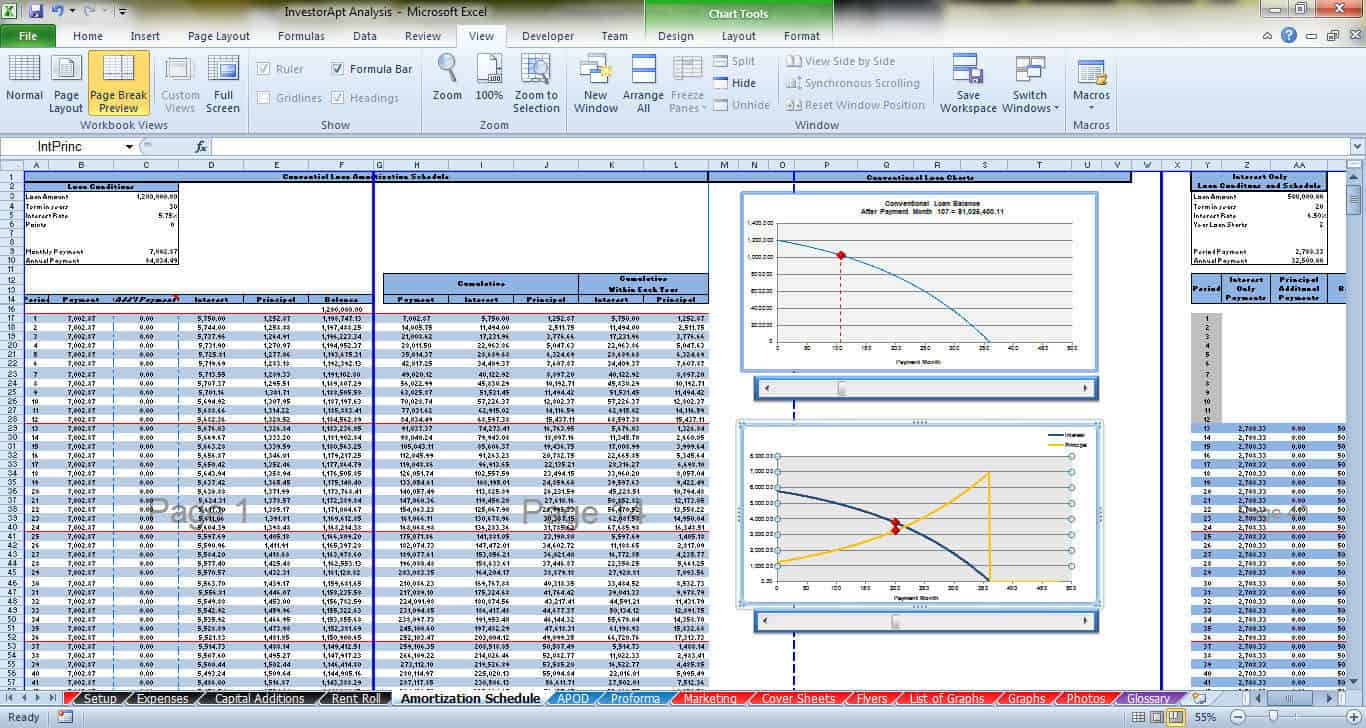

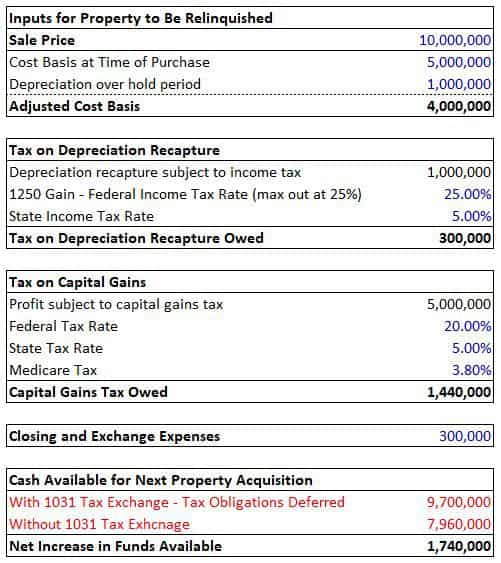

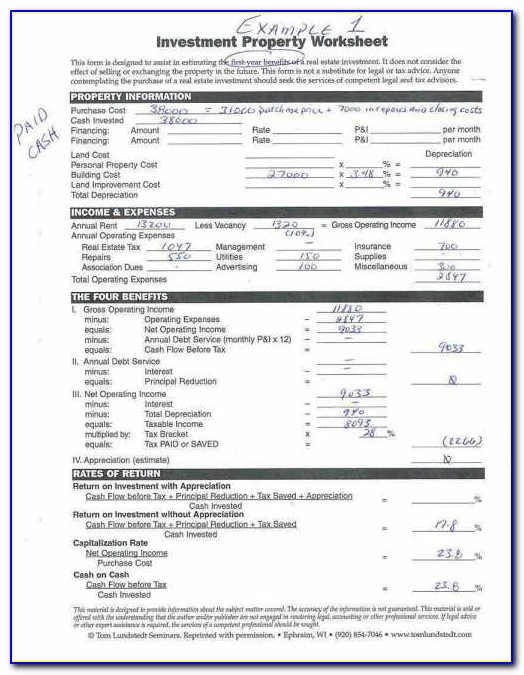

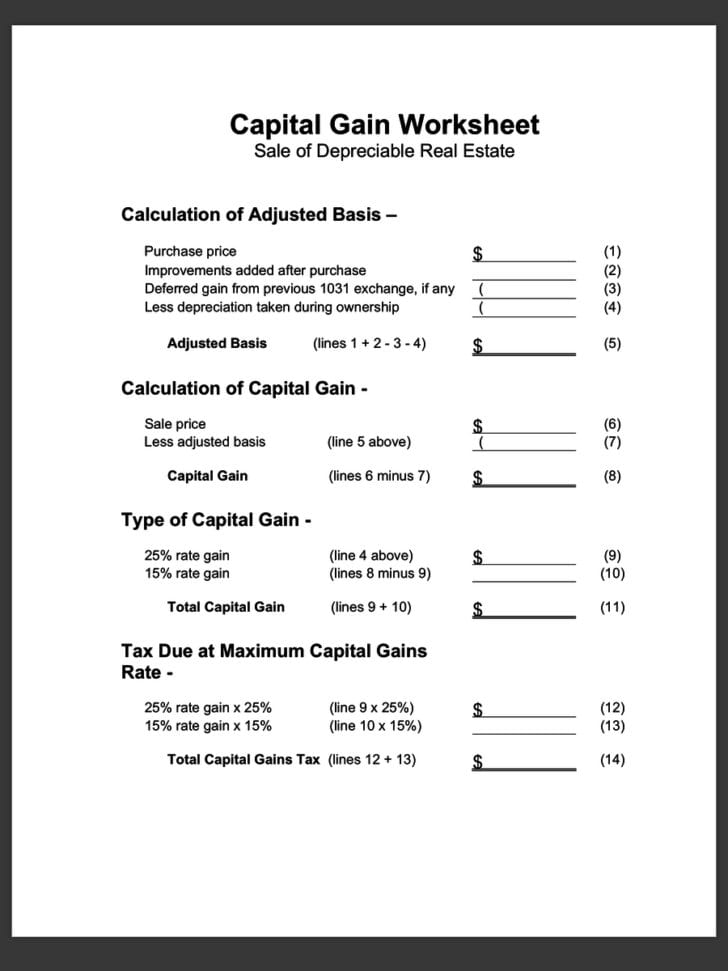

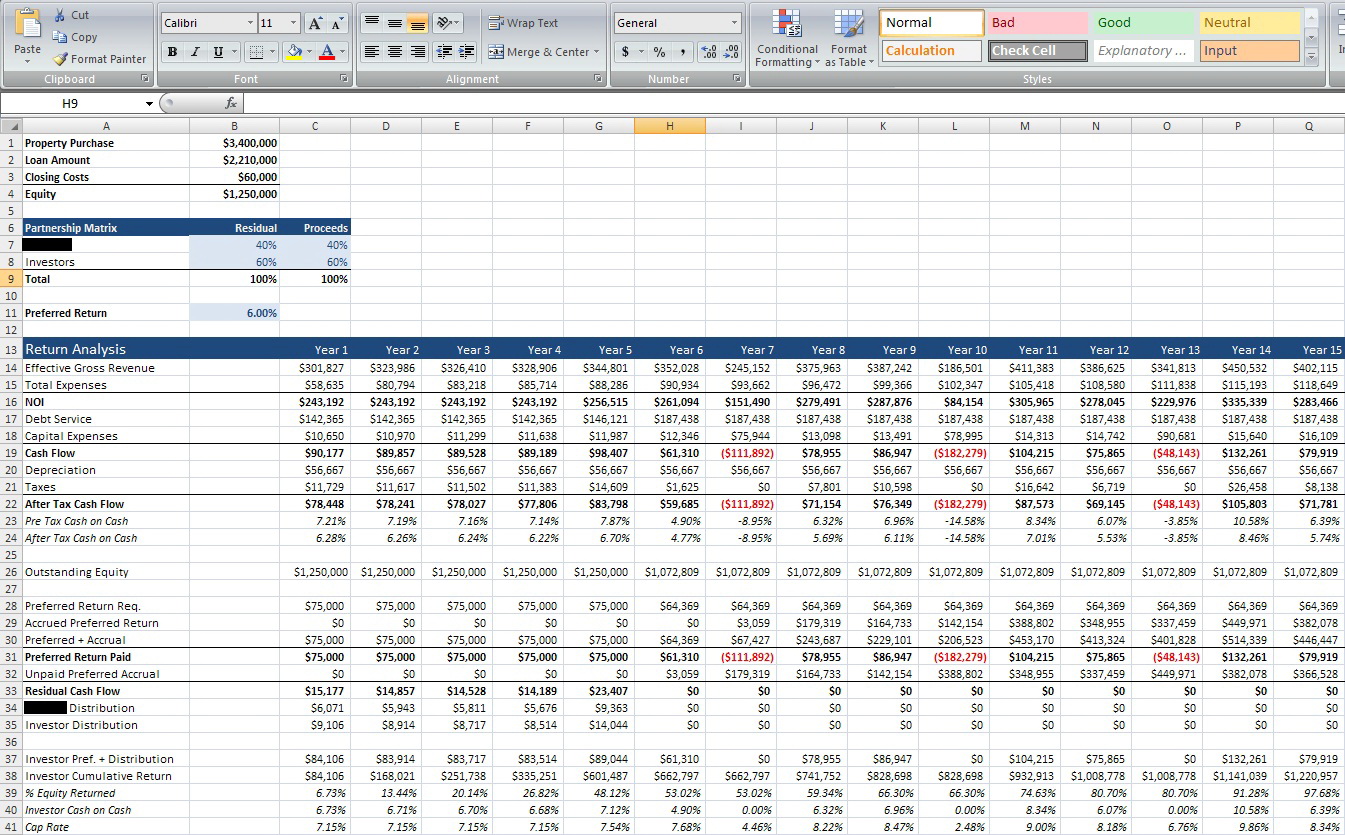

1031 Exchange Worksheet Excel - Web received in exchange for the property sold.$ _____ 4. Automatically create sample worksheets of irs form 8824. Open the asset entry worksheet for the asset being traded. Web 1031 property exchange for excel is designed for investors, real estate brokers and facilitators allowing to: Ad delaware statutory trust 1031 exchange. See definition of real property, later, for more details. Disposing of the original asset. Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Qualifying property must be held for use in a trade or business or for investment. We hope you can find what you need here. Allocation of the remaining cost basis to §1031 replacement prop erty: Web 1031 exchange tax worksheet and free 1031 exchange worksheet excel there are a few additional features that are available in this excel worksheet that can help you out. Web we tried to find some amazing references about 1031 exchange worksheet excel and example of form 8824 filled out. Allocation of the remaining cost basis to §1031 replacement prop erty: We hope you can find what you need here. For your convenience we list current boydton mortgage rates to help real estate investors estimate monthly loan payments & find local. Estimate the realized and recognized gains to calculate the transfer basis. The irs first allowed farmers to exchange land. §1031 basis allocation worksheet replacement property depreciation analysis (supplement to §1031 recapitulation worksheet form 354) Disposing of the original asset. We hope you can find what you need here. It was coming from reputable online resource and that we like it. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost. All three steps must be completed for the tax return to contain the correct information. Web 1031 exchange tax worksheet and free 1031 exchange worksheet excel there are a few additional features that are available in this excel worksheet that can help you out. We. Web the name 1031 exchange comes from title 26, section 1031 of the internal revenue code. Note that you can see all of the calculations so you can better understand how the final figures were calculated. We also offer a 1031 deadline calculator. Save or instantly send your ready documents. See definition of real property, later, for more details. We hope that this worksheet will help with these reporting issues that. Get access to free 1031 exchange delaware statutory trust property listings Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. Estimate the realized and recognized gains to calculate the transfer basis.. Estimate the realized and recognized gains to calculate the transfer basis. We hope you can find what you need here. See definition of real property, later, for more details. Web the name 1031 exchange comes from title 26, section 1031 of the internal revenue code. Ad search for answers from across the web with superdealsearch.com. Web the name 1031 exchange comes from title 26, section 1031 of the internal revenue code. Evaluate boot given and received. Web 1031 property exchange for excel is designed for investors, real estate brokers and facilitators allowing to: Qualifying property must be held for use in a trade or business or for investment. It was coming from reputable online resource. See below for an example and explanation. Evaluate boot given and received. Automatically create sample worksheets of irs form 8824. Qualifying property must be held for use in a trade or business or for investment. Save or instantly send your ready documents. Web 1031 property exchange for excel is designed for investors, real estate brokers and facilitators allowing to: Web partial 1031 exchange boot calculator. For your convenience we list current boydton mortgage rates to help real estate investors estimate monthly loan payments & find local. Save or instantly send your ready documents. Open the asset entry worksheet for the asset being. See below for an example and explanation. Easily fill out pdf blank, edit, and sign them. Web we tried to find some amazing references about 1031 exchange worksheet excel and example of form 8824 filled out for you. All three steps must be completed for the tax return to contain the correct information. Qualifying property must be held for use in a trade or business or for investment. We also offer a 1031 deadline calculator. Web 1031 property exchange for excel is designed for investors, real estate brokers and facilitators allowing to: Web enter the following information and our calculator will provide you an idea of how a 1031 exchange will work in your situation. Ad delaware statutory trust 1031 exchange. Investors can use 1031 exchanges to defer tax liabilities indefinitely so long as they keep. We hope you can find what you need here. We hope that this worksheet will help with these reporting issues that. Save or instantly send your ready documents. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. Get access to free 1031 exchange delaware statutory trust property listings The irs first allowed farmers to exchange land in 1921, but today’s exchanges are limited to real property assets purchased and held for investment purposes. Automatically create sample worksheets of irs form 8824. Web the name 1031 exchange comes from title 26, section 1031 of the internal revenue code. This calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a tax bill you can expect. Ad search for answers from across the web with superdealsearch.com. It was coming from reputable online resource and that we like it. We also offer a 1031 deadline calculator. This calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a tax bill you can expect. Allocation of the remaining cost basis to §1031 replacement prop erty: Ad delaware statutory trust 1031 exchange. The irs first allowed farmers to exchange land in 1921, but today’s exchanges are limited to real property assets purchased and held for investment purposes. Web partial 1031 exchange boot calculator. Ad delaware statutory trust 1031 exchange. See definition of real property, later, for more details. Ad search for answers from across the web with superdealsearch.com. All three steps must be completed for the tax return to contain the correct information. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost. This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. Automatically create sample worksheets of irs form 8824. Easily fill out pdf blank, edit, and sign them. Web received in exchange for the property sold.$ _____ 4.39 1031 like kind exchange worksheet Worksheet Live

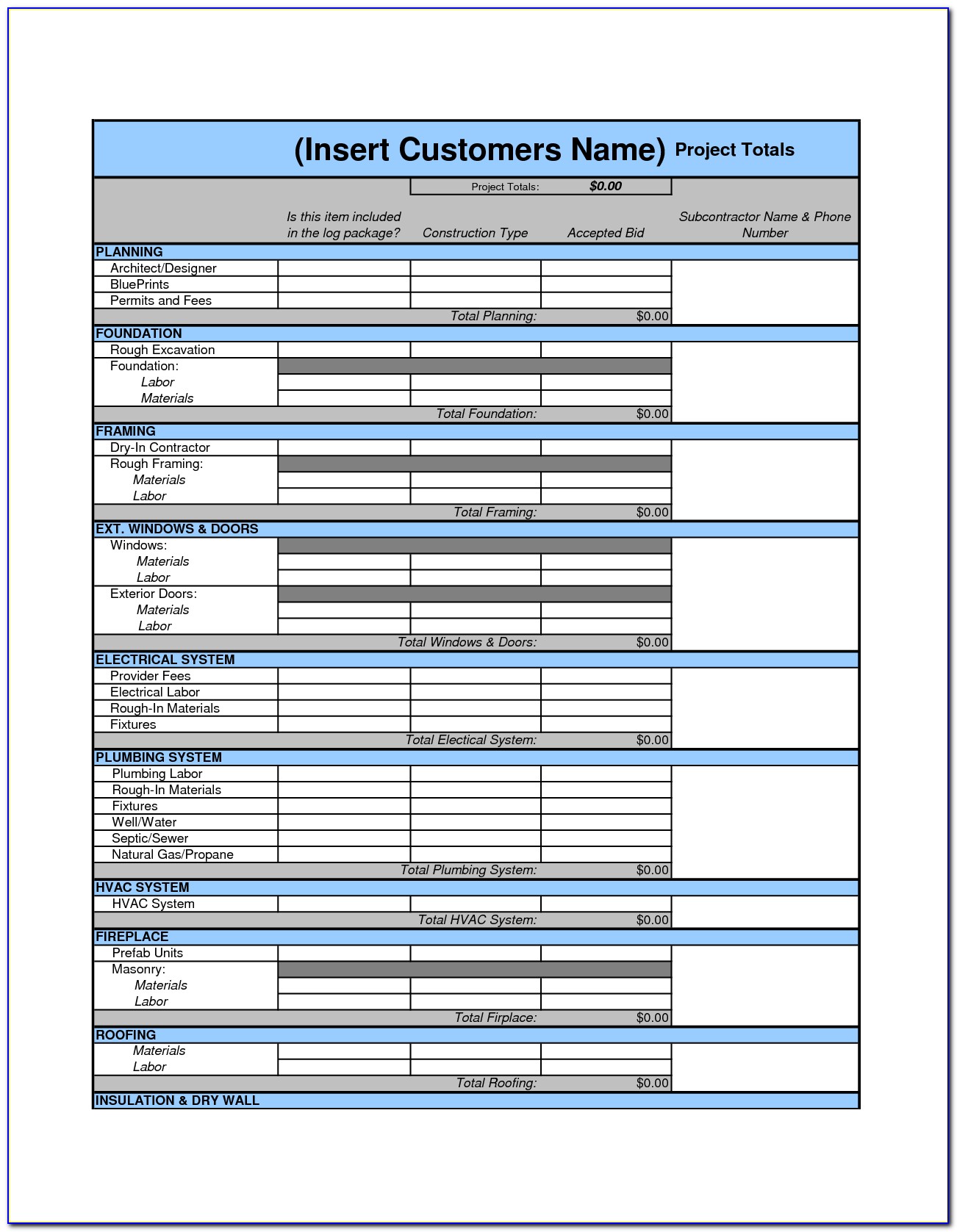

1031 Exchange Worksheet Excel Ivuyteq

1031 Exchange Worksheet Excel Ivuyteq

1031 Exchange Worksheet Excel Promotiontablecovers

1031 Exchange Worksheets Worksheets MTE5NzY Resume Examples

Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet

1031 Exchange Worksheet Report S Like Kind Example —

1031 Exchange Worksheet Excel Universal Network

1031 Exchange Worksheet Excel Ivuyteq

1031 Exchange Worksheet Excel Universal Network

Note That You Can See All Of The Calculations So You Can Better Understand How The Final Figures Were Calculated.

Open The Asset Entry Worksheet For The Asset Being Traded.

§1031 Basis Allocation Worksheet Replacement Property Depreciation Analysis (Supplement To §1031 Recapitulation Worksheet Form 354)

Estimate The Realized And Recognized Gains To Calculate The Transfer Basis.

Related Post: