1031 Exchange Worksheet

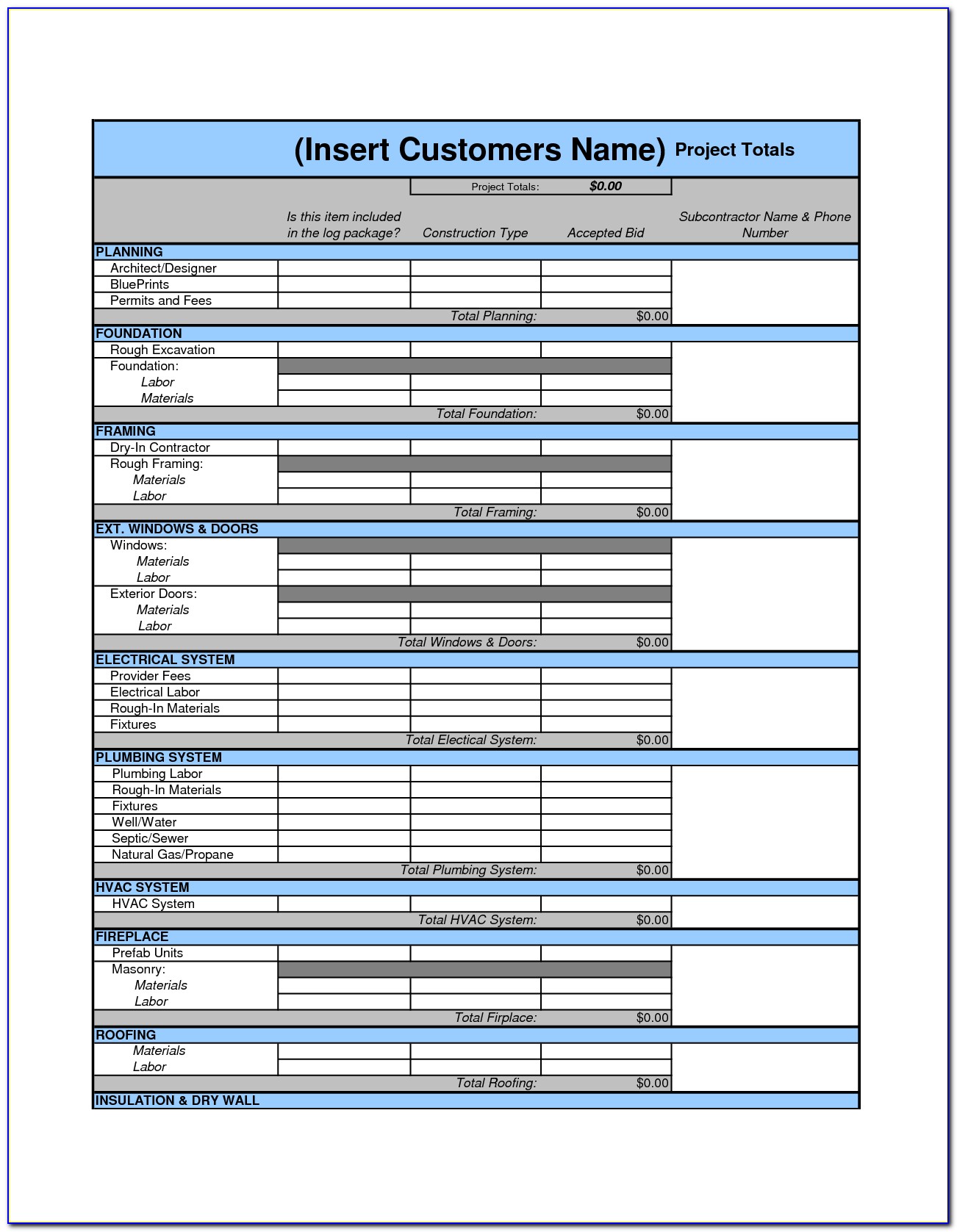

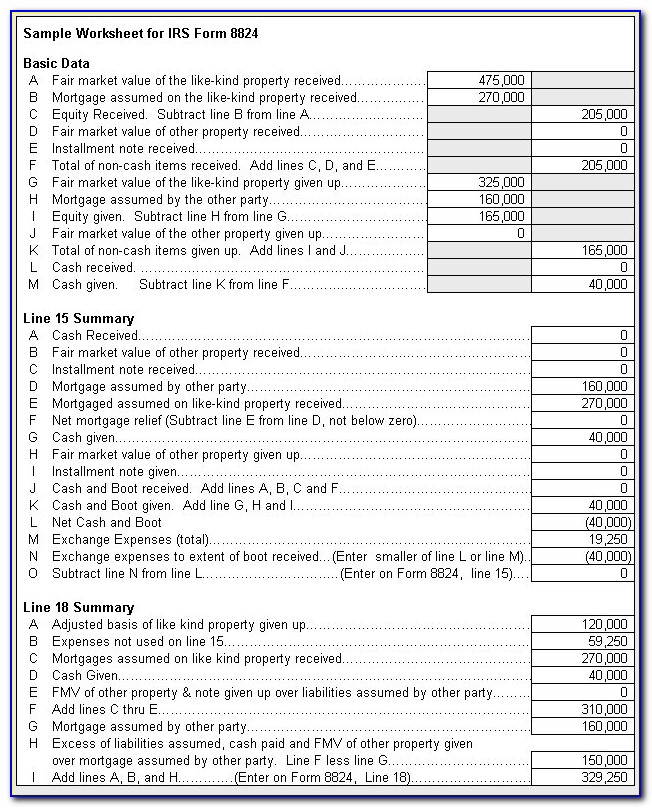

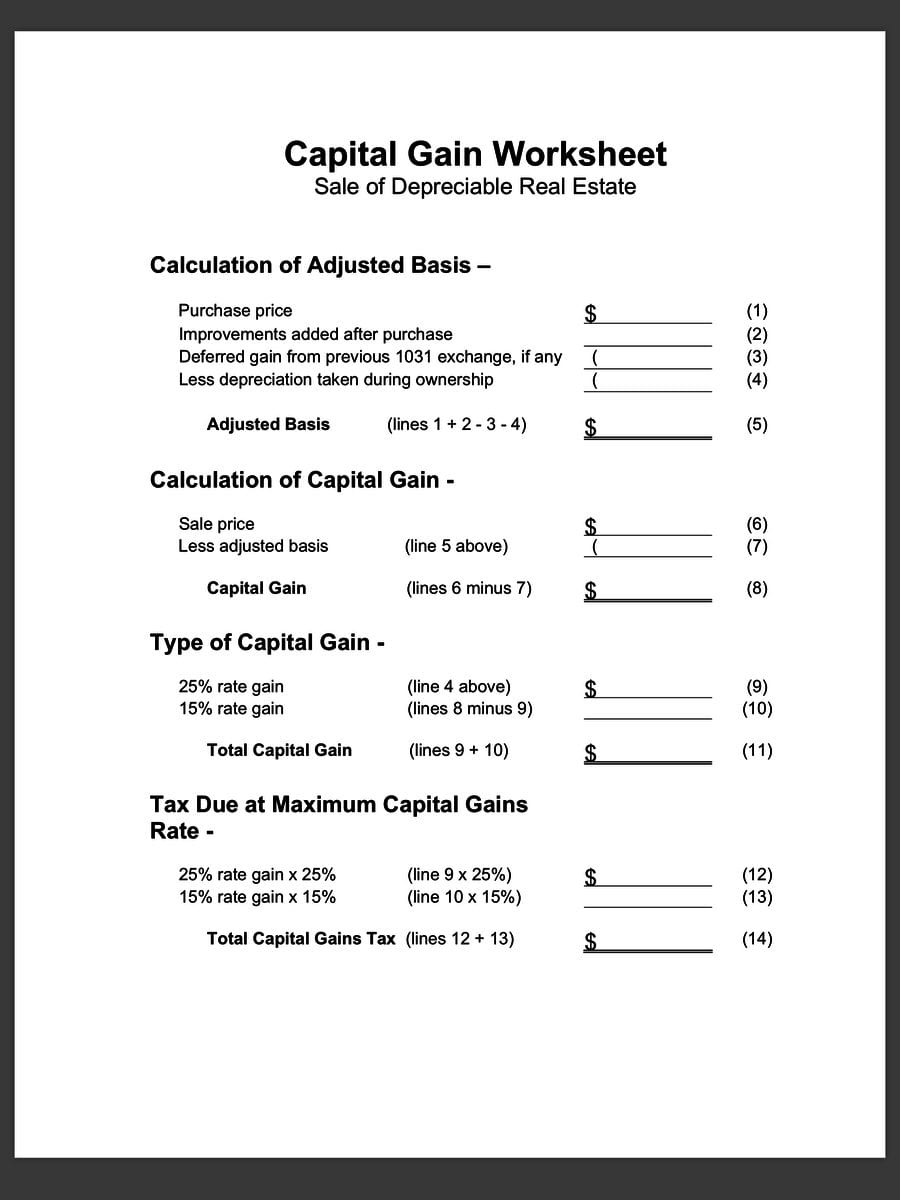

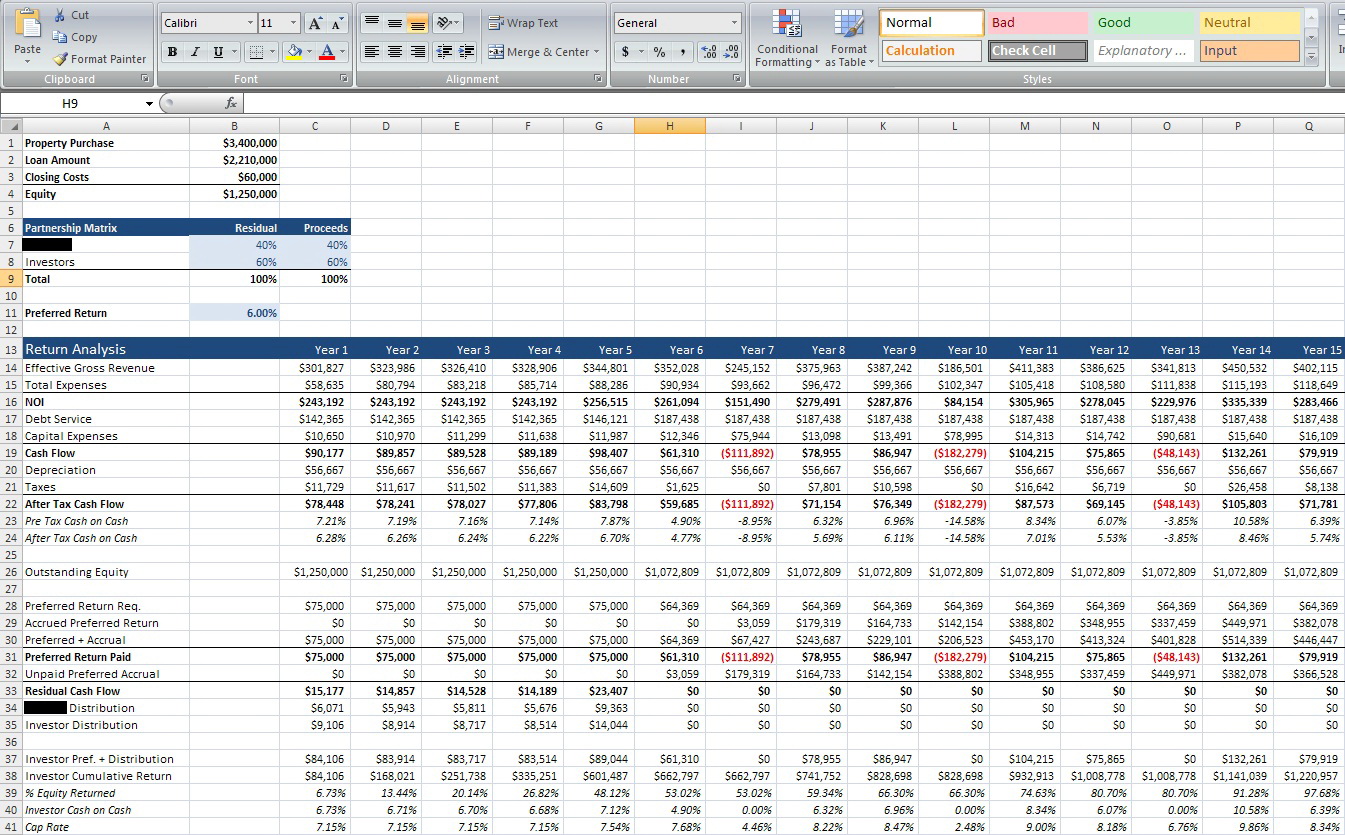

1031 Exchange Worksheet - Ad own real estate without dealing with the tenants, toilets and trash. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Worksheet february 03, 2023 05:57. Deferred exchanges are more complex but allow flexibility. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost. So let’s say you bought a real estate property five years ago. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Click here to see visual examples of a completed summary smart worksheet Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Use parts i, ii, and iii of form. Web 1031 exchange examples. Click here to see visual examples of a completed summary smart worksheet Web. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Web received in exchange for the property sold.$ _____ 4. §1031 basis allocation worksheet replacement property depreciation analysis (supplement to §1031 recapitulation worksheet form 354) Click here to see visual examples of a completed summary smart worksheet Web visit our library of important. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. The new property, or. So let’s say you bought a real estate property five years ago. The 1031 exchange worksheet is often used in financial and accounting applications, because it. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. Web visit our library of important 1031 exchange. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. First, there is a. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. Web 1031 exchange worksheet. Use parts i, ii, and iii of form. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and. Allocation of the remaining cost basis to §1031 replacement prop erty: Deferred exchanges are more complex but allow flexibility. Ad own real estate without dealing with the tenants, toilets and trash. §1031 basis allocation worksheet replacement property depreciation analysis (supplement to §1031 recapitulation worksheet form 354) Web the simplest type of section 1031 exchange is a simultaneous swap of one. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Click here to see visual examples of a completed summary smart worksheet Deferred exchanges are more complex but allow flexibility. Ad own real estate without dealing with the tenants, toilets and trash. Web we have developed the enclosed worksheets for use in calculating. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Ad own real estate without dealing with the tenants, toilets and trash. Web realty exchange corporation has created this simple capital gains calculator and analysis. Web received in exchange for the property sold.$ _____ 4. Web 1031 exchange examples. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Ad own real estate without dealing with the tenants, toilets and trash. The pros at equity. Use parts i, ii, and iii of form. Allocation of the remaining cost basis to §1031 replacement prop erty: Web 1031 exchange examples. Ad own real estate without dealing with the tenants, toilets and trash. Disposing of the original asset asset entry worksheet step 2: Web received in exchange for the property sold.$ _____ 4. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Web we have developed the enclosed worksheets for use in calculating the information used to report 1031 exchanges on form 8824 and herein enclose a copy. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost. The 1031 exchange worksheet is often used in financial and accounting applications, because it. Web what is a 1031 exchange? Web 1031 exchange worksheet. A 1031 exchange requires you to fulfill two crucial rules. First, there is a minimum value requirement. So let’s say you bought a real estate property five years ago. Web 2019 1031 exchange reporting guide helping to simplify the reporting of your 1031 exchange introduction in our ongoingcommitment to provide our valued clients with the. Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. Worksheet february 03, 2023 05:57. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Web the simplest type of section 1031 exchange is a simultaneous swap of one property for another. Web what is a 1031 exchange? Web realty exchange corporation has created this simple capital gains calculator and analysis form to estimate the tax impact if a property is sold and not exchanged, and to calculate. The pros at equity advantage have provided everything you need in easily downloadable pdf files. Web 1031 exchange examples. Web 1031 exchange worksheet. Worksheet february 03, 2023 05:57. Disposing of the original asset asset entry worksheet step 2: Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Ad own real estate without dealing with the tenants, toilets and trash. Web visit our library of important 1031 exchange forms. The new property, or properties, must have a purchase price equal to or more than the amount you sold your real estate for. A 1031 exchange requires you to fulfill two crucial rules. §1031 basis allocation worksheet replacement property depreciation analysis (supplement to §1031 recapitulation worksheet form 354) Deferred exchanges are more complex but allow flexibility. Click here to see visual examples of a completed summary smart worksheet1031 Exchange Worksheets Worksheets MTE5NzY Resume Examples

1031 Exchange Agreement Form Universal Network

1031 Exchange Calculation Worksheet CALCULATORVGW

1031 Exchange Calculation Worksheet CALCULATORVGW

1031 Exchange Worksheet Excel Ivuyteq

1031 Exchange Worksheet Excel Promotiontablecovers

39 1031 like kind exchange worksheet Worksheet Live

Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator Form

Like Kind Exchange Worksheet —

1031 Exchange Worksheet Excel Universal Network

4.1 Enter The Sum Of Line 1.1 Minus Lines 2.3 And 3.1 As The Cost.

Allocation Of The Remaining Cost Basis To §1031 Replacement Prop Erty:

So Let’s Say You Bought A Real Estate Property Five Years Ago.

Web Received In Exchange For The Property Sold.$ _____ 4.

Related Post: