1033 Exchange Worksheet

1033 Exchange Worksheet - Web section 1033 (a close cousin to 1031) allows you to defer the gain when you lose your property due to an involuntary conversion such as theft, condemnation,. Web section 1033 of the internal revenue code of 1954 provides for the nonrecognition of gain when the property is compulsorily or involuntarily converted. Whatever the size of your business, there is sure to be a business checking and savings account to. Web 1 best answer cherylw level 3 thanks lisa995. References to specific selling guide sections are provided below as appropriate. Our team of business banking experts are here to help you make the switch to plumas bank. If you have lost a property due to an involuntary conversion, then a 1033 exchange may be an excellent strategy for you to consider in acquiring a replacement property. Web pk ! ªê % [content_types].xml ¢ ( ìvmk 1 ½ ú ]ƒwnzj)^ç ¦ç6 z•¥±wx_hæ©ýï;+'¦ çî² íeå®vï½ùôì®·þu ñæðˆëz** : Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain from the insurance or condemnation proceeds. Web sample worksheet for determining value of separate property. References to specific selling guide sections are provided below as appropriate. A method of deferring capital gains taxes on property that is lost involuntary to condemnation, theft, or casualty, and a gain is realized from the insurance. Web sample worksheet for determining value of separate property. This, from irs' publication 544: Web our newest branch in chico, ca is now. References to specific selling guide sections are provided below as appropriate. Web sample worksheet for determining value of separate property. Let us show you how easy it is to reinvest your exchange dollars. If you have lost a property due to an involuntary conversion, then a 1033 exchange may be an excellent strategy for you to consider in acquiring a. Report your election to postpone reporting your gain,. Web section 1033 (a close cousin to 1031) allows you to defer the gain when you lose your property due to an involuntary conversion such as theft, condemnation,. Web our newest branch in chico, ca is now open! Web at first american exchange, we make the process of beginning a 1031 exchange. Business online banking with plumas bank is simple, convenient and secure to meet your unique business needs. Web section 1033 (a close cousin to 1031) allows you to defer the gain when you lose your property due to an involuntary conversion such as theft, condemnation,. A method of deferring capital gains taxes on property that is lost involuntary to condemnation,. Web at first american exchange, we make the process of beginning a 1031 exchange possible. Business online banking with plumas bank is simple, convenient and secure to meet your unique business needs. Let us show you how easy it is to reinvest your exchange dollars. Web section 1033 (a close cousin to 1031) allows you to defer the gain when. This, from irs' publication 544: Let us show you how easy it is to reinvest your exchange dollars. Report your election to postpone reporting your gain,. Our team of business banking experts are here to help you make the switch to plumas bank. References to specific selling guide sections are provided below as appropriate. An exchange of city property for farm property, or improved property for. Web at first american exchange, we make the process of beginning a 1031 exchange possible. Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural disasters such as fire, tornado or theft. Web 1 best answer cherylw. Our team of business banking experts are here to help you make the switch to plumas bank. Report your election to postpone reporting your gain,. Web 1 best answer cherylw level 3 thanks lisa995. Web pk ! ªê % [content_types].xml ¢ ( ìvmk 1 ½ ú ]ƒwnzj)^ç ¦ç6 z•¥±wx_hæ©ýï;+'¦ çî² íeå®vï½ùôì®·þu ñæðˆëz** : Disposing of the original asset asset entry. If you have lost a property due to an involuntary conversion, then a 1033 exchange may be an excellent strategy for you to consider in acquiring a replacement property. Let us show you how easy it is to reinvest your exchange dollars. Disposing of the original asset asset entry worksheet step 2: A method of deferring capital gains taxes on. Web our newest branch in chico, ca is now open! Our team of business banking experts are here to help you make the switch to plumas bank. Report your election to postpone reporting your gain,. Disposing of the original asset asset entry worksheet step 2: A method of deferring capital gains taxes on property that is lost involuntary to condemnation,. References to specific selling guide sections are provided below as appropriate. Our team of business banking experts are here to help you make the switch to plumas bank. Web 1 best answer cherylw level 3 thanks lisa995. Web section 1033 of the internal revenue code of 1954 provides for the nonrecognition of gain when the property is compulsorily or involuntarily converted. A method of deferring capital gains taxes on property that is lost involuntary to condemnation, theft, or casualty, and a gain is realized from the insurance. Web at first american exchange, we make the process of beginning a 1031 exchange possible. Business online banking with plumas bank is simple, convenient and secure to meet your unique business needs. Disposing of the original asset asset entry worksheet step 2: Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural disasters such as fire, tornado or theft. Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain from the insurance or condemnation proceeds. Report your election to postpone reporting your gain,. Web sample worksheet for determining value of separate property. Web section 1033 (a close cousin to 1031) allows you to defer the gain when you lose your property due to an involuntary conversion such as theft, condemnation,. An exchange of city property for farm property, or improved property for. Web pk ! ªê % [content_types].xml ¢ ( ìvmk 1 ½ ú ]ƒwnzj)^ç ¦ç6 z•¥±wx_hæ©ýï;+'¦ çî² íeå®vï½ùôì®·þu ñæðˆëz** : If you have lost a property due to an involuntary conversion, then a 1033 exchange may be an excellent strategy for you to consider in acquiring a replacement property. This, from irs' publication 544: Web this worksheet alone does not indicate complete compliance with the selling guide. 6 sample worksheet for determining value and division of community property. Whatever the size of your business, there is sure to be a business checking and savings account to. Report your election to postpone reporting your gain,. Web a 1033 exchange is available to those who have had their property condemned under eminent domain or because of natural disasters such as fire, tornado or theft. If you have lost a property due to an involuntary conversion, then a 1033 exchange may be an excellent strategy for you to consider in acquiring a replacement property. Web a 1033 exchange is a useful tool to defer tax when you lose property because of a casualty or condemnation yet have gain from the insurance or condemnation proceeds. Disposing of the original asset asset entry worksheet step 2: Web at first american exchange, we make the process of beginning a 1031 exchange possible. Business online banking with plumas bank is simple, convenient and secure to meet your unique business needs. An exchange of city property for farm property, or improved property for. Web 1 best answer cherylw level 3 thanks lisa995. Our team of business banking experts are here to help you make the switch to plumas bank. Web our newest branch in chico, ca is now open! Web pk ! ªê % [content_types].xml ¢ ( ìvmk 1 ½ ú ]ƒwnzj)^ç ¦ç6 z•¥±wx_hæ©ýï;+'¦ çî² íeå®vï½ùôì®·þu ñæðˆëz** : 6 sample worksheet for determining value and division of community property. Web section 1033 (a close cousin to 1031) allows you to defer the gain when you lose your property due to an involuntary conversion such as theft, condemnation,. References to specific selling guide sections are provided below as appropriate. Whatever the size of your business, there is sure to be a business checking and savings account to.Read Online columbian exchange worksheet Copy vcon.duhs.edu.pk

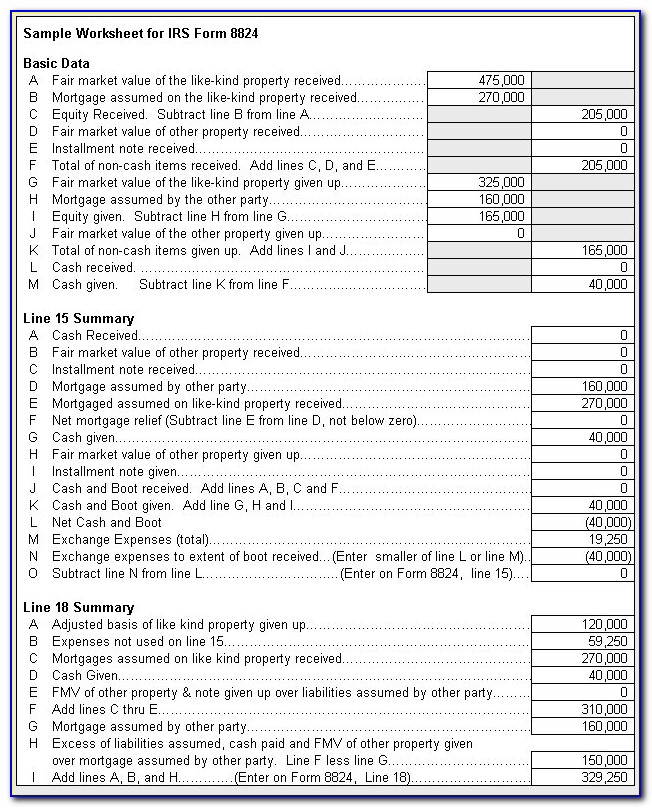

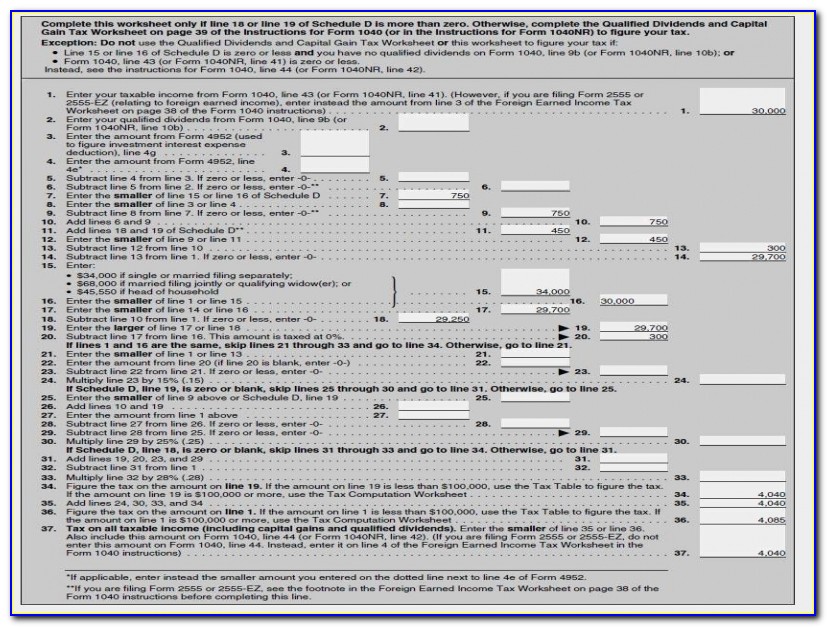

Irs 1031 Exchange Worksheet And Partial 1031 Exchange Calculator Form

1033 Exchange

Foreign Currency Worksheet Forex Diamond Ea Review

1031 Exchange Calculation Worksheets

️1031 Exchange Worksheet Excel Free Download Goodimg.co

Irs 1031 Exchange Form Form Resume Examples EpDLaMr5xR

1031 Exchange Worksheet Excel Ivuyteq

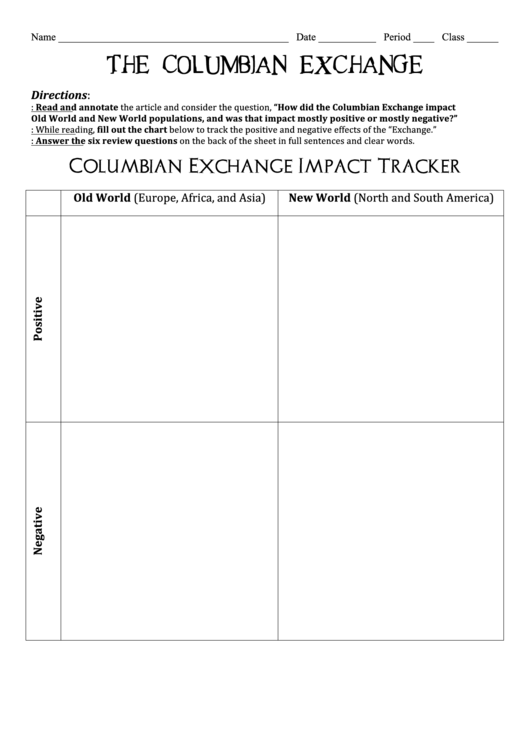

Columbian Exchange Activity Printables Printable Word Searches

42 sec 1031 exchange worksheet Worksheet Information

Let Us Show You How Easy It Is To Reinvest Your Exchange Dollars.

Web This Worksheet Alone Does Not Indicate Complete Compliance With The Selling Guide.

This, From Irs' Publication 544:

A Method Of Deferring Capital Gains Taxes On Property That Is Lost Involuntary To Condemnation, Theft, Or Casualty, And A Gain Is Realized From The Insurance.

Related Post: