1120S Income Calculation Worksheet

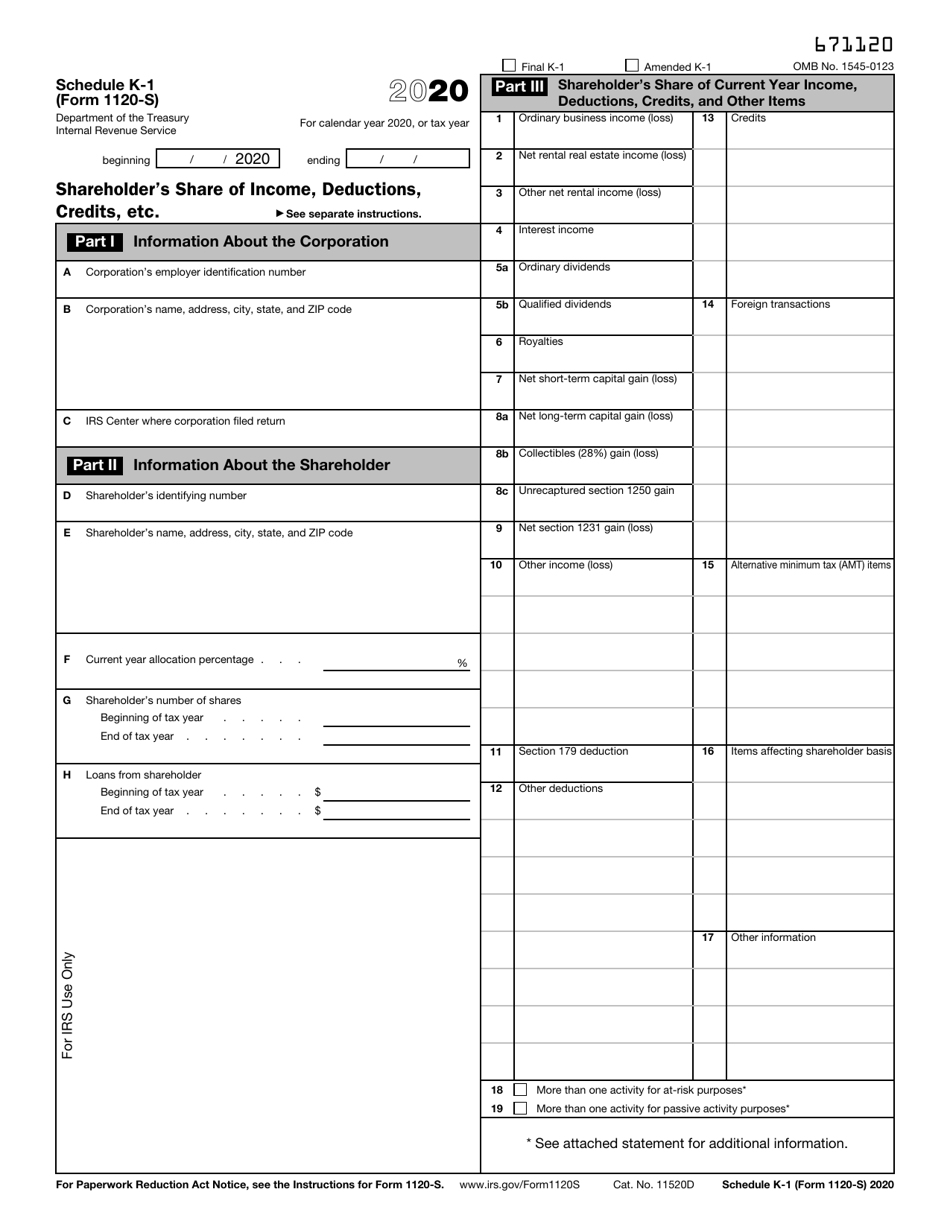

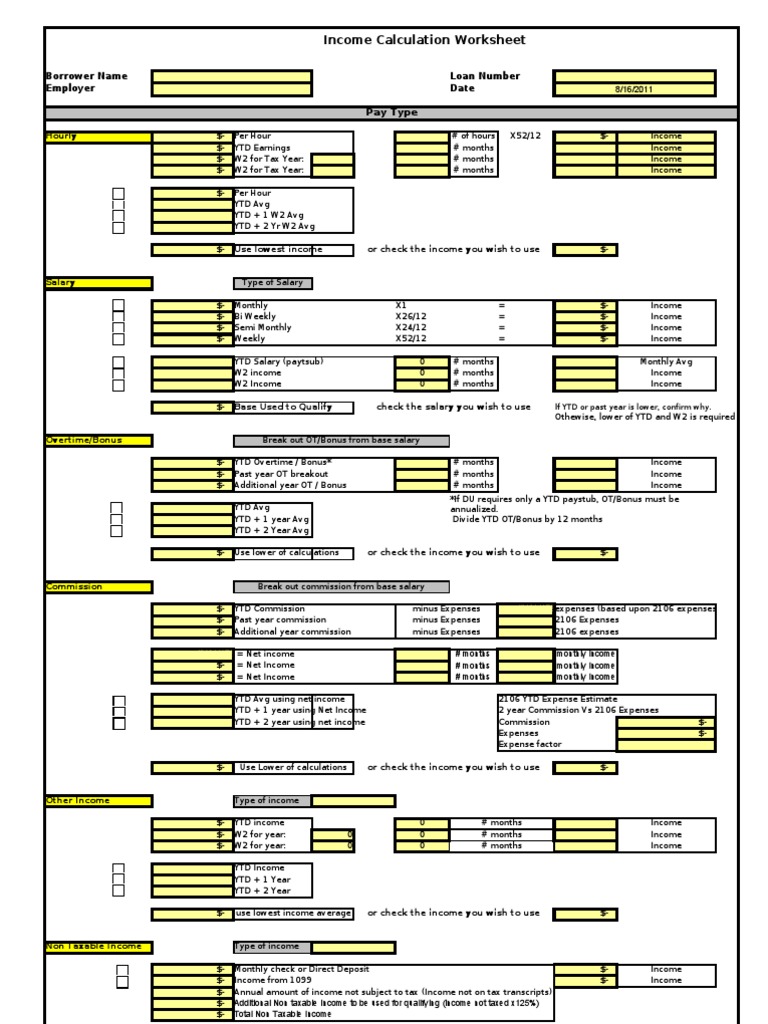

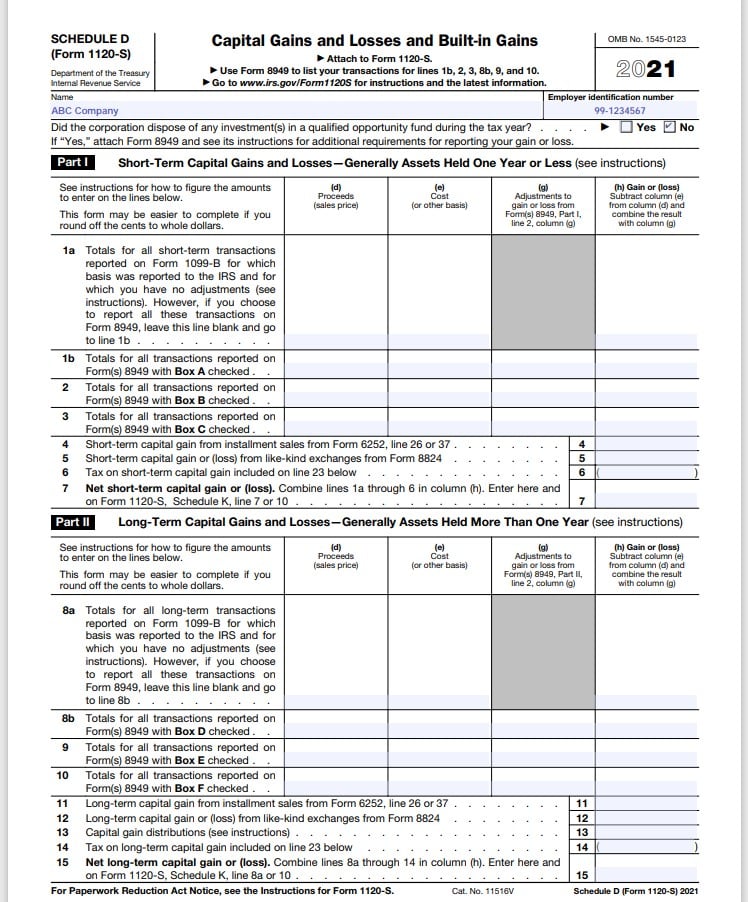

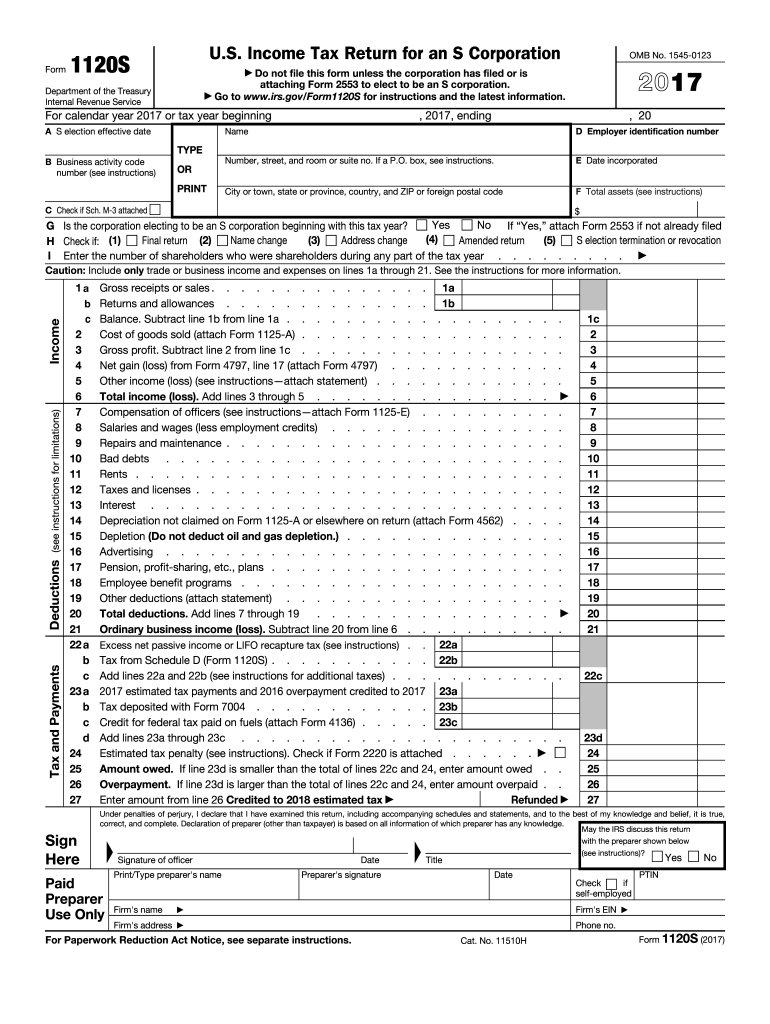

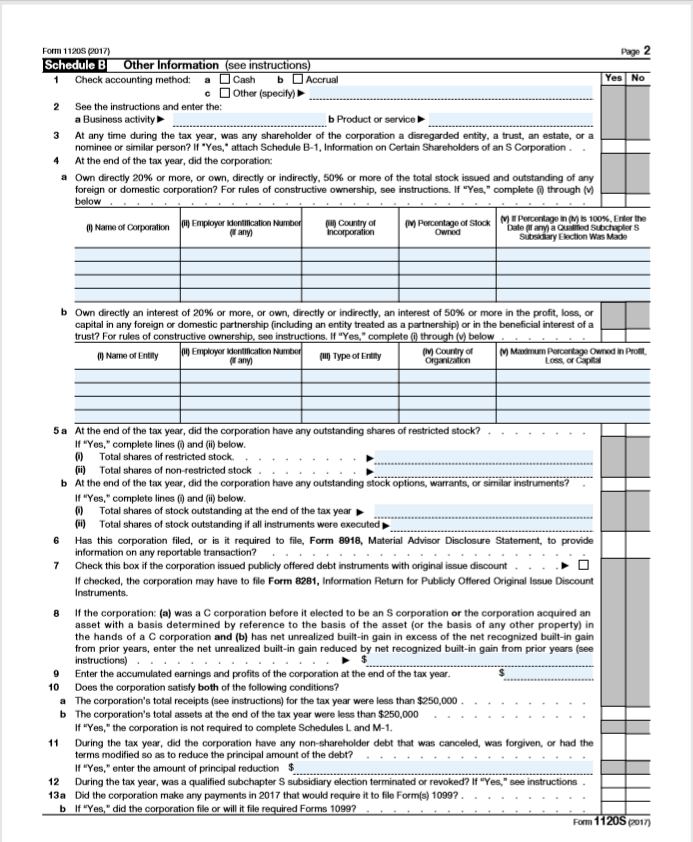

1120S Income Calculation Worksheet - Web income calculation worksheet = ytd salary (paytsub) past year ot breakout use lowest income average date w2 for tax year: The basis of s corporation stock is. Easy guidance & tools for c corporation tax returns. Follow the instructions for form 1120. Ad constant investment growth moves you forward with gainbridge. (for shareholder's use only) section references are. Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Web calculations where does my qualified business income calculation appear in the return? Business income calculation adjustment when the lender determines current year net business income. Subtotal from irs form 1120 $ $ combined subtotal from corporation (business name: Easy guidance & tools for c corporation tax returns. Attach to schedule d the form 1120 computation or other worksheet used to figure taxable income. Web calculations where does my qualified business income calculation appear in the return? The purpose of this written analysis is to determine. The stock basis before distributions is $19,000. Online annuities that are simple & straightforward. Attach to schedule d the form 1120 computation or other worksheet used to figure taxable income. The basis of s corporation stock is. Ytd avg using net income ytd + 1 year using. To estimate and analyze a borrower's. Web corporate income from irs form 1120 (chapter 5304) year: Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Web keep your career on the right track. (for shareholder's use only) section references are. Subtotal from irs form 1120 $ $ combined subtotal from corporation (business name: Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation instructions: Business income calculation adjustment when the lender determines current year net business income. Easy guidance & tools for c corporation tax returns. Ad constant investment growth moves you forward with gainbridge. Our income analysis tools and job aids are designed. Business income calculation adjustment when the lender determines current year net business income. Ad constant investment growth moves you forward with gainbridge. Follow the instructions for form 1120. Configure & buy in minutes. Enter the amount from line 28 of form 1120 on line 17 of schedule d. Web figure taxable income by completing lines 1 through 28 of form 1120. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of stock ownership in the business for the tax year. Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation instructions: (for. Income or loss reported on irs form. Ytd avg using net income ytd + 1 year using. Online annuities that are simple & straightforward. Web income calculation worksheet = ytd salary (paytsub) past year ot breakout use lowest income average date w2 for tax year: The stock basis before distributions is $19,000. Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Web figure taxable income by completing lines 1 through 28 of form 1120. Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation instructions: Business income calculation adjustment when the lender determines current. Web income calculation worksheet = ytd salary (paytsub) past year ot breakout use lowest income average date w2 for tax year: Attach to schedule d the form 1120 computation or other worksheet used to figure taxable income. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of stock ownership in the business for. Web corporate income from irs form 1120 (chapter 5304) year: Follow the instructions for form 1120. Easy guidance & tools for c corporation tax returns. The purpose of this written analysis is to determine. Web income calculation worksheet = ytd salary (paytsub) past year ot breakout use lowest income average date w2 for tax year: Web income calculation worksheet = ytd salary (paytsub) past year ot breakout use lowest income average date w2 for tax year: Web figure taxable income by completing lines 1 through 28 of form 1120. Web keep your career on the right track. Business income calculation adjustment when the lender determines current year net business income. Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of stock ownership in the business for the tax year. (for shareholder's use only) section references are. Web calculations where does my qualified business income calculation appear in the return? To estimate and analyze a borrower's. Online annuities that are simple & straightforward. Follow the instructions for form 1120. Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation instructions: Web corporate income from irs form 1120 (chapter 5304) year: Enter the amount from line 28 of form 1120 on line 17 of schedule d. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during the current year. The purpose of this written analysis is to determine. Second, reduce stock basis by distributions of $12,000. Attach to schedule d the form 1120 computation or other worksheet used to figure taxable income. Ytd avg using net income ytd + 1 year using. The basis of s corporation stock is. (for shareholder's use only) section references are. The purpose of this written analysis is to determine. Web irs form 1120(s) = ordinary income or loss (s corporation) irs form 1120 = taxable income (corporation) calculation instructions: Web figure taxable income by completing lines 1 through 28 of form 1120. Subtotal from irs form 1120 $ $ combined subtotal from corporation (business name: Online annuities that are simple & straightforward. Web corporate income from irs form 1120 (chapter 5304) year: The stock basis before distributions is $19,000. Web the borrower’s proportionate share of income or loss is based on the borrower’s (shareholder) percentage of stock ownership in the business for the tax year. Web keep your career on the right track. Web calculations where does my qualified business income calculation appear in the return? Ytd avg using net income ytd + 1 year using. Income or loss reported on irs form. The basis of s corporation stock is. Second, reduce stock basis by distributions of $12,000. Follow the instructions for form 1120.IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

Tax Deduction Expense

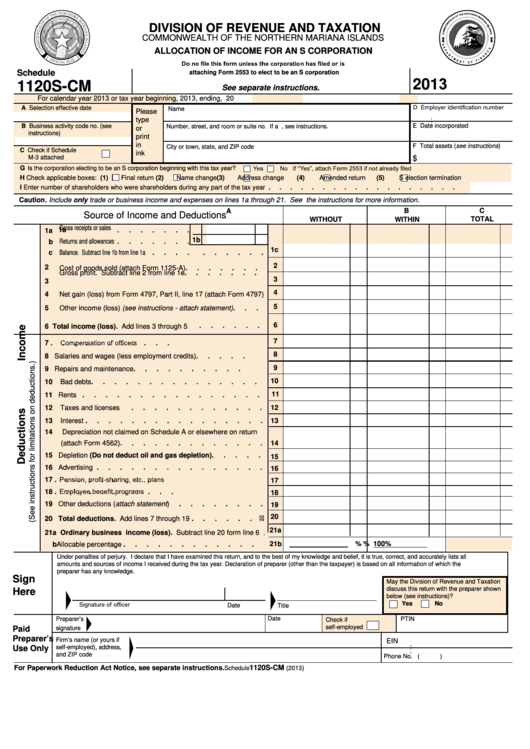

Fillable Schedule 1120sCm Allocation Of For An S Corporation

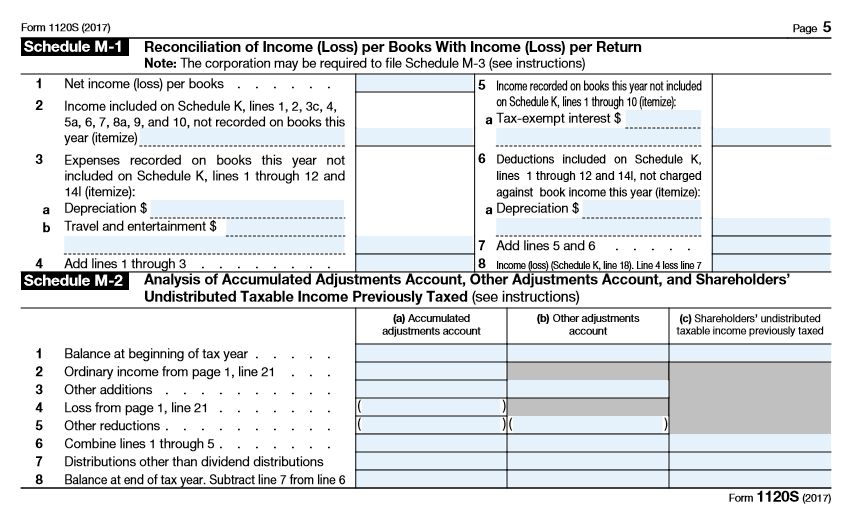

1120S Calculating Book Schedule M1 and M3 (K1, M1, M3)

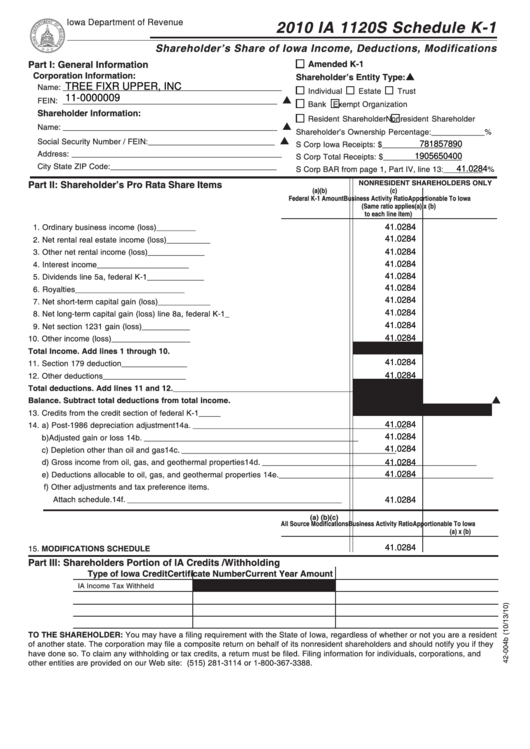

Fillable Form Ia 1120s Schedule K1 Shareholder'S Share Of Iowa

Fill out the 1120S Form including the M1 & M2

How to Complete Form 1120S & Schedule K1 (With Sample)

2017 Form IRS 1120S Fill Online, Printable, Fillable, Blank pdfFiller

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

Fill out the 1120S Form including the M1 & M2

Web Income Calculation Worksheet = Ytd Salary (Paytsub) Past Year Ot Breakout Use Lowest Income Average Date W2 For Tax Year:

Complete All The Fields On This Worksheet.

Our Income Analysis Tools And Job Aids Are Designed To Help You Evaluate Qualifying Income Quickly And Easily.

Web Use Screen Basis Wks, To Calculate A Shareholder's New Basis After Increases And/Or Decreases Are Made To Basis During The Current Year.

Related Post: