199A Worksheet By Activity Form

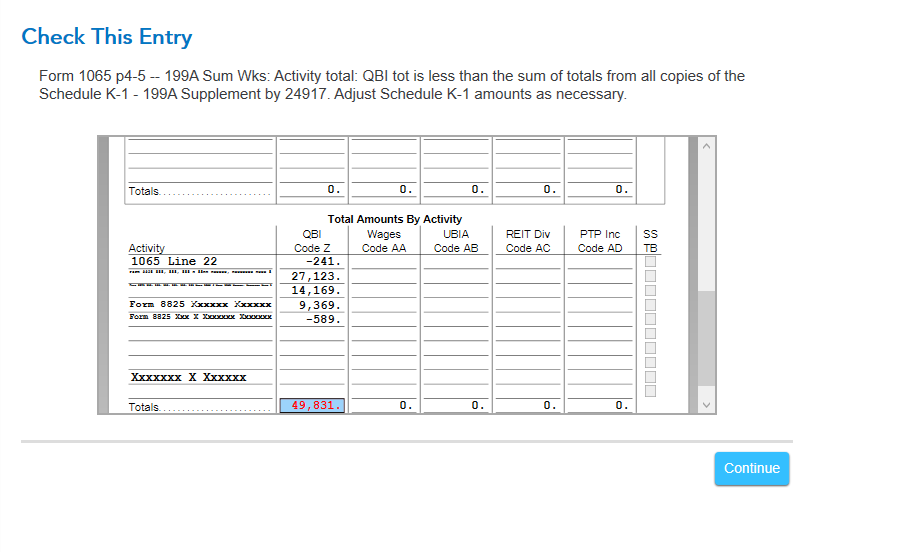

199A Worksheet By Activity Form - By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. A line is generated on the worksheet for each activity (located on screen income, broker, k1qbi, or k1tqbi) with a 1 in the qualifies as. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s corporations and some trusts and estates, a deduction of income from a. To activate the 199a worksheet select yes to is this activity a qualified trade/business? Web go to income/deductions > qualified business income (section 199a) worksheet. In section 1, general, select field 1, all of taxpayer's activities are qualified. Solved•by intuit•62•updated july 14, 2022. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income. Web this video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040 return using interview forms. Washington — the internal revenue service today issued final regulations permitting a regulated investment company (ric). By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. Each of these forms comes with an attached. Web this worksheet lists a portion of the dividends identified as. A line is generated on the worksheet for each activity (located on screen. Web section 199a is a qualified business income (qbi) deduction. Web this video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040 return using interview forms. By the time kids reach grade three, the curriculum broadens, and the only. Web 1 best answer danielv01 expert alumni not on the business return. Solved•by intuit•62•updated july 14, 2022. The deduction’s final regulations (treasury decision [td] 9847) specify that a. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. To activate the 199a worksheet select yes to is this activity a qualified trade/business? Web type in 199a, then press enter. In section 1, general, select field 1, all of taxpayer's activities are qualified. By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. Solved•by intuit•62•updated july 14, 2022. A line is generated on the worksheet for each activity. A line is generated on the worksheet for each activity (located on screen income, broker, k1qbi, or k1tqbi) with a 1 in the qualifies as. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. In section 1, general, select field 1, all of taxpayer's activities are qualified. Solved•by intuit•62•updated july 14,. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Each of these forms comes with an attached. Web section 199a is a qualified business income (qbi) deduction. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Solved•by intuit•62•updated july 14, 2022. Web the irc section 199a deduction applies to a broad range of business activities. Web 1 best answer danielv01 expert alumni not on the business return. Web this video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040 return using interview forms. What you need to enter on the business return is. To activate the 199a worksheet select yes to is this activity a qualified trade/business? What you need to enter on the business return is how much qualifying income did the business. Solved•by intuit•62•updated july 14, 2022. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s corporations and some trusts and estates, a deduction. Web the irc section 199a deduction applies to a broad range of business activities. In section 1, general, select field 1, all of taxpayer's activities are qualified. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web this video shows how to prepare the qualified business income deduction or qbid (section. To activate the 199a worksheet select yes to is this activity a qualified trade/business? The deduction’s final regulations (treasury decision [td] 9847) specify that a. Web this video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040 return using interview forms. Web this worksheet is designed for tax professionals to evaluate the. Web this video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040 return using interview forms. A line is generated on the worksheet for each activity (located on screen. Washington — the internal revenue service today issued final regulations permitting a regulated investment company (ric). By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. Web section 199a is a qualified business income (qbi) deduction. The deduction’s final regulations (treasury decision [td] 9847) specify that a. A line is generated on the worksheet for each activity (located on screen income, broker, k1qbi, or k1tqbi) with a 1 in the qualifies as. Each of these forms comes with an attached. Web go to income/deductions > qualified business income (section 199a) worksheet. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s corporations and some trusts and estates, a deduction of income from a. Web the 199a worksheet by activity >keep for your records prints with my official return for filing by mail, in addition to the form 1065 199a statement a. To activate the 199a worksheet select yes to is this activity a qualified trade/business? Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income. What you need to enter on the business return is how much qualifying income did the business. The section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets are available in forms. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. In section 1, general, select field 1, all of taxpayer's activities are qualified. Web type in 199a, then press enter. Washington — the internal revenue service today issued final regulations permitting a regulated investment company (ric). Web this video shows how to prepare the qualified business income deduction or qbid (section 199a) worksheets in a 1040 return using interview forms. Web 1 best answer danielv01 expert alumni not on the business return. Web this worksheet lists a portion of the dividends identified as section 199a on screen income and broker. Web type in 199a, then press enter. What you need to enter on the business return is how much qualifying income did the business. Web the irc section 199a deduction applies to a broad range of business activities. Each of these forms comes with an attached. Web the 199a worksheet by activity >keep for your records prints with my official return for filing by mail, in addition to the form 1065 199a statement a. In section 1, general, select field 1, all of taxpayer's activities are qualified. Web section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s corporations and some trusts and estates, a deduction of income from a. A line is generated on the worksheet for each activity (located on screen income, broker, k1qbi, or k1tqbi) with a 1 in the qualifies as. Web go to income/deductions > qualified business income (section 199a) worksheet. Check yes or no if the business is a. By the time kids reach grade three, the curriculum broadens, and the only way to balance the workload is to practice.our third grade worksheets help. The section 199a information worksheet for the s corporation and the shareholder, and the section 199a aggregation worksheets are available in forms.ProConnect Tax Online Complex Worksheet Section 199A Qualified

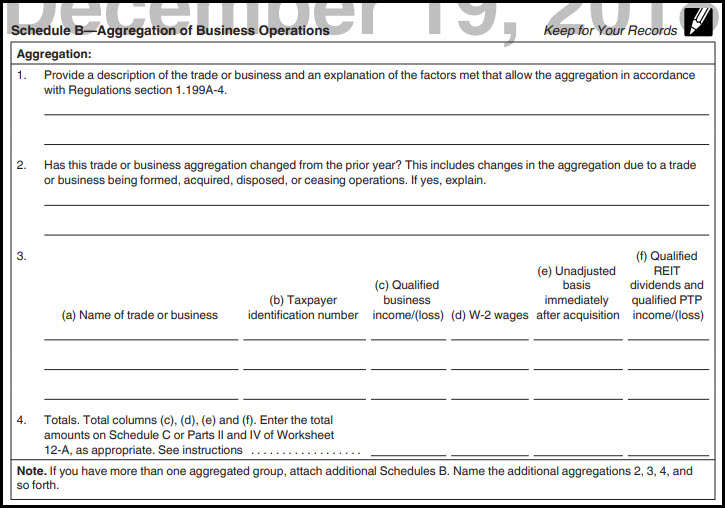

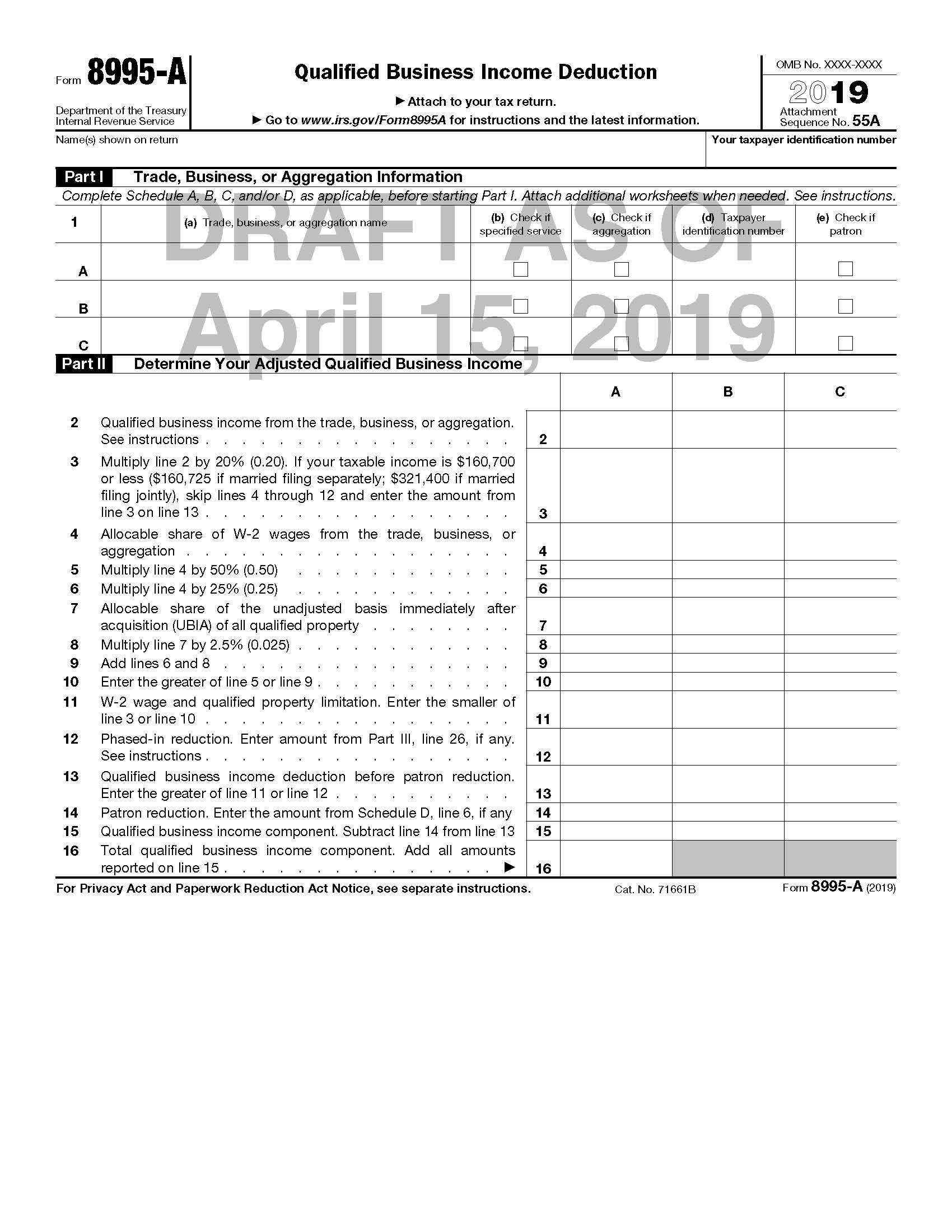

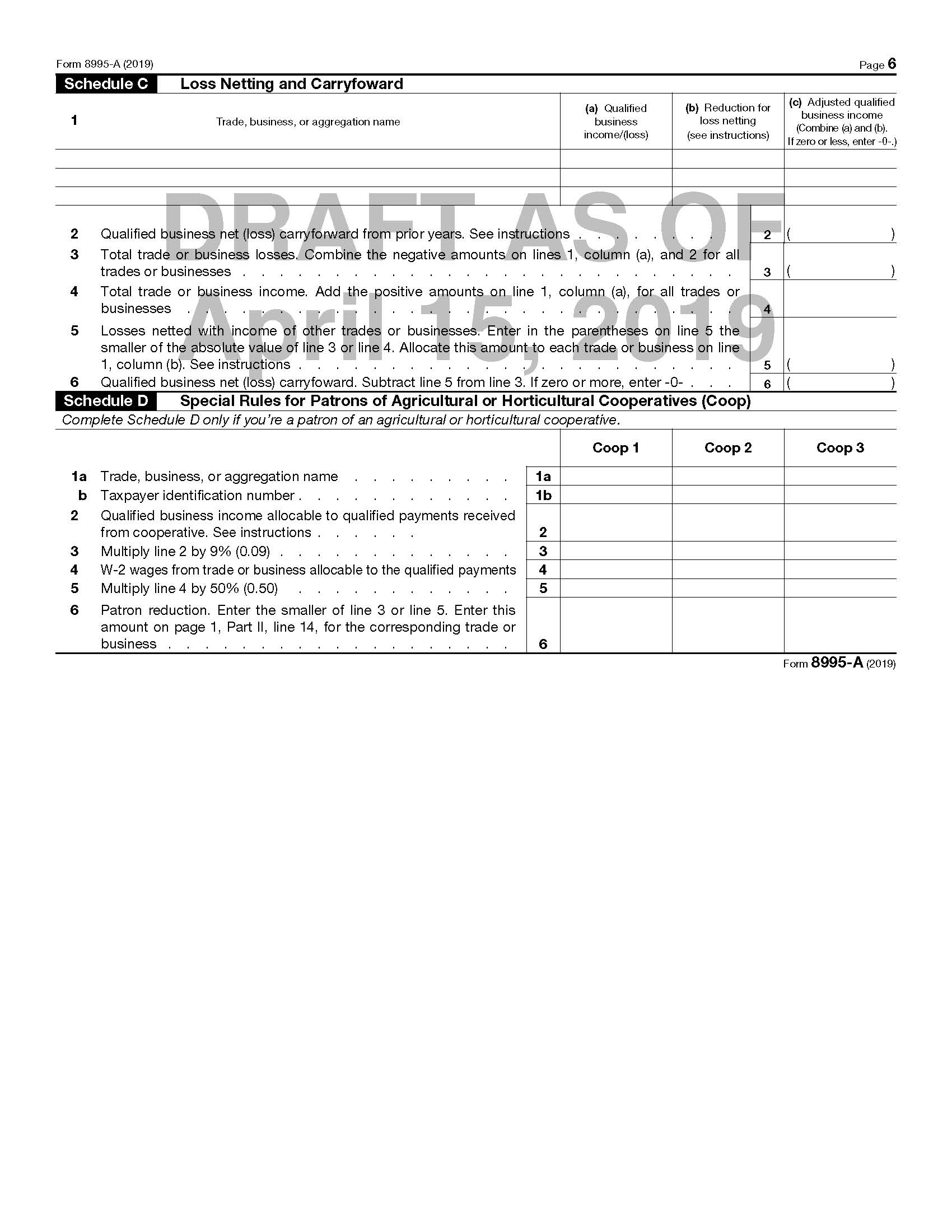

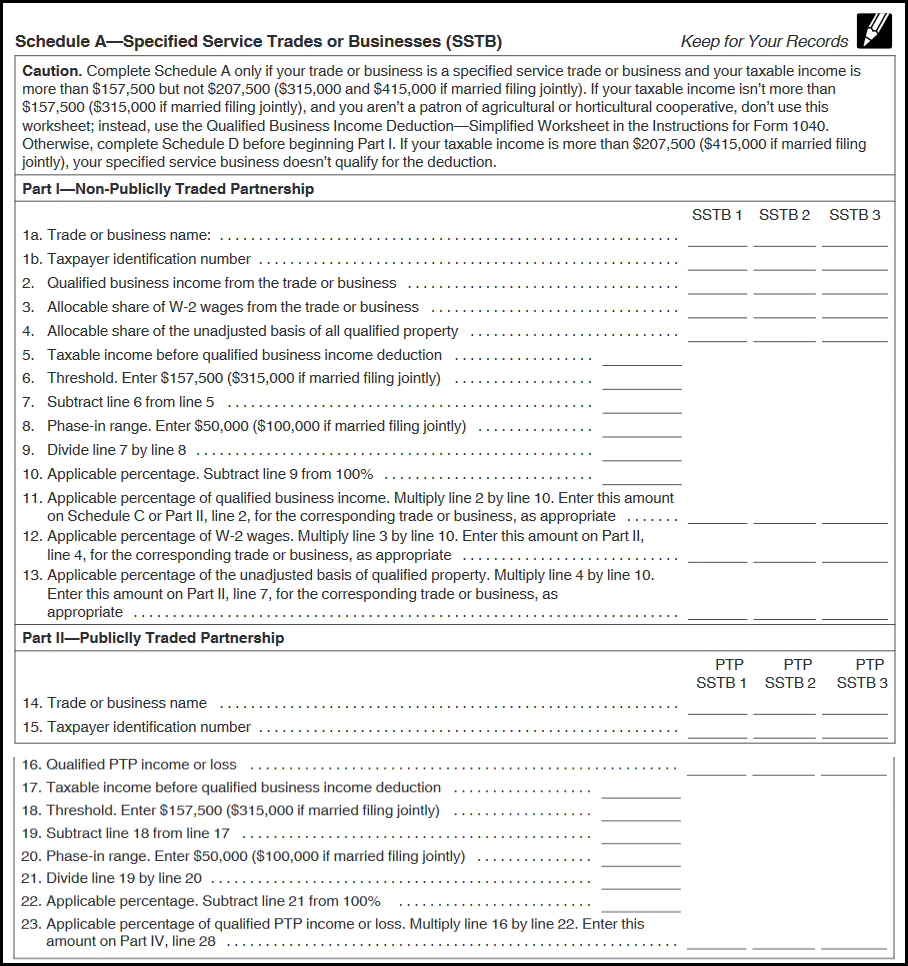

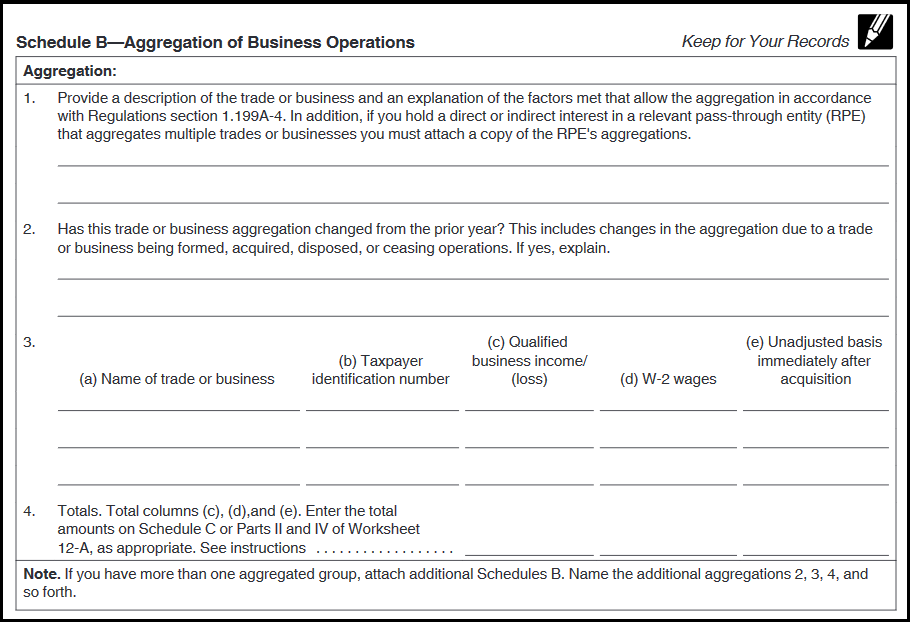

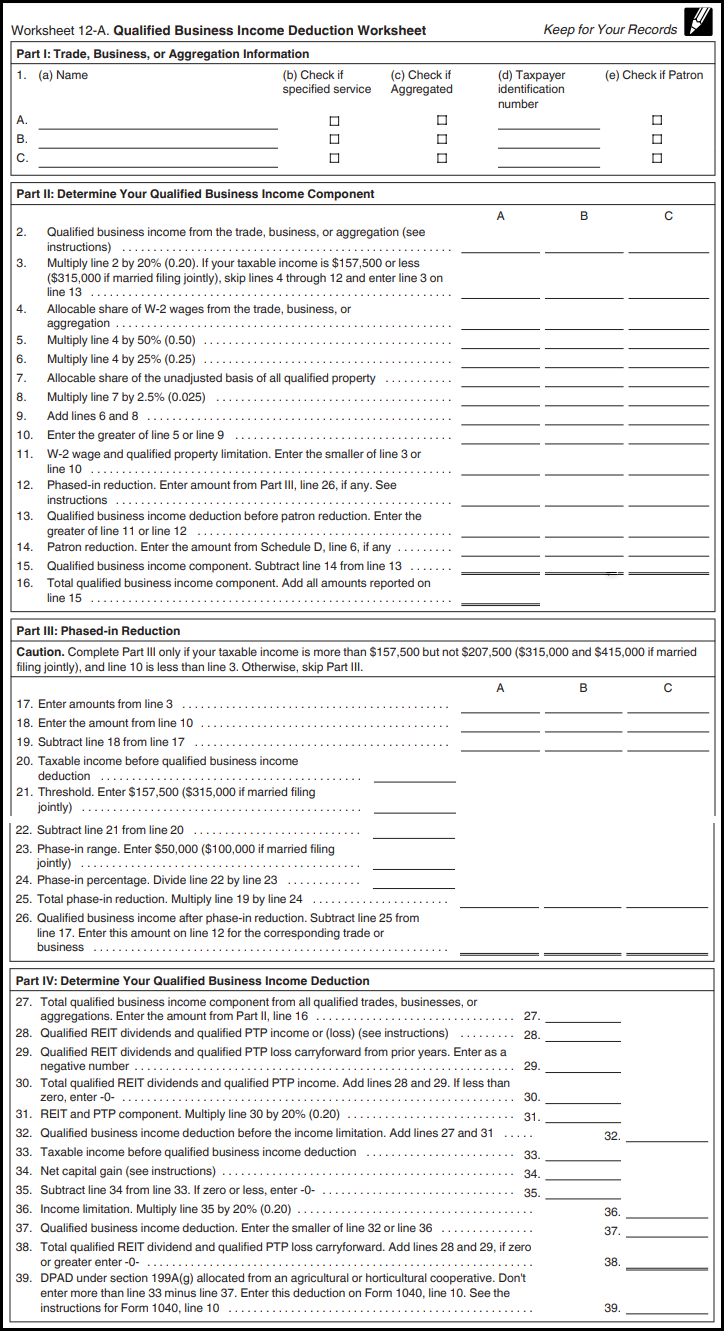

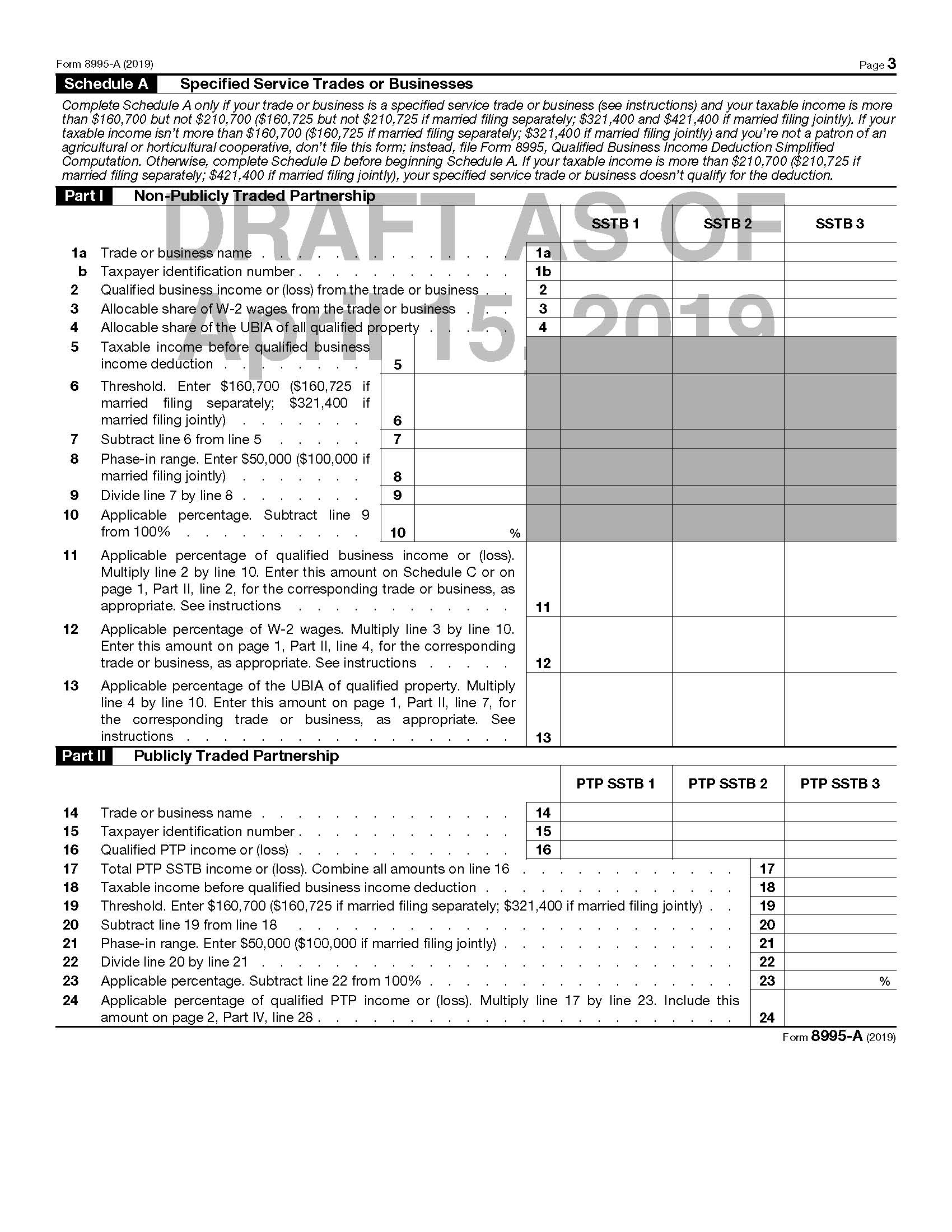

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

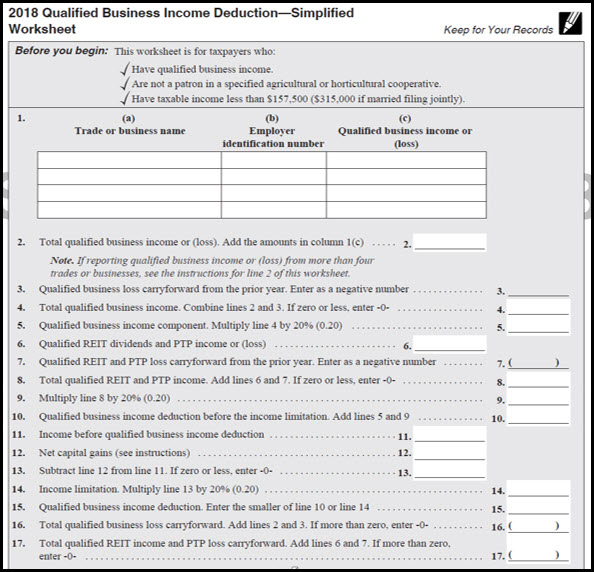

ProConnect Tax Online Simplified Worksheet Section 199A Qualif

Personal Worksheet Turbotax

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

Lacerte Complex Worksheet Section 199A Qualified Business

199A worksheet r/taxpros

Lacerte Complex Worksheet Section 199A Qualified Business Inco

Lacerte Complex Worksheet Section 199A Qualified Business

IRS Releases Drafts of Forms to Be Used to Calculate §199A Deduction on

To Activate The 199A Worksheet Select Yes To Is This Activity A Qualified Trade/Business?

Web This Worksheet Lists A Portion Of The Dividends Identified As Section 199A On Screen Income And Broker.

Solved•By Intuit•62•Updated July 14, 2022.

Web This Worksheet Is Designed For Tax Professionals To Evaluate The Type Of Legal Entity A Business Should Consider, Including The Application Of The Qualified Business Income.

Related Post: