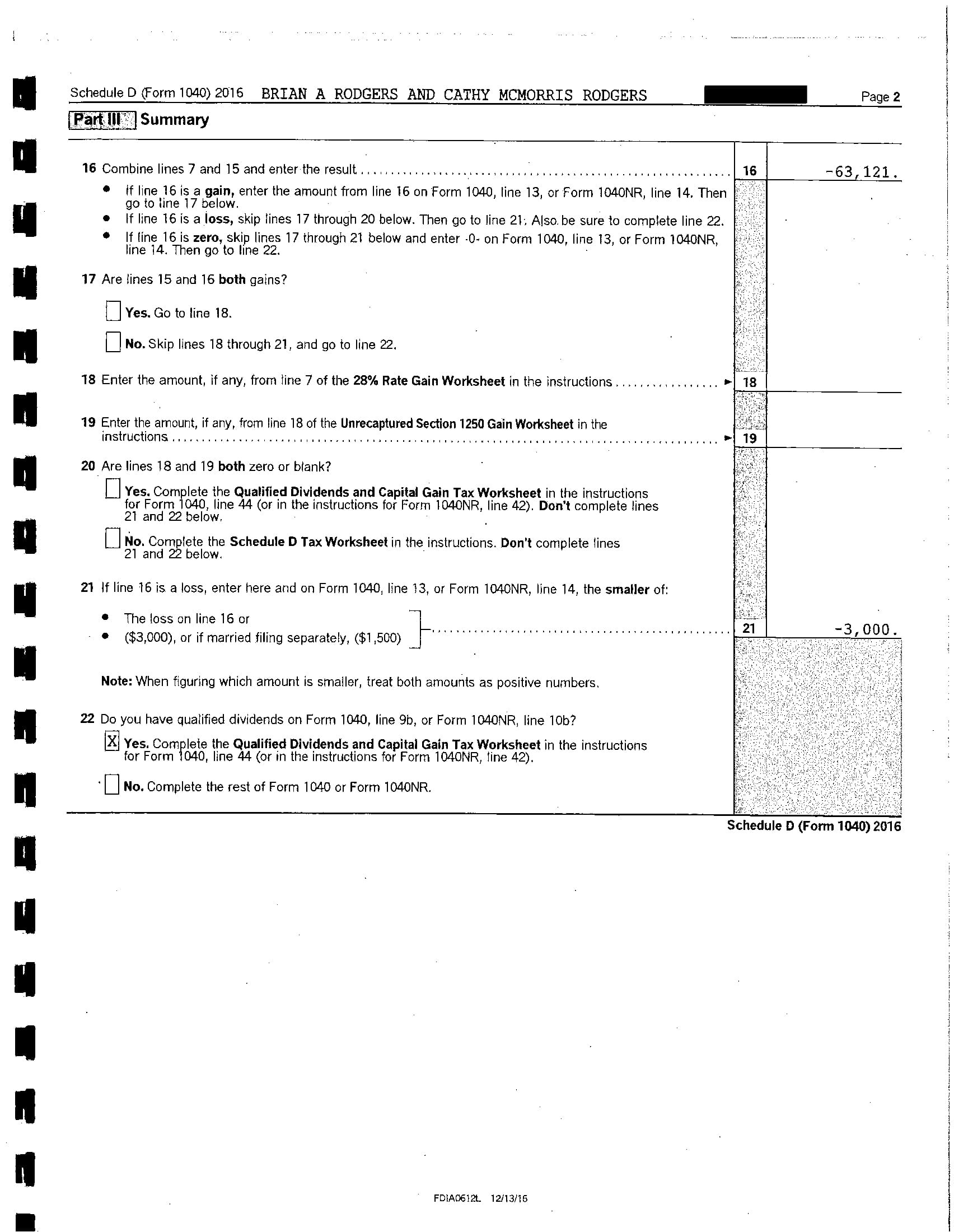

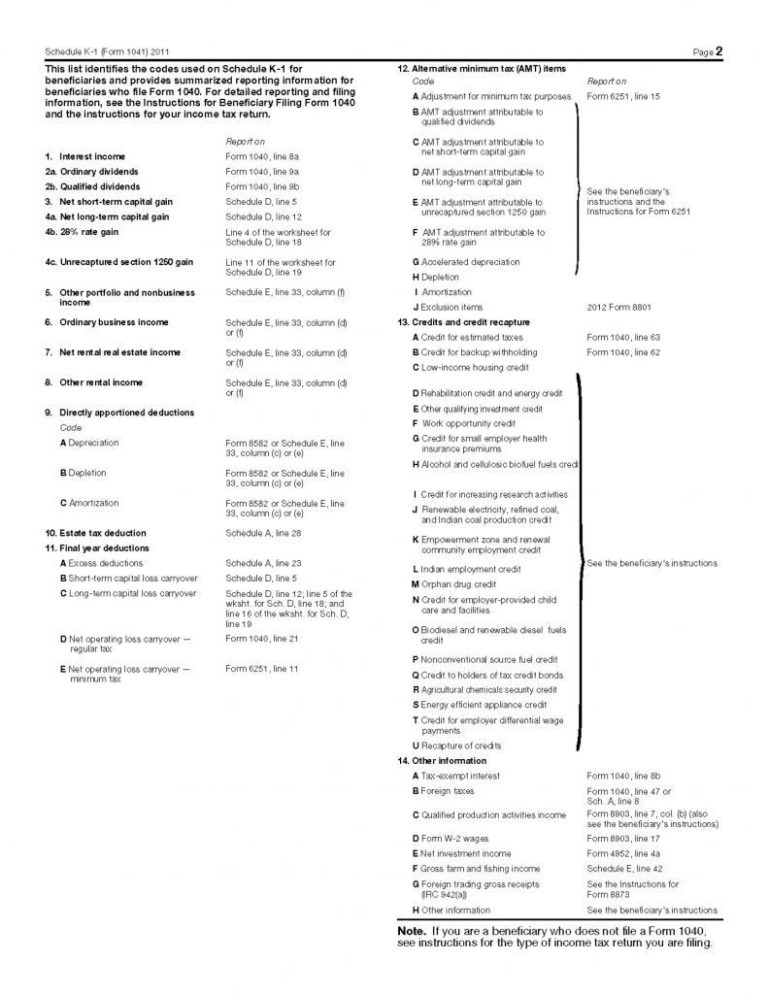

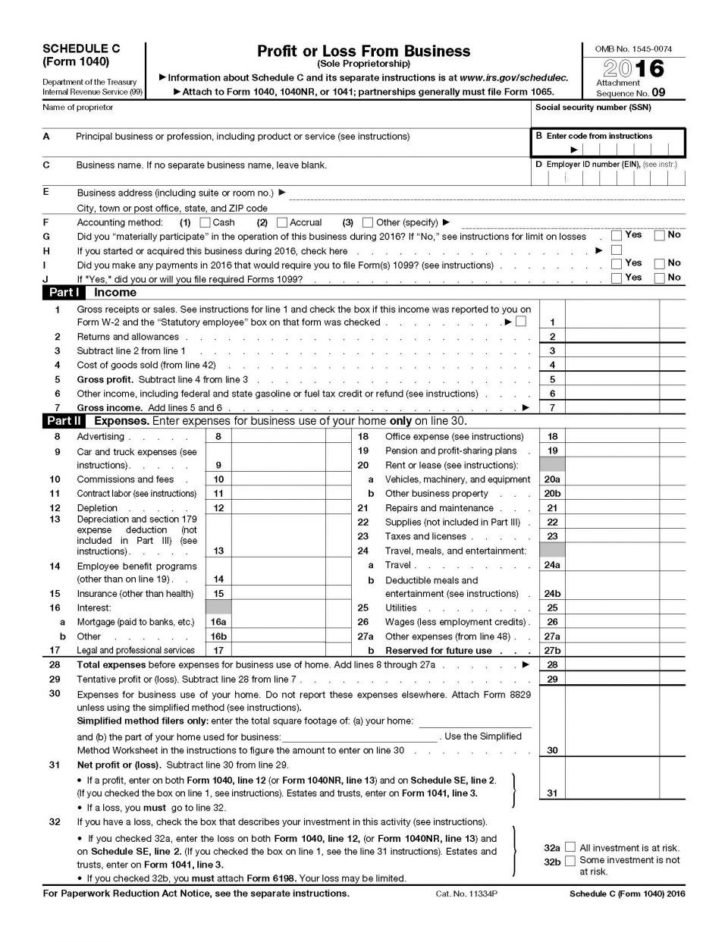

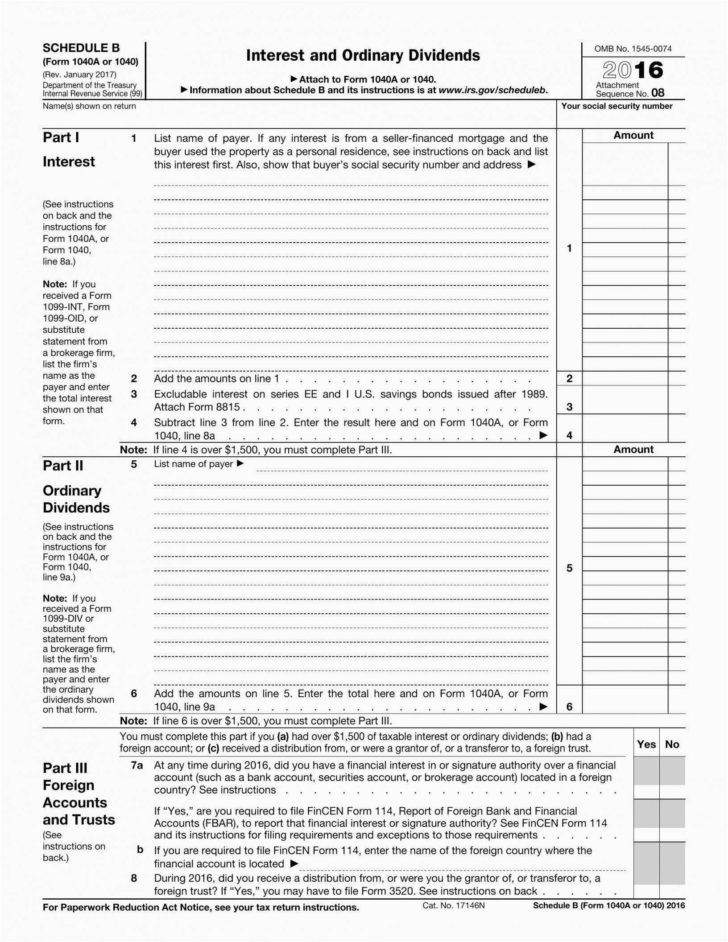

28 Percent Rate Gain Worksheet

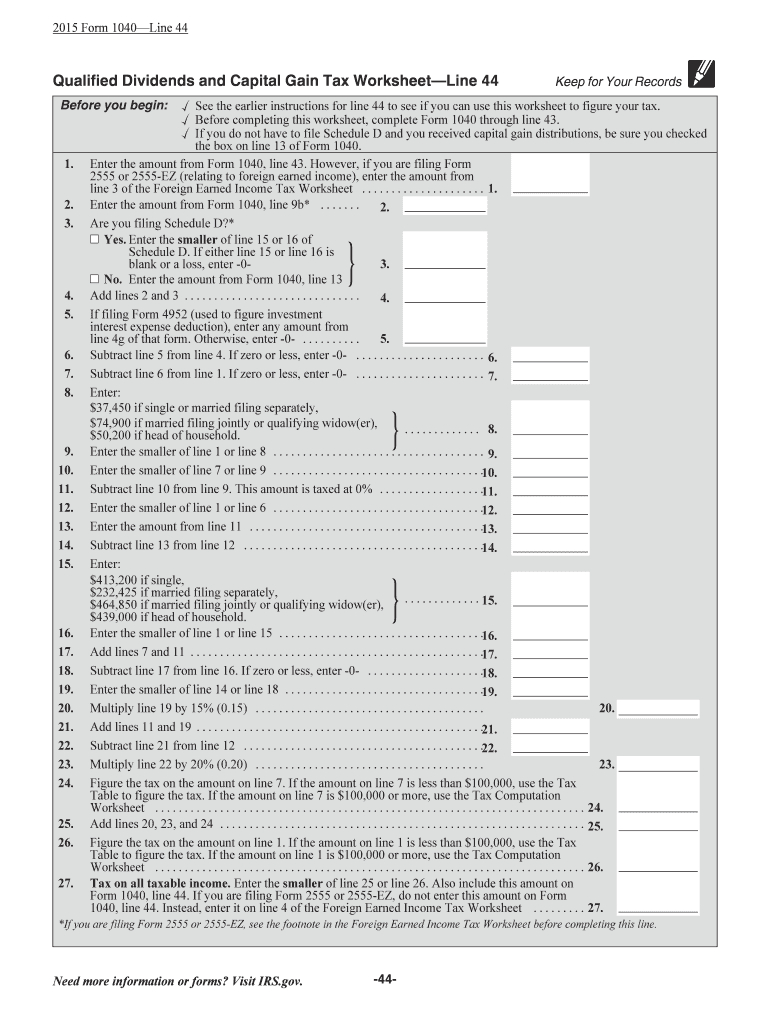

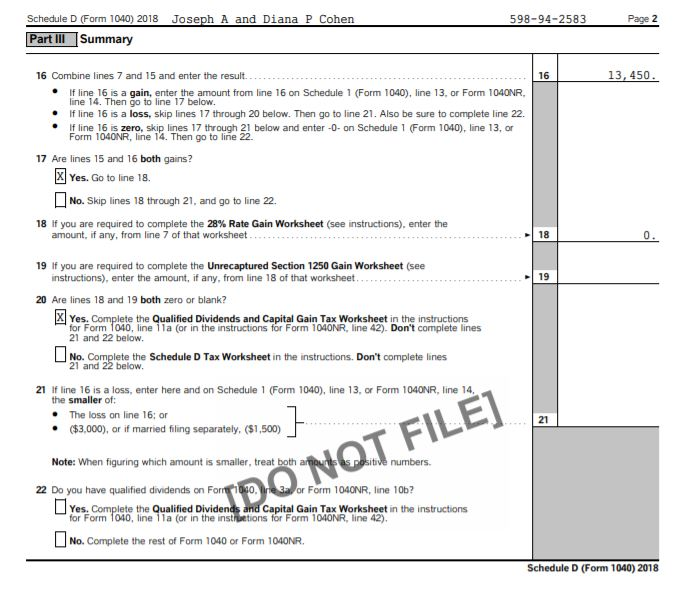

28 Percent Rate Gain Worksheet - Web hello on my 1099 div i had capital gain distributions and it shows.63 cents under 2d. Per the instructions, the 28% rate will generate if an. This is the smaller of line 22 or line 24 of your 2016 form 4797 (or the. The 0% and 15% rates continue to apply to certain threshold. Web what is the 28 rate gain worksheet used for? Web if you are completing line 18c of schedule. Web 28% rate gain worksheet (see instructions), enter the. Entries in schedule d with an adjustment code of c. Figure the smaller of (a) the depreciation allowed or allowable or (b) the total gain for the sale. Web web 28% rate gain worksheet—line 18 keep for your records 1. Web for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. If you realized a gain from qualified small business stock. Web if you answered yes to the question at line 17, you will complete the 28% rate gain worksheet. Web if you are completing line 18c of schedule. Web web. If you realized a gain from qualified small business stock. Per the instructions, the 28% rate will generate if an amount is present on. Web if you are completing line 18c of schedule. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. This is the smaller of line 22 or line 24 of your 2016 form 4797 (or. The 0% and 15% rates continue to apply to certain threshold. Web hello on my 1099 div i had capital gain distributions and it shows.63 cents under 2d. Figure the smaller of (a) the depreciation allowed or allowable or (b) the total gain for the sale. Web if you are completing line 18c of schedule. Web web 28 percent rate. If you excluded 60% of. Web web 28 percent rate gain worksheet; Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Web web 28% rate gain worksheet—line 18 keep for your records 1. Entries in schedule d with an adjustment code of c. Please let me know if i can assist you further. Web if you are completing line 18 of schedule d, enter as a positive number the amount of your allowable exclusion on line 2 of the 28% rate gain worksheet; In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. If you excluded. This is the smaller of line 22 or line 24 of your 2016 form 4797 (or the. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. Web for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web there are seven federal income. I want to know if i need to fill out the 28 percent worksheet because i did not. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Per the instructions, the 28% rate will. Please let me know if i can assist you further. Web 28% rate gain worksheet (see instructions), enter the. If there is an amount in box 2c, see exclusion of gain on qualified small. Figure the smaller of (a) the depreciation allowed or allowable, or (b) the total gain for the sale. Entries in schedule d with an adjustment code. Web if you are completing line 18 of schedule d, enter as a positive number the amount of your allowable exclusion on line 2 of the 28% rate gain worksheet; Web hello on my 1099 div i had capital gain distributions and it shows.63 cents under 2d. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250. This is the smaller of line 22 or line 24 of your 2016 form 4797 (or the. Figure the smaller of (a) the depreciation allowed or allowable or (b) the total gain for the sale. Web there are seven federal income tax rates in 2022: Per the instructions, the 28% rate will generate if an. Please let me know if. Figure the smaller of (a) the depreciation allowed or allowable or (b) the total gain for the sale. Web hello on my 1099 div i had capital gain distributions and it shows.63 cents under 2d. If you checked on line 17, complete the 28% rate gain worksheet in these instructions if either of the following applies for 20xx: Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Entries in schedule d with an adjustment code of c. Web 28% rate gain worksheet. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. Web if you are completing line 18 of schedule d, enter as a positive number the amount of your allowable exclusion on line 2 of the 28% rate gain worksheet; 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. Web web description of 28 rate gain worksheet. Per the instructions, the 28% rate will generate if an amount is present on. Per the instructions, the 28% rate will generate if an. Web web 28% rate gain worksheet—line 18 keep for your records 1. Web what is the 28 rate gain worksheet used for? The 0% and 15% rates continue to apply to certain threshold. I want to know if i need to fill out the 28 percent worksheet because i did not. In taxslayer pro, the 28% rate gain worksheet and the unrecaptured section 1250 gain worksheet are produced. This is the smaller of line 22 or line 24 of the 2009 form 4797. Web 28% rate gain worksheet (see instructions), enter the. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web for tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web there are seven federal income tax rates in 2022: Web what is the 28 rate gain worksheet used for? Web if you are completing line 18c of schedule. This is the smaller of line 22 or line 24 of the 2009 form 4797. 28% rate gain and unrecapture 1250 worksheet capital loss carryover forced. I want to know if i need to fill out the 28 percent worksheet because i did not. Web hello on my 1099 div i had capital gain distributions and it shows.63 cents under 2d. Web you will need to complete the 28% rate gain worksheet in the schedule d instructions. The 0% and 15% rates continue to apply to certain threshold. This is the smaller of line 22 or line 24 of your 2016 form 4797 (or the. If you realized a gain from qualified small business stock. Entries in schedule d with an adjustment code of c. If you excluded 60% of. Figure the smaller of (a) the depreciation allowed or allowable or (b) the total gain for the sale. Figure the smaller of (a) the depreciation allowed or allowable, or (b) the total gain for the sale.28 Rate Gain Worksheet Studying Worksheets

28 Rate Gain Worksheet

Paintive 28 Rate Gain Worksheet

28 Rate Gain Worksheet

28 Rate Gain Worksheet 2016 —

Irs 28 Rate Gain Worksheet

Paintive 28 Rate Gain Worksheet

Mecha Wiring 28 Rate Gain Worksheet 2017

Irs 28 Rate Gain Worksheet

Mecha Wiring 28 Rate Gain Worksheet 2017

Web Web 28 Percent Rate Gain Worksheet;

Per The Instructions, The 28% Rate Will Generate If An Amount Is Present On.

In Taxslayer Pro, The 28% Rate Gain Worksheet And The Unrecaptured Section 1250 Gain Worksheet Are Produced.

Please Let Me Know If I Can Assist You Further.

Related Post: