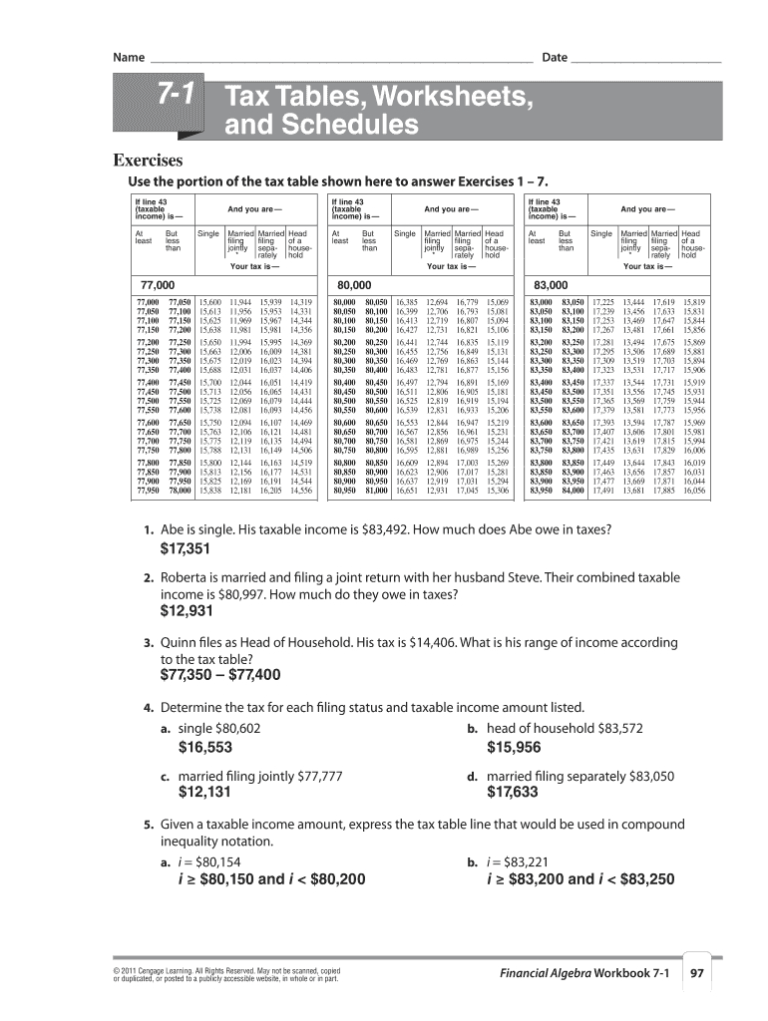

6 1 Tax Tables Worksheets And Schedules

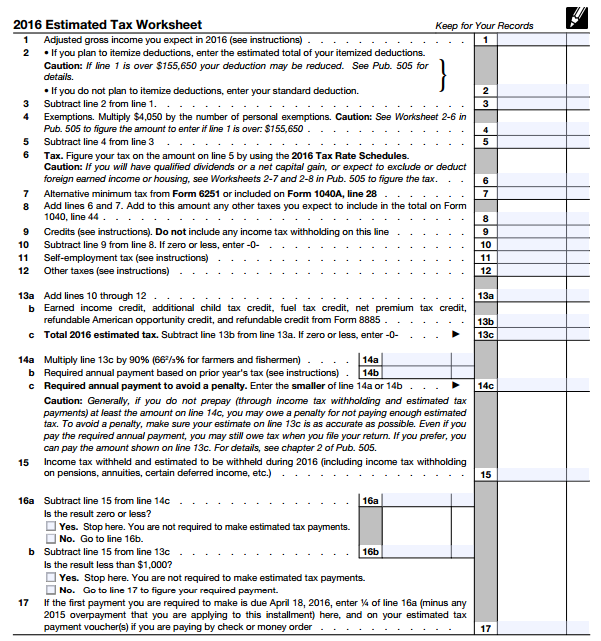

6 1 Tax Tables Worksheets And Schedules - Roberta is married and filing a joint. Practice here with 6000 plus worksheets for grade 1 to. Web study with quizlet and memorize flashcards containing terms like property taxes, sales taxes, income taxes and more. Complete the row below that. Web murrieta valley unified school district / overview Web understanding how to use the federal tax tables will produce it easier for you to calculate the tax you owes. Special status for unmarried taxpayers who support other people besides. His taxable income is $83,492. One year gain amount (add lines 1 and 2) if the sum of line 1 plus line 2 is zero or less, enter zero on line 3 and skip. Learn to calculate tip amount in a bill or how much tax was paid in a bill. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web tax, tip, and discount word problems worksheet. Learn to calculate tip amount in a bill or how much tax was paid in a bill. Learn to calculate tip amount in a bill or how. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. A table or chart displaying the amount of tax due based on income received. Web murrieta valley unified school district / overview The tax rate may be shown as a discrete amount, a percentage rate, or. Web tax, tip, and discount word. Web understanding how to use the federal tax tables will produce it easier for you to calculate the tax you owes. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Web tax tables and inequalities Learn to calculate tip amount in a bill or how much tax was paid in a. One year gain amount (add lines 1 and 2) if the sum of line 1 plus line 2 is zero or less, enter zero on line 3 and skip. Learn to calculate tip amount in a bill or how much tax was paid in a bill. Complete the row below that. Example 1 ron is single. However, if your return. Learn to calculate tip amount in a bill or how much tax was paid in a bill. .6 7 subtraction for 65 or older (born before january 2, 1959) or. There are many different types oftaxes • property tax. Web 6 add lines 1 through 5 (if you are a renter and this line is less than the rent you. Determine the tax for each filing status in taxable. A table or chart displaying the amount of tax due based on income received. One year gain amount (add lines 1 and 2) if the sum of line 1 plus line 2 is zero or less, enter zero on line 3 and skip. Web study with quizlet and memorize flashcards containing. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web 6 add lines 1 through 5 (if you are a renter and this line is less than the rent you paid, enclose an explanation). Learn to calculate tip amount in a bill or how. How much does abe owe in taxes? Web find and create gamified quizzes, lessons, presentations, and flashcards for students, employees, and everyone else. His taxable income is $83,492. Learn to calculate tip amount in a bill or how much tax was paid in a bill. The tax rate may be shown as a discrete amount, a percentage rate, or. Web study with quizlet and memorize flashcards containing. Web fa 6.1 tax tables, worksheets, and schedules ws 1. Example 1 ron is single. His taxable income is $83,492. Special status for unmarried taxpayers who support other people besides. The tax rate may be shown as a discrete amount, a percentage rate, or. Example 1 ron is single. Web worksheet 1b is used with the standard withholding rate schedules in the 2023 percentage. Web find and create gamified quizzes, lessons, presentations, and flashcards for students, employees, and everyone else. Web 6 1 tax tables worksheets and schedules. The tax rate may be shown as a discrete amount, a percentage rate, or. Web murrieta valley unified school district / overview There are many different types oftaxes • property tax. How much does abe owe in taxes? One year gain amount (add lines 1 and 2) if the sum of line 1 plus line 2 is zero or less, enter zero on line 3 and skip. There are seven federal income tax rates in. Practice here with 6000 plus worksheets for grade 1 to. Section a —use if your %ling status issingle. .6 7 subtraction for 65 or older (born before january 2, 1959) or. As the total taxable wages on line 1a of the withholding worksheet that. Determine the tax for each filing status in taxable. Web study with quizlet and memorize flashcards containing terms like property tax, sales tax, taxable income and more. Web fa 6.1 tax tables, worksheets, and schedules ws 1. Web 6 add lines 1 through 5 (if you are a renter and this line is less than the rent you paid, enclose an explanation). Web tax tables and inequalities Complete the row below that. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web find and create gamified quizzes, lessons, presentations, and flashcards for students, employees, and everyone else. A table or chart displaying the amount of tax due based on income received. He is using an irs tax form and calculates that. How much does abe owe in taxes? However, if your return is more complicated (for example, you. Special status for unmarried taxpayers who support other people besides. Web study with quizlet and memorize flashcards containing terms like property taxes, sales taxes, income taxes and more. Web fa 6.1 tax tables, worksheets, and schedules ws 1. His taxable income is $83,492. .6 7 subtraction for 65 or older (born before january 2, 1959) or. There are many different types oftaxes • property tax. Learn to calculate tip amount in a bill or how much tax was paid in a bill. There are seven federal income tax rates in. Web murrieta valley unified school district / overview The tax rate may be shown as a discrete amount, a percentage rate, or. Web study with quizlet and memorize flashcards containing. As the total taxable wages on line 1a of the withholding worksheet that. Web worksheet 1b is used with the standard withholding rate schedules in the 2023 percentage. One year gain amount (add lines 1 and 2) if the sum of line 1 plus line 2 is zero or less, enter zero on line 3 and skip.Publication 17 Your Federal Tax; 2001 Tax Table Taxable

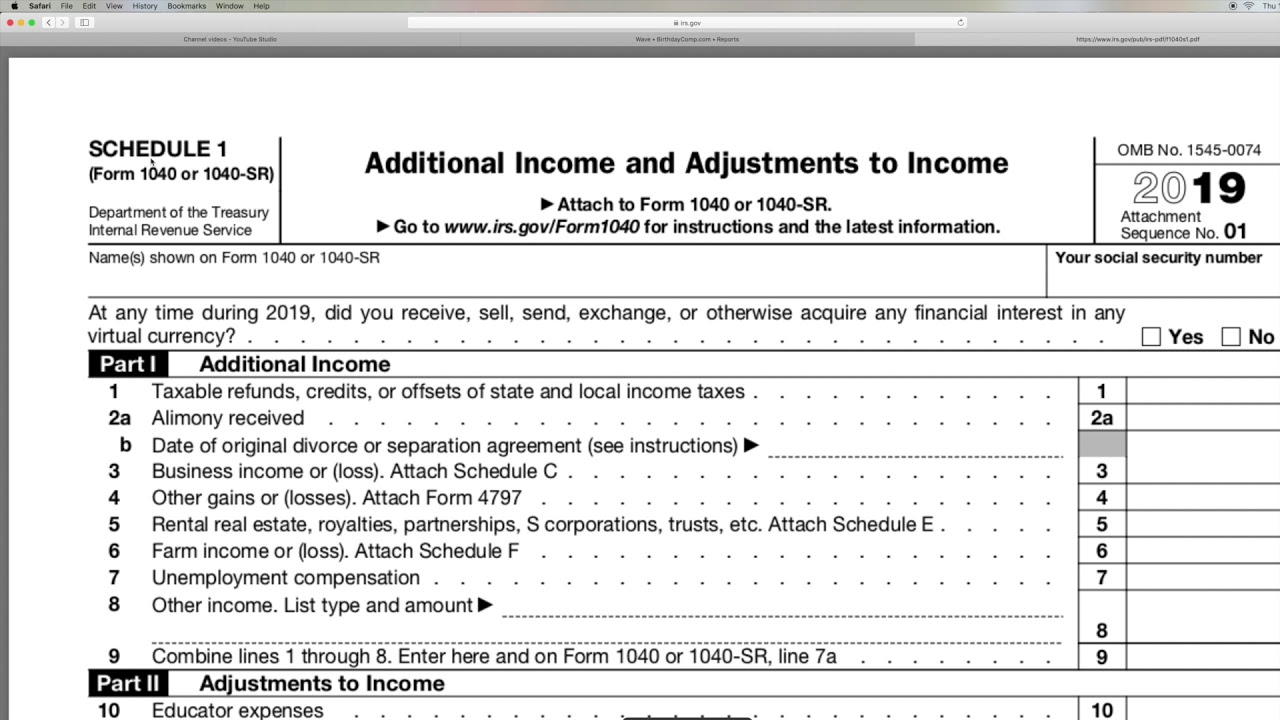

22 tax deductions, no itemizing required, on Schedule 1 Don't Mess

Itemized Deductions Form 1040 Schedule A Free Download Worksheet

Comprehensive Example

Alcoholics Anonymous 12 Step Worksheets Universal Network

How to find Form 1040 Schedule 1 for Individual Tax Return Additional

Form 1040 ES Worksheet 1040 Form Printable

2018 Tax Tables Letter G Decoration

7 1 Tax Tables Worksheets And Schedules Answers —

How to Pay Taxes for Side Hustles and Extra Young Adult Money

Web Tax, Tip, And Discount Word Problems Worksheet.

Web Study With Quizlet And Memorize Flashcards Containing Terms Like Property Tax, Sales Tax, Taxable Income And More.

He Is Using An Irs Tax Form And Calculates That.

A Table Or Chart Displaying The Amount Of Tax Due Based On Income Received.

Related Post: