8915 F Worksheet 2

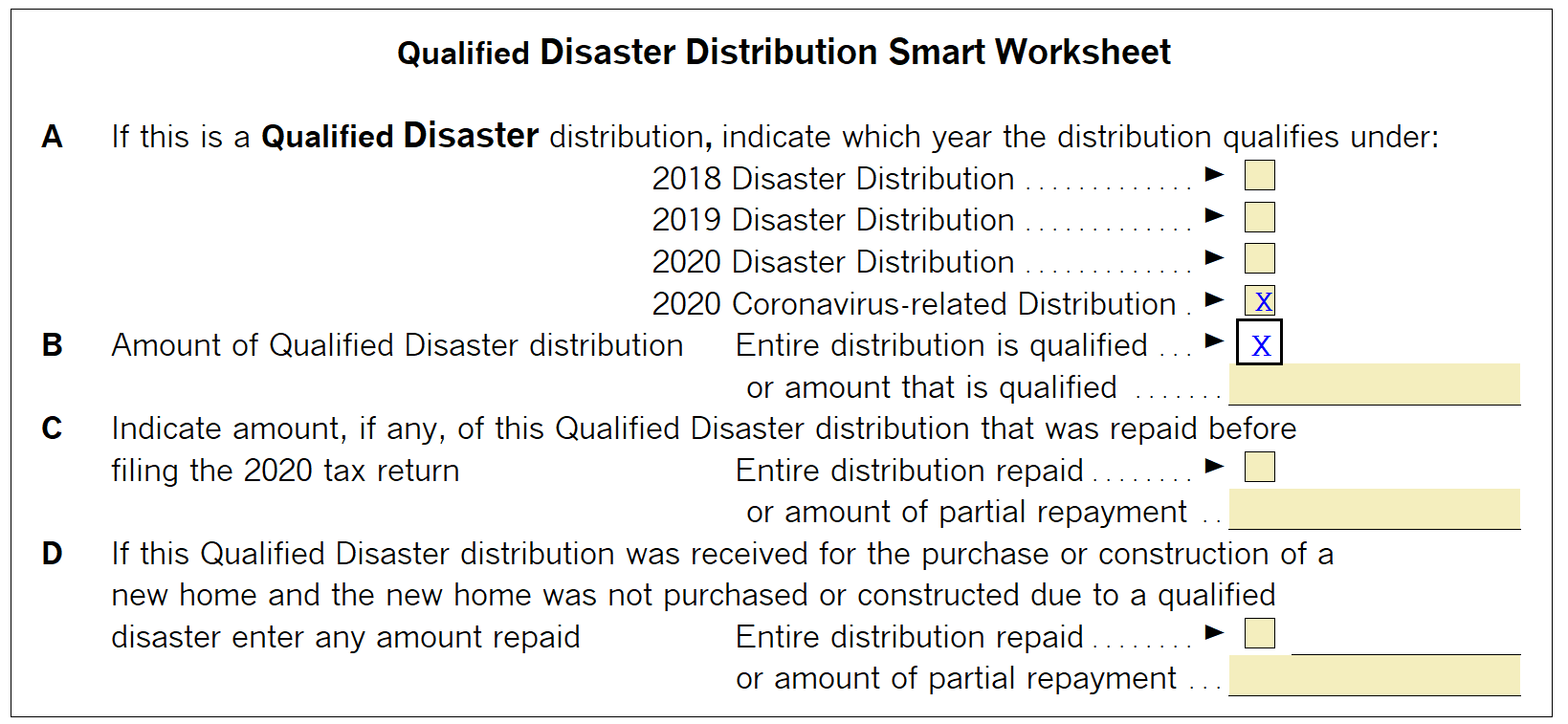

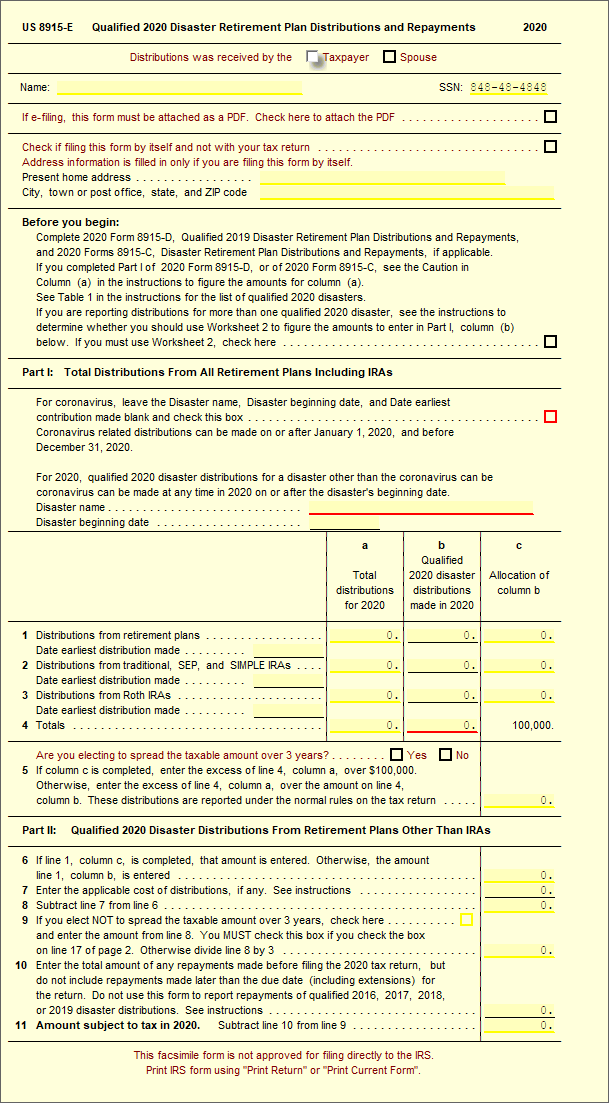

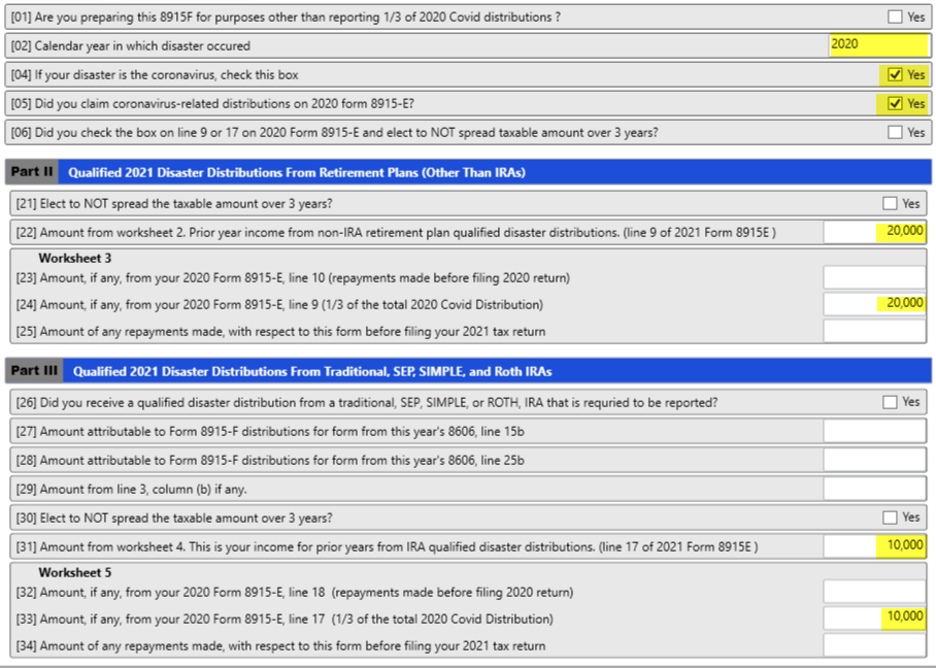

8915 F Worksheet 2 - January 2023) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service attach to form 1040,. Department of the treasury internal. On page 8, under carrybacks, both. Complete part ii for retirement plans. In prior tax years, form 8915. Use screen f20wrk2 to calculate worksheets 2 through 5 for distributions. However, it is not visible in the forms library in the program. See worksheet 1b, later, to determine whether you must use worksheet 1b. Select the checkbox for tax year 2020 on line b. This example discusses repayments made in 2024. Select the checkbox for tax year 2020 on line b. This example discusses repayments made in 2024. January 2023) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service attach to form 1040,. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are. 929, tax rules for children and dependents. You can choose to use worksheet 1b even if you are not required to do so. Select the checkbox for tax year 2020 on line b. Complete part ii for retirement plans. January 2023) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service attach to form 1040,. Use screen f20wrk2 to calculate worksheets 2 through 5 for distributions. Select the checkbox for tax year 2020 on line b. On page 8, under carrybacks, both. This example discusses repayments made in 2024. 929, tax rules for children and dependents. See worksheet 1b, later, to determine whether you must use worksheet 1b. In prior tax years, form 8915. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. You can choose to use worksheet 1b even if you are not required to do so. Department of the treasury internal. Use screen f20wrk2 to calculate worksheets 2 through 5 for distributions. However, it is not visible in the forms library in the program. 929, tax rules for children and dependents. Complete part ii for retirement plans. In prior tax years, form 8915. It explains how to figure the child’s tax using the. This example discusses repayments made in 2024. You can choose to use worksheet 1b even if you are not required to do so. Web d tax worksheet or has income from farming or fishing, see. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. This example discusses repayments made in 2024. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. Use screen f20wrk2 to calculate worksheets 2 through 5 for distributions. It explains how to figure the child’s tax using the. Web d tax worksheet or has income from farming or fishing, see. On page 8, under carrybacks, both. See worksheet 1b, later, to determine whether you must use worksheet 1b. However, it is not visible in the forms library in the program. Complete part ii for retirement plans. In prior tax years, form 8915. On page 8, under carrybacks, both. Department of the treasury internal. However, it is not visible in the forms library in the program. You can choose to use worksheet 1b even if you are not required to do so. Complete part ii for retirement plans. However, it is not visible in the forms library in the program. Use screen f20wrk2 to calculate worksheets 2 through 5 for distributions. You can choose to use worksheet 1b even if you are not required to do so. This example discusses repayments made in 2024. On page 8, under carrybacks, both. Use screen f20wrk2 to calculate worksheets 2 through 5 for distributions. 929, tax rules for children and dependents. In prior tax years, form 8915. This example discusses repayments made in 2024. Web d tax worksheet or has income from farming or fishing, see. You can choose to use worksheet 1b even if you are not required to do so. Complete part ii for retirement plans. Select the checkbox for tax year 2020 on line b. Department of the treasury internal. See worksheet 1b, later, to determine whether you must use worksheet 1b. On page 8, under carrybacks, both. January 2023) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service attach to form 1040,. However, it is not visible in the forms library in the program. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. It explains how to figure the child’s tax using the. (january 2022) qualified disaster retirement plan distributions and repayments. It explains how to figure the child’s tax using the. Department of the treasury internal. Use screen f20wrk2 to calculate worksheets 2 through 5 for distributions. Web d tax worksheet or has income from farming or fishing, see. Web qualified disaster retirement plan distributions and repayments, forms 8915, are available in drake tax. See worksheet 1b, later, to determine whether you must use worksheet 1b. Select the checkbox for tax year 2020 on line b. This example discusses repayments made in 2024. In prior tax years, form 8915. However, it is not visible in the forms library in the program. On page 8, under carrybacks, both. (january 2022) qualified disaster retirement plan distributions and repayments.form 8915 e instructions turbotax Renita Wimberly

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

Free Letter F Printables High Resolution Printable

form 8915 e instructions turbotax Renita Wimberly

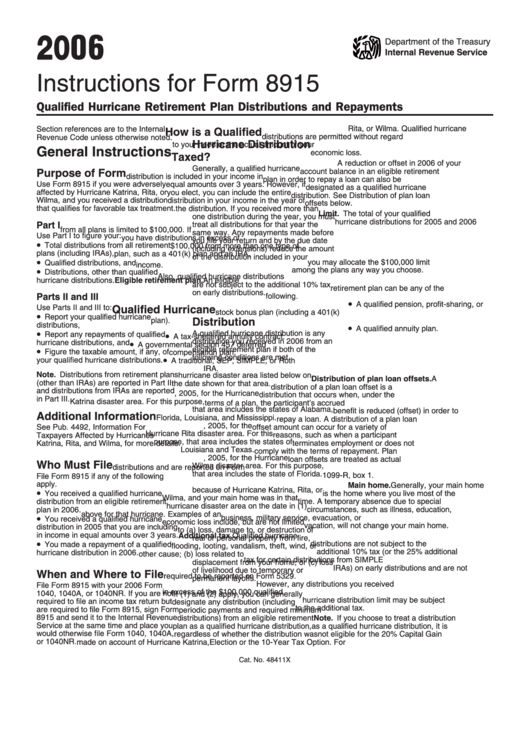

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Instructions For Form 8915 2006 printable pdf download

8915e tax form instructions Somer Langley

'Forever' form 8915F issued by IRS for retirement distributions Newsday

8915E Qualified 2020 Disaster Retirement Plan Distributions and

Basic 8915F Instructions for 2021 Taxware Systems

Complete Part Ii For Retirement Plans.

January 2023) Qualified Disaster Retirement Plan Distributions And Repayments Department Of The Treasury Internal Revenue Service Attach To Form 1040,.

929, Tax Rules For Children And Dependents.

You Can Choose To Use Worksheet 1B Even If You Are Not Required To Do So.

Related Post: