Adjusted Qualified Education Expenses Worksheet

Adjusted Qualified Education Expenses Worksheet - Web how do i calculate the amount of qualified education expenses? Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Are of adjusted qualified educating expenses calculated by adding the total tuition the required books/course basic, minus grants/scholarships? Amounts actually paid during 2020 for qualified tuition and. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a state, or an agency or instrumentality of a state, that. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. Web the tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Payments received for qualified tuition and related expenses (total from column b above) 1. Payments received for qualified tuition and related expenses (total from column b above) 1. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Web use this section to enter information needed to complete the student loan interest deduction worksheet. Amounts actually paid during 2020 for qualified tuition and. Web how do i calculate the. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. Web how do i calculate the amount of qualified education expenses? Web use this section to enter information needed to complete the student loan interest deduction worksheet. Payments received for qualified tuition and. The student interest deduction calculated on the worksheet. Web how do i calculate the amount of qualified education expenses? Payments received for qualified tuition and related expenses (total from column b above) 1. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Web complete the adjusted qualified education expenses worksheet in the instructions for. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a state, or an agency or instrumentality of a state, that. The. The student interest deduction calculated on the worksheet. Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. Web a qualified tuition program (qtp), also referred to as. Web the tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Are of adjusted qualified educating expenses calculated by adding the total tuition the required books/course basic, minus grants/scholarships? Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web how. Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a state, or an agency or instrumentality of a state, that. Payments received for qualified tuition and related expenses (total from column b above) 1. Web how do i calculate the amount of qualified education expenses? Web 12 rows. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Payments received for qualified tuition and related expenses (total from column b above) 1. Web the tuition and. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. The student interest deduction calculated on the worksheet. Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Web the tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Web. Web how do i calculate the amount of qualified education expenses? Web a qualified tuition program (qtp), also referred to as a section 529 plan, is a program established and maintained by a state, or an agency or instrumentality of a state, that. Are of adjusted qualified educating expenses calculated by adding the total tuition the required books/course basic, minus grants/scholarships? Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. Amounts actually paid during 2020 for qualified tuition and. Payments received for qualified tuition and related expenses (total from column b above) 1. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. The student interest deduction calculated on the worksheet. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Web the tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Web use this section to enter information needed to complete the student loan interest deduction worksheet. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. The student interest deduction calculated on the worksheet. Web the tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Are of adjusted qualified educating expenses calculated by adding the total tuition the required books/course basic, minus grants/scholarships? Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Amounts actually paid during 2020 for qualified tuition and. Web 12 rows 1 qualified expenses enter the total amount of your qualified educational expenses. Payments received for qualified tuition and related expenses (total from column b above) 1. Web complete the adjusted qualified education expenses worksheet in the instructions for form 8863 to determine what amount to enter on line 27 for the american opportunity. Web use this section to enter information needed to complete the student loan interest deduction worksheet.Education Credit 4 Form 8863 Lifetime Learning Credit

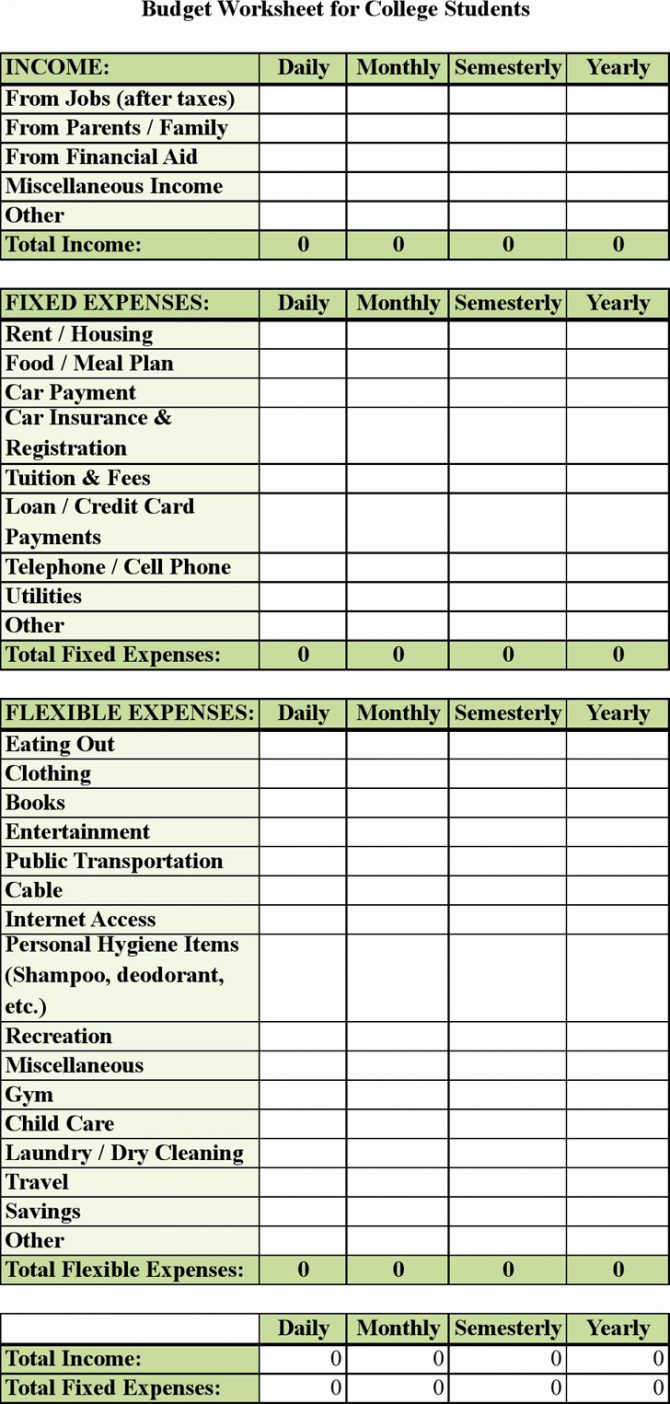

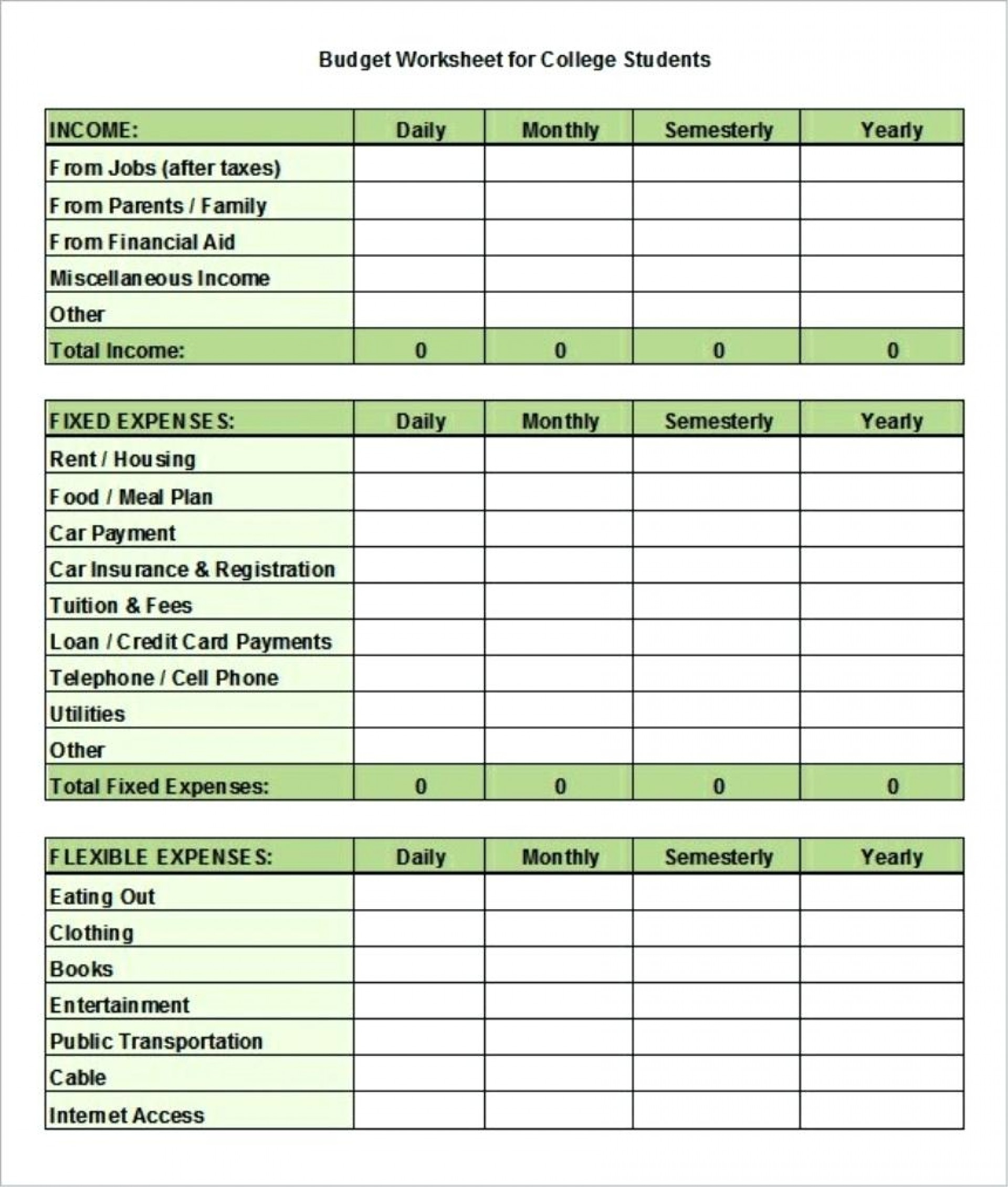

College Student Expenses Spreadsheet throughout College Expense

Receipt for qualified education expenses Fill out & sign online DocHub

Adjusted Qualified Education Expenses Worksheet Breadandhearth

1098T Tuition Statement Box 4 Adjustments Made for a Prior Year

College Student Expenses Spreadsheet regarding 020 Template Ideas

Qualified Education Expenses Worksheets

Qualified Education Expenses Worksheets

Adjusted Qualified Education Expenses Worksheet Breadandhearth

Adjusted Qualified Education Expenses Worksheet

Web How Do I Calculate The Amount Of Qualified Education Expenses?

Web Complete The Adjusted Qualified Education Expenses Worksheet In The Instructions For Form 8863 To Determine What Amount To Enter On Line 27 For The American Opportunity.

Web A Qualified Tuition Program (Qtp), Also Referred To As A Section 529 Plan, Is A Program Established And Maintained By A State, Or An Agency Or Instrumentality Of A State, That.

Related Post: