Annual Lease Value Calculation Worksheet

Annual Lease Value Calculation Worksheet - Web employee worksheet to calculate personal use of company car the irs requires written records be maintained by employers to document the business and personal use of. Web learn how to calculate lease liability (present value of your lease payments) and prepare the lease amortization schedule with expand. Web learn about minimum hire payments, future lease payments, & how go calculate the past value of your lease payments in choose. Web examples of annual lease value in a sentence. If the interest rate is known, use the fixed rate tab to. For an automobile provided only part of. (.25 x fair market value) + $500. Web the tips below will allow you to complete annual lease value method employers worksheet to calculate easily and quickly: Web than $59,999, the annual lease value is: The amount of the taxable fringe benefit is the annual lease value. Web the value is determined using annual lease value tables published annually by the irs. If the interest rate is known, use the fixed rate tab to. Web employee worksheet to calculate personal use of company car the irs requires written records be maintained by employers to document the business and personal use of. Web learn about minimum hire payments,. Web the tips below will allow you to complete annual lease value method employers worksheet to calculate easily and quickly: The amount of the taxable fringe benefit is the annual lease value. Web than $59,999, the annual lease value is: Open the template in the feature. Web examples of annual lease value in a sentence. It is mandatorythat the alv method is used when the. This method values usage based on the vehicle's fair market value. Web annual lease value $ 0 to 999 $ 600 $15,000 to 15,999 $ 4,350 $34,000 to 35,999 $ 9,250 For an automobile provided only part of. Web according to the irs annual lease value table, the annual lease. For an automobile provided only part of. Web annual lease value $ 0 to 999 $ 600 $15,000 to 15,999 $ 4,350 $34,000 to 35,999 $ 9,250 Web examples of annual lease value in a sentence. Under this rule, you determine the value of an automobile you provide to an employee by using its annual lease value. Web with these. Web learn about minimum hire payments, future lease payments, & how go calculate the past value of your lease payments in choose. The percentage of total miles that were deemed personal. To compute the annual lease value, first determine fair market value (fmv) as of the first date an auto is. Web than $59,999, the annual lease value is: Web. Open the template in the feature. To compute the annual lease value, first determine fair market value (fmv) as of the first date an auto is. Web learn about minimum hire payments, future lease payments, & how go calculate the past value of your lease payments in choose. This method values usage based on the vehicle's fair market value. Web. Web employee worksheet to calculate personal use of company car the irs requires written records be maintained by employers to document the business and personal use of. Web annual lease value method (for autos available 30 days or more) fair market value of vehicle ** (to be redetermined at the beginning of the fifth year and every four. Web with. Web than $59,999, the annual lease value is: Web learn how to calculate lease liability (present value of your lease payments) and prepare the lease amortization schedule with expand. If the interest rate is known, use the fixed rate tab to. Web examples of annual lease value in a sentence. Annual lease value per irs table _____ (table:. Web excess of $59,999, the annual lease value = (0.25 x the auto’s fair market value) + $500. Web examples of annual lease value in a sentence. The percentage of total miles that were deemed personal. Web according to the irs annual lease value table, the annual lease value of that $25,000 vehicle would be $6,850. (.25 x fair market. Web annual lease value method (for autos available 30 days or more) fair market value of vehicle ** (to be redetermined at the beginning of the fifth year and every four. Web examples of annual lease value in a sentence. The amount of the taxable fringe benefit is the annual lease value. Web learn how to calculate lease liability (present. The amount of the taxable fringe benefit is the annual lease value. Web the value is determined using annual lease value tables published annually by the irs. If the interest rate is known, use the fixed rate tab to. Open the template in the feature. The percentage of total miles that were deemed personal. Irs annual lease value table author: Annual lease value per irs table _____ (table:. Web than $59,999, the annual lease value is: Web the tips below will allow you to complete annual lease value method employers worksheet to calculate easily and quickly: Web according to the irs annual lease value table, the annual lease value of that $25,000 vehicle would be $6,850. Web examples of annual lease value in a sentence. For an automobile provided only part of. Web learn about minimum hire payments, future lease payments, & how go calculate the past value of your lease payments in choose. Web excess of $59,999, the annual lease value = (0.25 x the auto’s fair market value) + $500. Us legal forms is an. Web annual lease value method (for autos available 30 days or more) fair market value of vehicle ** (to be redetermined at the beginning of the fifth year and every four. Web learn how to calculate lease liability (present value of your lease payments) and prepare the lease amortization schedule with expand. Web employee worksheet to calculate personal use of company car the irs requires written records be maintained by employers to document the business and personal use of. Web the lease calculator can be used to calculate the monthly payment or the effective interest rate on a lease. Under this rule, you determine the value of an automobile you provide to an employee by using its annual lease value. Web than $59,999, the annual lease value is: Web examples of annual lease value in a sentence. Web learn how to calculate lease liability (present value of your lease payments) and prepare the lease amortization schedule with expand. Web employee worksheet to calculate personal use of company car the irs requires written records be maintained by employers to document the business and personal use of. Web the lease calculator can be used to calculate the monthly payment or the effective interest rate on a lease. Web excess of $59,999, the annual lease value = (0.25 x the auto’s fair market value) + $500. The percentage of total miles that were deemed personal. Web the tips below will allow you to complete annual lease value method employers worksheet to calculate easily and quickly: It is mandatorythat the alv method is used when the. Web according to the irs annual lease value table, the annual lease value of that $25,000 vehicle would be $6,850. Irs annual lease value table author: The amount of the taxable fringe benefit is the annual lease value. (.25 x fair market value) + $500. Web annual lease value method (for autos available 30 days or more) fair market value of vehicle ** (to be redetermined at the beginning of the fifth year and every four. This method values usage based on the vehicle's fair market value. For an automobile provided only part of.Car Lease Calculator Excel Template HQ Template Documents

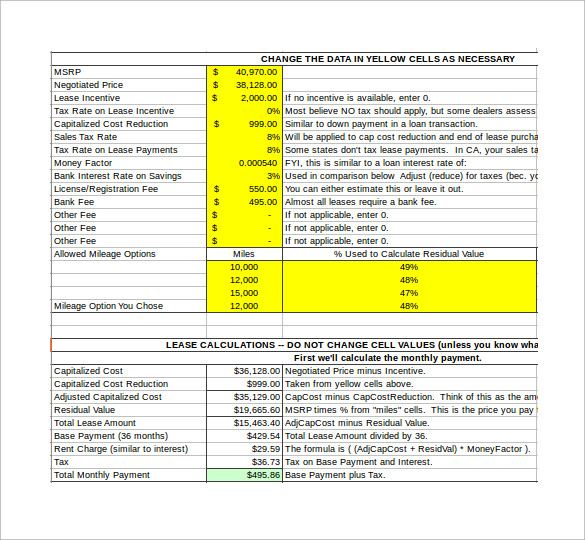

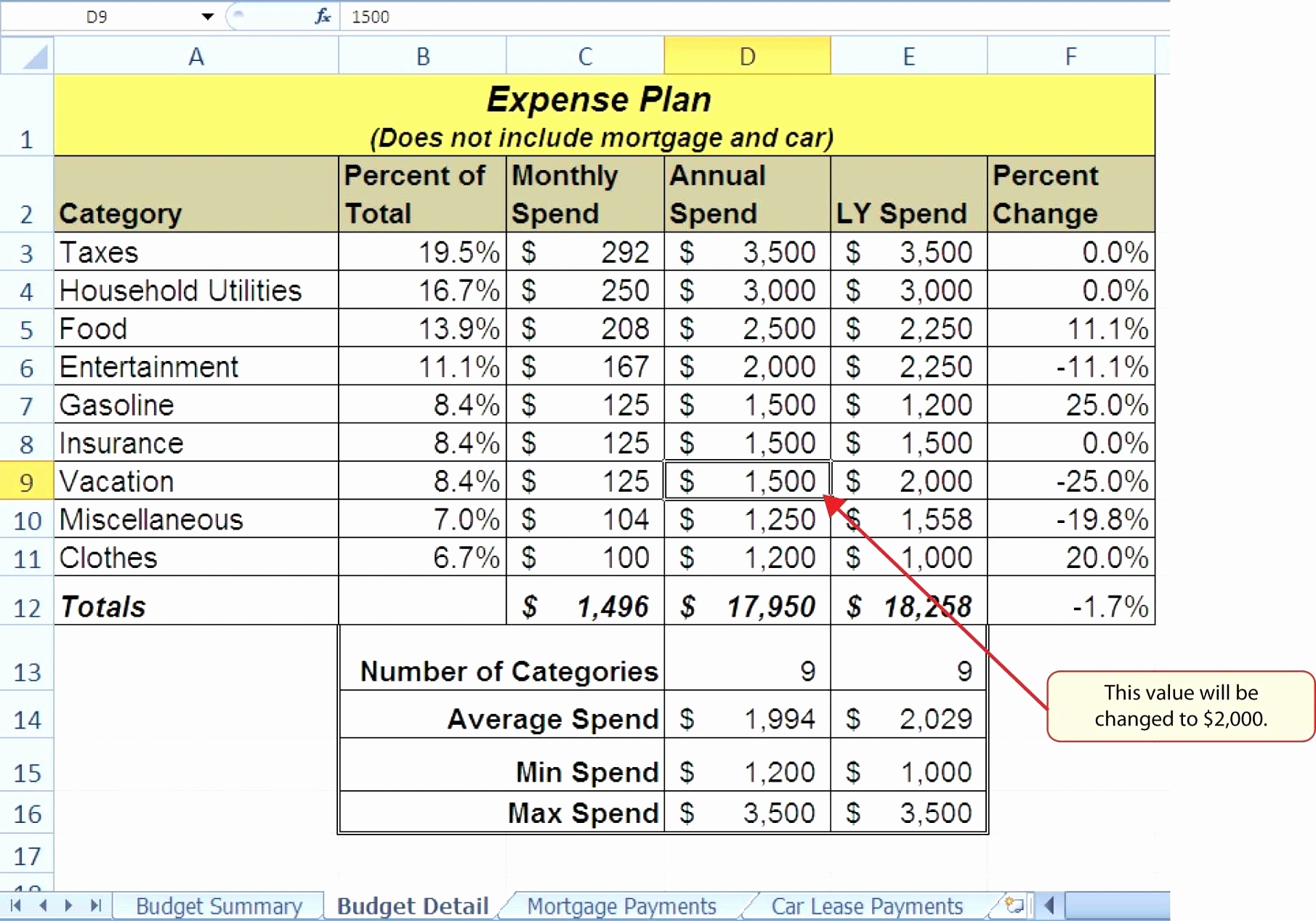

Car Lease Calculator Excel Spreadsheet —

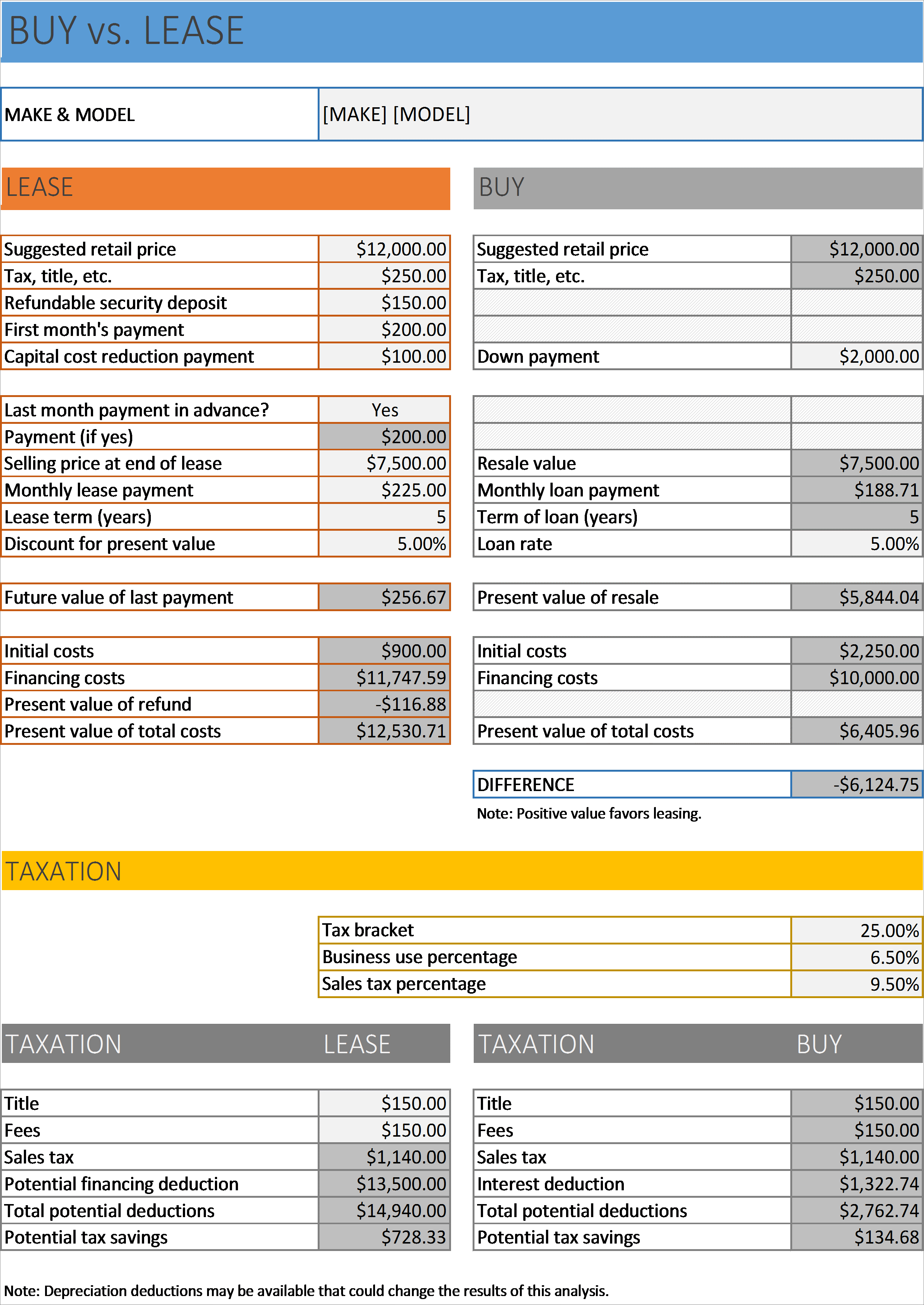

Spreadsheet For Lease Payment Calculator Mathematical Computations

Rate my Tundra Lease The calculator doesnt match the worksheet? Ask

Spreadsheet For Lease Payment Calculator Lease Payment Calculator

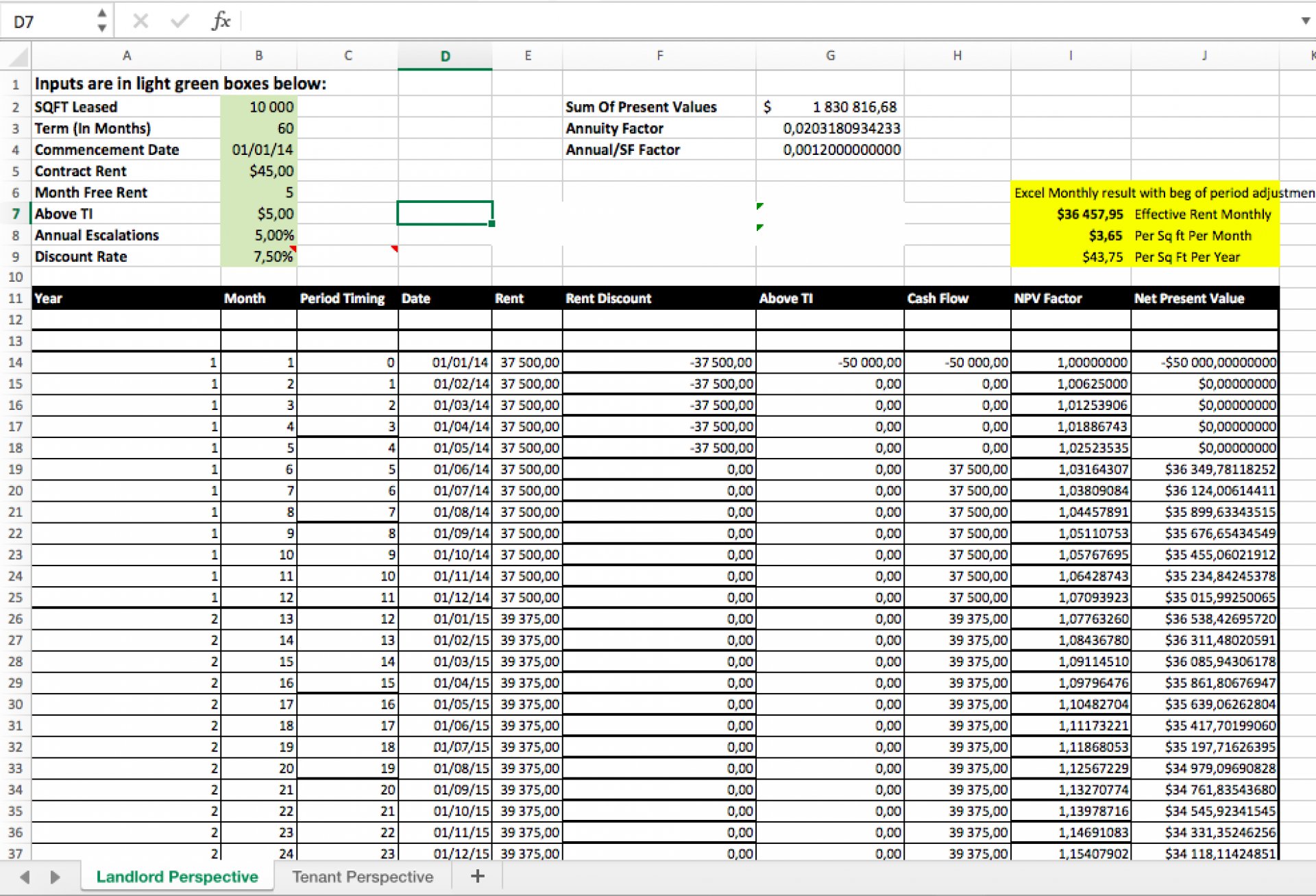

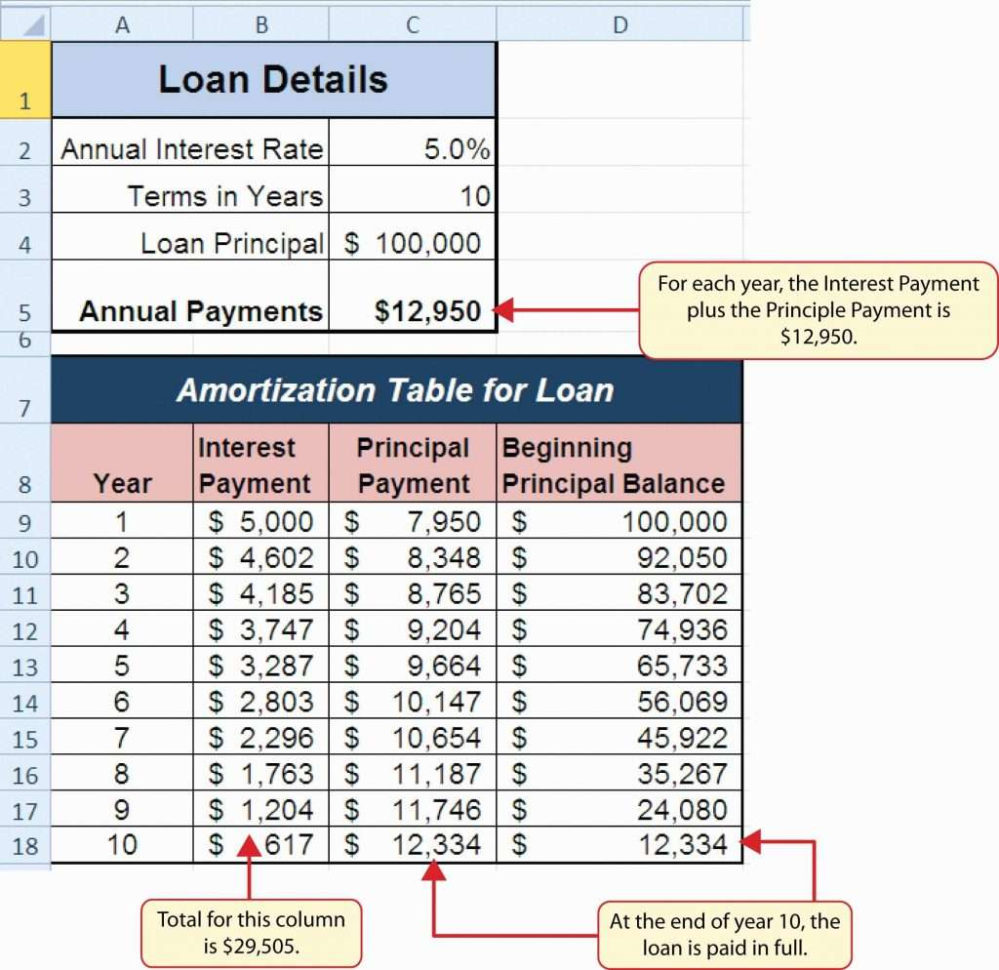

Manually calculate npv of lease in excel

Lease Calculator Excel Spreadsheet Natural Buff Dog

Spreadsheet For Lease Payment Calculator / Free 9 Sample Lease Payment

Spreadsheet For Lease Payment Calculator / Equipment Lease Calculator

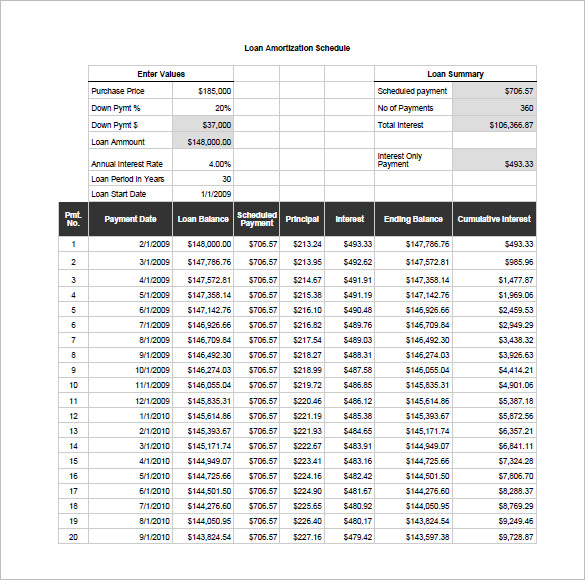

Novated Lease Calculator Spreadsheet in Lease Amortization Schedule

Web The Value Is Determined Using Annual Lease Value Tables Published Annually By The Irs.

Open The Template In The Feature.

Web With These Inputs, We'll Calculate The Monthly Lease Liability Amortization Schedule.

Annual Lease Value Per Irs Table _____ (Table:.

Related Post: