Auto Expense Worksheet

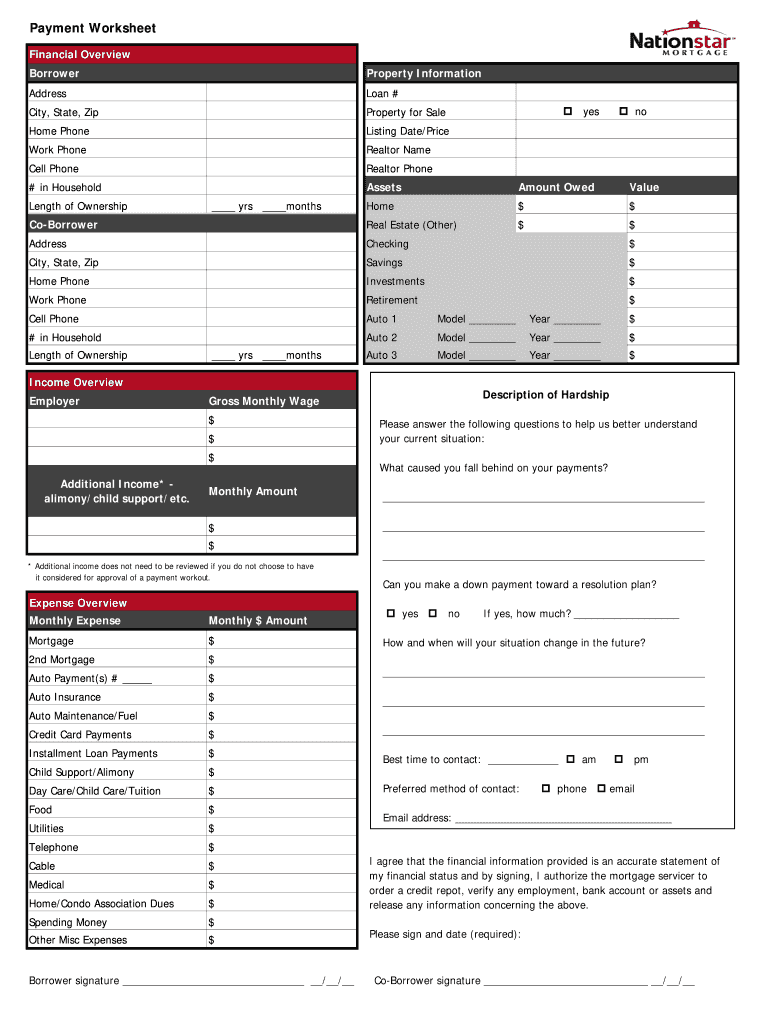

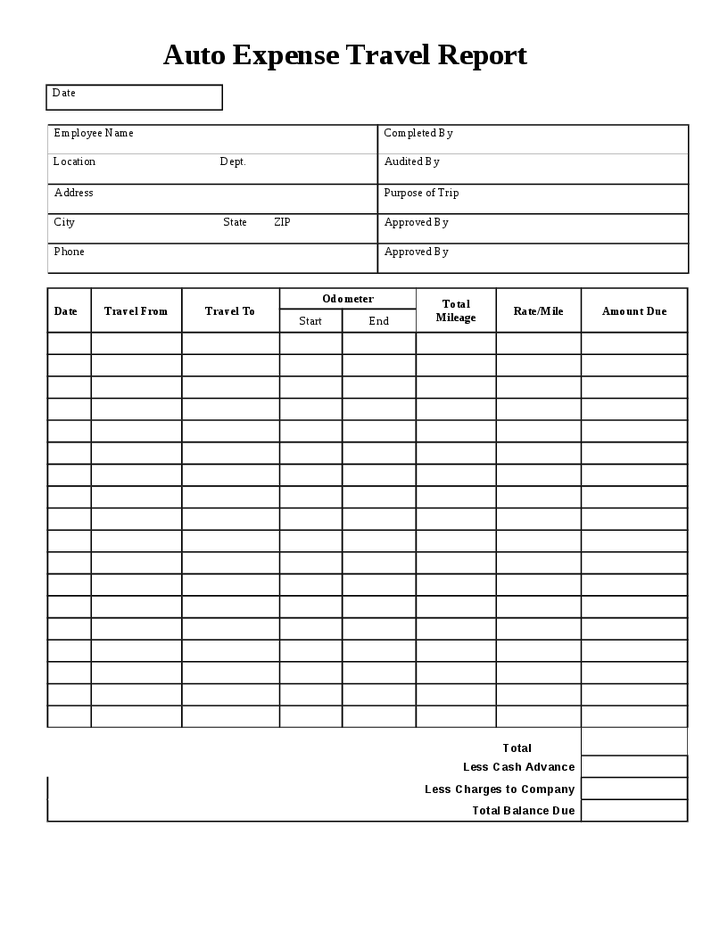

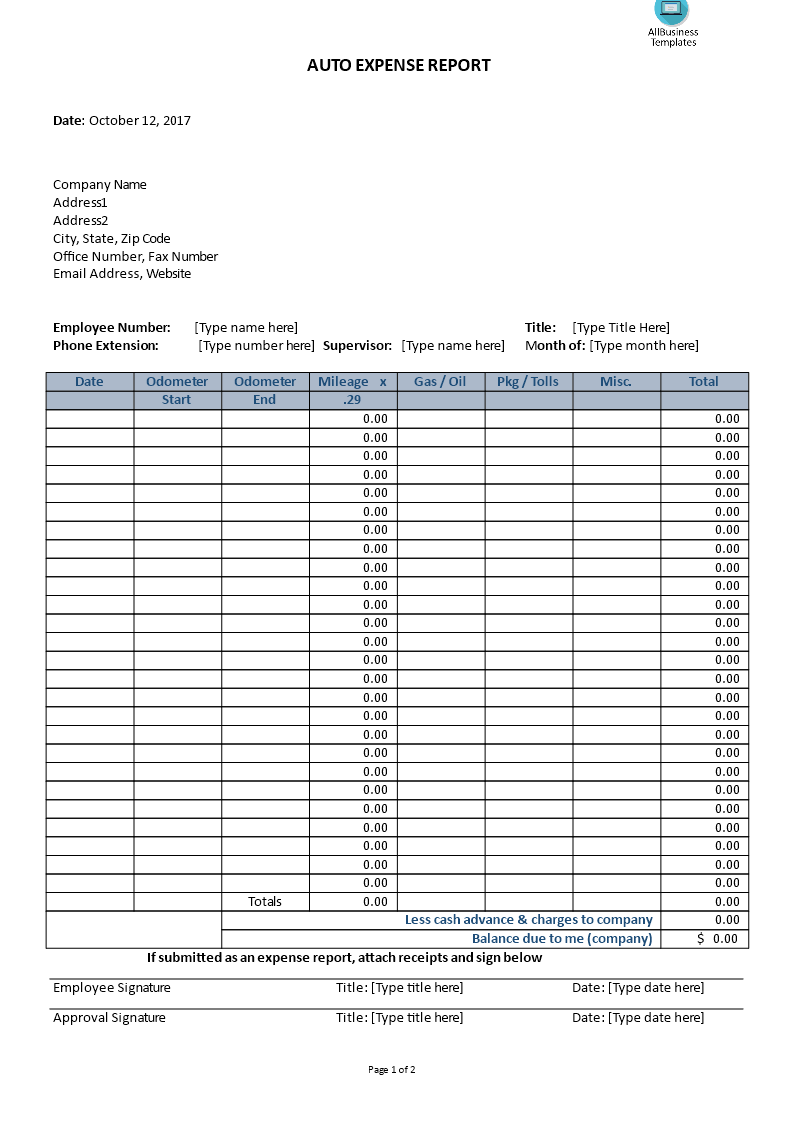

Auto Expense Worksheet - Web auto expense worksheet car and truck expenses for business purposes are deductible expenses. Web see qualified nonpersonal use vehicles under actual car expenses in chapter 4. If yes provide sales invoice. Web free budget planner worksheet. You generally can choose from two ways of deducting: Number of total miles for the year: Start from the car and truck worksheet and link to the activity: Each vehicle must have the vehicle information filled out, regardless of the deduction method. Web about form 2106, employee business expenses. Web please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. If you feel like safely and securely submitting this information via our website, please use this redirect link‐ For information on how to report your car expenses that your employer didn’t provide or reimburse you for (such as when you pay for gas and maintenance for a car your employer provides), see vehicle provided by your employer in chapter 6.. Mileage number of business miles for the year: Completing the vehicle information section. Each vehicle must have the vehicle information filled out, regardless of the deduction method. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type of vehicle 4a ending mileage reading b beginning mileage reading. Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date purchased/leased is the vehicle owned/leased by you odometer reading on december 31 total miles driven in 2021 purchase price / lease equivalent (if new purchase) gas repairs & maintenance. Web the auto expense report template is a. Start from the car and truck worksheet and link to the activity: Web the depreciation limitations for passenger automobiles placed in service during calendar year 2022 for which no section 168 (k) additional first year depreciation deduction applies is $11,200 for the 1st tax year, $18,000 for the 2nd tax year, $10,800 for the 3rd tax year, and $6,460 for. Start from the car and truck worksheet and link to the activity: Web please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. For information on how to report your car expenses that your employer didn’t provide or reimburse you for (such as when you pay for gas and maintenance for a car. If you feel like safely and securely submitting this information via our website, please use this redirect link‐ Did you acquire / purchase the vehicle this year? Is the vehicle leased (not owned at the end of the monthly payments)? Completing the vehicle information section. Web free budget planner worksheet. Web auto expense worksheet car and truck expenses for business purposes are deductible expenses. Did you acquire / purchase the vehicle this year? Start from the car and truck worksheet and link to the activity: Web about form 2106, employee business expenses. For each trip, the date, destination, business reason and mileage, should be listed. Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. All business mileage and expenses should be documented with exact current records. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. Web please use this worksheet to give us your. There are two versions of this worksheet; Employees file this form to deduct ordinary and necessary expenses for their job. Completing the vehicle information section. Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date purchased/leased is the vehicle owned/leased by you odometer reading on december 31. Web the auto expense report template is a document that keeps records of businesses, professional trips, vehicle repair expenses and maintenance. Web please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. 1290 stabler lane ste 800, yuba city, ca 95993. Completing the vehicle information section. You generally can choose from. Web auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date purchased/leased is the vehicle owned/leased by you odometer reading on december 31 total miles driven in 2021 purchase price / lease equivalent (if new purchase) gas repairs & maintenance. Web looking for an excel vehicle expense spreadsheet template? Web the auto expense report template is a document that keeps records of businesses, professional trips, vehicle repair expenses and maintenance. Web car and truck expenses worksheet (complete for all vehicles) 1 make and model of vehicle 2 date placed in service 3 type of vehicle 4a ending mileage reading b beginning mileage reading c total miles for the year 5 business miles for the year 6 commuting miles for the year 7 other personal miles for the year 8 percent of business use Each vehicle must have the vehicle information filled out, regardless of the deduction method. Web free budget planner worksheet. Employees file this form to deduct ordinary and necessary expenses for their job. Moreover, drivers use their vehicles for business purposes. 1290 stabler lane ste 800, yuba city, ca 95993. Mileage number of business miles for the year: To use the child support calculator, select or enter the appropriate information next to each statement. Currently, the file does not function on mac versions of microsoft excel. Start from the car and truck worksheet and link to the activity: Is there evidence to support the business use claimed? This means you need to enable or allow macros to run while using the spreadsheet. Web terms and conditions, features, support, pricing, and service options subject to change without notice. A necessary expense is one that is helpful and appropriate for your business. Is the vehicle leased (not owned at the end of the monthly payments)? Web the myvehicle expense log spreadsheet is compatible with excel versions 2007 and later (even excel 2016!). A non‐fillable pdf (what you are viewing now) and an online digital form. Web the depreciation limitations for passenger automobiles placed in service during calendar year 2022 for which no section 168 (k) additional first year depreciation deduction applies is $11,200 for the 1st tax year, $18,000 for the 2nd tax year, $10,800 for the 3rd tax year, and $6,460 for each succeeding year. Web free budget planner worksheet. Web please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Web the auto expense report template is a document that keeps records of businesses, professional trips, vehicle repair expenses and maintenance. Currently, the file does not function on mac versions of microsoft excel. Is there evidence to support the business use claimed? Add your income and expenses to this monthly budget template, and we'll show how your spending aligns with the 50/30/20 rule. Start from the car and truck worksheet and link to the activity: Web the myvehicle expense log spreadsheet is compatible with excel versions 2007 and later (even excel 2016!). An ordinary expense is one that is common and accepted in your field of trade, business, or profession. Web looking for an excel vehicle expense spreadsheet template? If yes provide sales invoice. A non‐fillable pdf (what you are viewing now) and an online digital form. For information on how to report your car expenses that your employer didn’t provide or reimburse you for (such as when you pay for gas and maintenance for a car your employer provides), see vehicle provided by your employer in chapter 6. A necessary expense is one that is helpful and appropriate for your business. Web see qualified nonpersonal use vehicles under actual car expenses in chapter 4.Vehicle Expense Tracker GOFAR

20++ Car And Truck Expenses Worksheet

Fillable Online auto expense travel report Fax Email Print pdfFiller

12 Vehicle Sales Worksheet /

Car And Truck Expenses Worksheet —

Irs Vehicle Expense Worksheet Fill Out and Sign Printable PDF

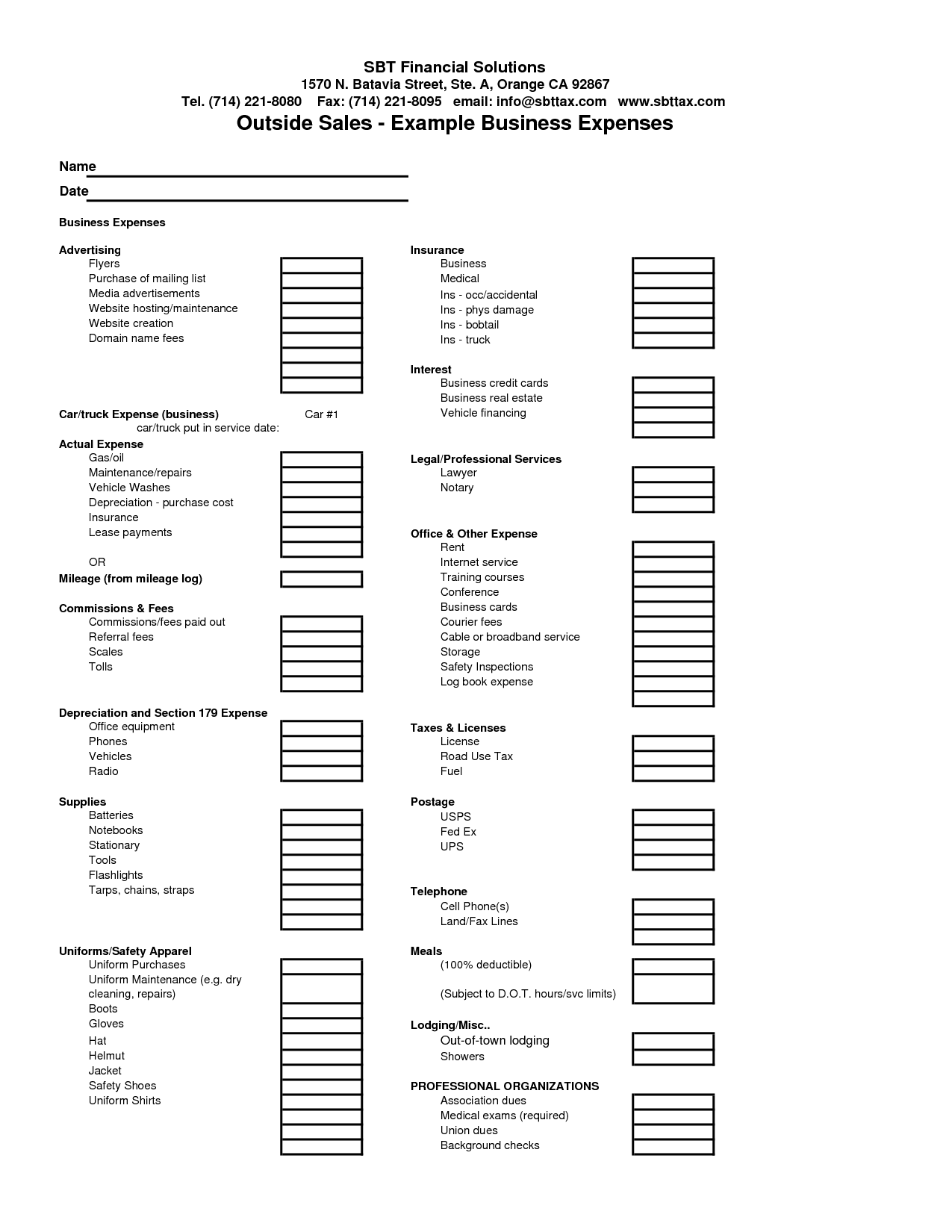

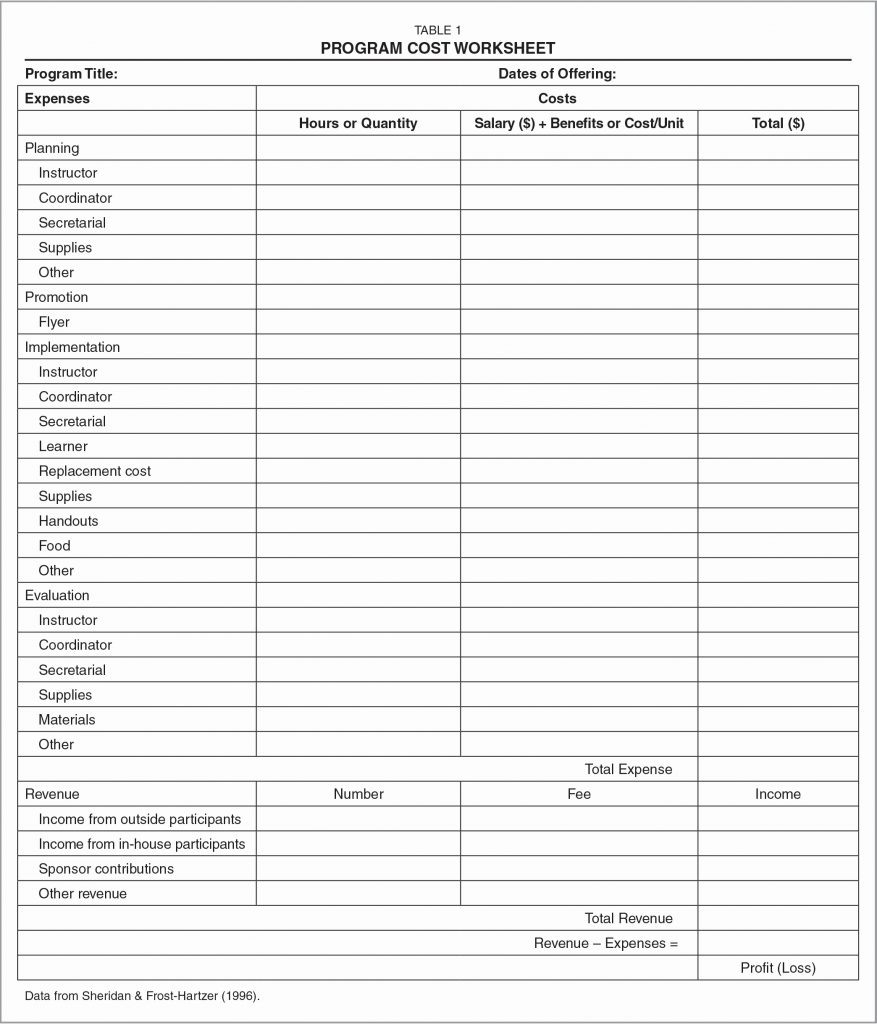

13 Free Sample Auto Expense Report Templates Printable Samples

16 Best Images of Travel Expense Worksheet Small Business Plans

13 Free Sample Auto Expense Report Templates Printable Samples

Auto Expense Report Templates at

2020 Tax Year Car And Truck Expense Worksheet.xlsx Author:

Is The Vehicle Leased (Not Owned At The End Of The Monthly Payments)?

This File Does Use Vba For Some Of The Enhanced Features.

Number Of Total Miles For The Year:

Related Post: