Bank Statement Reconciliation Worksheet

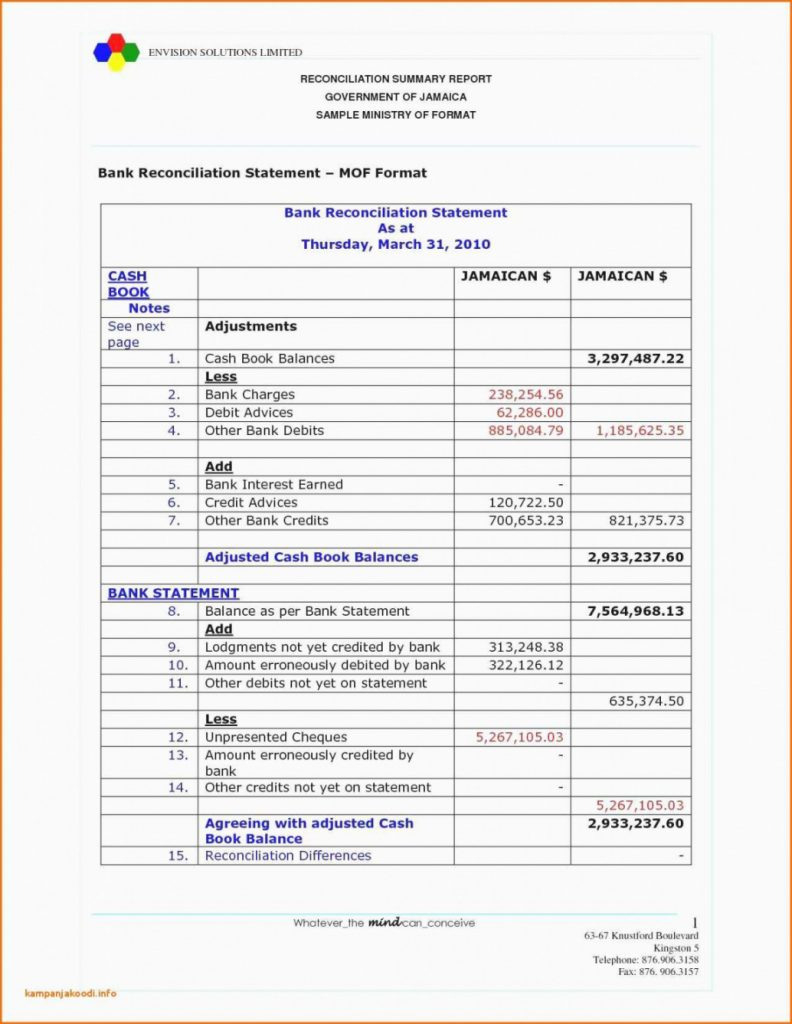

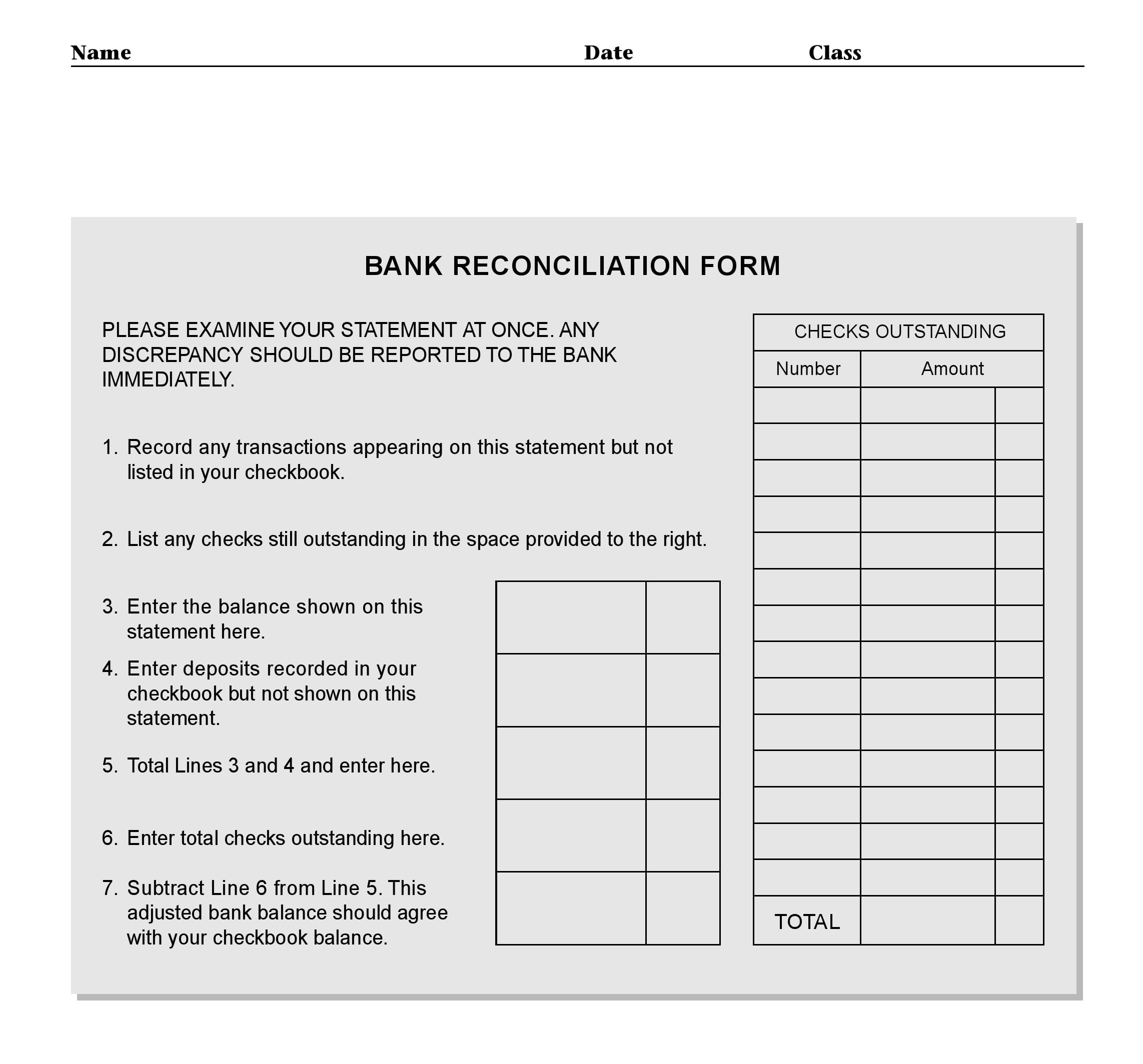

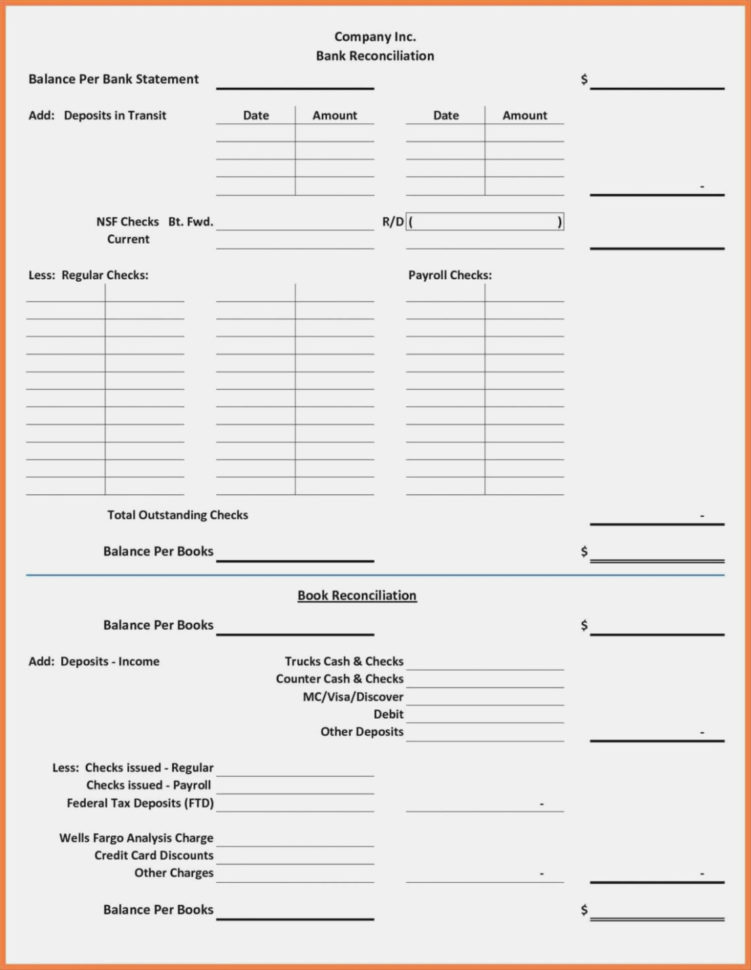

Bank Statement Reconciliation Worksheet - A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. For more financial management tools, download cash flow and other accounting templates. Reconciling the two accounts helps identify whether accounting changes are needed. Web free bank reconciliation exercises and answers. Reconciling the two accounts helps determine if accounting changes are needed. Bank reconciliations are completed at regular intervals to ensure that the company’s cash. Learn how to match transactions on bank statement vs cashbook, how to note and solve differences, when to adjust cashbook and when to use a bank reconciliation worksheet. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Web updated april 17, 2023 what is a bank reconciliation? Web to do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent transactions. You can customize all of the templates offered below for business use or for reconciling personal accounts. Web to do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. For more financial management tools, download cash flow and other accounting templates. You can customize all of the templates offered below for business use or for reconciling personal accounts. Web to do a bank reconciliation you would match the cash balances on the balance sheet to. Web a bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Bank reconciliations are completed at regular intervals to ensure that the company’s cash. Such a process determines the differences between the balances as per the cash book and bank passbook. You can customize all. Bank reconciliations are completed at regular intervals to ensure that the company’s cash. You can customize all of the templates offered below for business use or for reconciling personal accounts. Web free bank reconciliation exercises and answers. Web bank reconciliation is the process of matching the bank balances reflected in the cash book of a business with the balances reflected. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Such a process determines the differences between the balances as per the cash book and bank passbook. Web bank reconciliation is. Bank reconciliations are completed at regular intervals to ensure that the company’s cash. Reconciling the two accounts helps determine if accounting changes are needed. Learn how to match transactions on bank statement vs cashbook, how to note and solve differences, when to adjust cashbook and when to use a bank reconciliation worksheet. You can customize all of the templates offered. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. You can customize all of the templates offered below for business use or for reconciling personal accounts. Such a process determines the differences between the balances as per the cash book and bank passbook. For more financial management tools, download cash flow and other accounting templates.. Learn how to match transactions on bank statement vs cashbook, how to note and solve differences, when to adjust cashbook and when to use a bank reconciliation worksheet. Web to do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order. Web a bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Such a process determines the differences between the balances as per the cash book and bank passbook. Learn how to match transactions on bank statement vs cashbook, how to note and solve differences, when. In the case of personal bank accounts, like. Bank reconciliations are completed at regular intervals to ensure that the company’s cash. Web to do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records,. Web free bank reconciliation exercises and answers. You can customize all of the templates offered below for business use or for reconciling personal accounts. Reconciling the two accounts helps determine if accounting changes are needed. For more financial management tools, download cash flow and other accounting templates. Learn how to match transactions on bank statement vs cashbook, how to note and solve differences, when to adjust cashbook and when to use a bank reconciliation worksheet. Web bank reconciliation is the process of matching the bank balances reflected in the cash book of a business with the balances reflected in the bank statement of the business in a given period. Such a process determines the differences between the balances as per the cash book and bank passbook. Reconciling the two accounts helps identify whether accounting changes are needed. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Web a bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. In the case of personal bank accounts, like. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web to do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent transactions. Web updated april 17, 2023 what is a bank reconciliation? Bank reconciliations are completed at regular intervals to ensure that the company’s cash. Such a process determines the differences between the balances as per the cash book and bank passbook. Learn how to match transactions on bank statement vs cashbook, how to note and solve differences, when to adjust cashbook and when to use a bank reconciliation worksheet. Web bank reconciliation is the process of comparing accounting records to a bank statement to identify differences and make adjustments or corrections. Reconciling the two accounts helps determine if accounting changes are needed. Web a bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the corresponding amount on its bank statement. Web free bank reconciliation exercises and answers. You can customize all of the templates offered below for business use or for reconciling personal accounts. Web bank reconciliation is the process of matching the bank balances reflected in the cash book of a business with the balances reflected in the bank statement of the business in a given period. Reconciling the two accounts helps identify whether accounting changes are needed. Web to do a bank reconciliation you would match the cash balances on the balance sheet to the corresponding amount on your bank statement, determining the differences between the two in order to make changes to the accounting records, resolve any discrepancies and identify fraudulent transactions. In the case of personal bank accounts, like. For more financial management tools, download cash flow and other accounting templates.Reconciling A Bank Statement Worksheet Lovely Bank Reconciliation

50+ Bank Reconciliation Examples & Templates [100 Free]

Reconciling A Bank Statement Worksheet Reconciliation Of 22 —

File Type PDF bank reconciliation worksheet ? vcon.duhs.edu.pk

Free Bank Reconciliation Form PDF Template Form Download

FREE 9+ Bank Reconciliation Samples in MS Word MS Excel Pages

50+ Bank Reconciliation Examples & Templates [100 Free]

50+ Bank Reconciliation Examples & Templates [100 Free]

Bank Reconciliation Worksheet For Students Excel Pdf In Ax —

50+ Bank Reconciliation Examples & Templates [100 Free]

Web Save Time, Protect Financial Assets, And Increase Accuracy With Free Bank Reconciliation Templates.

Bank Reconciliations Are Completed At Regular Intervals To Ensure That The Company’s Cash.

Web Updated April 17, 2023 What Is A Bank Reconciliation?

A Bank Reconciliation Statement Is A Document That Compares The Cash Balance On A Company’s Balance Sheet To The Corresponding Amount On Its Bank Statement.

Related Post:

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-40.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-39.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-20.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-13.jpg)