Business Income Calculation Worksheet

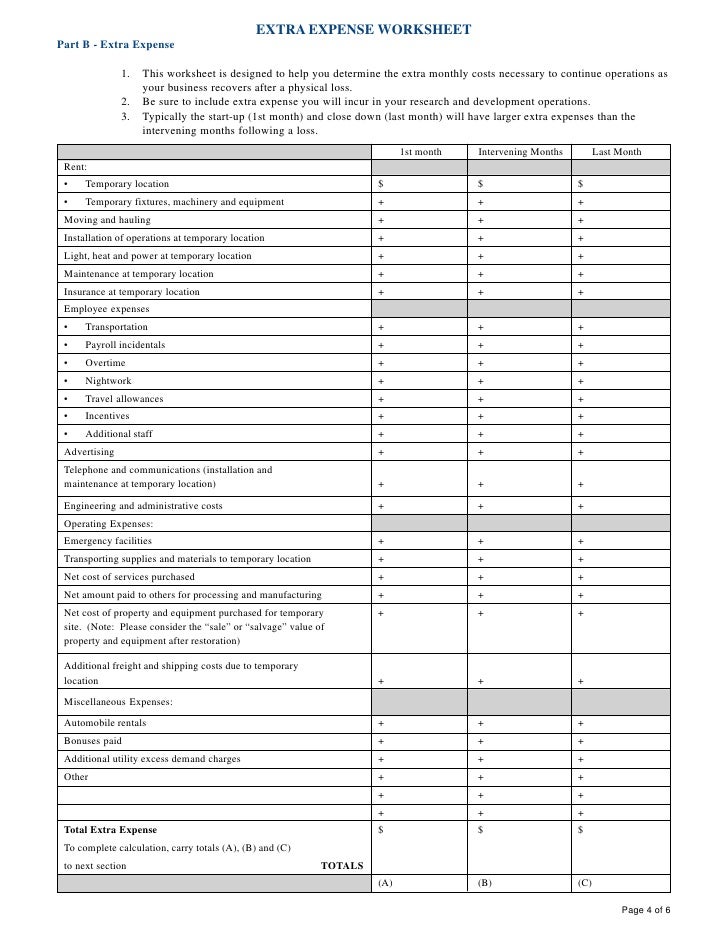

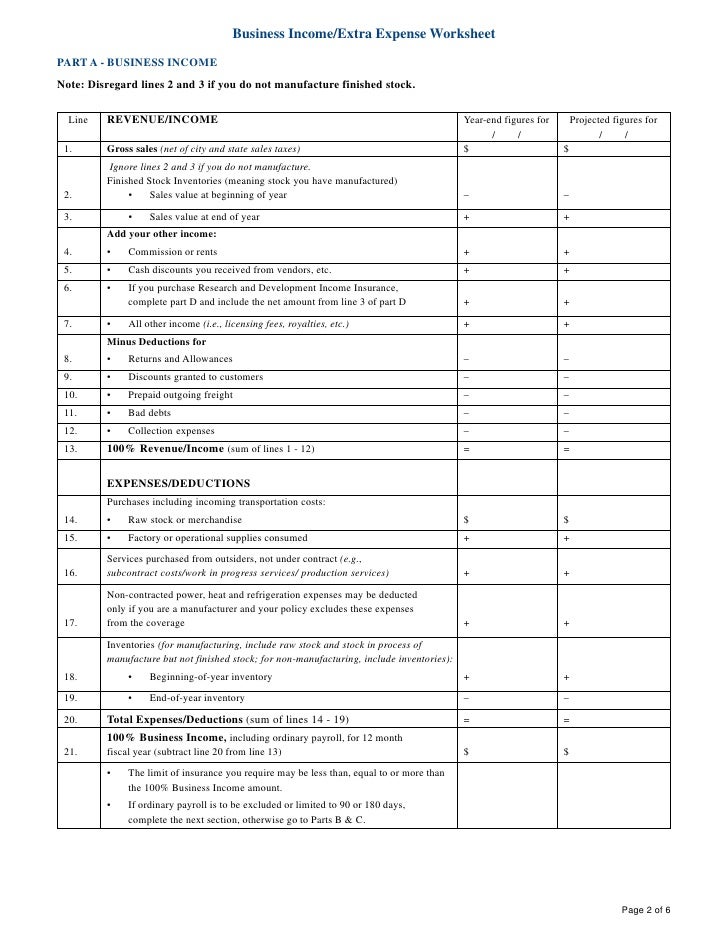

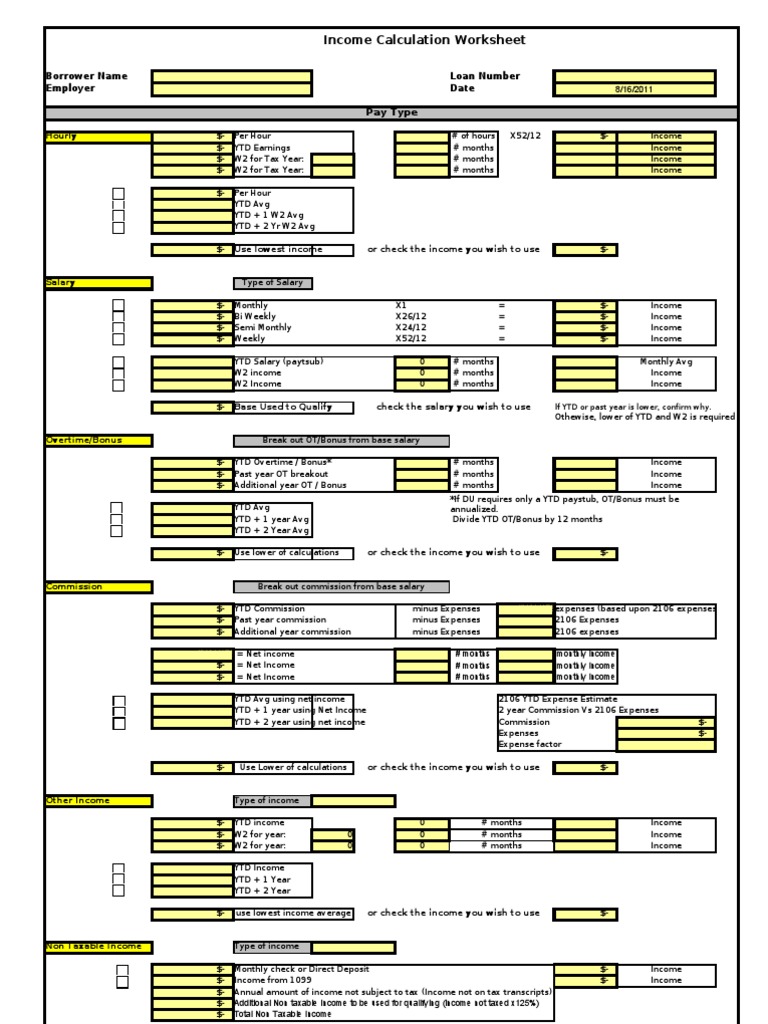

Business Income Calculation Worksheet - Together with a sound business continuity plan, it serves as a critical planning tool to help your business. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4 properties). Upon completion, the user will be able to save the completed worksheet as an excel document to a destination folder and file name of her own choice. 1, 2010 • 0 likes • 5,963 views. Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. The intent of the worksheet is to develop the income (revenue or sales) from operations. Fannie mae rental guide (calculator 1039) calculate qualifying rental income for fannie mae form 1039 (business rental income from investment property). Section 1 from income tax return: Net income (or loss) before taxes b. Total undepreciated capital cost at end of. You can review your understanding of business income tax calculations by completing this quiz. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to. Enter your projected net income (or loss) before taxes. If the coverage you are purchasing includes extra expense,. This is the amount of income that will be lost while the operations are interrupted. Simply follow the flow of the user friendly screens. Some questions will ask you to identify forms and calculations, while. The top marginal income tax rate of 37 percent will hit taxpayers with taxable. Web a worksheet is added to provide a reasonable method to. Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Enter your projected net income (or loss) before taxes. Web keep your career on the right track our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Located in the qbid folder in. Web the qualified business income deduction simplified worksheet. Use this template to track and compare your finances over a. This is the amount of income that will be lost while the operations are interrupted. It is a comprehensive tool for companies to plan their potential losses. The best tax strategies may include a combination of business entities to optimize the. Web qualified business income deduction simplified computation attach to your tax return. Web about this quiz & worksheet. Simply follow the flow of the user friendly screens. Some questions will ask you to identify forms and calculations, while. The intent of the worksheet is to develop the income (revenue or sales) from operations. Web simplified business income & extra expense calculator. Taxable income before qualified business income deduction is less than $157,500 ($315,000 if married filing jointly) and Form 1120(s) = taxable income (s corporation) Located in the qbid folder in form view, this worksheet prints under the following conditions: You can claim the qualified business income deduction. 1, 2010 • 0 likes • 5,963 views. The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. Form 1120(s) = taxable income (s corporation) Simply follow the flow of the user friendly screens. It helps cover payments, revenue, or property damage in the event of a covered loss. You can review your understanding of business income tax calculations by completing this quiz. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Located in the qbid folder in form view, this worksheet prints under the following conditions: Web in 2022, the income limits for all tax brackets and all filers will be adjusted. Use this template to track and compare your finances over a. Total undepreciated capital cost at end of. Form 1065 = ordinary income or loss (partnership); Together with a sound business continuity plan, it serves as a critical planning tool to help your business. The key concepts for business income excellence All expenses (be sure this includes payroll but not cost of goods sold) c. Web the qualified business income deduction simplified worksheet. Qbi entity selection calculator inputs Net income (or loss) before taxes b. If the coverage you are purchasing includes extra expense, this worksheet also helps you estimate the additional amount of insurance needed to cover your extra expense. Taxable income before qualified business income deduction is less than $157,500 ($315,000 if married filing jointly) and 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Web page two is where the total annual business income amount is calculated. Web business income worksheet non manufacturing or mercantile operations actual values for estimated values year ending 200_ for year ending 200_ a. It helps cover payments, revenue, or property damage in the event of a covered loss. Web simplified business income & extra expense calculator. Web a worksheet is added to provide a reasonable method to track and compute your previously disallowed losses or deductions to be included in your qualified business income deduction calculation for the year allowed. It is a comprehensive tool for companies to plan their potential losses. Form 1065 = ordinary income or loss (partnership); Form 1120(s) = taxable income (s corporation) Use this template to track and compare your finances over a. This is a copy of the chubb business income worksheet. Fannie mae rental guide (calculator 1039) calculate qualifying rental income for fannie mae form 1039 (business rental income from investment property). Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. Web keep your career on the right track our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. Expenses = cost of goods sold (+) total deductions schedule c = net profit or loss (sole proprietorship); Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Simply follow the flow of the user friendly screens. Go to www.irs.gov/form8995 for instructions and the latest information. The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. Net income before taxes b. Total undepreciated capital cost at end of. Simply follow the flow of the user friendly screens. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to. Fannie mae rental guide (calculator 1039) calculate qualifying rental income for fannie mae form 1039 (business rental income from investment property). Web from the start, the tool guides the user through a detailed step by step process, to complete a business income worksheet. Net income (or loss) before taxes b. Web this simple small business income statement template calculates your total revenue and expenses, including advising, equipment, and employee benefits, to determine your net income. Web this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business income (qbi) deduction. It helps cover payments, revenue, or property damage in the event of a covered loss. Web this worksheet is a tool to help you estimate the amount of business income insurance you will need to cover your business income exposure in the event of a major covered loss. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Some questions will ask you to identify forms and calculations, while. Enter your projected net income (or loss) before taxes. Qbi entity selection calculator inputs Use this template to track and compare your finances over a.Analysis Worksheet PDF Expense S Corporation

11 Best Images of Federal State And Local Government Worksheets 3

Acord Business Worksheet

Business Calculation Worksheet

Download Accounting Worksheet For End Of Year Sale Salaries Expense Gif

Mgic Calculation Worksheet 2022

Fannie Mae Calculation Worksheet Fill Online, Printable

Tax Deduction Expense

FREE 23+ Asset Worksheet Templates in PDF Excel

FREE 23+ Asset Worksheet Templates in PDF Excel

Deduct Any Or All Ordinary Payroll Expense D.

Located In The Qbid Folder In Form View, This Worksheet Prints Under The Following Conditions:

It Is A Comprehensive Tool For Companies To Plan Their Potential Losses.

Web Business Income Worksheet.

Related Post: