Business Use Of Home Worksheet

Business Use Of Home Worksheet - Click the forms button in the top left corner of the toolbar. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. The total amount of unreimbursed partnership expenses will flow to schedule. You can have more than one business location, including your home, for a single trade or. The final test is the principal place of business test. Apply this percentage to the shelter costs to determine. Web instructions for the simplified method worksheet keep for your records use this worksheet to figure the amount of expenses you may deduct for a qualified business. Expand the federal view and then expand the worksheets view. Web there is a separate supporting worksheet to enter the business use of your home expenses. For tax deduction purposes, people who run a home business should fill out this free, printable worksheet. Irs form 4797 (sales of business property) is not included on this worksheet due to its infrequent use. Apply this percentage to the shelter costs to determine. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web principal place of business test. Record and total the. Click the forms button in the top left corner of the toolbar. Record and total the cost of the. Web calculation of business use worksheet (what % of house is used for business) to calculate the percentage of square footage used for business activities in the subject. Web start your taxact desktop program. Web business or rental use of hometrue. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Expand the federal view and then expand the worksheets view. You can have more than one business location, including your home, for a single trade or. This section applies only if you used a portion of your you weren’t using the space for business or. Record and total the cost of the. Listed below are steps you can take to create a unique small business worksheet. Web start your taxact desktop program. Irs form 4797 (sales of business property) is not included on this worksheet due to its infrequent use. Web in the taxact program, the worksheet to figure the deduction for business use of. Web the simplified option allows qualifying taxpayers to use a prescribed rate of $5 per square foot of the portion of the home used for business (up to a maximum of 300 square feet). You can have more than one business location, including your home, for a single trade or. Web tech jobs (coders, computer programmers, software engineers, data analysts). Web business or rental use of hometrue. Web business use of home (+) _____ (+) _____ note: Apply this percentage to the shelter costs to determine. The final test is the principal place of business test. Are you required to work from home for the convenience of your employer? Listed below are steps you can take to create a unique small business worksheet. Web principal place of business test. Web business or rental use of hometrue. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web well, you’ve come to the right place. Web calculation of business use worksheet (what % of house is used for business) to calculate the percentage of square footage used for business activities in the subject. Web principal place of business test. You can have more than one business location, including your home, for a single trade or. Web there is a separate supporting worksheet to enter the. For tax deduction purposes, people who run a home business should fill out this free, printable worksheet. Listed below are steps you can take to create a unique small business worksheet. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) You can have more than one business location, including your home, for a single. Web instructions for the simplified method worksheet keep for your records use this worksheet to figure the amount of expenses you may deduct for a qualified business. You can have more than one business location, including your home, for a single trade or. Your first step in creating your. Web start your taxact desktop program. Web in general, you may. Record and total the cost of the. For tax deduction purposes, people who run a home business should fill out this free, printable worksheet. Web start your taxact desktop program. Are you required to work from home for the convenience of your employer? Web method 1 use for all businesses except those licensed or exempt from licensing daycare businesses. Web the simplified option allows qualifying taxpayers to use a prescribed rate of $5 per square foot of the portion of the home used for business (up to a maximum of 300 square feet). Web there is a separate supporting worksheet to enter the business use of your home expenses. Web business or rental use of hometrue. Irs form 4797 (sales of business property) is not included on this worksheet due to its infrequent use. You can have more than one business location, including your home, for a single trade or. Web well, you’ve come to the right place. Web did you use a portion of your home for regular and exclusive business use? Web calculation of business use worksheet (what % of house is used for business) to calculate the percentage of square footage used for business activities in the subject. Your first step in creating your. Click the forms button in the top left corner of the toolbar. The total amount of unreimbursed partnership expenses will flow to schedule. Apply this percentage to the shelter costs to determine. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Use form 8829 to figure the. Expand the federal view and then expand the worksheets view. Web in general, you may not deduct expenses for the parts of your home not used for business, for example, lawn care or painting a room not used for business. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. You can have more than one business location, including your home, for a single trade or. Apply this percentage to the shelter costs to determine. Web 10 rows standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Are you required to work from home for the convenience of your employer? Web in the taxact program, the worksheet to figure the deduction for business use of your home shows the expenses used to calculate the total amount on form 2106 employee. This section applies only if you used a portion of your you weren’t using the space for business or rental at the time you sold the. Web tech jobs (coders, computer programmers, software engineers, data analysts) coders, software developers, and data analysts could be displaced by ai, an expert says. For tax deduction purposes, people who run a home business should fill out this free, printable worksheet. Web well, you’ve come to the right place. Web the simplified option allows qualifying taxpayers to use a prescribed rate of $5 per square foot of the portion of the home used for business (up to a maximum of 300 square feet). Expand the federal view and then expand the worksheets view. Web principal place of business test. The total amount of unreimbursed partnership expenses will flow to schedule. Your first step in creating your.Living Room Parts Parts Of The House Living Room And Dining Room

Home Office Tax Deduction What to Know Fast Capital 360®

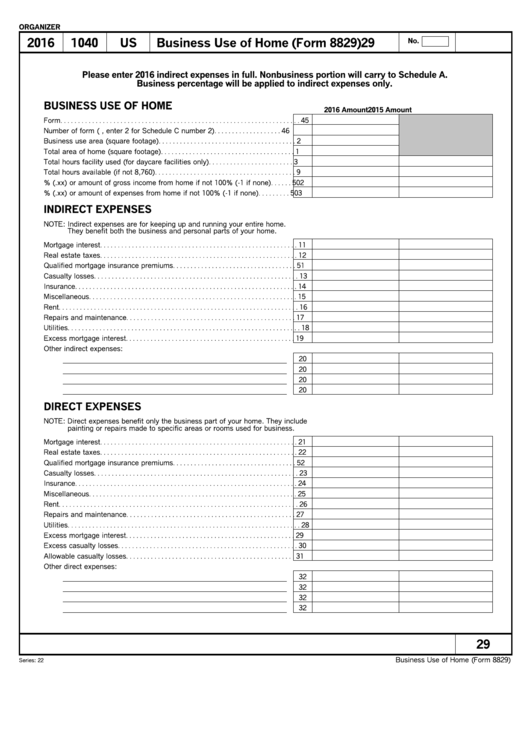

Business Use Of Home (Form 8829) Organizer 2016 printable pdf download

Insurance Home Inventory Worksheet MS Excel Templates

Rooms in the house worksheet for Grade 1

15 best The House worksheets ESL English images on Pinterest

Anchor Tax Service Home use worksheet

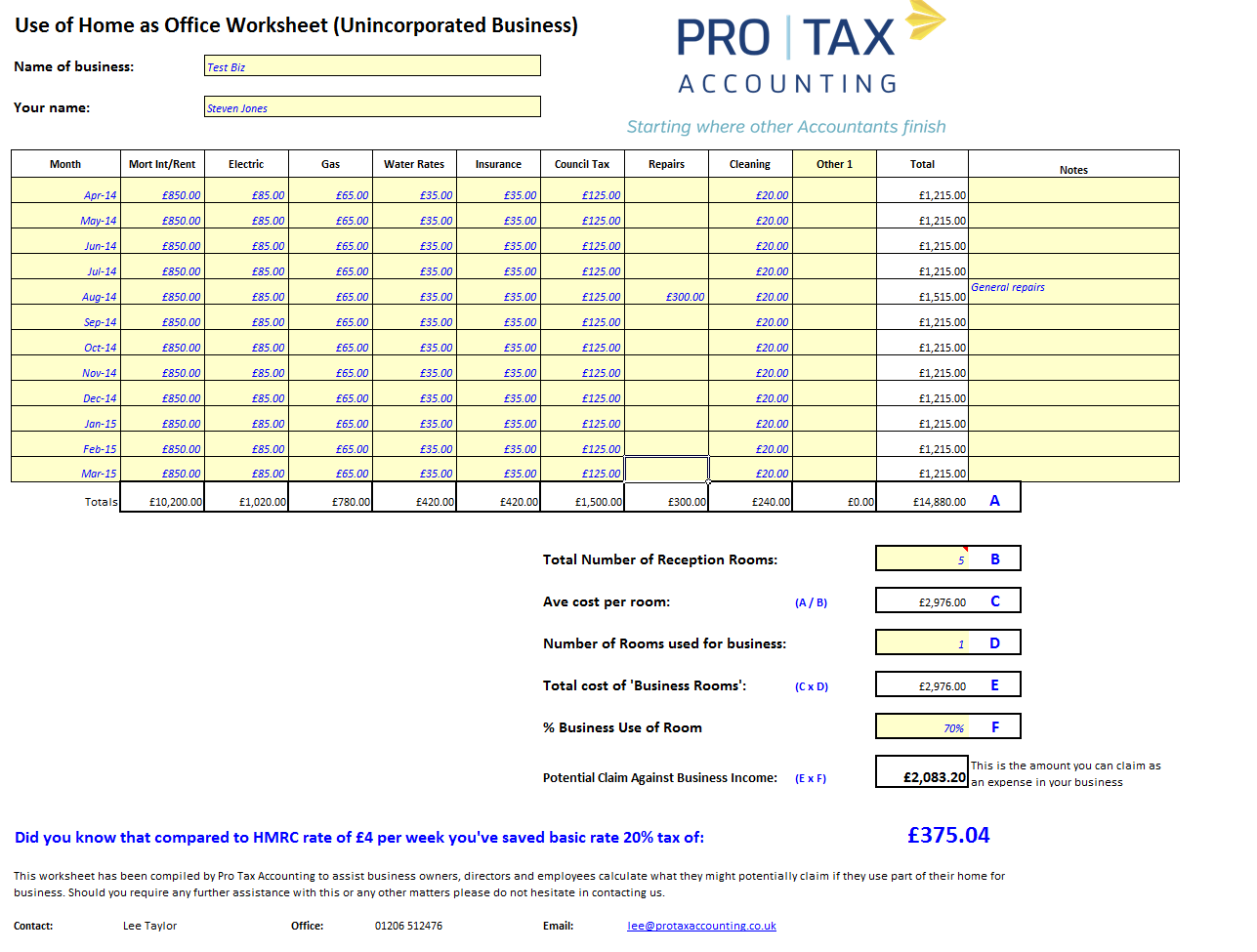

Use of home Worksheet for SE Pro Tax Accounting Accountant Colchester

Sale Of Main Home Worksheet —

At home ESL worksheet by mahaenglish

The Final Test Is The Principal Place Of Business Test.

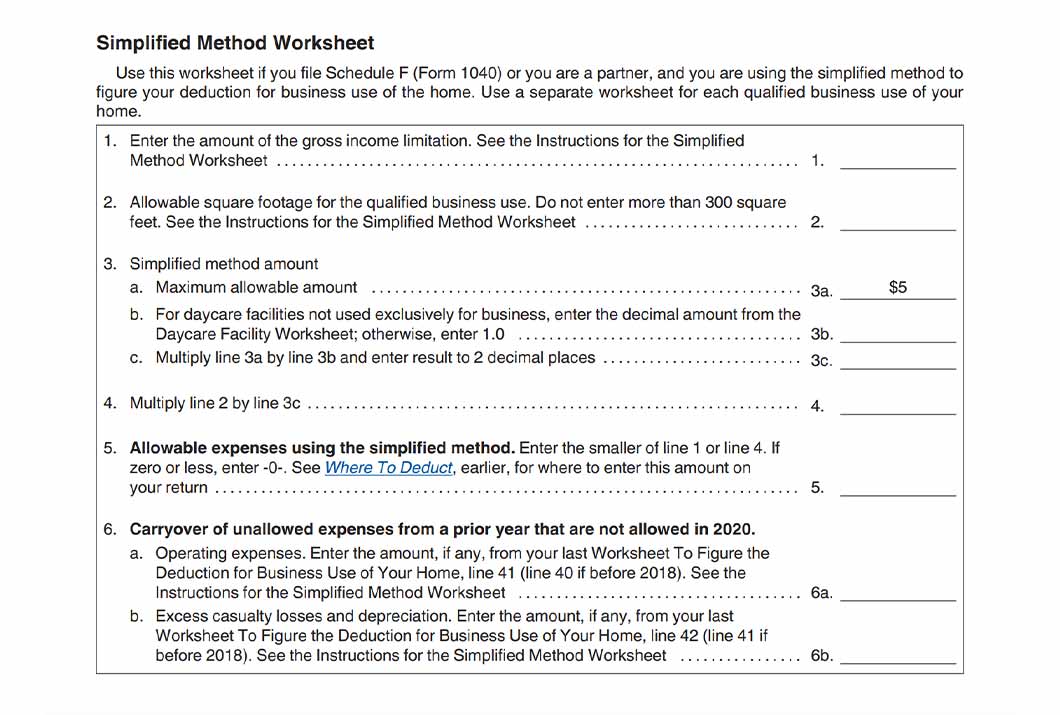

Web Instructions For The Simplified Method Worksheet Keep For Your Records Use This Worksheet To Figure The Amount Of Expenses You May Deduct For A Qualified Business.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Record And Total The Cost Of The.

Related Post: