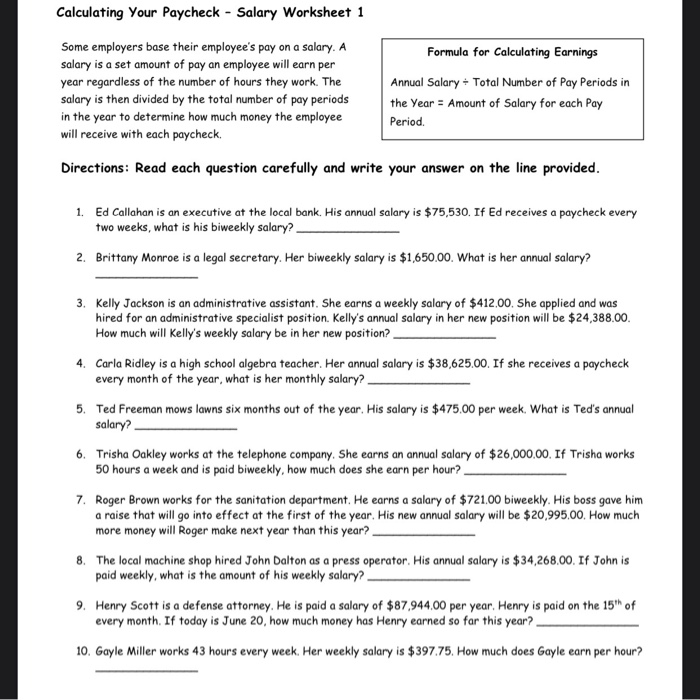

Calculating Your Paycheck Salary Worksheet 1

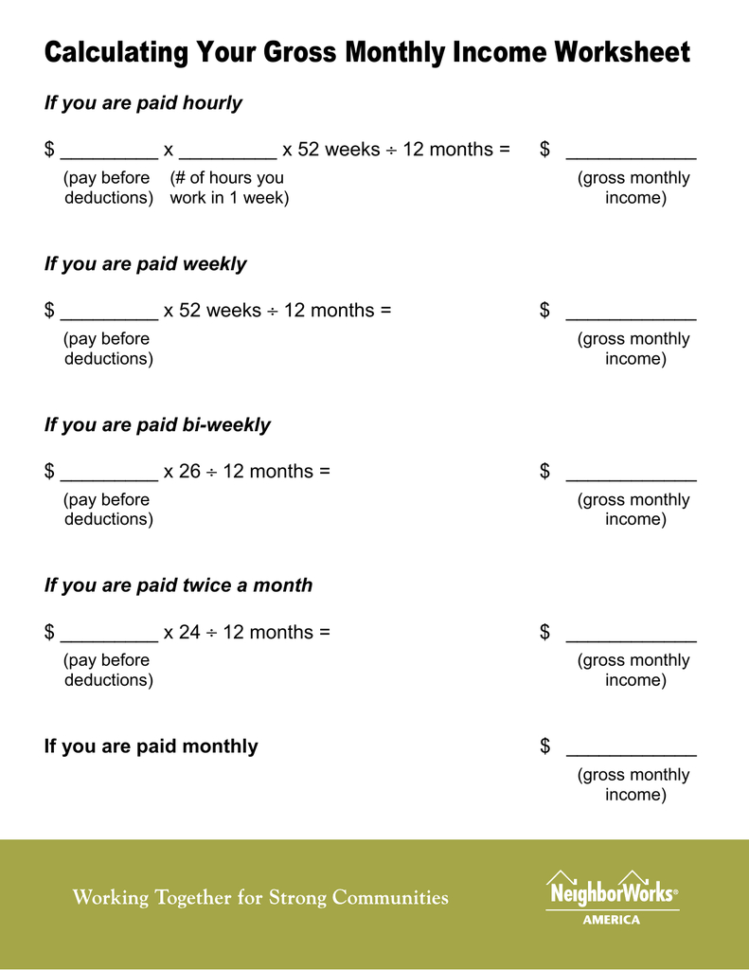

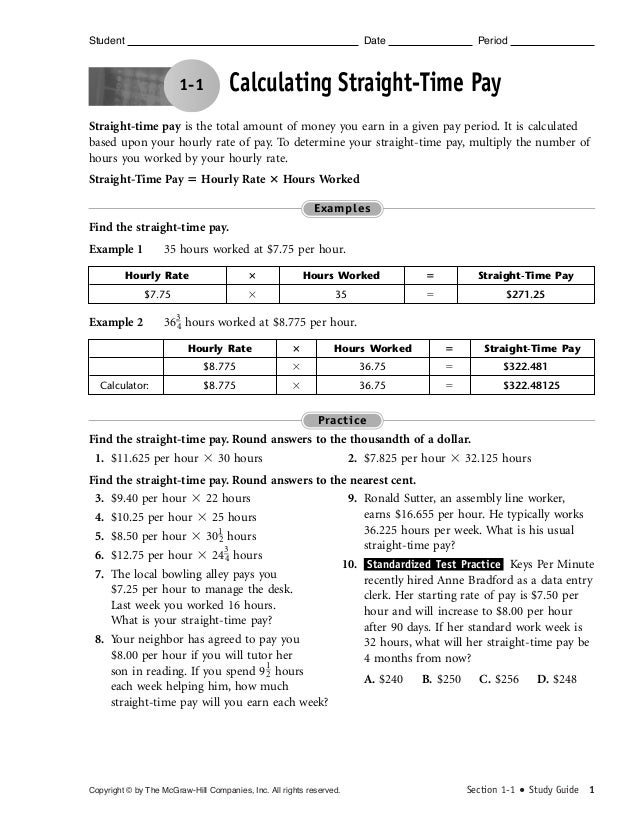

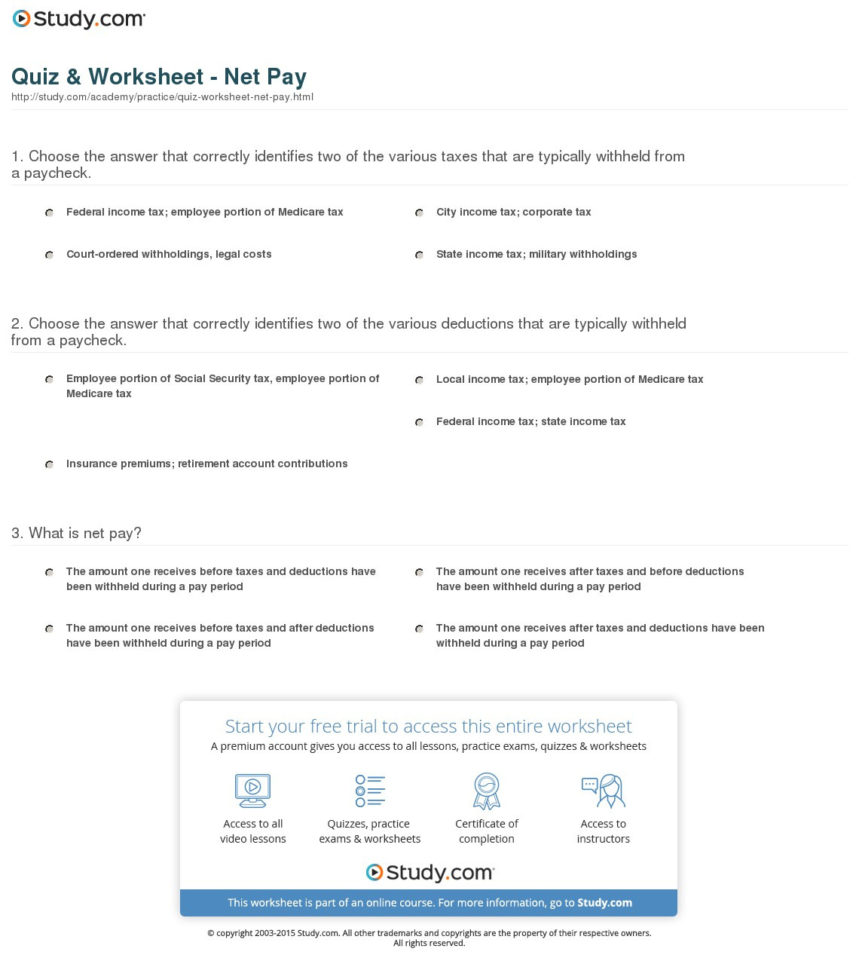

Calculating Your Paycheck Salary Worksheet 1 - If you know your per pay period payment amount (weekly, twice a month, monthly or even annual) you can estimate your federal. What’s the pay period for this paycheck? Web this worksheet uses basic mathematical operations in order to solve for the salary paycheck. Enter your info to see your take home pay. To calculate the payroll based on hourly requirements, the organization also needs the rate assigned. For example, if you earn $2,000/week, your annual income is. Our salary paycheck calculator will then do the rest, calculating your salary and showing you. Weekly (52 paychecks per year), every other week (26 paychecks per year), twice a month (24 paychecks per. Web gross annual pay = gross pay x pay periods per year. The mathematical concept behind solving the salary paycheck is. Web gross annual pay = gross pay x pay periods per year. Our salary paycheck calculator will then do the rest, calculating your salary and showing you. Enter your info to see your take home pay. This calculator is for educational and illustrative purposes only and should not be construed as financial or. The mathematical concept behind solving the salary. Web calculating the numbers in your paycheck. Web pay period this is how often you are paid. If you make $70,000 a year living in california you will be taxed $11,221. Enter your annual salary or earnings per pay period. This number is the gross pay per pay period. What’s the gross income for this pay. To calculate the payroll based on hourly requirements, the organization also needs the rate assigned. Your average tax rate is 11.67% and your marginal tax rate is. Web updated march 10, 2023. What’s the pay period for this paycheck? Get an accurate picture of the employee’s gross. Web this worksheet uses basic mathematical operations in order to solve for the salary paycheck. If you make $70,000 a year living in california you will be taxed $11,221. Web updated march 10, 2023. Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes. Web this total net pay comprises salary, wages, bonus, commission, deduction,. This number is the gross pay per pay period. Web gross annual pay = gross pay x pay periods per year. Get an accurate picture of the employee’s gross. If you make $70,000 a year living in california you will be taxed $11,221. Web it’s calculated based on how much the employee wants to pay in social security taxes. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Get an accurate picture of the employee’s gross. Web this total net pay comprises salary, wages, bonus, commission, deduction,. Your average tax. To calculate the payroll based on hourly requirements, the organization also needs the rate assigned. Weekly (52 paychecks per year), every other week (26 paychecks per year), twice a month (24 paychecks per. This calculator is for educational and illustrative purposes only and should not be construed as financial or. Web smartasset's hourly and salary paycheck calculator shows your income. Web smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Web calculating the numbers in your paycheck. For example, if you earn $2,000/week, your annual income is. Web to calculate your annual salary, multiply the gross pay — before taxes — by the number of pay periods in the year. Web updated march 10,. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. If you make $70,000 a year living in california you will be taxed $11,221. To calculate the payroll based on hourly requirements, the organization also needs the rate assigned. Web smartasset's hourly and salary paycheck calculator shows your. What’s the gross income for this pay. What’s the pay period for this paycheck? To calculate the payroll based on hourly requirements, the organization also needs the rate assigned. This calculator is for educational and illustrative purposes only and should not be construed as financial or. Web this worksheet uses basic mathematical operations in order to solve for the salary. Web calculating the numbers in your paycheck. Web русский tiếng việt kreyòl ayisyen use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Web it’s calculated based on how much the employee wants to pay in social security taxes. Web gross annual pay = gross pay x pay periods per year. To calculate the payroll based on hourly requirements, the organization also needs the rate assigned. If you know your per pay period payment amount (weekly, twice a month, monthly or even annual) you can estimate your federal. Get an accurate picture of the employee’s gross. Web smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Our salary paycheck calculator will then do the rest, calculating your salary and showing you. Web to calculate your annual salary, multiply the gross pay — before taxes — by the number of pay periods in the year. Web this worksheet uses basic mathematical operations in order to solve for the salary paycheck. For example, if your gross pay is $8,000 and payment is monthly, then $8,000 x 12 = $96,000 will be his annual salary. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. What’s the gross income for this pay. What’s the pay period for this paycheck? Enter your info to see your take home pay. Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. Weekly (52 paychecks per year), every other week (26 paychecks per year), twice a month (24 paychecks per. Web pay period this is how often you are paid. For example, if you earn $2,000/week, your annual income is. Web gross annual pay = gross pay x pay periods per year. Enter your info to see your take home pay. To calculate the payroll based on hourly requirements, the organization also needs the rate assigned. Web this total net pay comprises salary, wages, bonus, commission, deduction,. Web it’s calculated based on how much the employee wants to pay in social security taxes. Web pay period this is how often you are paid. Web to calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Our salary paycheck calculator will then do the rest, calculating your salary and showing you. Weekly (52 paychecks per year), every other week (26 paychecks per year), twice a month (24 paychecks per. If you know your per pay period payment amount (weekly, twice a month, monthly or even annual) you can estimate your federal. Get an accurate picture of the employee’s gross. What’s the pay period for this paycheck? Web updated march 10, 2023. Web smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Web this free hourly and salary paycheck calculator can estimate an employee’s net pay, based on their taxes and withholdings. Web to calculate your annual salary, multiply the gross pay — before taxes — by the number of pay periods in the year.Paycheck Calculation Templates at

Calculating Your Paycheck Salary Worksheet 1 Answer Key —

Calculating Your Paycheck Salary Worksheet 1 Answers —

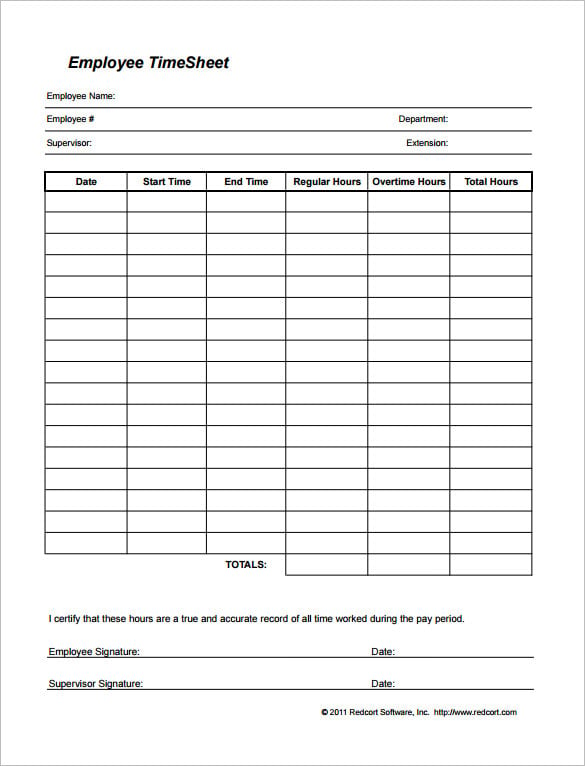

Calculating Your Paycheck Weekly Time Card 1 Worksheet Answers Cards

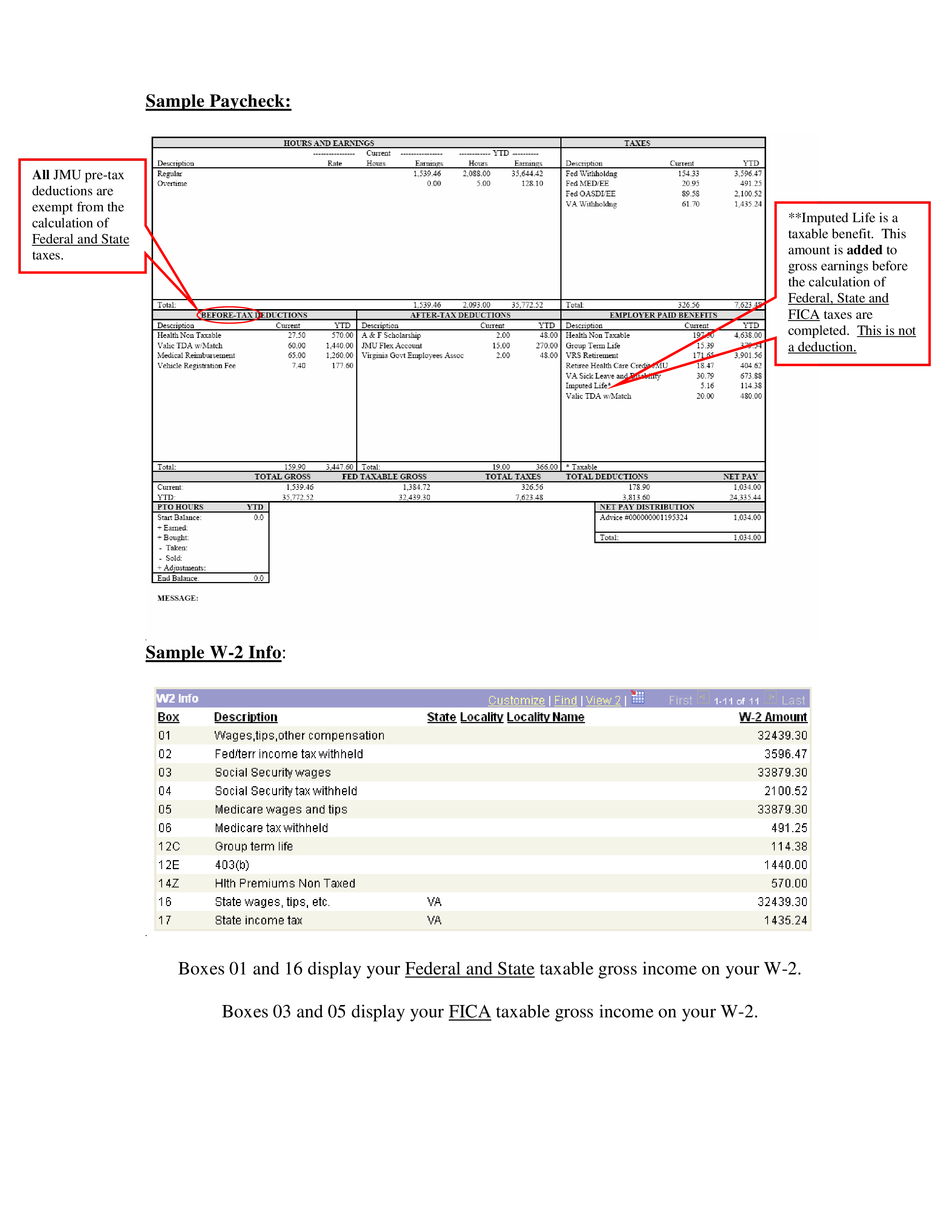

Solved Calculating Your Paycheck Salary Worksheet 1 Some

Calculating Your Paycheck Salary Worksheet 1 Answer Key —

Calculating Gross Pay Worksheets

Calculating Your Paycheck Salary Worksheet 1

Calculating Wages Worksheet Master of Documents

Hourly paycheck to yearly calculator DavinaBrogan

Enter Your Annual Salary Or Earnings Per Pay Period.

This Calculator Is For Educational And Illustrative Purposes Only And Should Not Be Construed As Financial Or.

For Example, If Your Gross Pay Is $8,000 And Payment Is Monthly, Then $8,000 X 12 = $96,000 Will Be His Annual Salary.

Web Calculating The Numbers In Your Paycheck.

Related Post: