California Capital Loss Carryover Worksheet

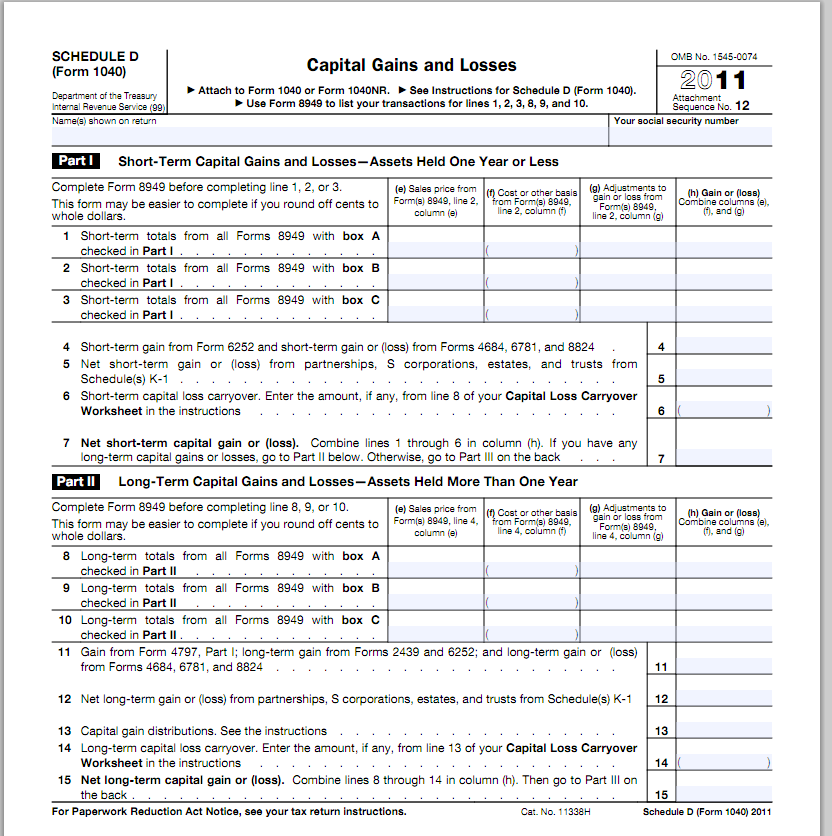

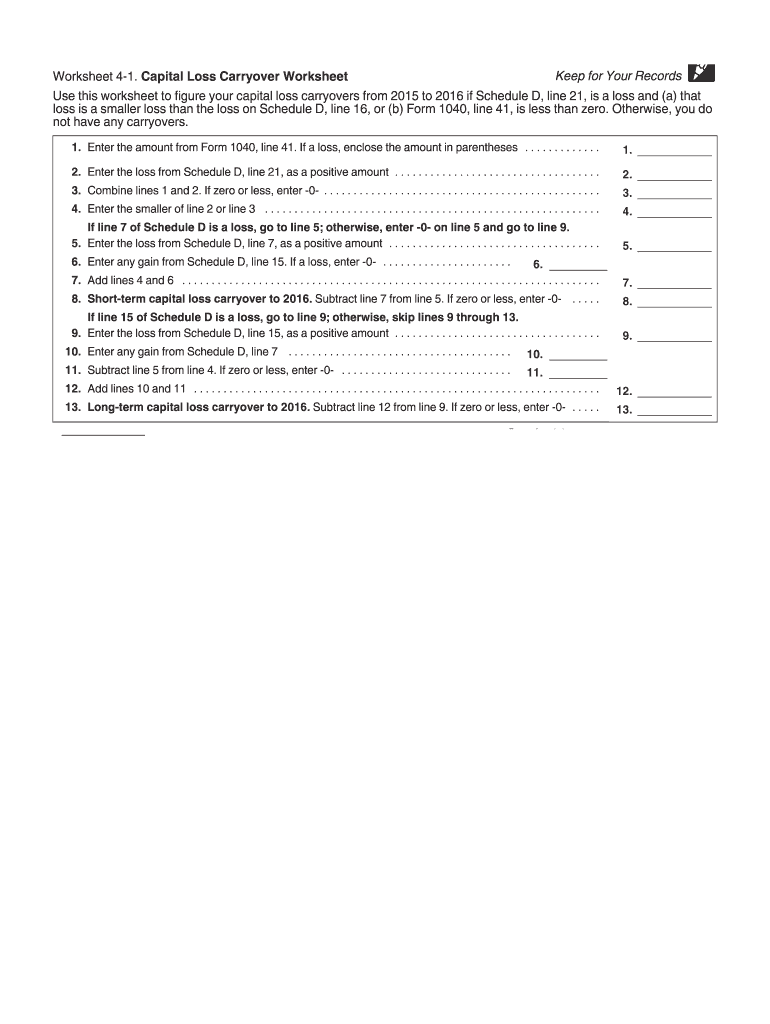

California Capital Loss Carryover Worksheet - A capital loss carryover is the net amount of capital losses that aren't deductible for the current tax year but can be carried over into. That loss is a smaller loss. Web california law does not conform to the following federal provisions under the caa, 2021: Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if married or an rdp. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web ca currently follows the federal treatment of capital loss carryovers (not sure how long they have done that so be careful for each year you are working on). Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if you are. Web report your capital assets on schedule d (540nr), california capital gains or loss adjustment. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9,. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, col. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Increased limitations and carryovers for charitable contributions that were made during. That loss is a smaller loss. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018. Web the irs caps your claim of excess loss at the lesser of $3,000 or your total net loss ($1,500 if you are married and filing separately). I do see the carryover. Web use the worksheet on this page to figure your capital loss carryover to 2021. Web the 2020 capital loss carryover to 2021 is computed using the california. Web use the worksheet below to figure your capital loss carryover to 2022. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller. Web use the worksheet below to figure your capital loss carryover to 2022. Web california law does not conform to the following federal provisions under the caa, 2021: Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if married or an rdp. Web if you do not. A capital loss carryover is the net amount of capital losses that aren't deductible for the current tax year but can be carried over into. Web report your capital assets on schedule d (540nr), california capital gains or loss adjustment. Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or. Web if you do not want to restart your 2022 return to get the amounts to match up as they should, you can make the adjustments in forms mode to the capital loss. Web capital loss carryover: Complete form 8949 before you complete line 1b, 2, 3, 8b, 9,. That loss is a smaller loss. Web california law does not. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and. A capital loss carryover is the net amount of capital losses that aren't deductible for the current tax year but can be carried over into. That loss is a smaller loss. Web the irs caps your claim of excess loss at the lesser of $3,000 or your total net loss ($1,500 if you are married and filing separately). Line 9. Web california law does not conform to the following federal provisions under the caa, 2021: That loss is a smaller loss. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss. Web california law does not conform to the following federal provisions under the caa, 2021: Web the 2020 capital loss carryover to 2021 is computed using the california capital loss carryover worksheet in the 2020 instructions for california schedule d. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if you are. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web ca currently follows the federal treatment of capital loss carryovers (not sure how long they have done that so be careful for each year you are working on). Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if married or an rdp. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. So clearly line 6 is not the right one to show the carryover information for 2019 tax year. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, col. Web the irs caps your claim of excess loss at the lesser of $3,000 or your total net loss ($1,500 if you are married and filing separately). A capital loss carryover is the net amount of capital losses that aren't deductible for the current tax year but can be carried over into. Carryover comes in when your. Web report your capital assets on schedule d (540nr), california capital gains or loss adjustment. Web if you do not want to restart your 2022 return to get the amounts to match up as they should, you can make the adjustments in forms mode to the capital loss. Web use the worksheet below to figure your capital loss carryover to 2022. Web capital loss carryover: Increased limitations and carryovers for charitable contributions that were made during. Web use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 schedule d, line 21, is a loss and (a) that loss is a smaller loss than the loss on your. Web use the worksheet below to figure your capital loss carryover to 2022. That loss is a smaller loss. Line 9 if line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if married or an rdp. Web use this worksheet to figure the estate's or trust's capital loss carryovers from 2022 to 2023 if schedule d, line 20, is a loss and (a) the loss on schedule d, line 19, col. Web the 2020 capital loss carryover to 2021 is computed using the california capital loss carryover worksheet in the 2020 instructions for california schedule d. Web california capital loss carryover from 2017 if any. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9,. I do see the carryover. Web use the worksheet on this page to figure your capital loss carryover to 2021. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Web report your capital assets on schedule d (540nr), california capital gains or loss adjustment. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web 2022 capital gains and losses introduction these instructions explain how to complete schedule d (form 1040). Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web ca currently follows the federal treatment of capital loss carryovers (not sure how long they have done that so be careful for each year you are working on).Federal Carryover Worksheet

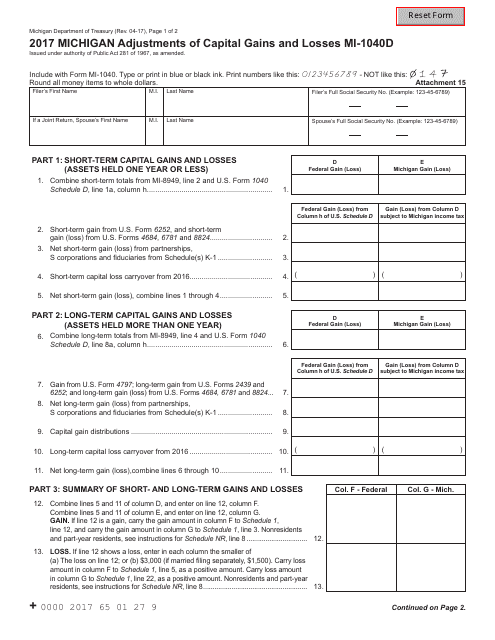

Federal Carryover Worksheet

Carryover Worksheet Turbotax

Capital Loss Carryover Worksheet slidesharedocs

Carryover Worksheet Turbotax

Federal Carryover Worksheet

️Capital Loss Carryover Worksheet 2014 Free Download Qstion.co

California Capital Loss Carryover Worksheet

Capital Gains Carryover Loss Worksheet Worksheet Resume Examples

California Capital Loss Carryover Worksheet

Web The Irs Caps Your Claim Of Excess Loss At The Lesser Of $3,000 Or Your Total Net Loss ($1,500 If You Are Married And Filing Separately).

A Capital Loss Carryover Is The Net Amount Of Capital Losses That Aren't Deductible For The Current Tax Year But Can Be Carried Over Into.

Carryover Comes In When Your.

Web California Law Does Not Conform To The Following Federal Provisions Under The Caa, 2021:

Related Post: