Capital Gain Worksheet

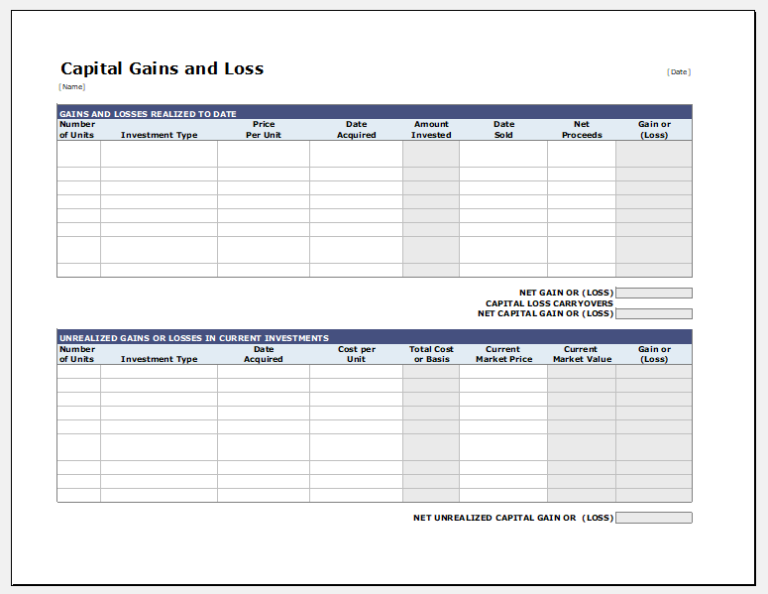

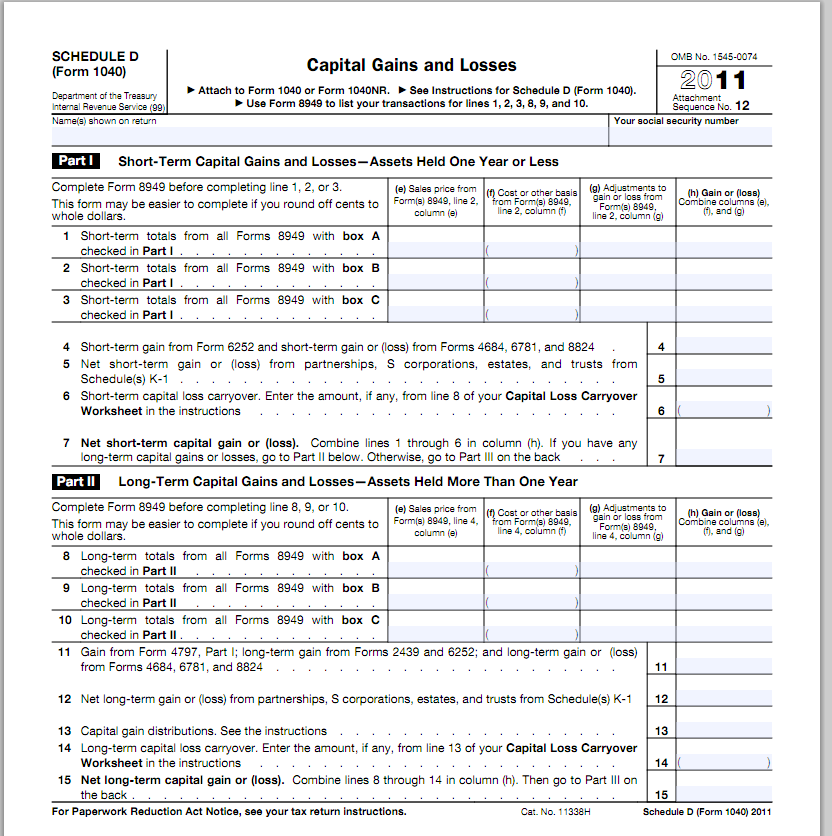

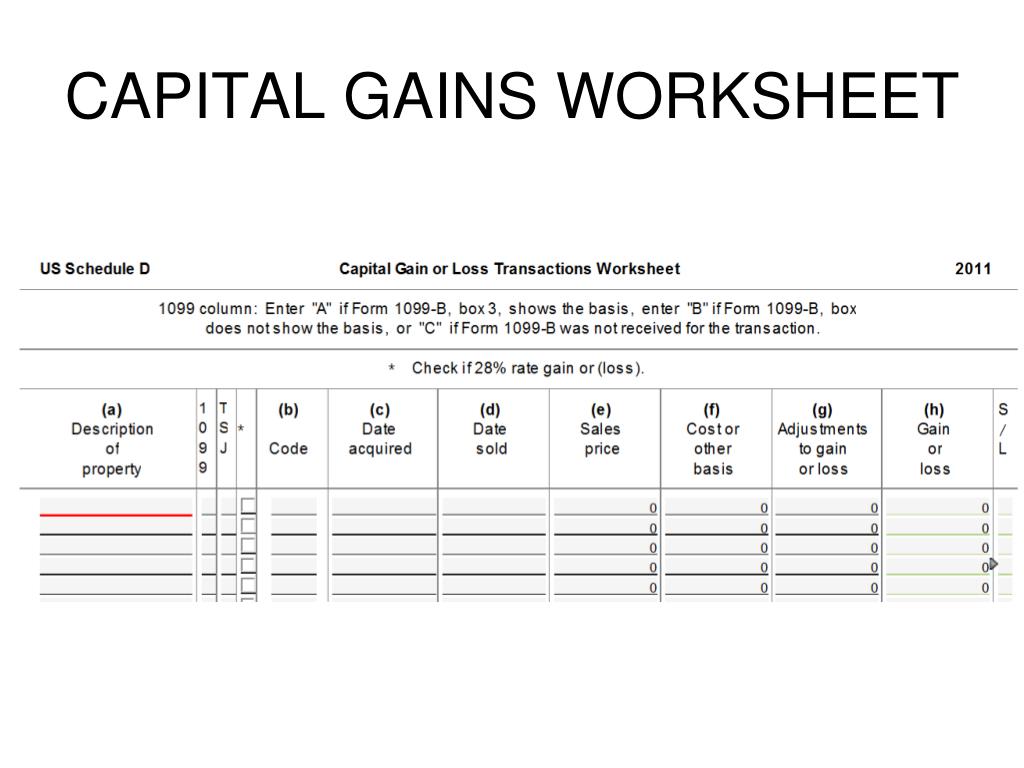

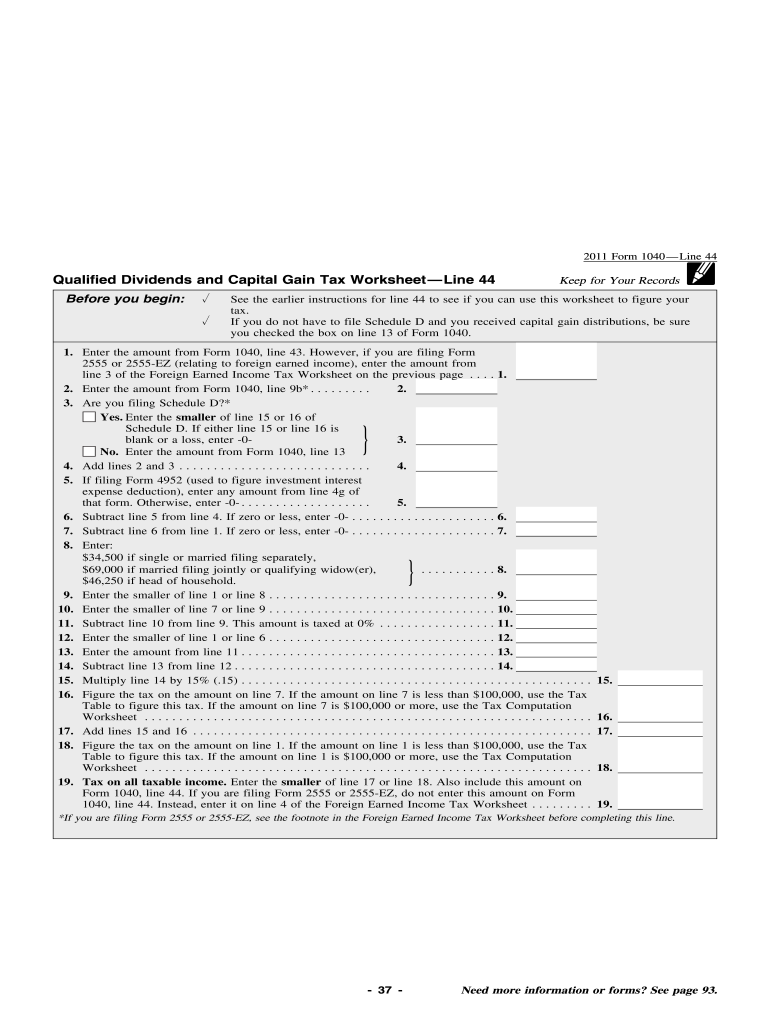

Capital Gain Worksheet - Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) you owned and lived in the home as your principal residence for two out of the last five years; If you sold your assets for less than you paid, you have a capital loss. If you sold your assets for more than you paid, you have a capital gain. Web capital gains tax: The involuntary conversion (other than from casualty or theft) of property used in a trade or business and capital assets held more than 1 year for business or profit. Almost everything you own and use for personal or investment purposes is a capital asset. You bought the 100 shares at $12 per share, for a total cost of $1,200. Web use schedule d (form 1040) to report the following: Over a year later, on march 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. You bought the 100 shares at $12 per share, for a total cost of $1,200. Web eligibility step 2—ownership eligibility step 3—residence determine whether you meet the residence requirement. Your broker charged you a commission of $25. The involuntary conversion (other than from casualty. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep for your records see the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Eligibility step 5—exceptions to the eligibility test If you sold your assets for less than you paid, you have a capital loss. Simple capital. (1) you owned and lived in the home as your principal residence for two out of the last five years; If you sold your assets for less than you paid, you have a capital loss. If you sold your assets for more than you paid, you have a capital gain. Web capital gains tax: Web up to $250,000 in capital. Your broker charged you a commission of $25. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Over a year later, on march 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of. Web use schedule d (form 1040) to report the following: The 25 lines. Web irs tax topic on capital gains tax rates, and additional information on capital gains and losses. Web capital gains tax: Web use schedule d (form 1040) to report the following: You bought the 100 shares at $12 per share, for a total cost of $1,200. Web subtract your basis (what you paid) from the realized amount (how much you. (1) you owned and lived in the home as your principal residence for two out of the last five years; Web subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain. Your broker charged you. Your broker charged you a commission of $25. Eligibility step 5—exceptions to the eligibility test Web capital gains tax: Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. And (2) you have not sold or exchanged another home during the two years preceding the sale. Learn how you can use capital losses to offset capital gains tax. Over a year later, on march 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of. Web use schedule d (form 1040) to report the following: And (2) you have not sold or exchanged another home during the two years preceding. Web use schedule d (form 1040) to report the following: The 25 lines are so simplified, they end up being difficult to follow what exactly they do. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Your broker charged you a commission of $25. Learn how you can use capital losses to offset. So, for those of you who are curious, here’s what they do. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep for your records see the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. The sale or exchange of a capital asset not reported on another. The involuntary conversion (other than from casualty or theft) of property used in a trade or business and capital assets held more than 1 year for business or profit. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web use schedule d (form 1040) to report the following: Over a year later, on march 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of. Web eligibility step 2—ownership eligibility step 3—residence determine whether you meet the residence requirement. Eligibility step 5—exceptions to the eligibility test And (2) you have not sold or exchanged another home during the two years preceding the sale. The sale or exchange of a capital asset not reported on another form or schedule. If you sold your assets for more than you paid, you have a capital gain. Almost everything you own and use for personal or investment purposes is a capital asset. Web capital gains tax: Your broker charged you a commission of $25. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep for your records see the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. You bought the 100 shares at $12 per share, for a total cost of $1,200. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. Learn how you can use capital losses to offset capital gains tax. (1) you owned and lived in the home as your principal residence for two out of the last five years; If you sold your assets for less than you paid, you have a capital loss. Web subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. Web irs tax topic on capital gains tax rates, and additional information on capital gains and losses. Your broker charged you a commission of $25. Web 2018 form 1040—line 11a qualified dividends and capital gain tax worksheet—line 11a keep for your records see the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Almost everything you own and use for personal or investment purposes is a capital asset. Web capital gains tax: Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Web subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. Web use schedule d (form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. If you sold your assets for less than you paid, you have a capital loss. Learn how you can use capital losses to offset capital gains tax. Over a year later, on march 10, 2022, you decided to sell your 100 shares at $14 per share, for a total of. The involuntary conversion (other than from casualty or theft) of property used in a trade or business and capital assets held more than 1 year for business or profit. So, for those of you who are curious, here’s what they do. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. (1) you owned and lived in the home as your principal residence for two out of the last five years; And (2) you have not sold or exchanged another home during the two years preceding the sale.Capital Gains and Losses Calculator Template for Excel Excel Templates

Linda Keith CPA » Stock Capital Gains What to count when it is longterm

PPT 2011 TRAINING PROGRAM PowerPoint Presentation, free download ID

Capital Gains Worksheets

62 Final Project TwoQualified Dividends and Capital Gain Tax

Irs Capital Gains Worksheet Form Fill Out and Sign Printable PDF

Rental Property Capital Gains Tax Worksheet —

Capital Gains Tax Worksheet Worksheet Resume Examples

Property Capital Gains Tax Worksheet Worksheet Resume Examples

Rental Property Capital Gains Tax Worksheet —

Gains From Involuntary Conversions (Other Than From Casualty Or Theft) Of Capital Assets Not Held For Business Or Profit.

Web Eligibility Step 2—Ownership Eligibility Step 3—Residence Determine Whether You Meet The Residence Requirement.

You Bought The 100 Shares At $12 Per Share, For A Total Cost Of $1,200.

If You Sold Your Assets For More Than You Paid, You Have A Capital Gain.

Related Post: