Capital Gains And Dividends Worksheet

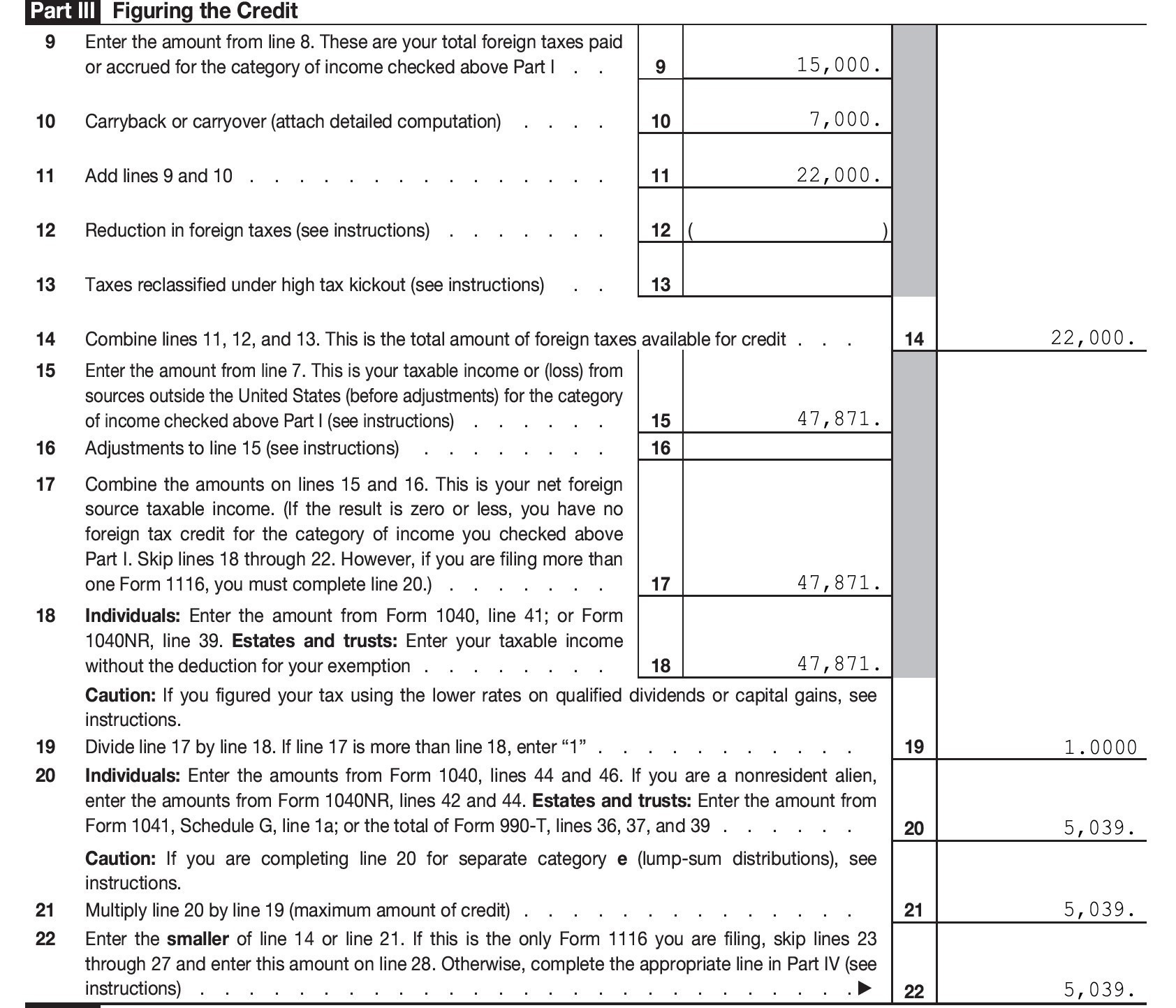

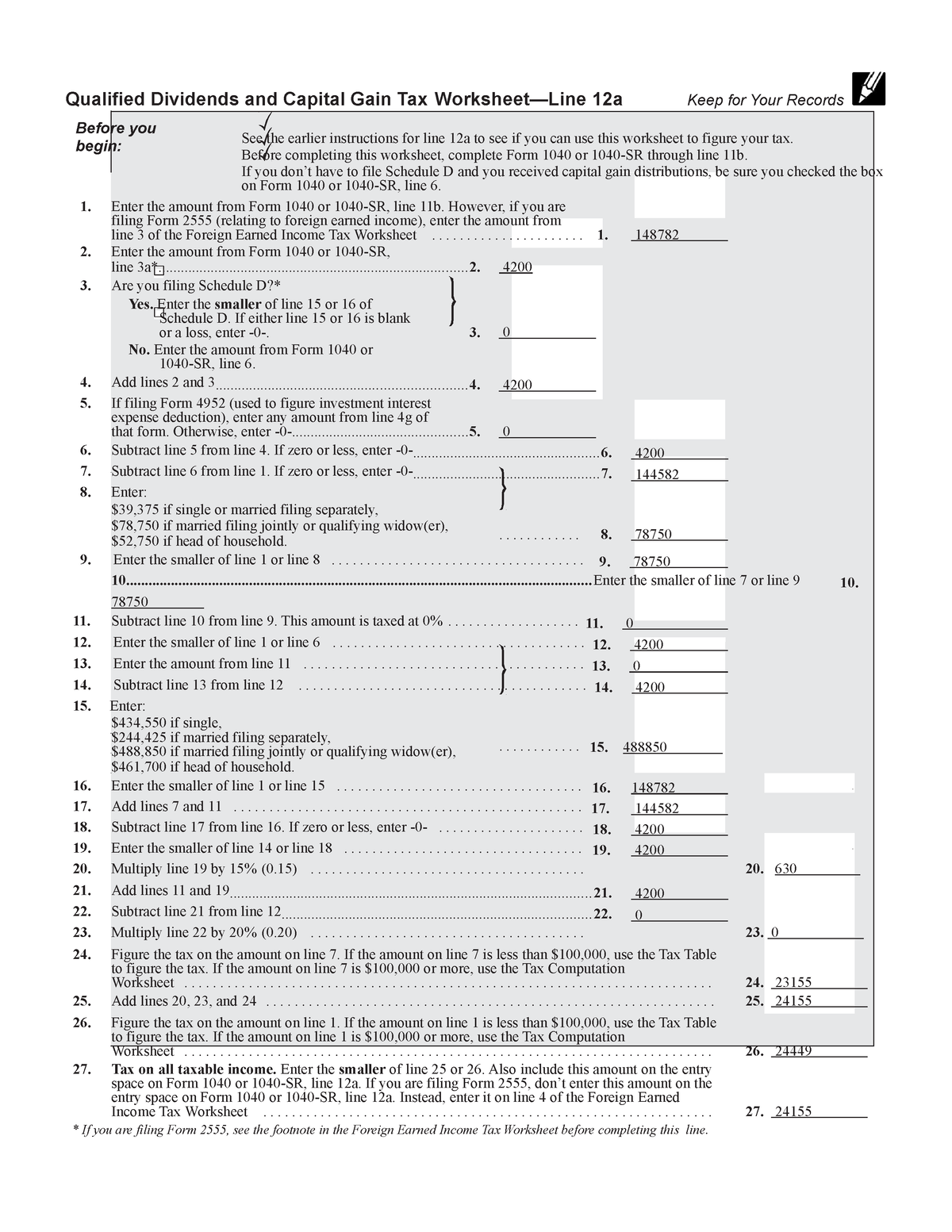

Capital Gains And Dividends Worksheet - For tax year 2023, the 20% rate applies to amounts above $14,650. This is the sale price minus any commissions or fees paid. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web richard rubin april 8, 2021 2:40 pm et listen (5 min) the tax rates on capital gains and dividends depend on how long you hold an investment, your taxable income. Web capital gain calculation in four steps. Explore updated credits, deductions, and exemptions, including the standard. It is used to calculate the. Also use form 8949, schedule d, and the qualified. Capital gains taxes on assets held for a year or less correspond to ordinary. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Before completing this worksheet, complete form 1040 through line 43. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web richard rubin april 8, 2021 2:40 pm et listen (5 min) the tax rates on capital gains and dividends depend on how long you hold an investment, your taxable income. This is the sale price. Web capital gain calculation in four steps. What is the qualified dividend and capital. Tax on capital gain and qualified. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on.. Locate ordinary dividends in box 1a, qualified dividends in box 1b and total capital gain distributions in. The 0% rate applies to amounts up to $3,000. Web the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. The 0% and 15% rates continue to apply to amounts below certain threshold amounts.. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the.. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. What is the qualified dividend and capital. Explore updated credits, deductions, and exemptions, including the standard. Web capital gain calculation in four steps. Also use form 8949, schedule d, and the qualified. Web richard rubin april 8, 2021 2:40 pm et listen (5 min) the tax rates on capital gains and dividends depend on how long you hold an investment, your taxable income. Explore updated credits, deductions, and exemptions, including the standard. Gain or loss from sales of stocks or bonds : You bought the 100 shares at $12 per. Web qualified. This is generally the purchase price plus any commissions or fees paid. You bought the 100 shares at $12 per. Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet and if any of the following. What is the qualified dividend and capital. Tax. Web the qualified dividends and capital gain tax worksheet is an important document for anyone who earns any of these types of income. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. Web richard rubin april 8, 2021 2:40 pm et listen (5 min) the tax rates on capital gains and dividends depend on how. Explore updated credits, deductions, and exemptions, including the standard. Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet and if any of the following. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. This is the sale price minus any commissions or fees paid. Basis may also be increased by reinvested dividends on stocks and other factors. What is the qualified dividend and capital. This is generally the purchase price plus any commissions or fees paid. For tax year 2023, the 20% rate applies to amounts above $14,650. Tax on capital gain and qualified. It is used to calculate the. Web capital gain calculation in four steps. Web the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Capital gains taxes on assets held for a year or less correspond to ordinary. Web richard rubin april 8, 2021 2:40 pm et listen (5 min) the tax rates on capital gains and dividends depend on how long you hold an investment, your taxable income. The 0% rate applies to amounts up to $3,000. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. The 0% and 15% rates continue to apply to amounts below certain threshold amounts. Web the purpose of the qualified dividends and capital gain tax worksheet is to report and. Simple capital gains worksheet let's say you bought 100 shares of company xyz stock on jan. Explore updated credits, deductions, and exemptions, including the standard. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. What is the qualified dividend and capital. Basis may also be increased by reinvested dividends on stocks and other factors. This is the sale price minus any commissions or fees paid. Tax on capital gain and qualified. The 0% and 15% rates continue to apply to amounts below certain threshold amounts. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax worksheet and if any of the following. For tax year 2023, the 20% rate applies to amounts above $14,650. Web capital gains and qualified dividends. Web the capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Before completing this worksheet, complete form 1040 through line 43. It is used to calculate the. Capital gains taxes on assets held for a year or less correspond to ordinary.39 1040 qualified dividends and capital gains worksheet Worksheet Master

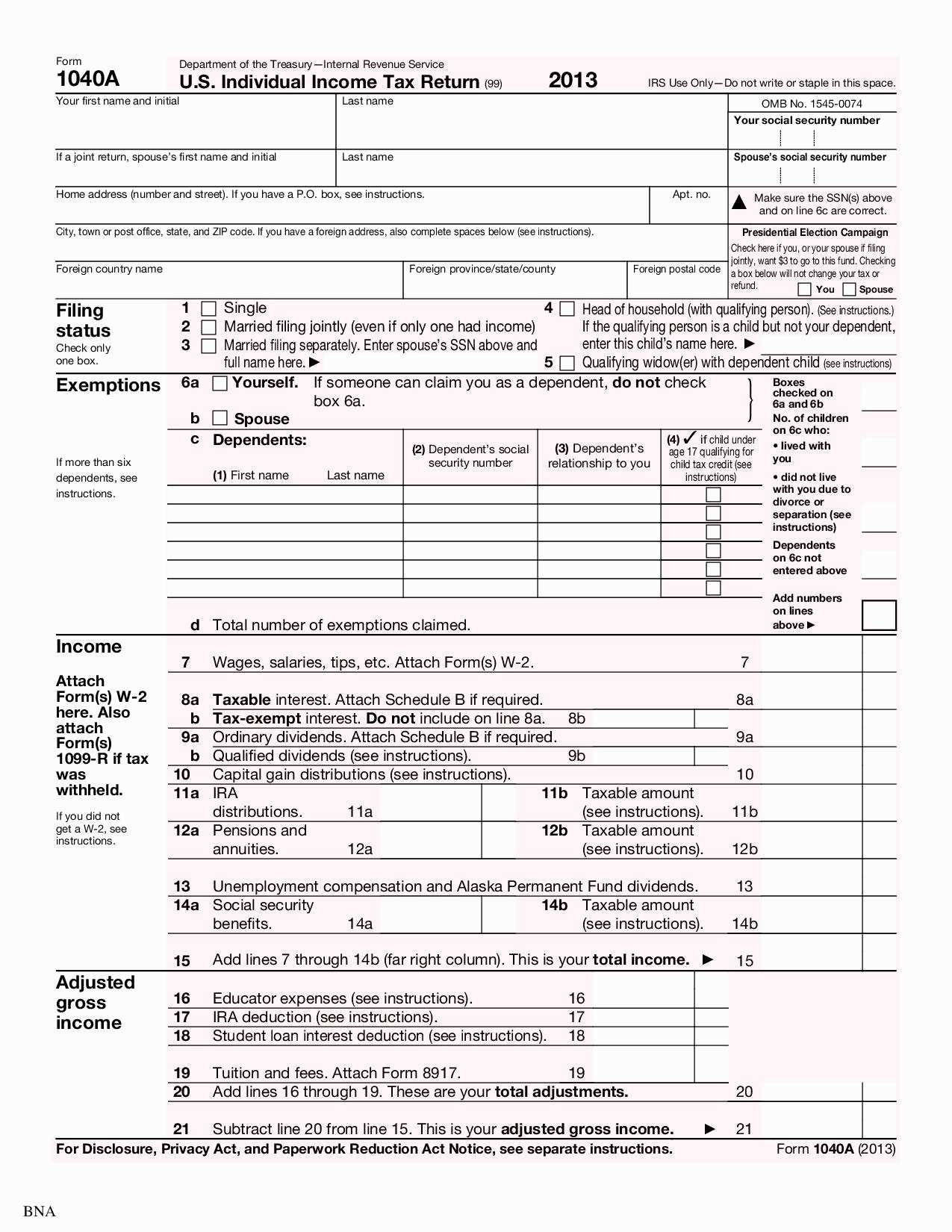

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

31 Qualified Dividends And Capital Gain Tax Worksheet Line 44 support

20++ Qualified Dividends And Capital Gains Worksheet 2020

2020 Qualified Dividends And Capital Gains Worksheet

Qualified Dividends and Capital Gains Worksheet Qualified Dividends

Qualified Dividends and Capital Gain Tax Worksheet

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Qualified Dividends And Capital Gain Tax Worksheet —

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

This Is Generally The Purchase Price Plus Any Commissions Or Fees Paid.

Web The Qualified Dividends And Capital Gain Tax Worksheet Is An Important Document For Anyone Who Earns Any Of These Types Of Income.

Web See The Instructions For Line 44 To See If You Can Use This Worksheet To Figure Your Tax.

Gain Or Loss From Sales Of Stocks Or Bonds :

Related Post: