Capital Loss Carryforward Worksheet

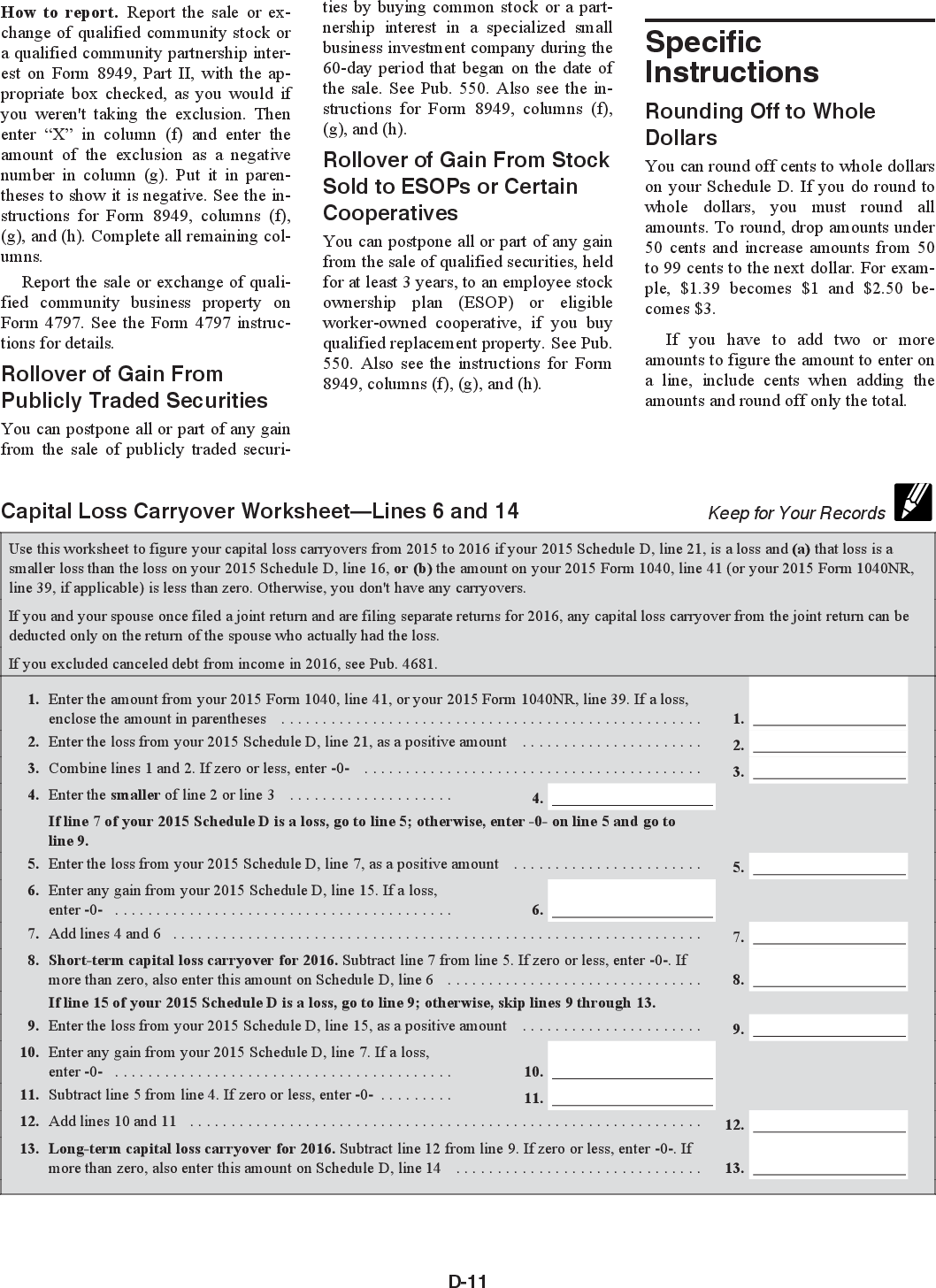

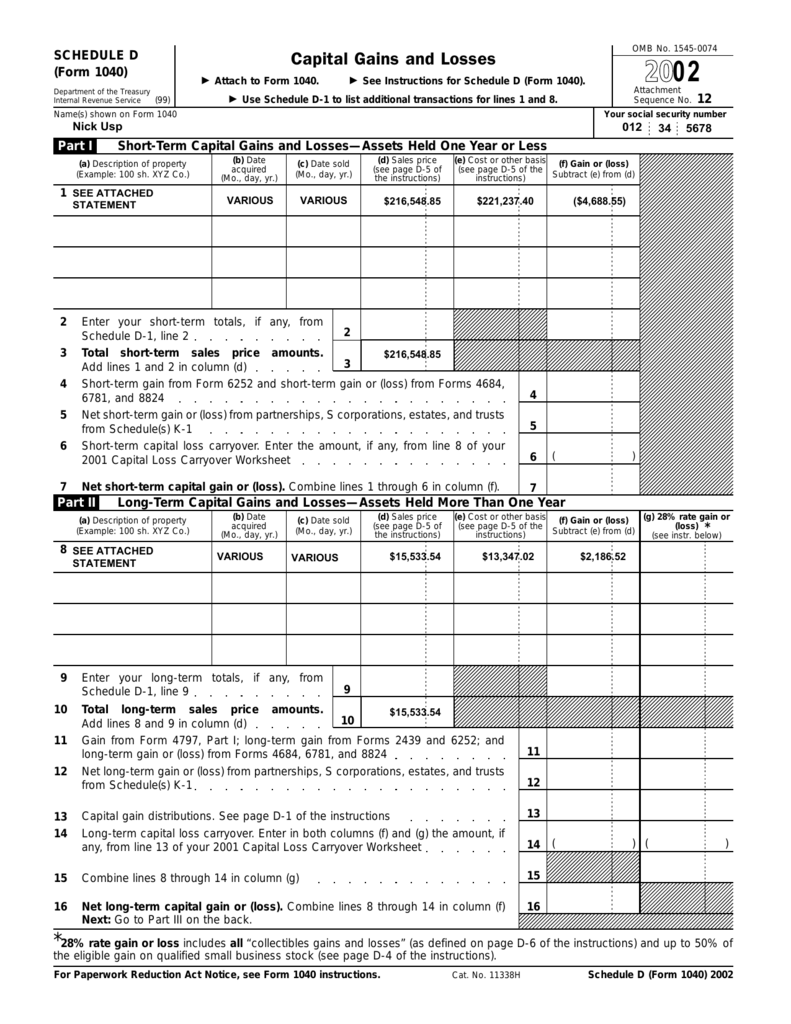

Capital Loss Carryforward Worksheet - Difference between line 10 and line 11: Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d (form 1040). Web current revision schedule d (form 1040) pdf instructions for schedule d (form 1040) | print version pdf | ebook (epub) epub recent developments correction to the 2020. Use the capital loss carryover. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the capital loss carryover section using tt premier 2021; That loss is a smaller loss than the. Fill in all needed lines in the doc utilizing. Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. I am prompted to enter the. ($2,000) california gain on line 11 is: Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. Web the irs caps your claim of excess loss at the lesser of $3,000 or your total net loss ($1,500 if you are married and filing separately).. You may deduct capital losses up to the amount of your capital gains, plus $3,000 ($1,500 if married filing separately). ($2,000) california gain on line 11 is: Use the capital loss carryover. Web loss on line 10 and gain on line 11. Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover. Web capital loss carryover worksheet keep for your records use this worksheet to figure the estate’s or trust’s capital loss carryovers from 2009 to 2010 if schedule d, line 16 is. Click the button get form to open it and begin editing. Use get form or simply click on the template preview to open it in the editor. That loss. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Use the capital loss carryover. Click the button get form to open it and begin editing. Fill in all needed lines in the doc utilizing. Web loss on line 10 and. Carryover comes in when your. I am prompted to enter the. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web for any year (including the final year) in which capital losses exceed capital gains, the estate or trust may. Fill in all needed lines in the doc utilizing. Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. Click the button get form to open it and begin editing. Web capital loss carryover worksheet keep for. Use get form or simply click on the template preview to open it in the editor. Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d (form 1040). Web a tax loss carryforward is a special tax rule that allows capital losses to be carried over. Web use the worksheet below to figure your capital loss carryover to 2023. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the capital loss carryover section using tt premier 2021; Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the capital loss carryover section using tt premier 2021; ($2,000) california gain on line 11 is: Web current revision schedule d (form 1040) pdf instructions for schedule d (form 1040) | print version pdf | ebook (epub) epub recent developments correction to the 2020. Click the. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the capital loss carryover section using tt premier 2021; Click the button get form to open it and begin editing. You may deduct capital losses up to the amount of your capital gains, plus $3,000 ($1,500 if married filing separately). Web a tax loss carryforward is. Use the capital loss carryover. Web use the worksheet below to figure your capital loss carryover to 2023. Fill in all needed lines in the doc utilizing. Web a tax loss carryforward is a special tax rule that allows capital losses to be carried over from one year to another. If line 8 is a net capital loss, enter the smaller of the loss on line 8 or $3,000 ($1,500 if married or an. Web capital loss carryover worksheet keep for your records use this worksheet to figure the estate’s or trust’s capital loss carryovers from 2009 to 2010 if schedule d, line 16 is. Use get form or simply click on the template preview to open it in the editor. In other words, an investor can take capital. Web loss on line 10 and gain on line 11. Click the button get form to open it and begin editing. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d (form 1040). You may deduct capital losses up to the amount of your capital gains, plus $3,000 ($1,500 if married filing separately). Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. Web current revision schedule d (form 1040) pdf instructions for schedule d (form 1040) | print version pdf | ebook (epub) epub recent developments correction to the 2020. Carryover comes in when your. I am prompted to enter the. That loss is a smaller loss than the. Web capital loss carryforward worksheet hi, for my 2021 taxes when i get to the capital loss carryover section using tt premier 2021; Click the button get form to open it and begin editing. Federal loss on line 10 is: Web if the estate or trust incurs capital losses in the final year, use the capital loss carryover worksheet in the instructions for schedule d (form 1041) to figure the amount of capital. Web capital loss carryover worksheet—schedule d (form 1040) (2021) use this worksheet to calculate capital loss carryovers from 2020 to 2021 if 2020 schedule d, line 21, is a. Web a tax loss carryforward is a special tax rule that allows capital losses to be carried over from one year to another. Web use this worksheet to calculate capital loss carryovers from 2019 to 2020 if 2019 schedule d, line 21, is a loss and one of the following is true. Web the irs caps your claim of excess loss at the lesser of $3,000 or your total net loss ($1,500 if you are married and filing separately). Web loss on line 10 and gain on line 11. Difference between line 10 and line 11: Fill in all needed lines in the doc utilizing. Web you may use the capital loss carryover worksheet found in publication 550, investment income and expenses or in the instructions for schedule d (form 1040). ($2,000) california gain on line 11 is: Web current revision schedule d (form 1040) pdf instructions for schedule d (form 1040) | print version pdf | ebook (epub) epub recent developments correction to the 2020. Web use the worksheet below to figure your capital loss carryover to 2023. That loss is a smaller loss than the. Use the capital loss carryover.Federal Carryover Worksheet

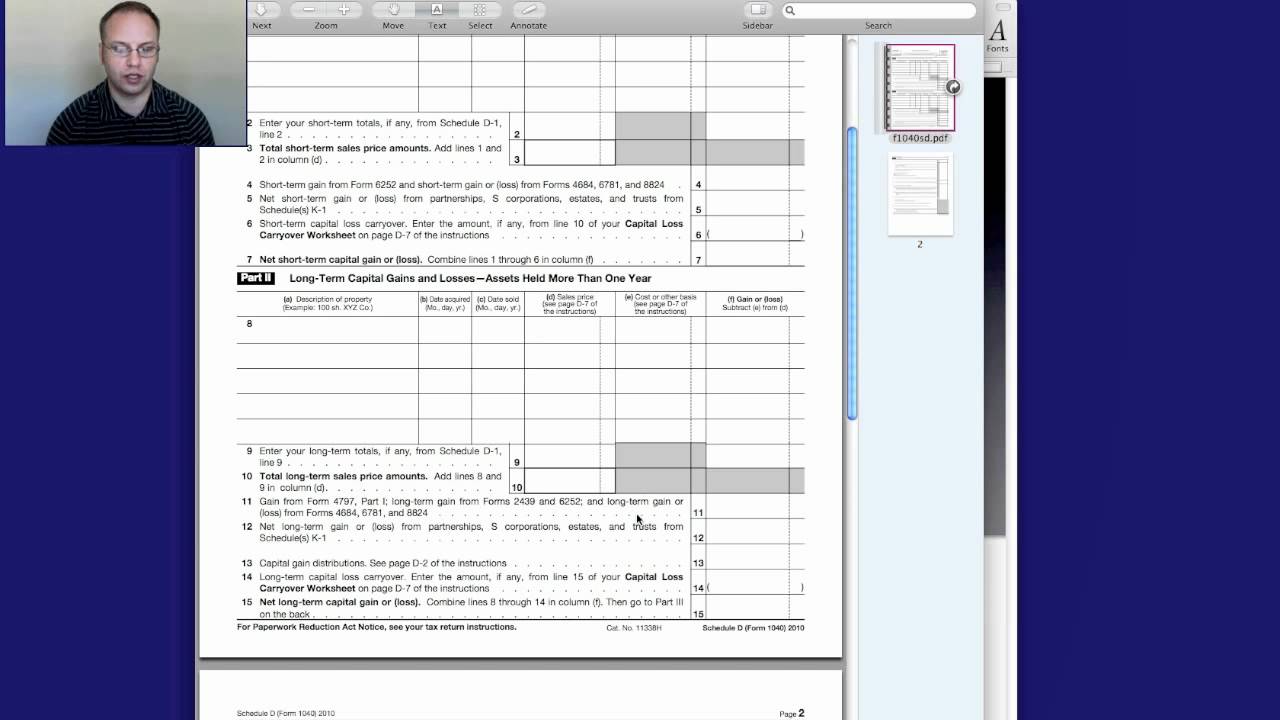

Capital Loss Carryover Worksheet slidesharedocs

Capital Loss Carryover Worksheet slidesharedocs

Carryover Worksheets

California Capital Loss Carryover Worksheet

California Capital Loss Carryover Worksheet

Capital Loss Carryover Worksheet slidesharedocs

Capital Loss Carryover Worksheet 2019 To 2020 Fill Online, Printable

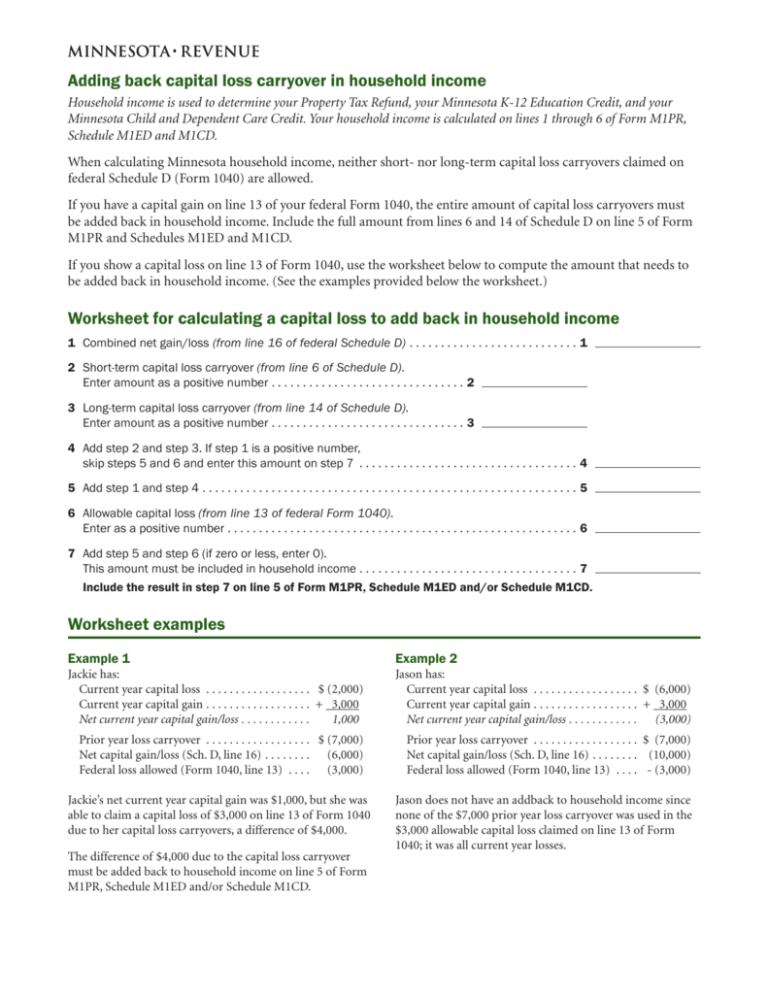

Adding back capital loss carryover in household Worksheet

California Capital Loss Carryover Worksheet

Web For Any Year (Including The Final Year) In Which Capital Losses Exceed Capital Gains, The Estate Or Trust May Have A Capital Loss Carryover.

In Other Words, An Investor Can Take Capital.

Web Capital Loss Carryforward Worksheet Hi, For My 2021 Taxes When I Get To The Capital Loss Carryover Section Using Tt Premier 2021;

Web Capital Loss Carryover Worksheet Keep For Your Records Use This Worksheet To Figure The Estate’s Or Trust’s Capital Loss Carryovers From 2009 To 2010 If Schedule D, Line 16 Is.

Related Post: