Checking Account Reconciliation Worksheet

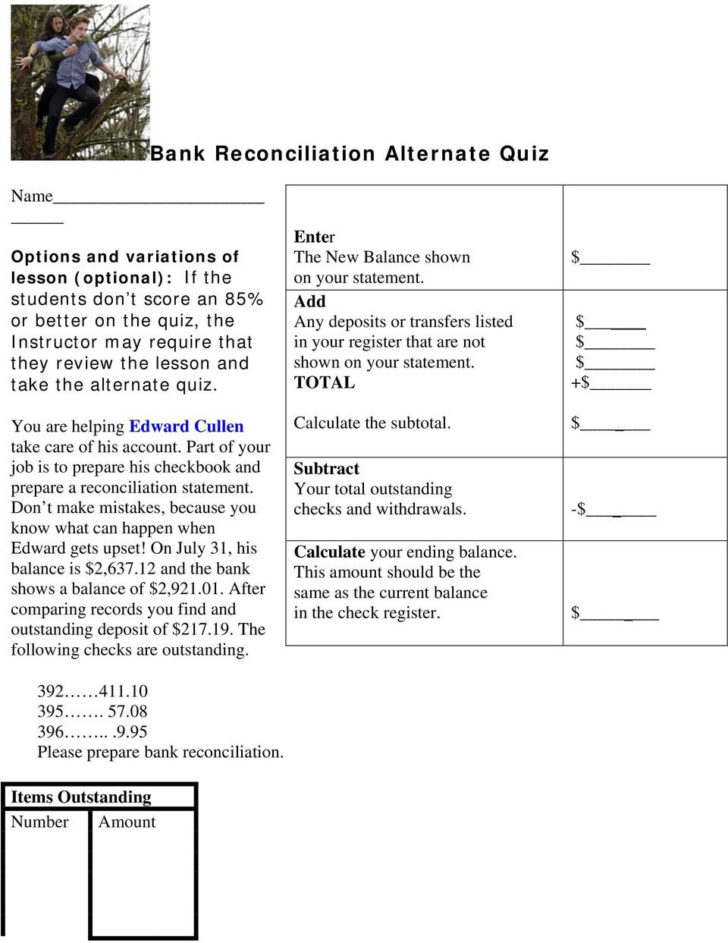

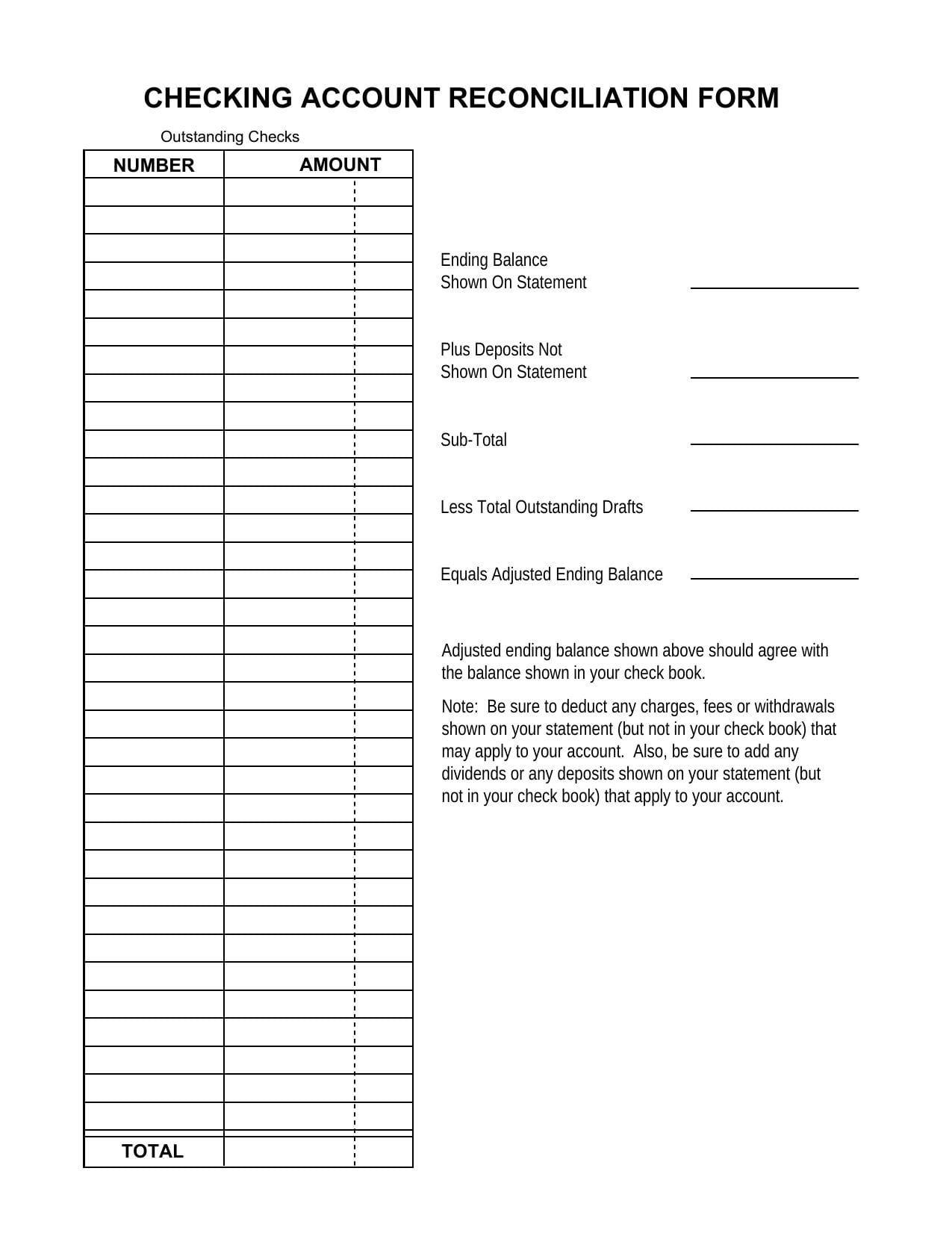

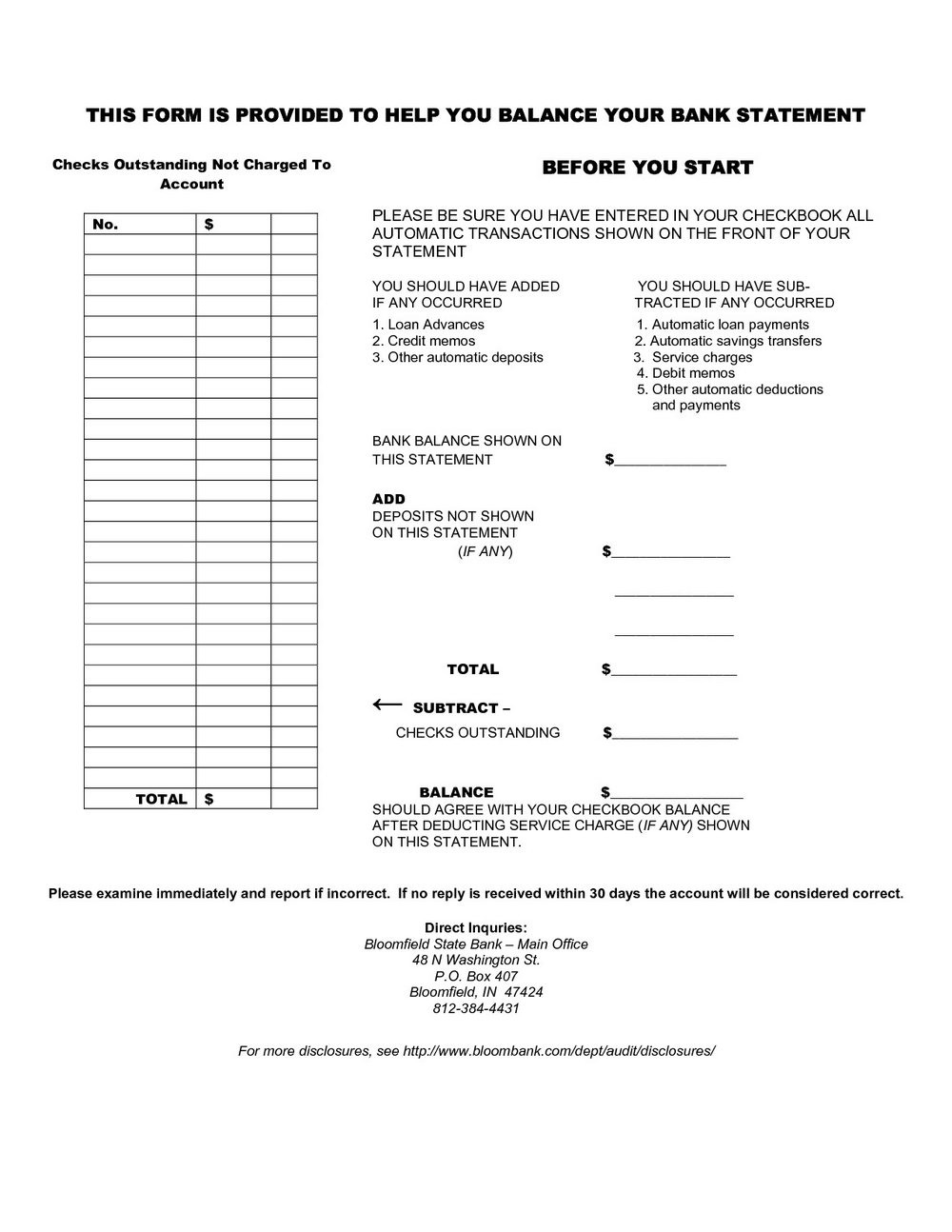

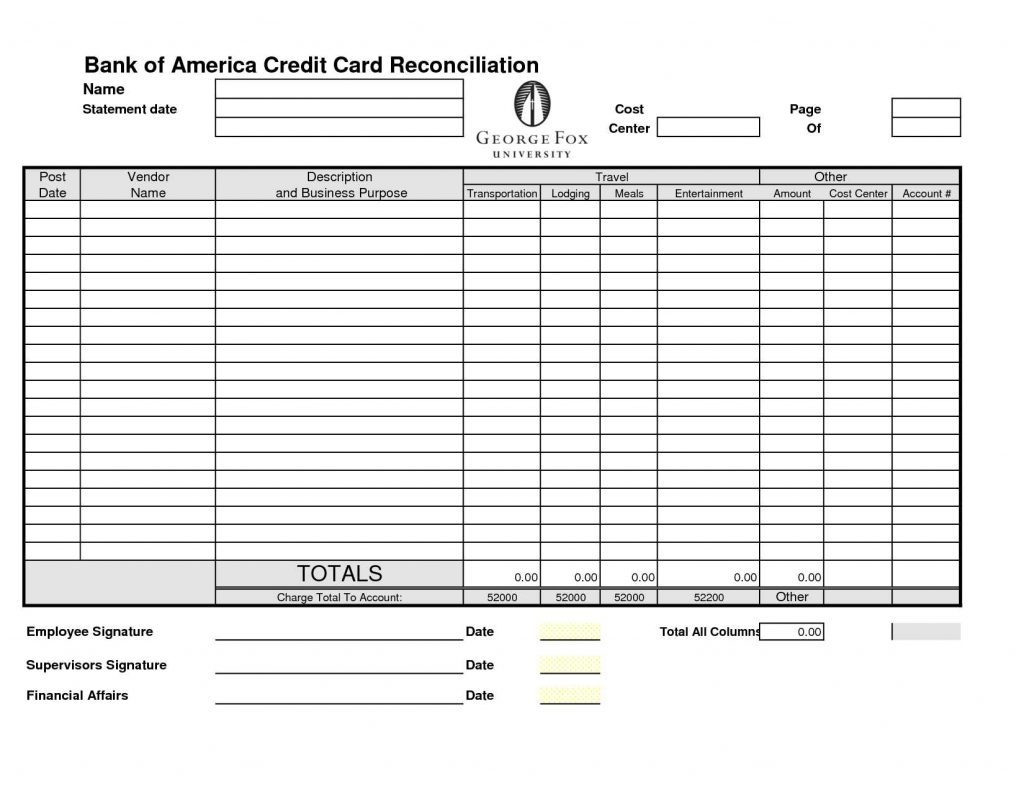

Checking Account Reconciliation Worksheet - Web reconciliation of checking account. Web a checking account reconciliation form is a financial form that business owners and accountants use to organize and track transactions from a company’s checking account. Web how to do a bank reconciliation. Choose your method for reconciliation. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. How to reconcile spending with your checking register; You can also enter bank deposits and bank withdrawals. Checking account reconcile worksheet created date:. Total of transactions not paid: Date of check check# description amount date of deposit deposit amount: Read and understand a checking account statement; Web reconciliation of checking account. How to shop around for the right bank and banking services; Choose your method for reconciliation. How to write a check; It ensures that your records of all deposits and withdrawals match with what the bank has so that you have an accurate view of your balance and any outstanding payments or deposits that have not yet cleared the account. A enter the ending balance on your statement. Web how to do a bank reconciliation. Total of transactions not paid: How. Date of check check# description amount date of deposit deposit amount: Web use this teacher’s guide, set of worksheets, and powerpoint presentation to teach kids the basics about banking. Checking account reconcile worksheet created date:. Web a checking account reconciliation form is a financial form that business owners and accountants use to organize and track transactions from a company’s checking. Date of check check# description amount date of deposit deposit amount: Total of deposits not credited by bank: This microsoft excel document allows you to quickly reconcile a checking account. Web balancing your checkbook is the process of reconciling the bank's record of your account activities with your own. How to write a check; List your account register/checkbook balance here $ 2. Web follow the steps below to reconcile your statement balance with your account register balance. Web balancing your checkbook is the process of reconciling the bank's record of your account activities with your own. You can also enter bank deposits and bank withdrawals. For more financial management tools, download cash flow and. Be sure to deduct any. You can also enter bank deposits and bank withdrawals. This is your new account register balance $ now, with your account. List your account register/checkbook balance here $ 2. For more financial management tools, download cash flow and other accounting templates. You can also enter bank deposits and bank withdrawals. This is your new account register balance $ now, with your account. For more financial management tools, download cash flow and other accounting templates. How to reconcile spending with your checking register; You can enter your checking account information such as date and statement balance. This microsoft excel document allows you to quickly reconcile a checking account. List your account register/checkbook balance here $ 2. It ensures that your records of all deposits and withdrawals match with what the bank has so that you have an accurate view of your balance and any outstanding payments or deposits that have not yet cleared the account. Checking. Total of transactions not paid: You can customize all of the templates offered below for business use or for reconciling personal accounts. How to shop around for the right bank and banking services; You can enter your checking account information such as date and statement balance. How to write a check; Web follow the steps below to reconcile your statement balance with your account register balance. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. You can enter your checking account information such as date and statement balance. How to reconcile spending with your checking register; Web balancing your checkbook is the process of reconciling the. You can enter your checking account information such as date and statement balance. How to write a check; Read and understand a checking account statement; This is your new account register balance $ now, with your account. How to shop around for the right bank and banking services; It ensures that your records of all deposits and withdrawals match with what the bank has so that you have an accurate view of your balance and any outstanding payments or deposits that have not yet cleared the account. How you choose to perform a bank reconciliation depends on how you track your money. This microsoft excel document allows you to quickly reconcile a checking account. Web balancing your checkbook is the process of reconciling the bank's record of your account activities with your own. Web use this teacher’s guide, set of worksheets, and powerpoint presentation to teach kids the basics about banking. A enter the ending balance on your statement. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. List your account register/checkbook balance here $ 2. How to reconcile spending with your checking register; Subtract any service charges or other deductions not previously recorded that are listed on this statement $ 3. You can customize all of the templates offered below for business use or for reconciling personal accounts. Add any credits not previously recorded that are listed on this statement (for example interest) $ 4. Be sure that your register shows any interest paid into your account and any service charges, automatic payments or atm transactions withdrawn from your account during the statement period. Web follow the steps below to reconcile your statement balance with your account register balance. Web how to do a bank reconciliation. Web how to do a bank reconciliation. Web save time, protect financial assets, and increase accuracy with free bank reconciliation templates. Checking account reconcile worksheet created date:. Web download the free printable bank reconciliation spreadsheet below. How to shop around for the right bank and banking services; Date of check check# description amount date of deposit deposit amount: Add any credits not previously recorded that are listed on this statement (for example interest) $ 4. Subtract any service charges or other deductions not previously recorded that are listed on this statement $ 3. Read and understand a checking account statement; For more financial management tools, download cash flow and other accounting templates. It ensures that your records of all deposits and withdrawals match with what the bank has so that you have an accurate view of your balance and any outstanding payments or deposits that have not yet cleared the account. Web use this teacher’s guide, set of worksheets, and powerpoint presentation to teach kids the basics about banking. Total of deposits not credited by bank: Total of transactions not paid: How to write a check; This microsoft excel document allows you to quickly reconcile a checking account.Bank Reconciliation Worksheet

Reconciliation Of Bank Statement Worksheet 3 2 Reconcile A —

Excel Checking Account Reconciliation Template Collection

Checking Account Reconciliation Worksheet —

Checking Account Reconciliation Worksheet Excel Universal —

reconciling a bank statement worksheet

Bank Reconciliation Template

Reconciling A Checking Account Worksheet Answers

Checkbook Reconciliation Practice Worksheets checking account

Perfect Bank Reconciliation Spreadsheet Printable Work Schedule Template

Web Balancing Your Checkbook Is The Process Of Reconciling The Bank's Record Of Your Account Activities With Your Own.

You Can Customize All Of The Templates Offered Below For Business Use Or For Reconciling Personal Accounts.

Be Sure That Your Register Shows Any Interest Paid Into Your Account And Any Service Charges, Automatic Payments Or Atm Transactions Withdrawn From Your Account During The Statement Period.

Choose Your Method For Reconciliation.

Related Post: