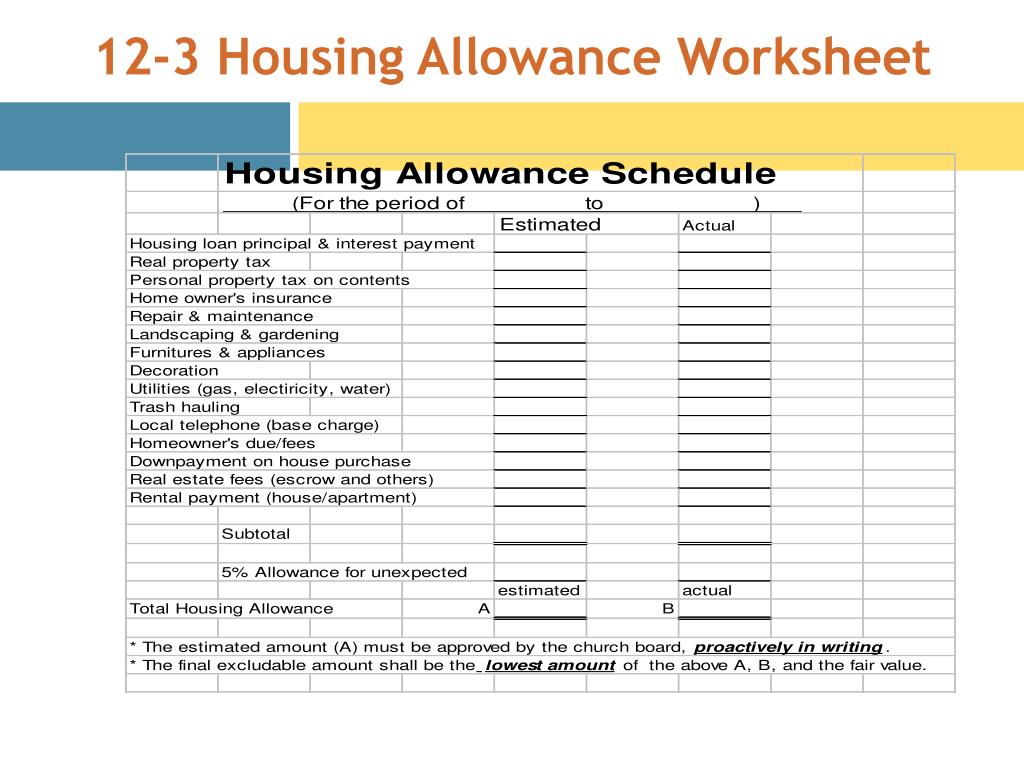

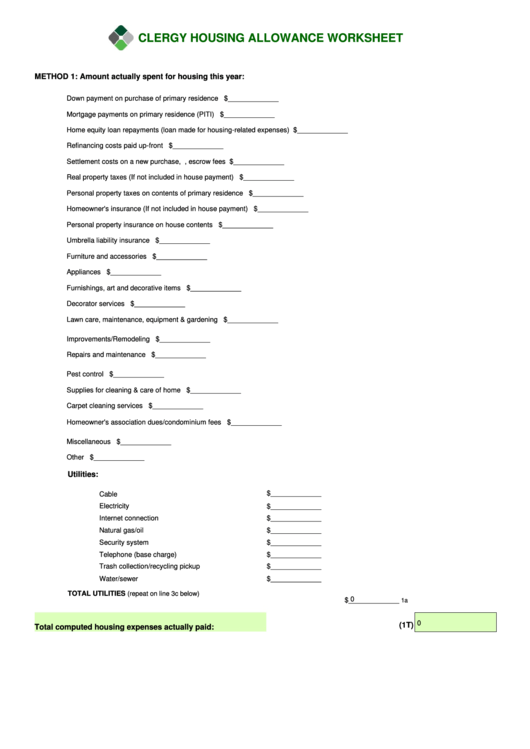

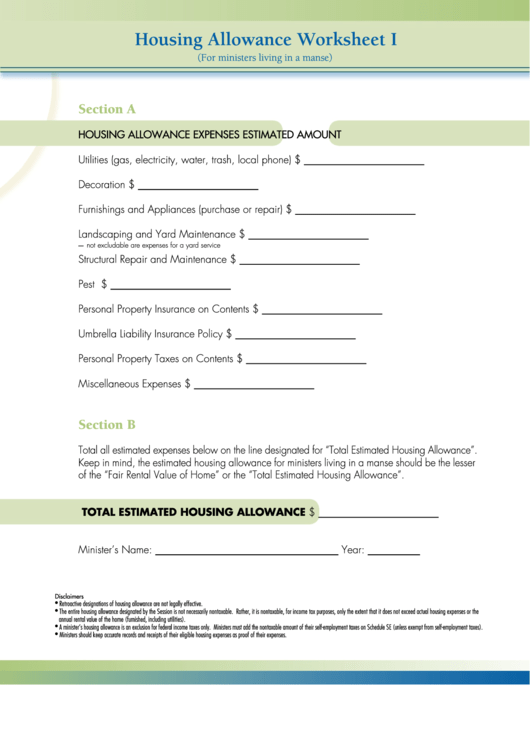

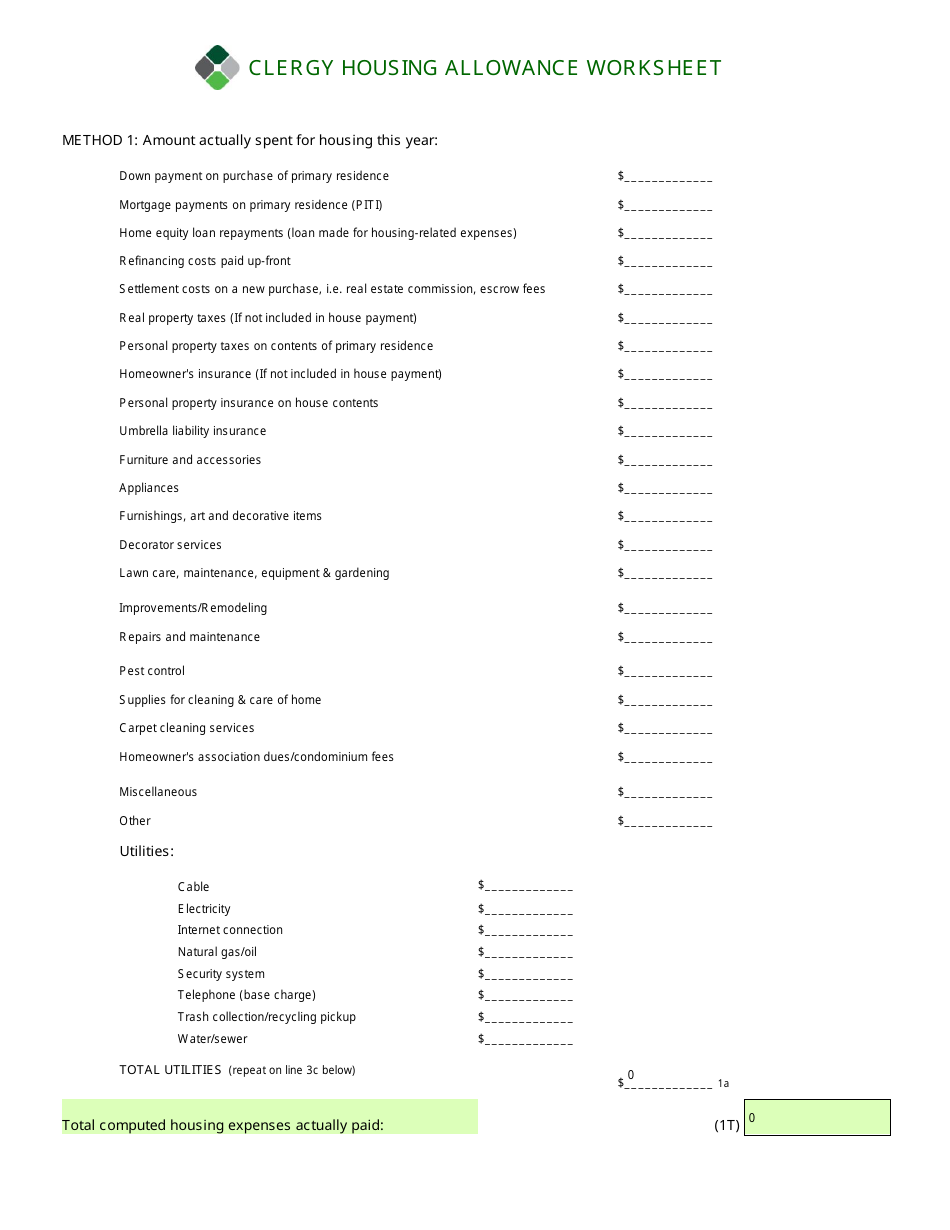

Clergy Housing Allowance Worksheet

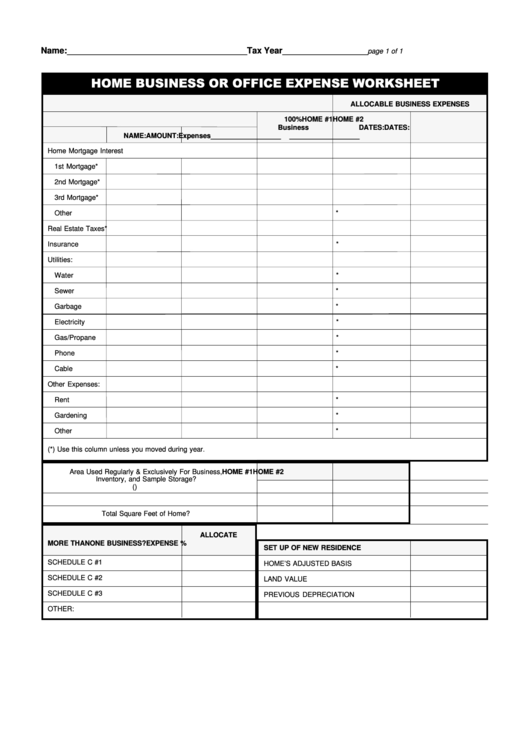

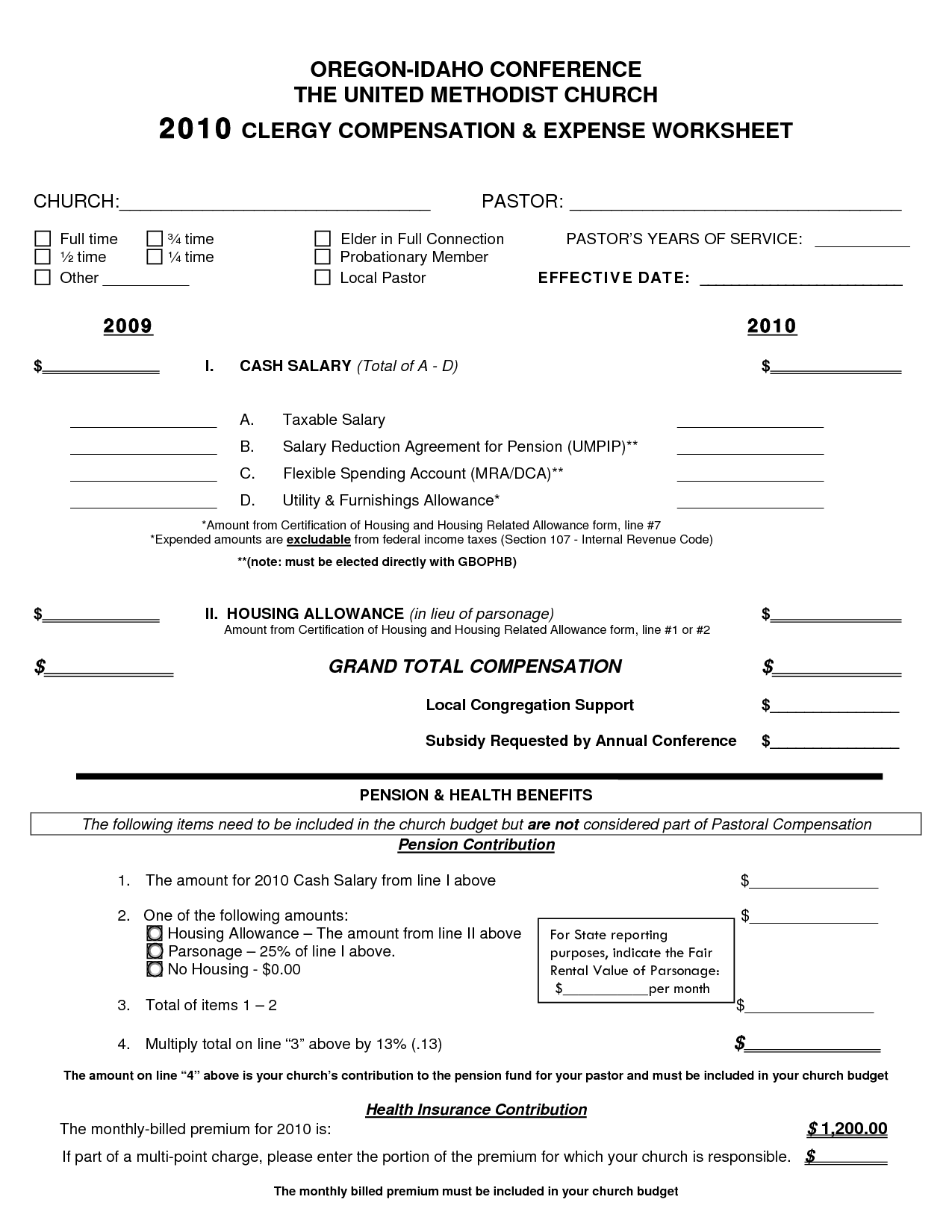

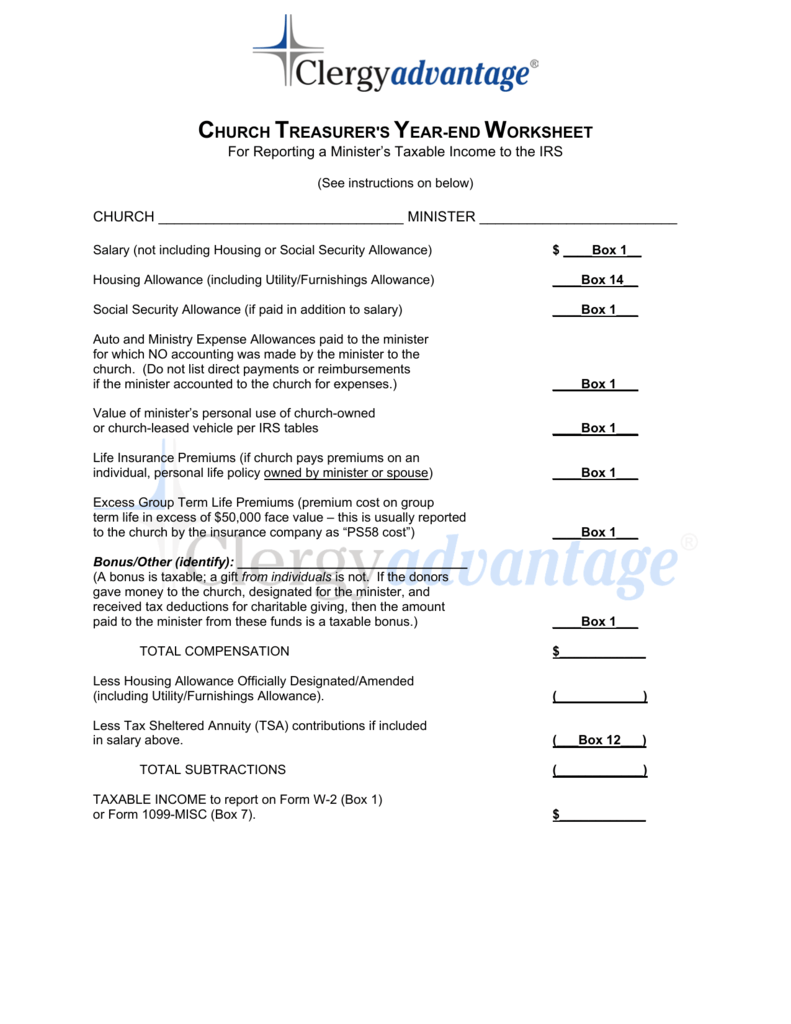

Clergy Housing Allowance Worksheet - Web clergy housing allowance worksheet tax return for year 200____ note: This worksheet is provided for educational purposes only. Web for more information on a minister’s housing allowance, refer to publication 517, social security and other information for members of the clergy and religious. Web clergy housing allowance worksheet. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). ♦ amounts actually paid for housing and related expenses. Down payment on purchase of primary residence mortgage payments. Web clergy housing allowance clearing the clouds: Web 2022 housing allowance form sign up today! Web the amount designated by the church or employer. Web minister’s housing expenses worksheet annual housing expenses (gas, water, sewer, electricity, trash service, telephone charges, internet, etc.) property. ♦ the “fair rental value” of the home. Clergy housing allowance wespath benefits and investments (wespath) recognizes the unique and often complex nature of. Web get the most out of your minister’s housing allowance. Web clergy housing allowance clearing the clouds: Web for more information on a minister’s housing allowance, refer to publication 517, social security and other information for members of the clergy and religious. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Experience the most recent techniques in digital management. Web clergy housing allowance clearing the clouds: Web. ♦ the “fair rental value” of the home. This worksheet will help you determine your specific housing expenses when filing your annual tax return. This worksheet is provided for educational purposes only. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Web clergy housing allowance worksheet. Web video instructions and help with filling out and completing clergy housing allowance worksheet 2022. ♦ the amount actually paid or. Housing / manse / parsonage worksheet housing / manse / parsonage annual form. ♦ amounts actually paid for housing and related expenses. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Web this housing allowance reference guide provides information on the following: ♦ the “fair rental value” of the home. Web housing allowance a licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income. Web 2022 housing allowance form sign up today! Web clergy housing allowance worksheet method 1: Clergy housing allowance wespath benefits and investments (wespath) recognizes the unique and often complex nature of. Web the fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. Clergy who own or rent their primary residence. Web total annual housing cost for calendar year 20_____. Web the housing allowance amount. The amount the clergy person actually spends on yearly housing and furnishings. This worksheet is provided for educational purposes only. Clergy who own or rent their primary residence. Web clergy housing allowance worksheet method 1: Clergy financial resources 2023 housing. Web the housing allowance amount is the lesser of: Housing / manse / parsonage worksheet housing / manse / parsonage annual form. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Web for more information on a minister’s housing allowance, refer to publication 517, social security and other information for members of the. Web total annual housing cost for calendar year 20_____. Clergy housing allowance wespath benefits and investments (wespath) recognizes the unique and often complex nature of. Web the fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. ♦ the “fair rental value” of the home. Check out how easy it. Web housing allowance a licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income. ♦ the amount actually paid or. Web this housing allowance reference guide provides information on the following: Experience the most recent techniques in digital management. Housing allowance i understand that i assume full responsibility for compliance. Web minister’s housing expenses worksheet annual housing expenses (gas, water, sewer, electricity, trash service, telephone charges, internet, etc.) property. Web for more information on a minister’s housing allowance, refer to publication 517, social security and other information for members of the clergy and religious. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Web the amount designated by the church or employer. Web the housing allowance amount is the lesser of: Clergy housing allowance wespath benefits and investments (wespath) recognizes the unique and often complex nature of. Clergy who own or rent their primary residence. Web this housing allowance reference guide provides information on the following: ♦ amounts actually paid for housing and related expenses. ♦ the “fair rental value” of the home. Web clergy housing allowance worksheet tax return for year 200____ note: Web clergy housing allowance worksheet. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Housing allowance i understand that i assume full responsibility for compliance with irs regulations and. Experience the most recent techniques in digital management. Amount actually spent for housing this year: The fair rental value of a furnished house. Web for more information on a minister’s housing allowance, refer to publication 517, social security and other information for members of the clergy and religious. The amount the clergy person actually spends on yearly housing and furnishings. Ministers who own their homes should take the following. Web the amount designated by the church or employer. ♦ the amount actually paid or. Clergy financial resources 2023 housing. Web generally, any expense to provide or maintain the home can be used to substantiate the housing exclusion. The amount the clergy person actually spends on yearly housing and furnishings. Clergy who own or rent their primary residence. Amount actually spent for housing this year: Web clergy housing allowance worksheet. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Web clergy housing allowance clearing the clouds: Web the housing allowance amount is the lesser of: ♦ the “fair rental value” of the home. Web clergy housing allowance worksheet tax return for year 200____ note: Web video instructions and help with filling out and completing clergy housing allowance worksheet 2022. Web clergy housing allowance worksheet method 1: Ministers who own their homes should take the following.Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Clergy Housing Allowance Worksheet Master of Documents

Fillable Clergy Housing Allowance Worksheet printable pdf download

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

20 Church Monthly Budget Worksheet /

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Web Get The Most Out Of Your Minister’s Housing Allowance.

♦ Amounts Actually Paid For Housing And Related Expenses.

This Worksheet Is Provided For Educational Purposes Only.

Web Housing Allowance For Ministers Who Own Their Home To The Fair Rental Value Of The Home (Furnished, Plus Utilities).

Related Post: