Clergy Tax Deductions Worksheet

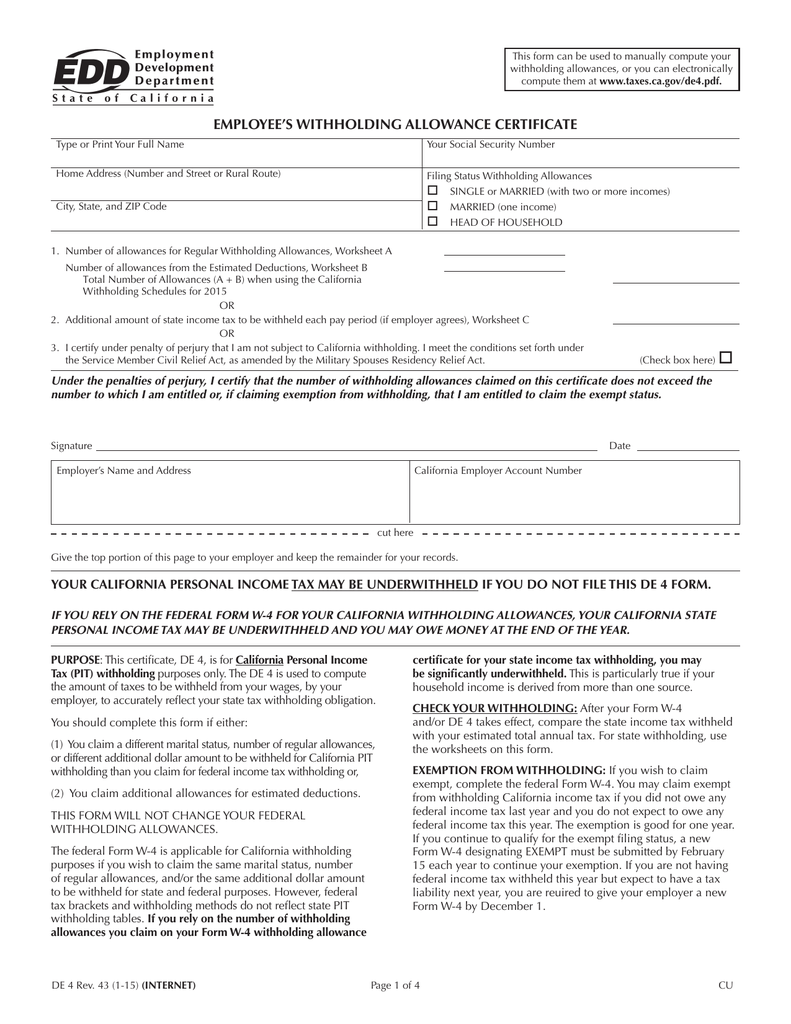

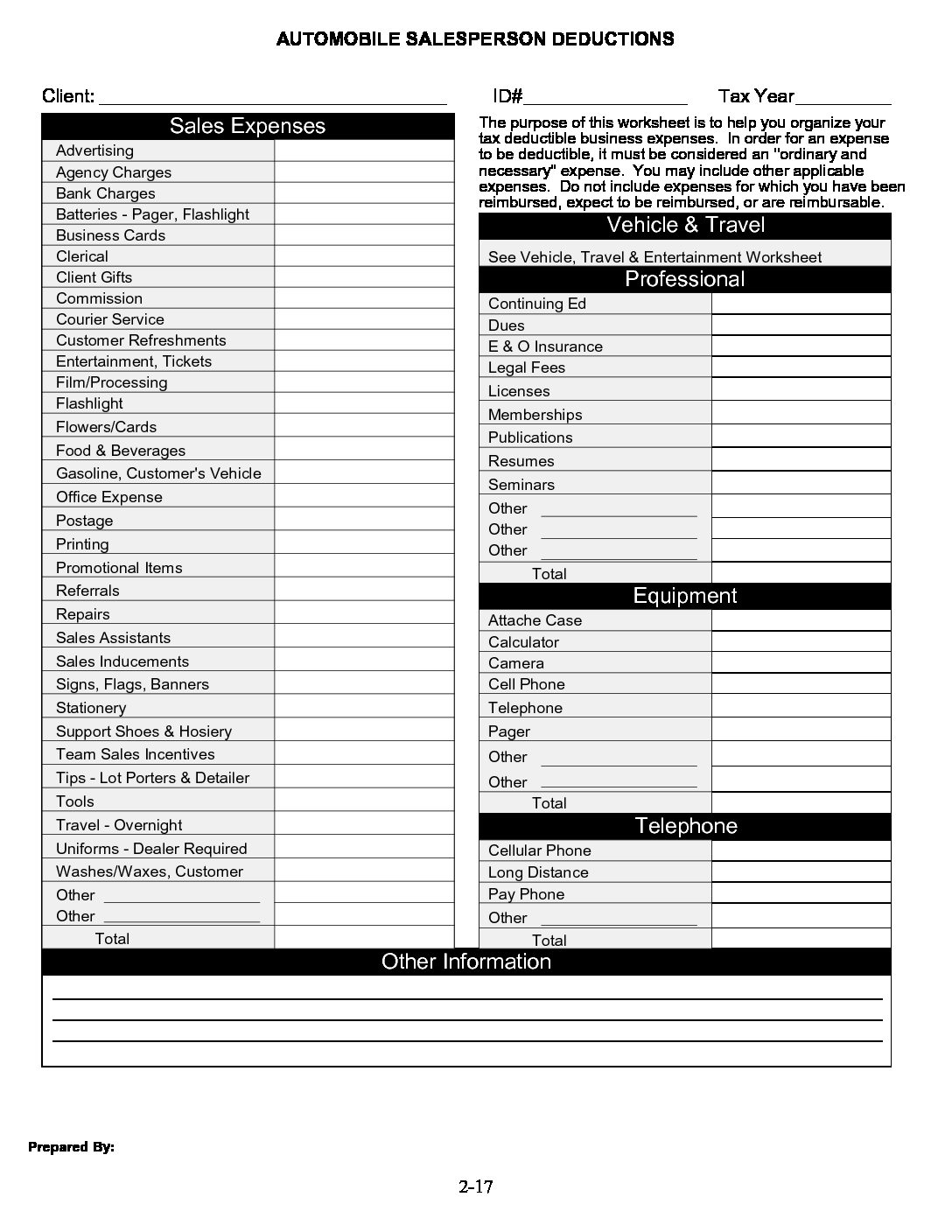

Clergy Tax Deductions Worksheet - Web the fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. Federal income tax from your pay. Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy living in an owned or rented home, active clergy living in a. Listing of your employees and their hourly wage, tax status, federal allowancesm state tax, federal tax, social security tax, medicare tax, tax withheld,. Web clergy housing allowance worksheet method 1: Complete this form so that your employer can withhold the correct. Below are several questions you should. Web substantially increases the standard deduction, thereby significantly reducing the number of taxpayers who will itemize deductions; A special rule allows this 100% deduction for the full meal portion of a per. Down payment on purchase of primary residence mortgage payments. A special rule allows this 100% deduction for the full meal portion of a per. Find free wordpress themes and plugins. This form will help you calculate the expenses you can deduct. Below are several questions you should. Repeals the deduction for personal exemptions;. Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy living in an owned or rented home, active clergy living in a. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. This. Web irs publication 517 clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Plus, the limit on charitable contributions to. Web deductions worksheet, line 5, if you expect to claim deductions other. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Clergy tax organizer ® state checklists; Web a 100% deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Below are several questions you should. A special rule allows this 100% deduction for the full meal portion. Plus, the limit on charitable contributions to. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Down payment on purchase of primary residence mortgage payments. Web clergy housing allowance worksheet method 1: Find free wordpress themes and plugins. Down payment on purchase of primary residence mortgage payments. Find free wordpress themes and plugins. Amount actually spent for housing this year: Web clergy housing allowance worksheet method 1: Plus, the limit on charitable contributions to. Federal income tax from your pay. Below are several questions you should. Web the fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. Clergy tax organizer ® state checklists; Web if you are a clergy member, use this form to claim the clergy residence deduction. Amount actually spent for housing this year: Clergy tax organizer ® state checklists; Web the fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not. Web substantially increases the standard deduction, thereby significantly reducing the number of taxpayers who will itemize deductions; Repeals the deduction for personal exemptions;. Web clergy tax deductions want create site? A special rule allows this 100% deduction for the full meal portion of a per. Down payment on purchase of primary residence mortgage payments. Repeals the deduction for personal exemptions;. Federal income tax from your pay. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for. Web a 100% deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Complete this form so. Amount actually spent for housing this year: Federal income tax from your pay. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Web clergy tax deductions want create site? Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy living in an owned or rented home, active clergy living in a. A special rule allows this 100% deduction for the full meal portion of a per. Plus, the limit on charitable contributions to. Web clergy housing allowance worksheet method 1: Complete this form so that your employer can withhold the correct. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for. Repeals the deduction for personal exemptions;. Down payment on purchase of primary residence mortgage payments. Web substantially increases the standard deduction, thereby significantly reducing the number of taxpayers who will itemize deductions; Web if you are a clergy member, use this form to claim the clergy residence deduction. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Below are several questions you should. This form will help you calculate the expenses you can deduct. Clergy tax organizer ® state checklists; Listing of your employees and their hourly wage, tax status, federal allowancesm state tax, federal tax, social security tax, medicare tax, tax withheld,. Web irs publication 517 clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. Web extended this deduction through 2021 and increased it to $600 for married couples filing a joint return. Web housing allowance estimate worksheet learn more about the clergy housing allowance as it pertains to active clergy living in an owned or rented home, active clergy living in a. Plus, the limit on charitable contributions to. Complete this form so that your employer can withhold the correct. Below are several questions you should. Find free wordpress themes and plugins. Clergy tax organizer ® state checklists; Web a 100% deduction is allowed for certain business meals paid or incurred after 2020 and before 2023. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. A special rule allows this 100% deduction for the full meal portion of a per. Web irs publication 517 clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. Web a minister's housing allowance (sometimes called a parsonage allowance or a rental allowance) is excludable from gross income for income tax purposes but not for. Federal income tax from your pay. Down payment on purchase of primary residence mortgage payments. This form will help you calculate the expenses you can deduct. Web clergy housing allowance worksheet method 1:40 clergy tax deductions worksheet Worksheet For Fun

40 clergy tax deductions worksheet Worksheet Live

40 clergy tax deductions worksheet Worksheet Master

️Clergy Housing Allowance Worksheet Free Download Goodimg.co

Clergy Tax Deductions Worksheets

40 clergy tax deductions worksheet Worksheet Live

27 Clergy Tax Deductions Worksheet Worksheet Resource Plans

Tax Worksheet

39 Clergy Tax Deductions Worksheet combining like terms worksheet

40 clergy tax deductions worksheet Worksheet Live

For Additional Information Refer To Publication 517, Social.

Web If You Are A Clergy Member, Use This Form To Claim The Clergy Residence Deduction.

Repeals The Deduction For Personal Exemptions;.

Amount Actually Spent For Housing This Year:

Related Post: