Credit Limit Worksheet

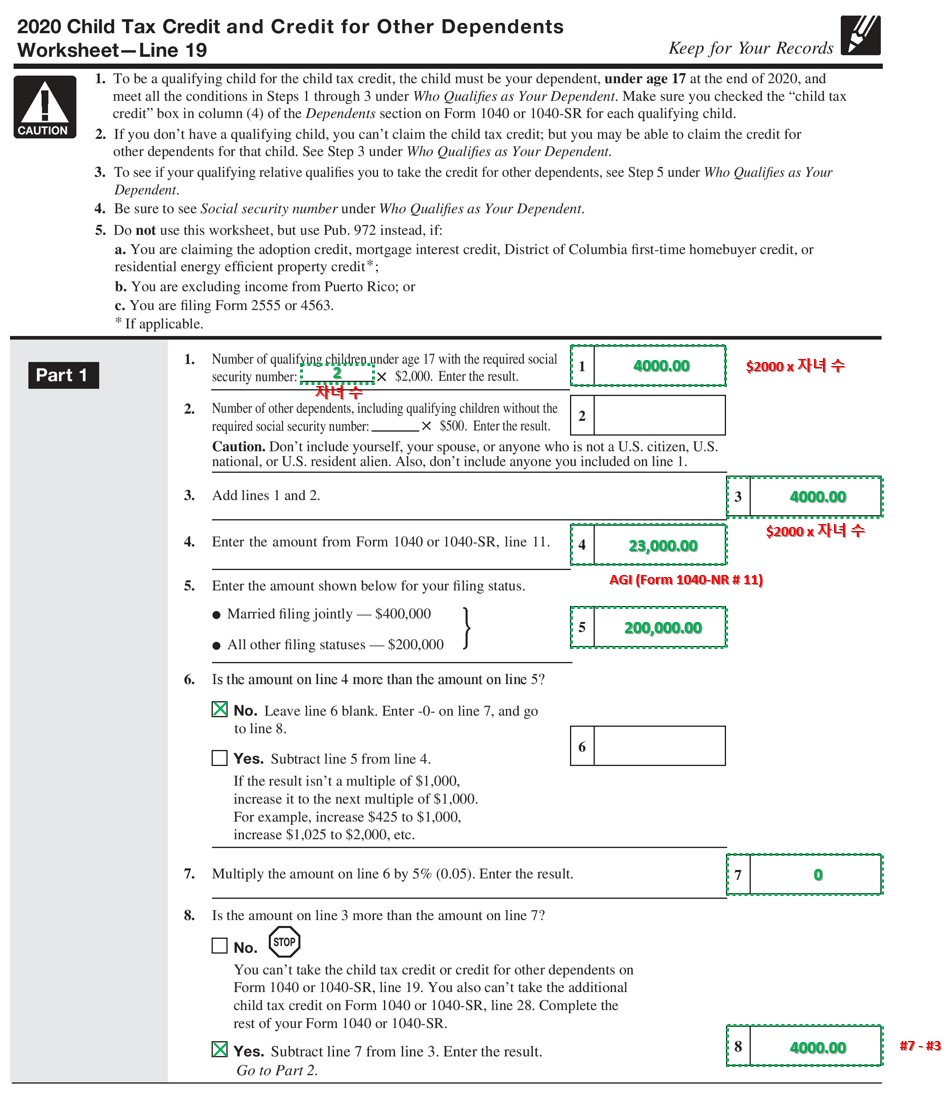

Credit Limit Worksheet - Edit your form 8863 credit limit worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Web enter the amount from credit limit worksheet a. The maximum amount of qualifying expenses is $3,000 for one. Web 5 hours agocredit utilization is a measurement of the percentage of your credit card limits in use, aka the “amounts owed” category and counts for up to 30% of your fico. When completing credit limit worksheet a, you may be instructed to complete credit limit worksheet b if you meet. If you can take the credit and you want us to figure it for you, check. Or form 1040nr, line 37, is more than $30,000 ($45,000 if head of household; The lifetime learning credit and the american. The worksheet shows the amount of education and other tax credits. Web level 1 credit limit worksheet in reviewing my forms (via print to pdf), i printed all forms, i found on form 8812 if references credit limit worksheet a number. Web in order to claim the credit, the taxpayer, child or dependent, and expenses must meet numerous requirements. Web be worth opening the credit card? Web the amount on form 1040, line 38; Edit your form 8863 credit limit worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Want the irs to figure your credit? Web 29 votes how to fill out and sign what is a credit limit worksheet a online? The maximum amount of qualifying expenses is $3,000 for one. Want the irs to figure your credit? Web be worth opening the credit card? Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Enjoy smart fillable fields and. Sign it in a few clicks draw. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Want the irs to figure your credit? Web 11 limitation based on tax liability. Enter the amount from form 8863, line 18. Web see income limits for the credit for the elderly or the disabled, later. Sign it in a few clicks draw. The more you earn, the lower the. Some of the worksheets displayed are 2018 instructions for form 8863, money math for teens, a. The worksheet shows the amount of education and other tax credits. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Given your initial purchase, use the spreadsheet for the following scenarios. $60,000 if married filing jointly). Sign it in a few clicks draw. Web limits on modified adjusted gross income (magi). Web enter the amount from credit limit worksheet a. The lifetime learning credit and the american. Or form 1040nr, line 37, is more than $30,000 ($45,000 if head of household; Some of the worksheets displayed are 2018 instructions for form 8863, money math for teens, a. Web the limits for 2020 are as follows: Given your initial purchase, use the spreadsheet for the following scenarios. The maximum amount of qualifying expenses is $3,000 for one. Enter the amount from the credit limit worksheet in the instructions 12 credit for qualified retirement savings contributions. Estimate this period for each scenario. The worksheet shows the amount of education and other tax credits. Edit your form 8863 credit limit worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Enter the amount from the credit limit worksheet in the instructions 12 credit for qualified retirement savings contributions. Web the limits for 2020 are as follows: The lifetime learning. Web 29 votes how to fill out and sign what is a credit limit worksheet a online? Enter the amount from form 8863, line 18. Web the amount on form 1040, line 38; Web level 1 credit limit worksheet in reviewing my forms (via print to pdf), i printed all forms, i found on form 8812 if references credit limit. Web form 8863 credit limit worksheet is a document couples should consult when preparing their tax returns. Web 11 limitation based on tax liability. Given your initial purchase, use the spreadsheet for the following scenarios. When completing credit limit worksheet a, you may be instructed to complete credit limit worksheet b if you meet. Web be worth opening the credit. Web enter the amount from credit limit worksheet a. Web be worth opening the credit card? Edit your form 8863 credit limit worksheet online type text, add images, blackout confidential details, add comments, highlights and more. Web see income limits for the credit for the elderly or the disabled, later. Given your initial purchase, use the spreadsheet for the following scenarios. Web internal revenue service 2022 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax. Web 11 limitation based on tax liability. Enter the amount from the credit limit worksheet in the instructions 12 credit for qualified retirement savings contributions. The maximum amount of qualifying expenses is $3,000 for one. Sign it in a few clicks draw. Web the limits for 2020 are as follows: Enjoy smart fillable fields and. Web the amount on form 1040, line 38; $60,000 if married filing jointly). Web in order to claim the credit, the taxpayer, child or dependent, and expenses must meet numerous requirements. If you can take the credit and you want us to figure it for you, check. Web level 1 credit limit worksheet in reviewing my forms (via print to pdf), i printed all forms, i found on form 8812 if references credit limit worksheet a number. When completing credit limit worksheet a, you may be instructed to complete credit limit worksheet b if you meet. Web limits on modified adjusted gross income (magi). Want the irs to figure your credit? Get your online template and fill it in using progressive features. Web level 1 credit limit worksheet in reviewing my forms (via print to pdf), i printed all forms, i found on form 8812 if references credit limit worksheet a number. The maximum amount of qualifying expenses is $3,000 for one. Web see income limits for the credit for the elderly or the disabled, later. The lifetime learning credit and the american. Given your initial purchase, use the spreadsheet for the following scenarios. Web be worth opening the credit card? Enter the amount from the credit limit worksheet in the instructions 12 credit for qualified retirement savings contributions. When completing credit limit worksheet a, you may be instructed to complete credit limit worksheet b if you meet. Some of the worksheets displayed are 2018 instructions for form 8863, money math for teens, a. Estimate this period for each scenario. Web 11 limitation based on tax liability. Or form 1040nr, line 37, is more than $30,000 ($45,000 if head of household; Enjoy smart fillable fields and. Web limits on modified adjusted gross income (magi). Want the irs to figure your credit?Schedule 8812 Credit Limit Worksheet A

Irs Credit Limit Worksheet A

Credit Limit Worksheet 2020

Credit Limit Worksheet 8880 Briefencounters

credit limit worksheet Fill Online, Printable, Fillable Blank form

Credit Limit Worksheet 8880

Credit Limit Worksheet 8880 Briefencounters

Credit Limit Worksheet a Form Fill Out and Sign Printable PDF

Irs Credit Limit Worksheets A

Credit Limit Worksheet 2020

Edit Your Form 8863 Credit Limit Worksheet Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web Enter The Amount From Credit Limit Worksheet A.

$60,000 If Married Filing Jointly).

Web The Credit Limit Worksheet Of Form 8863 Is A Section Of The Form That Is Used To Calculate The Amount Of The Education Tax Credit That A Taxpayer Is Eligible To Claim.

Related Post: