De4 Worksheet A

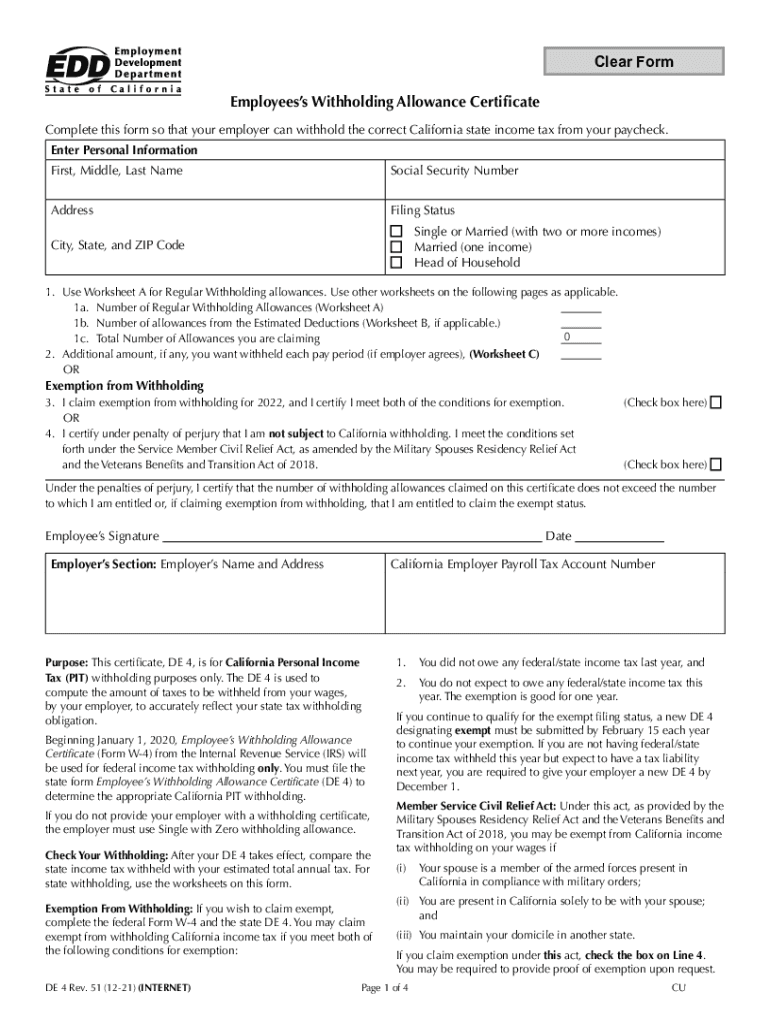

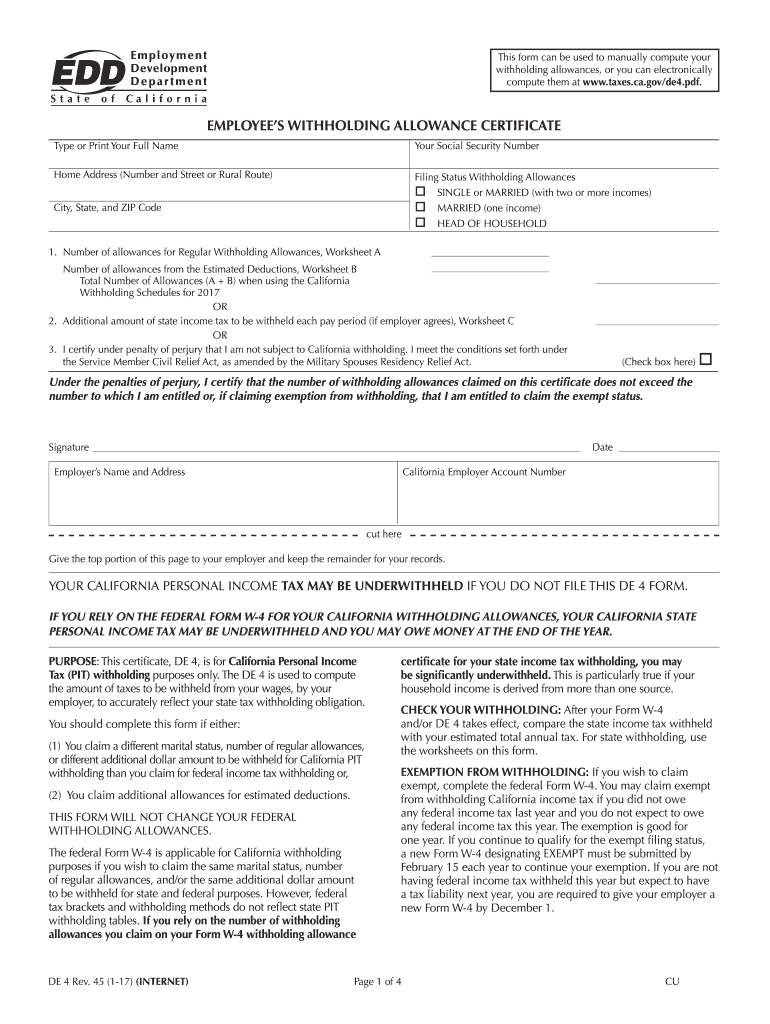

De4 Worksheet A - The fractional part of the. Web 3 attorney answers posted on aug 12, 2013 as my fellow counselors have advised, you want to be sure that you avoid owing taxes at the end of the year. The de 4 is used to compute the amount of taxes to be withheld from. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Web de 4 takes effect, compare the state income tax withheld with your estimated total annual tax. These grade 4 math worksheets focus on converting decimals to fractions. Below are six versions of our grade 4 math worksheet on converting mixed numbers to decimals; For state withholding, use the worksheets on this form. Web employer’s obligations for the employee’s withholding allowance certificate (de 4) beginning january 1, 2020, the internal revenue service (irs). Web this video is all about the california de 4 form and i will show you how to fill it out in 2021. Convert mixed numbers to decimals. Below are six versions of our grade 4 math worksheet on converting mixed numbers to decimals; These grade 4 math worksheets focus on converting decimals to fractions. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Web the de. Web this certificate, de 4, is for. Web this video is all about the california de 4 form and i will show you how to fill it out in 2021. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Enter. The fractional part of the. Web this video is all about the california de 4 form and i will show you how to fill it out in 2021. California personal income tax (pit) withholding. There are seven federal income tax rates in. Web employer’s obligations for the employee’s withholding allowance certificate (de 4) beginning january 1, 2020, the internal revenue. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Below are six versions of our grade 4 math worksheet on converting mixed numbers to decimals; The fractional part of the. Convert mixed numbers to decimals. For state withholding, use the. California personal income tax (pit) withholding. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. For state withholding, use the worksheets on this form. The de 4 is used to compute the amount of taxes to be withheld from. Web. Convert mixed numbers to decimals. Web employer’s obligations for the employee’s withholding allowance certificate (de 4) beginning january 1, 2020, the internal revenue service (irs). For state withholding, use the worksheets on this form. There are seven federal income tax rates in. California personal income tax (pit) withholding. The de 4 is used to compute the amount of taxes to be withheld from your wages,. These grade 4 math worksheets focus on converting decimals to fractions. All numbers are less than 1 and have one or two decimal digits, for conversion. The fractional part of the. Web these 4th grade math worksheets benefit them not only in learning. Web de 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Enter estimate of total wages for tax year 2023. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The fractional part of the. These grade 4 math worksheets focus on converting decimals to fractions. For state withholding, use the worksheets on this form. Convert mixed numbers to decimals. There are seven federal income tax rates in. The de 4 is used to compute the amount of taxes to be withheld from. Web de 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Starting 2020, there are new requirements for the. California personal income tax (pit) withholding. Earnings for the monthly payroll period are greater than the amount shown in. For state withholding, use the worksheets on this form. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. Convert mixed numbers to decimals. All numbers are less than 1 and have one or two decimal digits, for conversion. Earnings for the monthly payroll period are greater than the amount shown in. Web employer’s obligations for the employee’s withholding allowance certificate (de 4) beginning january 1, 2020, the internal revenue service (irs). Starting 2020, there are new requirements for the. The de 4 is used to compute the amount of taxes to be withheld from. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The fractional part of the. These grade 4 math worksheets focus on converting decimals to fractions. Web this video is all about the california de 4 form and i will show you how to fill it out in 2021. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. This certificate, de 4, is for california personal income tax (pit) withholding purposes only. The de 4 is used to compute the amount of taxes to be withheld from your wages,. Web this certificate, de 4, is for. Web 3 attorney answers posted on aug 12, 2013 as my fellow counselors have advised, you want to be sure that you avoid owing taxes at the end of the year. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Web de 4 takes effect, compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this form. There are seven federal income tax rates in. Web 1 or 2 digit decimals. The fractional part of the. Earnings for the monthly payroll period are greater than the amount shown in. The de 4 is used to compute the amount of taxes to be withheld from your wages,. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). There are seven federal income tax rates in. Enter estimate of total wages for tax year 2023. Web 3 attorney answers posted on aug 12, 2013 as my fellow counselors have advised, you want to be sure that you avoid owing taxes at the end of the year. All numbers are less than 1 and have one or two decimal digits, for conversion. Web the de 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Convert mixed numbers to decimals. The de 4 is used to compute the amount of taxes to be withheld from. For state withholding, use the worksheets on this form. Web up to 10% cash back the california form de 4, employee's withholding allowance certificate, must be completed so that you know how much state income tax to withhold from. Web de 4 takes effect, compare the state income tax withheld with your estimated total annual tax. Web this video is all about the california de 4 form and i will show you how to fill it out in 2021.G5cky1 de4 worksheet

De 4 worksheet

BoDeThiThuDe4 worksheet

de4 worksheet a Chaton Letter

de4 worksheet a Chaton Letter

de4 worksheet a Chaton Letter

De4 Fill Out and Sign Printable PDF Template signNow

De 4 Fill Online, Printable, Fillable, Blank pdfFiller

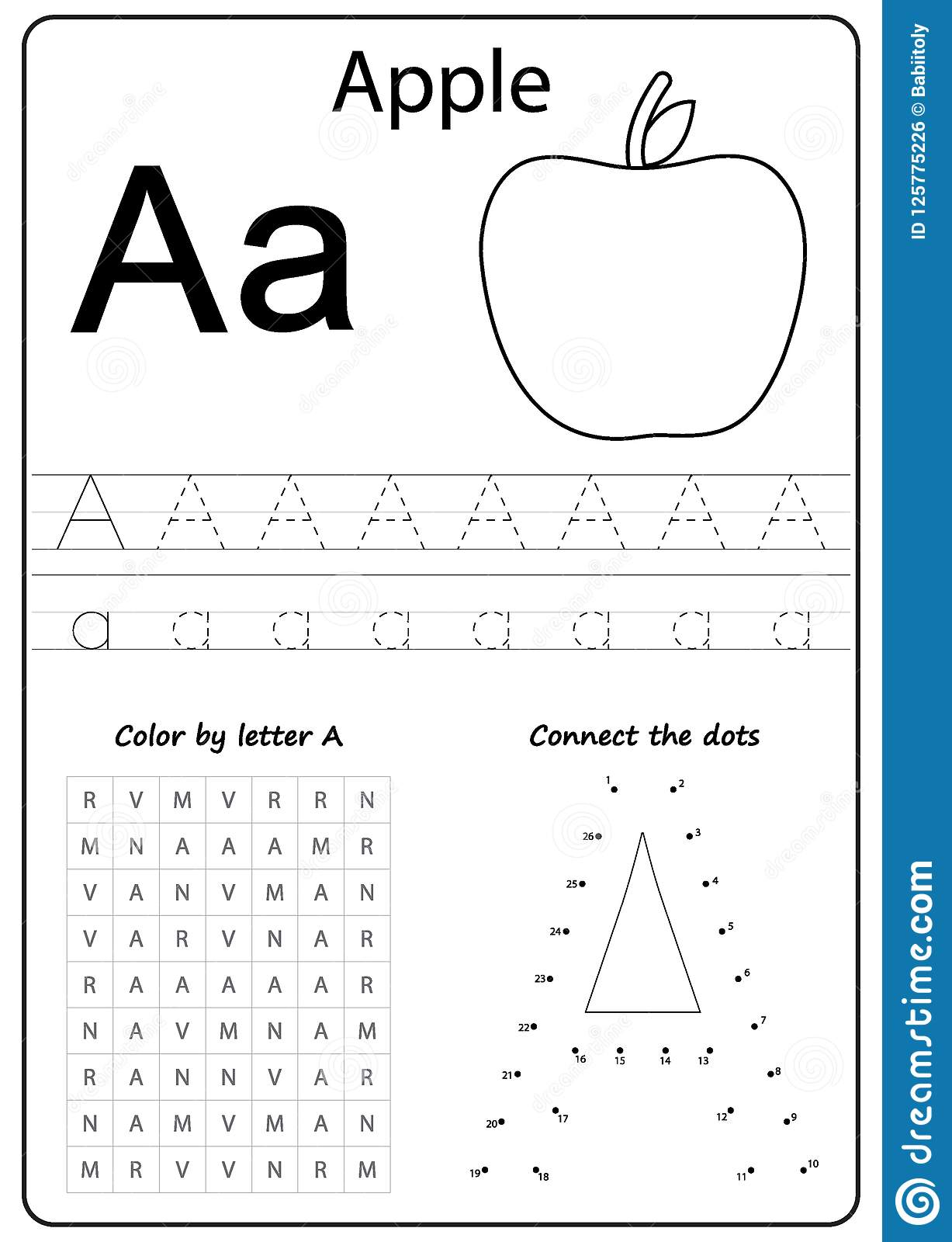

Letter A Worksheets For Toddlers

De4De worksheet

These Grade 4 Math Worksheets Focus On Converting Decimals To Fractions.

California Personal Income Tax (Pit) Withholding.

Below Are Six Versions Of Our Grade 4 Math Worksheet On Converting Mixed Numbers To Decimals;

Starting 2020, There Are New Requirements For The.

Related Post: