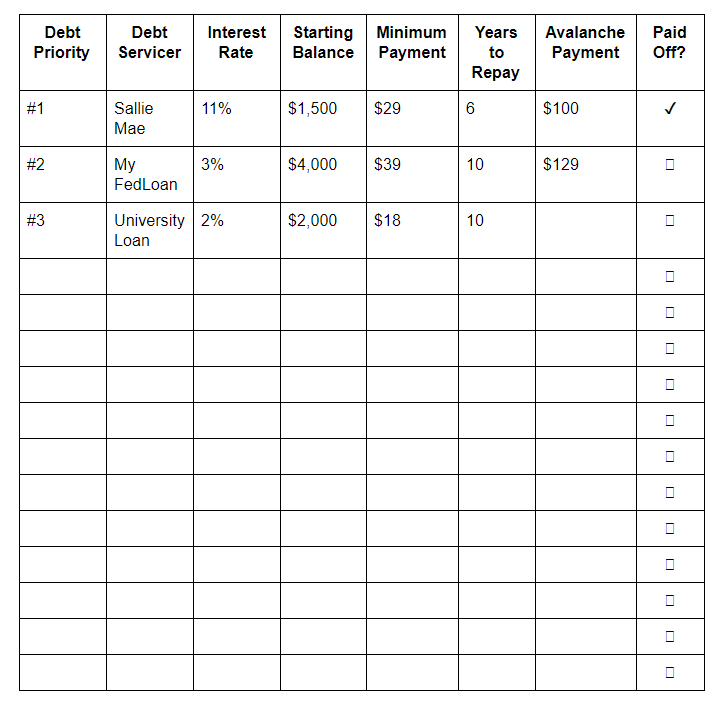

Debt Avalanche Worksheet

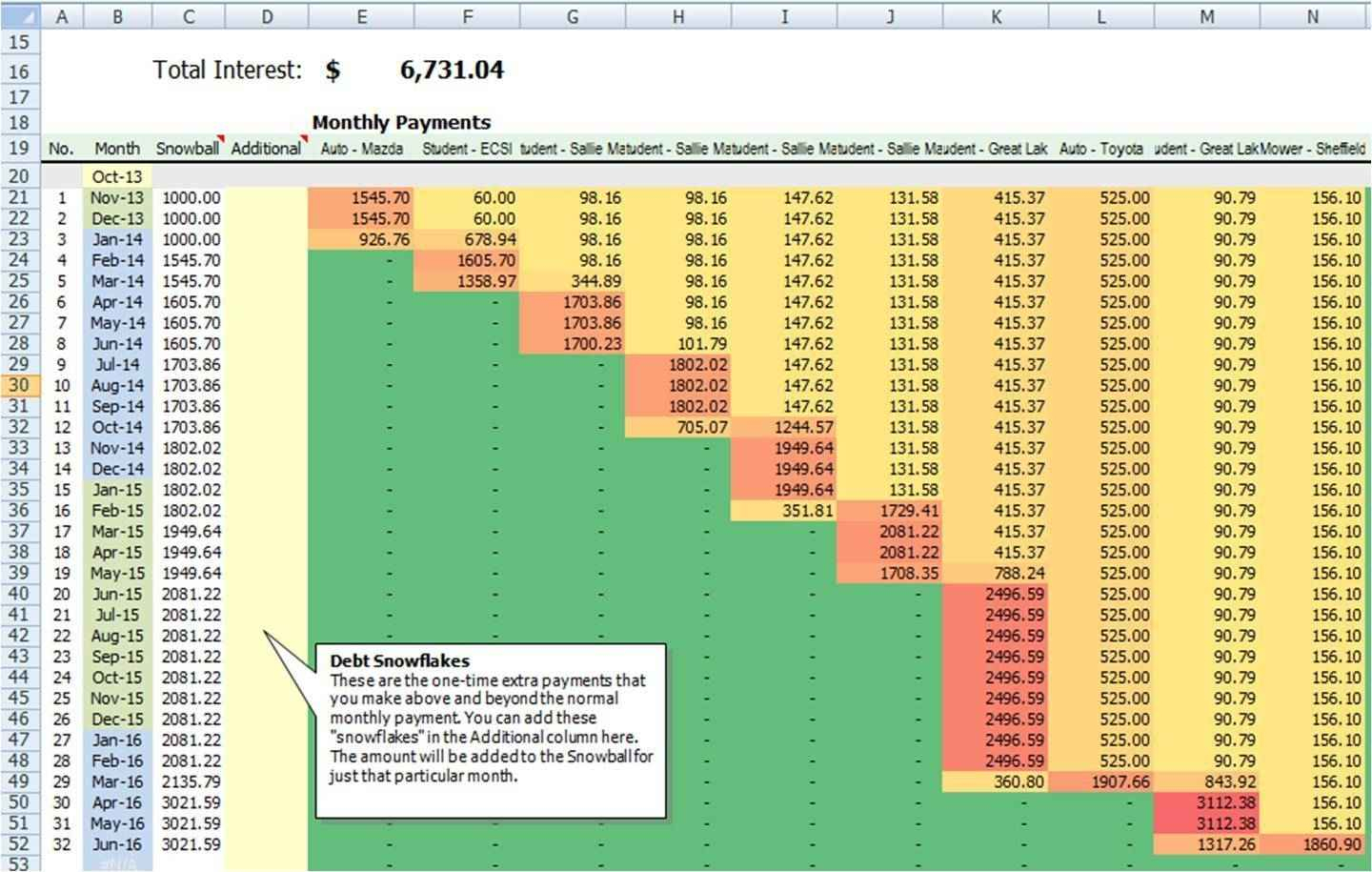

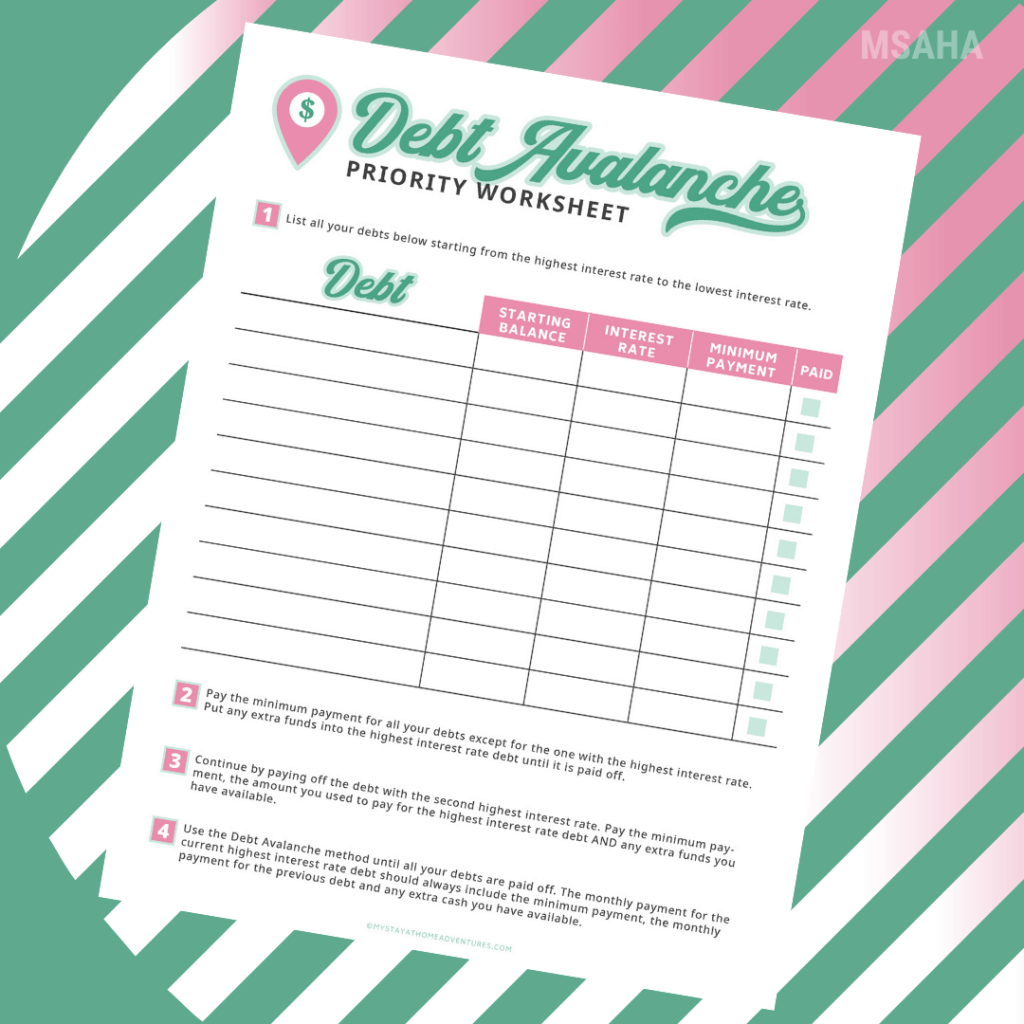

Debt Avalanche Worksheet - Web forbes advisor's debt avalanche calculator helps you minimize the interest charges, and pay back your debt faster. A debt snowball plan, in contrast,. Web the first step in setting up your debt avalanche spreadsheet is to list all of your debts. Pay as much as possible on your smallest debt. Learn how it compares vs debt snowball, the best calculator app. Web the debt avalanche targets debts with the highest interest rates first. Web if you don’t want to scroll all the way down to grab your free debt avalanche worksheets, just sign up for them in the box below 🙂 sign up here to grab.3 printables over 3 days! You can either print it or fill it in online as a pdf, so it works no matter which format you prefer. List your debts from smallest to largest regardless of interest rate. You can color code your progress on this free debt worksheet pdf, which has lots of fields to put all the deets you might want handy. Fill in all of your debt into the worksheet (the one labeled priority worksheet) starting with the highest interest rate to the lowest interest rate. Any additional money you can put toward debt will be paid on the debt with the highest interest rate. Web you’ll pay the monthly minimum ($150), plus the $300 you’ve set aside for credit card. Web by brynne conroy december 10, 2022 a debt snowball spreadsheet is one of the most effective tools for tackling your debt payoff goals in 2023. You make all of the minimum payments on all of your debts. When using the debt avalanche strategy, it’s still important to make at least the minimum payments on all debt. List your debts. There are two online resources that are completely free that i. Aim to pay off the smallest debt first. You repeat this step with cards c and d until you are credit card debt free. Grab a free worksheet printable! The way it works is you make the minimum payment due each month on each account. You repeat this step with cards c and d until you are credit card debt free. Fill in all of your debt into the worksheet (the one labeled priority worksheet) starting with the highest interest rate to the lowest interest rate. List your debts from smallest to largest regardless of interest rate. Web personal loan b with a $10,000 balance. Web the debt avalanche method works by paying off debts with the highest interest rates first. Any additional money you can put toward debt will be paid on the debt with the highest interest rate. Then list your debts in order from highest apr to lowest aprto determine the order that you pay them off. Web you’ll pay the monthly. That comes out to $550 a month on card b until it’s paid off. When using the debt avalanche strategy, it’s still important to make at least the minimum payments on all debt. Web the debt avalanche google sheets template is the perfect tool for guiding you through the debt avalanche process of paying off your debt. This route may. Be sure to include the debt amount, the minimum payment, and the interest percentage. Say you have a credit card balance of $20,000 at 20% interest and a student loan of $10,000 at 5% interest. Aim to pay off the smallest debt first. Make minimum payments on all your debts except the smallest. Using the debt avalanche method, you would. This includes the name of the creditor, the balance owed, the interest rate, and the minimum monthly payment. Pay the minimum payments on all debts. Web the debt snowball and debt avalanche are just two of the strategies you can use to repay your debts. Web debt avalanche tracker template. Web you can always create a worksheet like the one. Web utilize the snowball or avalanche method. There are two online resources that are completely free that i. Web the debt avalanche method works by paying off debts with the highest interest rates first. Apply all the extra funds you have to this debt to pay it off. Web here's how to use the free debt reduction spreadsheet in excel: Using the debt avalanche method, you would prioritize your debt repayment as follows: The debt avalanche is different from the debt snowball method, which involves paying off debts with the smallest balances first. Grab a free worksheet printable! Web here’s how the debt snowball works: Learn how it compares vs debt snowball, the best calculator app. Input your debt—from the highest interest down to the lowest interest (from left to right) in the data tab. The debt avalanche is different from the debt snowball method, which involves paying off debts with the smallest balances first. Fill in all of your debt into the worksheet (the one labeled priority worksheet) starting with the highest interest rate to the lowest interest rate. Repeat until each debt is paid in full. The way it works is you make the minimum payment due each month on each account. It’s based on the popular debt snowball payoff method, with three simple principles: Aim to pay off the smallest debt first. There are two online resources that are completely free that i. Any additional money you can put toward debt will be paid on the debt with the highest interest rate. Web the avalanche debt method is a debt payment plan that focuses the most money on the debt with the highest interest rate. Using the debt avalanche method, you would prioritize your debt repayment as follows: Pay as much as possible on your smallest debt. Grab a free worksheet printable! Web here's how to use the free debt reduction spreadsheet in excel: Web debt avalanche method: You might choose to prioritize other debts first, based on the type of debt, the risks involved if you fail to repay, or the emotional stress that some debts create. Web forbes advisor's debt avalanche calculator helps you minimize the interest charges, and pay back your debt faster. This includes the name of the creditor, the balance owed, the interest rate, and the minimum monthly payment. Web the debt avalanche google sheets template is the perfect tool for guiding you through the debt avalanche process of paying off your debt. Web utilize the snowball or avalanche method. You start by listing your debts from largest to smallest by interest rate. Be sure to include the debt amount, the minimum payment, and the interest percentage. Web the debt avalanche method works by paying off debts with the highest interest rates first. Web forbes advisor's debt avalanche calculator helps you minimize the interest charges, and pay back your debt faster. Web the debt avalanche, also known as debt stacking, is when you pay off your debts in order from the highest interest rate to the lowest, regardless of balance. Web the debt avalanche targets debts with the highest interest rates first. Say you have a credit card balance of $20,000 at 20% interest and a student loan of $10,000 at 5% interest. List all your debts by how much you owe. Using the debt avalanche method, you would prioritize your debt repayment as follows: List your debts from smallest to largest regardless of interest rate. Input your debt—from the highest interest down to the lowest interest (from left to right) in the data tab. Web the debt snowball and debt avalanche are just two of the strategies you can use to repay your debts. Web here's how to use the free debt reduction spreadsheet in excel: Web utilize the snowball or avalanche method. Any additional money you can put toward debt will be paid on the debt with the highest interest rate. Start by determining how much cash flow you have available to pay off debt.Debt Avalanche Payment Tracker Printable in 2021 Debt payoff

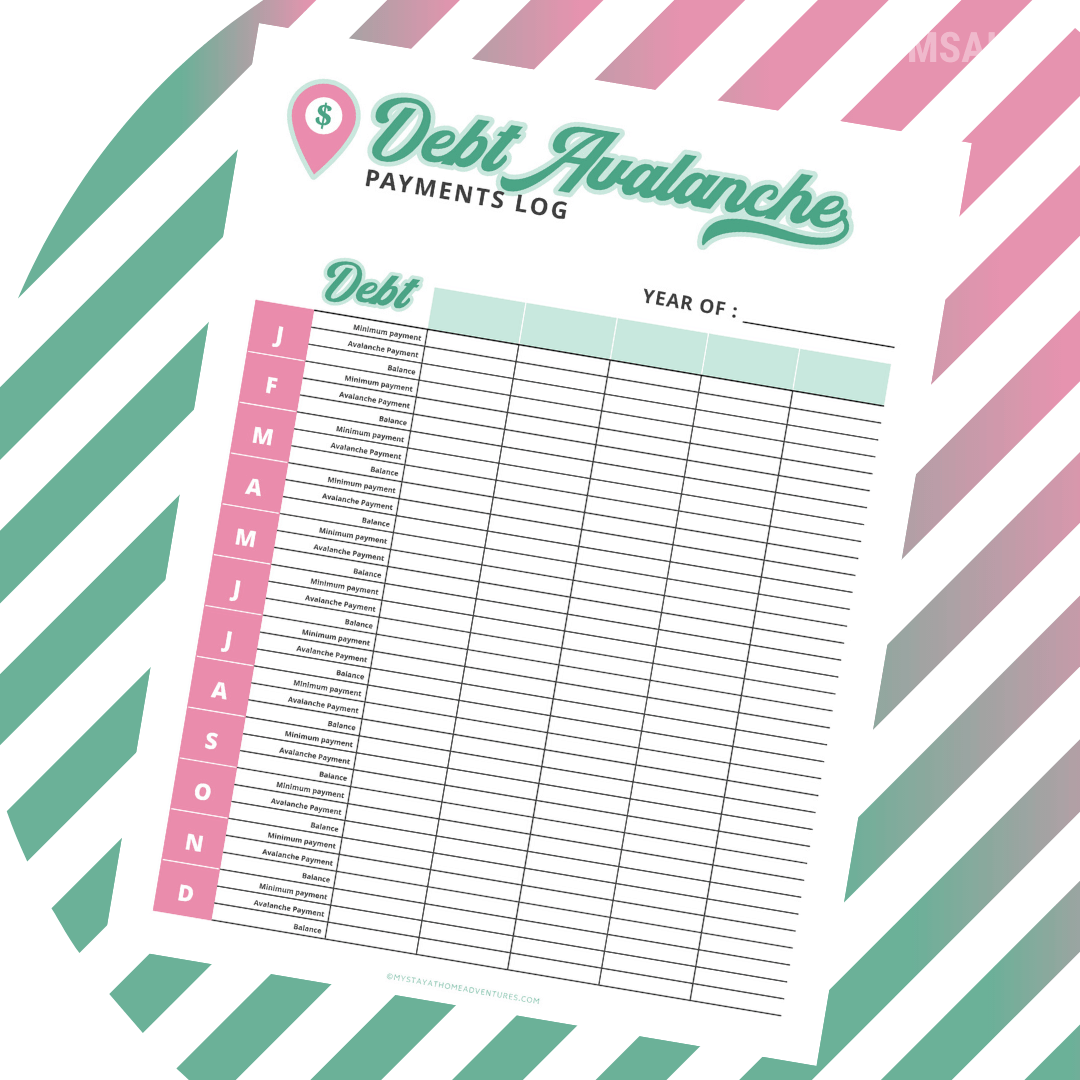

10 Ways to Attack the Debt Avalanche Printable Savor + Savvy

What is Debt Avalanche (Plus Free Debt Avalanche Printables)

Debt Avalanche Spreadsheet in Debt Avalanche Spreadsheet Stunning How

What is Debt Avalanche (Plus Free Debt Avalanche Printables)

Using the Debt Avalanche Method to Pay Off Debt Credible

Debt Avalanche Spreadsheet for Debt Avalanche Calculator Spreadsheet

10 Ways to Attack the Debt Avalanche Printable Savor + Savvy

Does the Debt Snowball Method Work?

Free Debt Avalanche Method Worksheet Printables Debt avalanche, Debt

Learn How It Compares Vs Debt Snowball, The Best Calculator App.

The Way It Works Is You Make The Minimum Payment Due Each Month On Each Account.

There Are Two Online Resources That Are Completely Free That I.

Web Debt Avalanche Tracker Template.

Related Post: