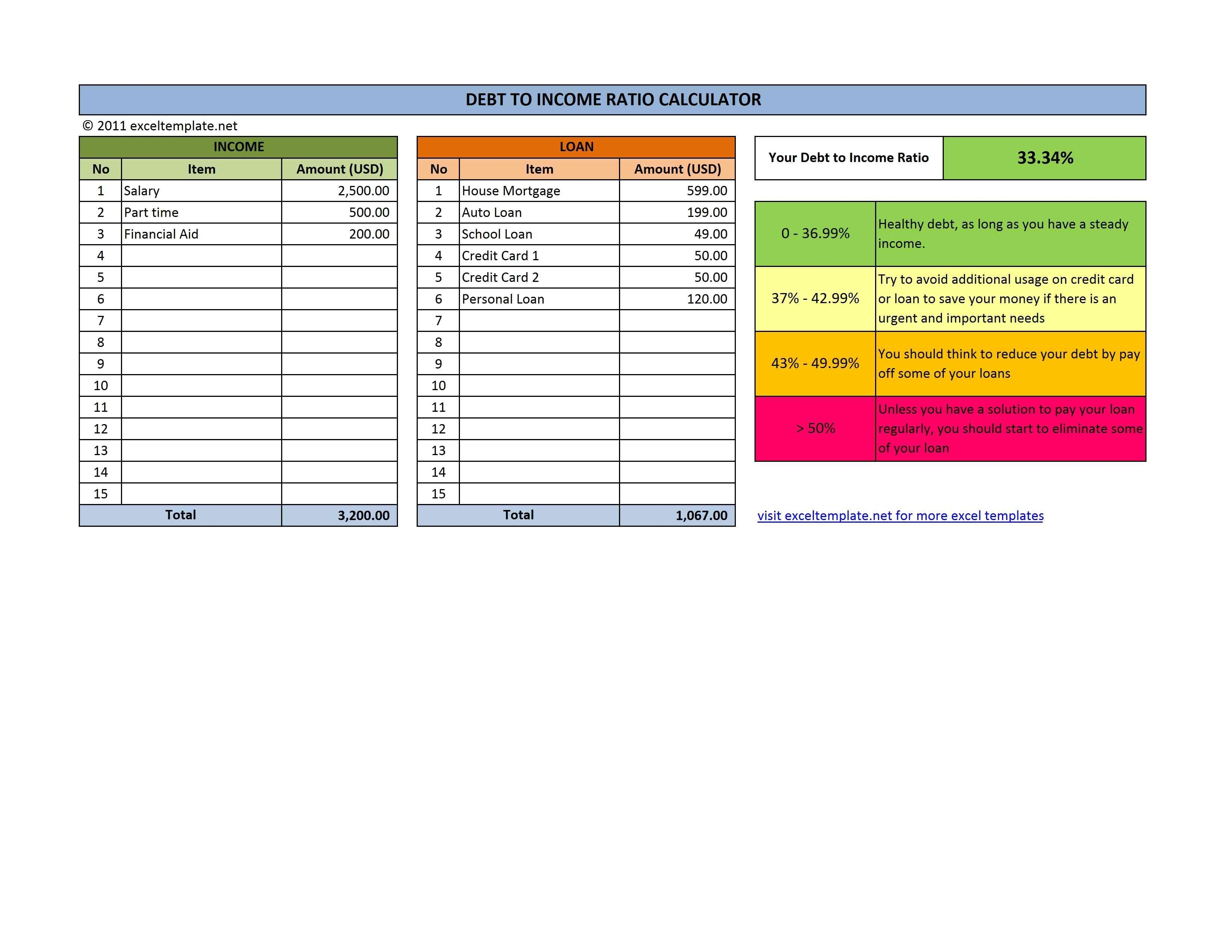

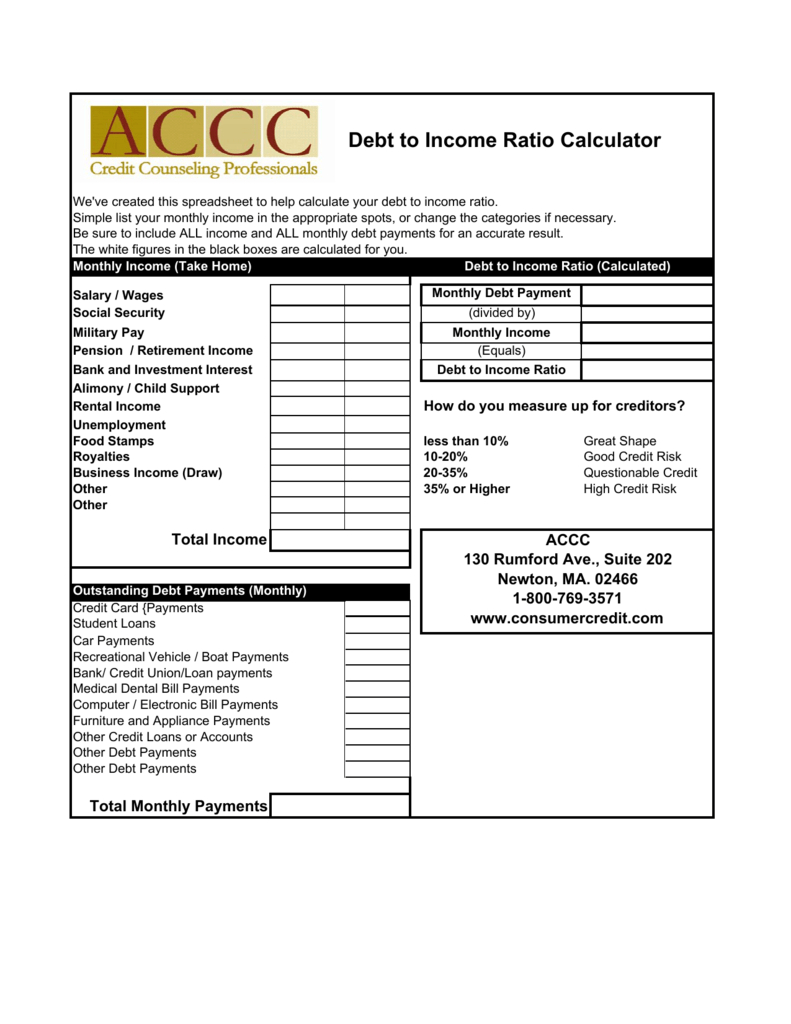

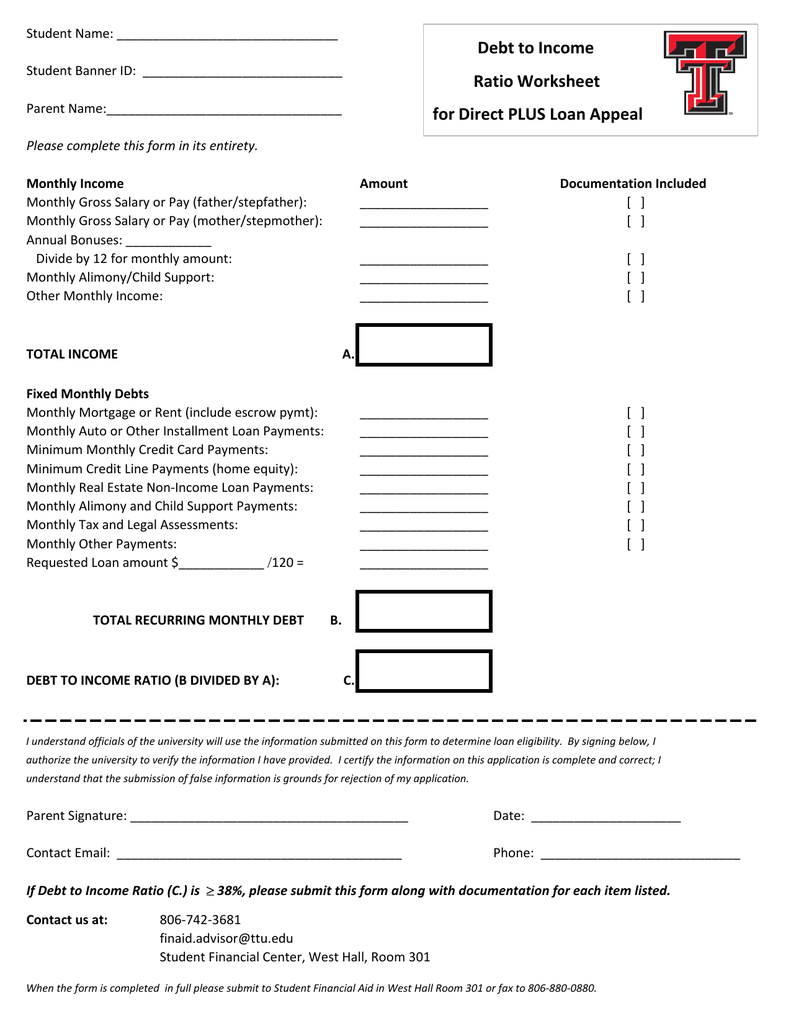

Debt To Income Ratio Worksheet

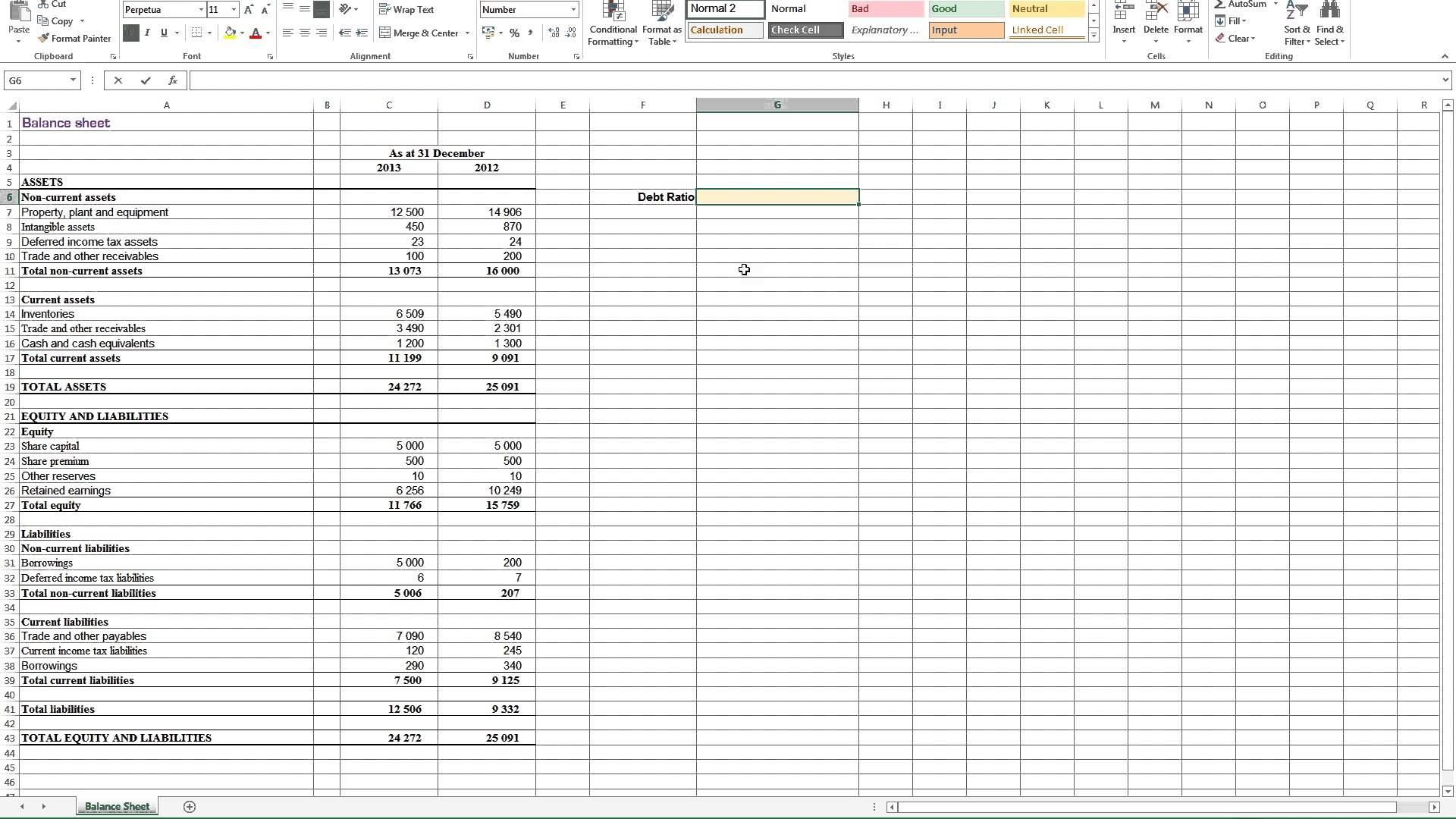

Debt To Income Ratio Worksheet - Dti ratio = ($2,000 + $100 + $500) / $4,500 x 100 = 57.78%. Student’s parent (if applicable) the parent who applied for the plus. Then, multiply the result by 100 to come up with a percent. Fill in your monthly take home income and all your monthly debt payments. We’ll help you understand what it means for you. Web dti = monthly debt payments / gross monthly income x 100. An easy way is to look at the relationship your monthly debt. Web to calculate your estimated dti ratio, simply enter your current income and payments. Fill in your monthly take home income and all your monthly debt payments. The ratio is expressed as a. Web to calculate your estimated dti ratio, simply enter your current income and payments. Student’s parent (if applicable) the parent who applied for the plus. Dti ratio = ($2,000 + $100 + $500) / $4,500 x 100 = 57.78%. Fill in your monthly take home income and all your monthly debt payments. Divide your total monthly debt payments by your. Web dti = monthly debt payments / gross monthly income x 100. Debt to income ratio divide total debt by total income c. Fill in your monthly take home income and all your monthly debt payments. From there, multiply the number. Please note this calculator is for. Divide your total monthly debt payments by your gross monthly income. Web dti = monthly debt payments / gross monthly income x 100. Fill in your monthly take home income and all your monthly debt payments. Please note this calculator is for. An easy way is to look at the relationship your monthly debt. An easy way is to look at the relationship your monthly debt. The ratio is expressed as a. Dti ratio = ($2,000 + $100 + $500) / $4,500 x 100 = 57.78%. Divide your total monthly debt payments by your gross monthly income. Web to calculate the ratio, divide your monthly debt payments by your monthly income. Dti ratio = ($2,000 + $100 + $500) / $4,500 x 100 = 57.78%. Divide your total monthly debt payments by your gross monthly income. Then, multiply the result by 100 to come up with a percent. An easy way is to look at the relationship your monthly debt. Web dti = monthly debt payments / gross monthly income x. Web dti = monthly debt payments / gross monthly income x 100. Fill in your monthly take home income and all your monthly debt payments. Web let's say your gross monthly income is $7,000, and you have a $1,500 mortgage, a $700 car payment and $150 in minimum credit card payments for a total of. Web to calculate the ratio,. Web dti = monthly debt payments / gross monthly income x 100. Web debt to income ratio worksheet how do you determine what level of debt is reasonable to carry at your income level? Please note this calculator is for. Fill in your monthly take home income and all your monthly debt payments. Divide your total monthly debt payments by. Web debt to income ratio worksheet how do you determine what level of debt is reasonable to carry at your income level? Web to calculate your estimated dti ratio, simply enter your current income and payments. The ratio is expressed as a. Debt to income ratio divide total debt by total income c. Divide your total monthly debt payments by. Fill in your monthly take home income and all your monthly debt payments. Fill in your monthly take home income and all your monthly debt payments. Divide your total monthly debt payments by your gross monthly income. Please note this calculator is for. The ratio is expressed as a. Web dti = monthly debt payments / gross monthly income x 100. Web debt to income ratio worksheet how do you determine what level of debt is reasonable to carry at your income level? An easy way is to look at the relationship your monthly debt. Student’s parent (if applicable) the parent who applied for the plus. The ratio is. Student’s parent (if applicable) the parent who applied for the plus. Please note this calculator is for. Web to calculate your estimated dti ratio, simply enter your current income and payments. An easy way is to look at the relationship your monthly debt. Web debt to income ratio worksheet how do you determine what level of debt is reasonable to carry at your income level? Fill in your monthly take home income and all your monthly debt payments. Then, multiply the result by 100 to come up with a percent. Dti ratio = ($2,000 + $100 + $500) / $4,500 x 100 = 57.78%. The ratio is expressed as a. Web dti = monthly debt payments / gross monthly income x 100. Divide your total monthly debt payments by your gross monthly income. Fill in your monthly take home income and all your monthly debt payments. From there, multiply the number. Debt to income ratio divide total debt by total income c. Web let's say your gross monthly income is $7,000, and you have a $1,500 mortgage, a $700 car payment and $150 in minimum credit card payments for a total of. We’ll help you understand what it means for you. Web to calculate the ratio, divide your monthly debt payments by your monthly income. Please note this calculator is for. Then, multiply the result by 100 to come up with a percent. Divide your total monthly debt payments by your gross monthly income. Debt to income ratio divide total debt by total income c. Web dti = monthly debt payments / gross monthly income x 100. From there, multiply the number. Dti ratio = ($2,000 + $100 + $500) / $4,500 x 100 = 57.78%. We’ll help you understand what it means for you. An easy way is to look at the relationship your monthly debt. The ratio is expressed as a. Fill in your monthly take home income and all your monthly debt payments. Web to calculate your estimated dti ratio, simply enter your current income and payments. Web debt to income ratio worksheet how do you determine what level of debt is reasonable to carry at your income level?debt to ratio spreadsheet free Natural Buff Dog

Debt to Ratio Calculator Template for Numbers Free iWork Templates

debt to ratio worksheet usmc Natural Buff Dog

Debt To Ratio Spreadsheet regarding Debt To Ratio

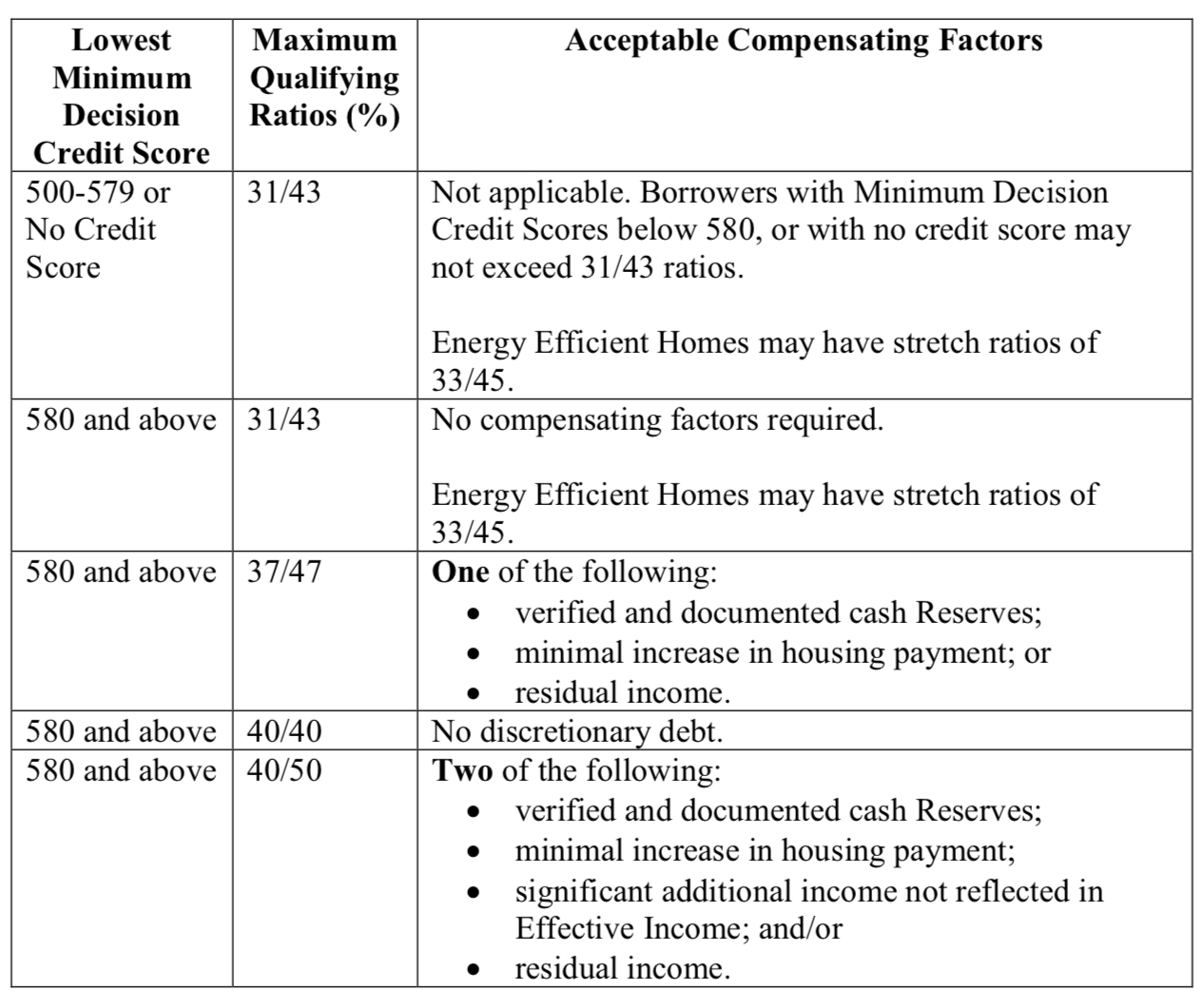

Debt To Ratio Spreadsheet intended for Fha Dti

4 Debt Calculator Excel Template SampleTemplatess SampleTemplatess

Free Debt To Ratio Calculator Template Throughout Debt to Debt

Debt To Ratio Spreadsheet regarding Debt To Ratio

Debt to Ratio Worksheet

Debt To Ratio Spreadsheet —

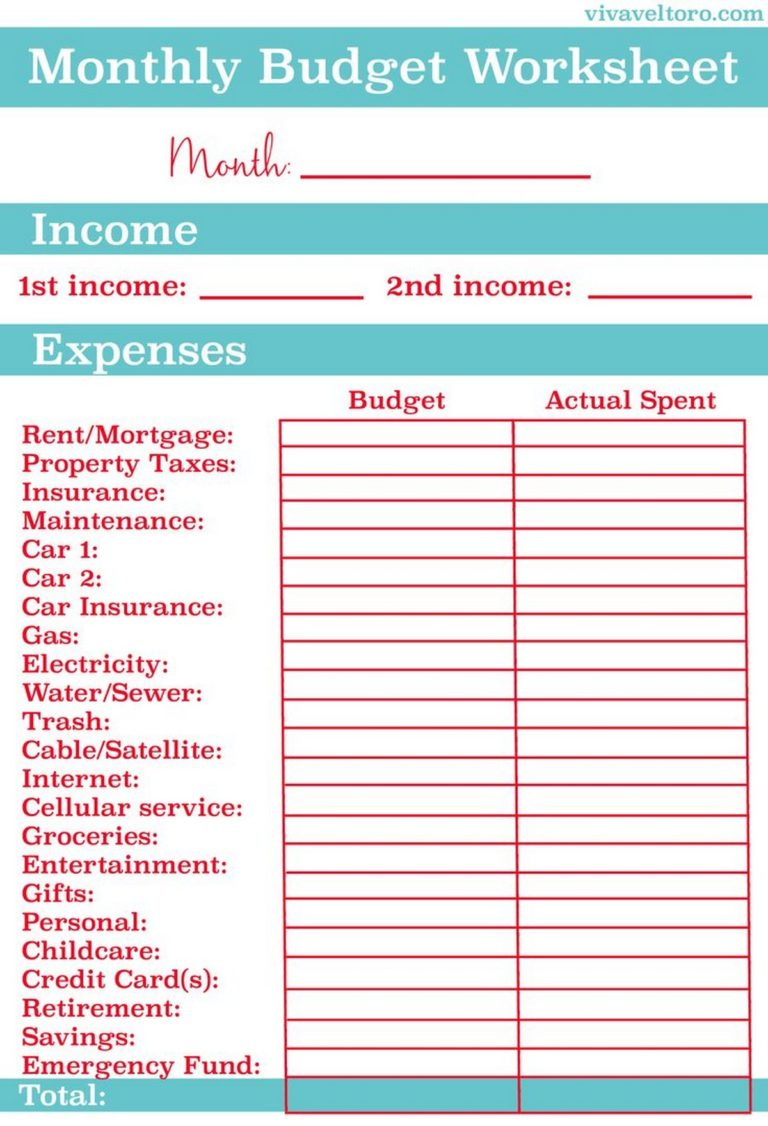

Fill In Your Monthly Take Home Income And All Your Monthly Debt Payments.

Web Let's Say Your Gross Monthly Income Is $7,000, And You Have A $1,500 Mortgage, A $700 Car Payment And $150 In Minimum Credit Card Payments For A Total Of.

Student’s Parent (If Applicable) The Parent Who Applied For The Plus.

Web To Calculate The Ratio, Divide Your Monthly Debt Payments By Your Monthly Income.

Related Post: