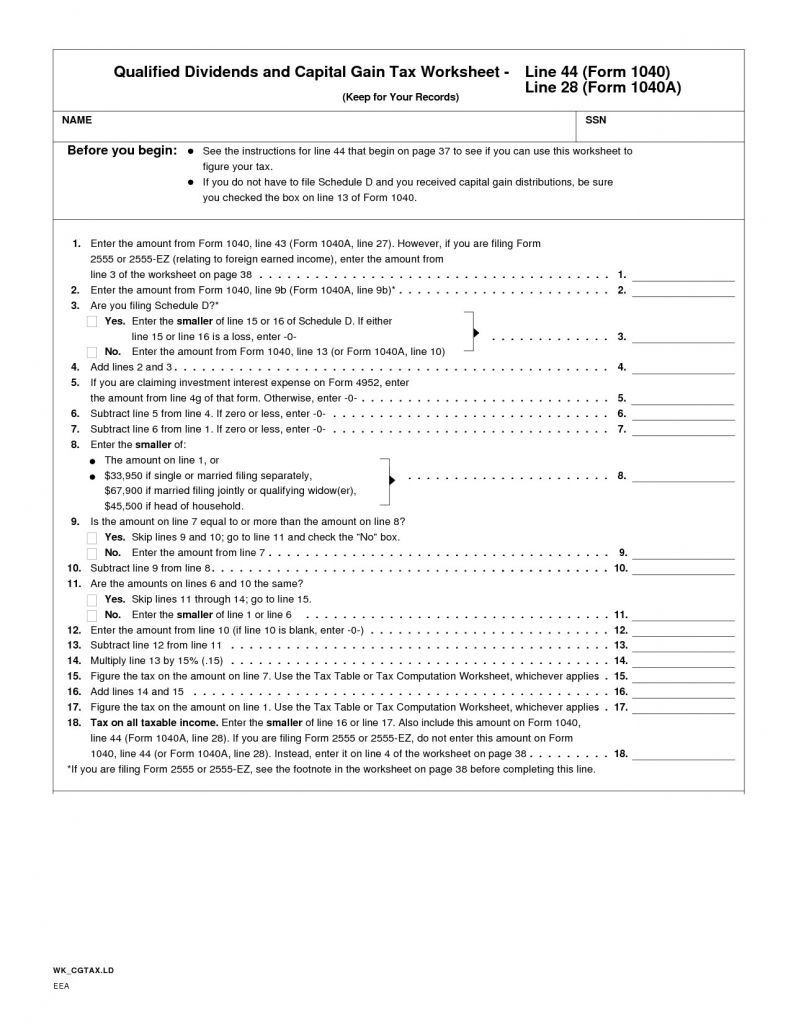

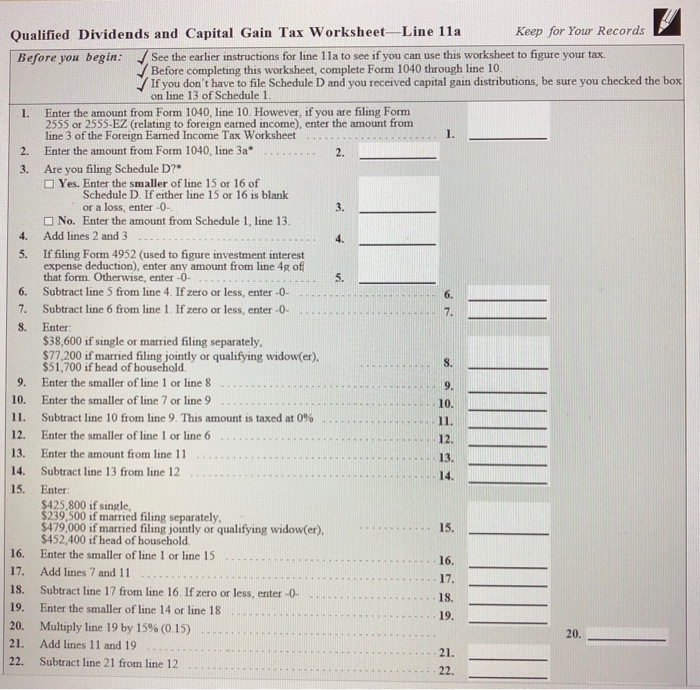

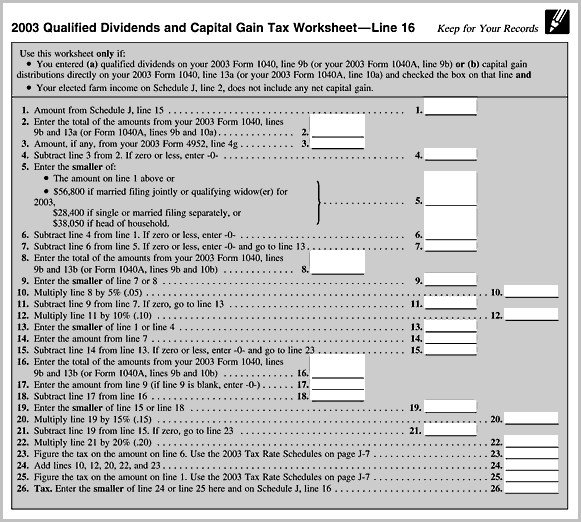

Dividends And Capital Gains Worksheet

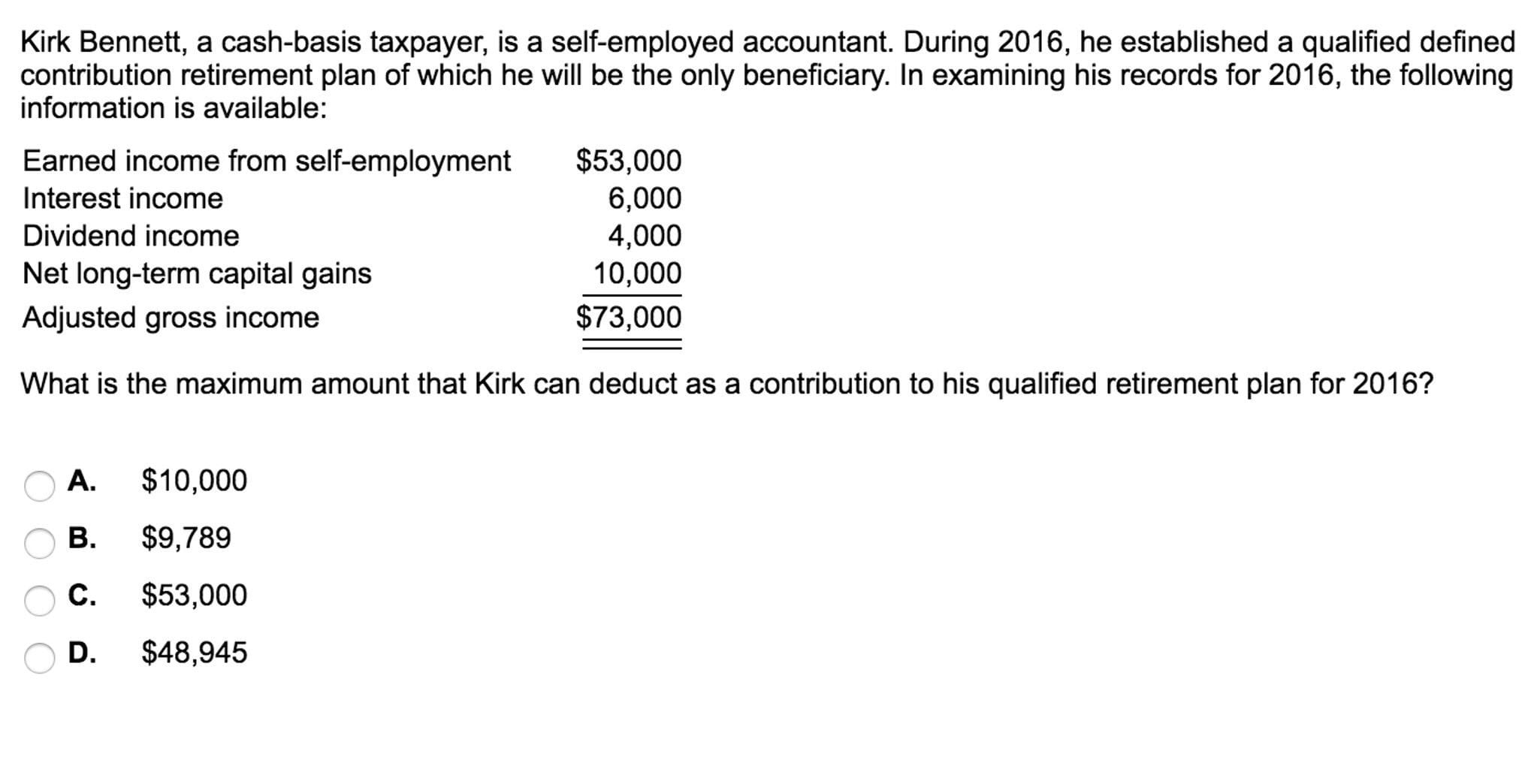

Dividends And Capital Gains Worksheet - Web returns containing certain forms or taxable income amounts may need to calculate the tax on the return using a different method or worksheet as outlined in the 1040 instructions. The dividend is defined as the profit percentage given by an organisation to its investor. If you received qualified dividend. See the earlier instructions for line 12a to see if you can use this worksheet to figure. The form is used to report distributions on form 1040, schedule b,. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Web edit qualified dividends and capital gain tax worksheet 2021. Web capital gains and qualified dividends. Web the new regulations made changes to the rules relating to the creditability of foreign taxes under internal revenue code section 901 and 903, the applicable period. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web capital gains and qualified dividends. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: The dividend is defined as the profit percentage given by an organisation to its investor. Web returns containing certain forms or taxable income amounts may need to calculate the tax on the return using a different method or worksheet. Capital gain is defined as the profit made by an investor after. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web qualified dividends and ltcg are subject to either a 0%, 15%, or 20% tax rate, depending upon your overall income levels. Web returns containing certain forms or taxable income amounts may need to. Web the new regulations made changes to the rules relating to the creditability of foreign taxes under internal revenue code section 901 and 903, the applicable period. The dividend is defined as the profit percentage given by an organisation to its investor. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. To inform the irs of your. Web capital gains and qualified dividends. Web jamesg1 expert alumni turbotax will generate the worksheet to compute your tax on line 16 of the federal 1040 tax return if your tax return meets the. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. Web the new regulations made changes to the rules relating to the creditability of foreign taxes under internal revenue code section 901 and 903, the applicable period. Web click forms in the upper right (upper left for mac) and look through the forms in my return list and. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web returns containing certain forms or taxable income amounts may need to calculate the tax on the return using a different method or worksheet as outlined in the 1040 instructions. Web jamesg1 expert alumni turbotax will generate the worksheet to compute your tax on line 16. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero. If you received qualified dividend. Web jamesg1 expert alumni turbotax will generate the worksheet to compute your tax on line 16 of the federal 1040 tax return if your tax return meets the. Web forbes advisor's capital gains tax calculator helps estimate the. To inform the irs of your dividends from shares or ltcg; Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or. Web the new regulations made changes to the rules relating to the creditability of foreign taxes under. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. If you received qualified dividend. Web capital gains and qualified dividends. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web edit qualified dividends and capital gain tax worksheet 2021. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: I am attaching a hypothetical example of a. The dividend is defined as the profit percentage given by an organisation to. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. To inform the irs of your dividends from shares or ltcg; Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Quickly add and underline text, insert images, checkmarks, and symbols, drop new fillable fields, and rearrange or. Web qualified dividends and capital gain tax worksheet (2019) •form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web click forms in the upper right (upper left for mac) and look through the forms in my return list and open the qualified dividends and capital gain tax worksheet. If you received qualified dividend. Explore updated credits, deductions, and exemptions, including the standard. Web returns containing certain forms or taxable income amounts may need to calculate the tax on the return using a different method or worksheet as outlined in the 1040 instructions. For tax year 2019, the 20% rate applies to amounts. Web the new regulations made changes to the rules relating to the creditability of foreign taxes under internal revenue code section 901 and 903, the applicable period. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Capital gain is defined as the profit made by an investor after. I am attaching a hypothetical example of a. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the. Web qualified dividends and ltcg are subject to either a 0%, 15%, or 20% tax rate, depending upon your overall income levels. The dividend is defined as the profit percentage given by an organisation to its investor. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. To inform the irs of your dividends from shares or ltcg; Web returns containing certain forms or taxable income amounts may need to calculate the tax on the return using a different method or worksheet as outlined in the 1040 instructions. Web qualified dividends and capital gain tax worksheet—line 12akeep for your records. See the earlier instructions for line 12a to see if you can use this worksheet to figure. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. Web you’ll need the qualified dividend and capital gain worksheet for the following major purposes: For tax year 2019, the 20% rate applies to amounts. Web qualified dividends and ltcg are subject to either a 0%, 15%, or 20% tax rate, depending upon your overall income levels. Explore updated credits, deductions, and exemptions, including the standard. Web edit qualified dividends and capital gain tax worksheet 2021. Web capital gains and qualified dividends. Web click forms in the upper right (upper left for mac) and look through the forms in my return list and open the qualified dividends and capital gain tax worksheet. Capital gain is defined as the profit made by an investor after. Web qualified dividends and capital gain tax worksheet (2019) •form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web the new regulations made changes to the rules relating to the creditability of foreign taxes under internal revenue code section 901 and 903, the applicable period.62 Final Project TwoQualified Dividends and Capital Gain Tax

Qualified Dividends and Capital Gains Worksheet Qualified Dividends

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Understanding The Qualified Dividends And Capital Gains Worksheet 2020

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Solved Create Function Calculating Tax Due Qualified Divi

41 1040 qualified dividends worksheet Worksheet Live

42 1040 qualified dividends and capital gains worksheet Worksheet Works

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Qualified Dividends And Capital Gains Worksheet 2018 —

Web This Is Not Just A Problem With Turbotax, The Flawed Logic Is In The Irs Worksheet Included In The 1040 Instructions.

The Dividend Is Defined As The Profit Percentage Given By An Organisation To Its Investor.

I Am Attaching A Hypothetical Example Of A.

Web Irs Introduced The Qualified Dividend And Capital Gain Tax Worksheet As An Alternative To Schedule D And Added The Qualified Dividends And New Rates To The.

Related Post: