E&P Calculation Worksheet

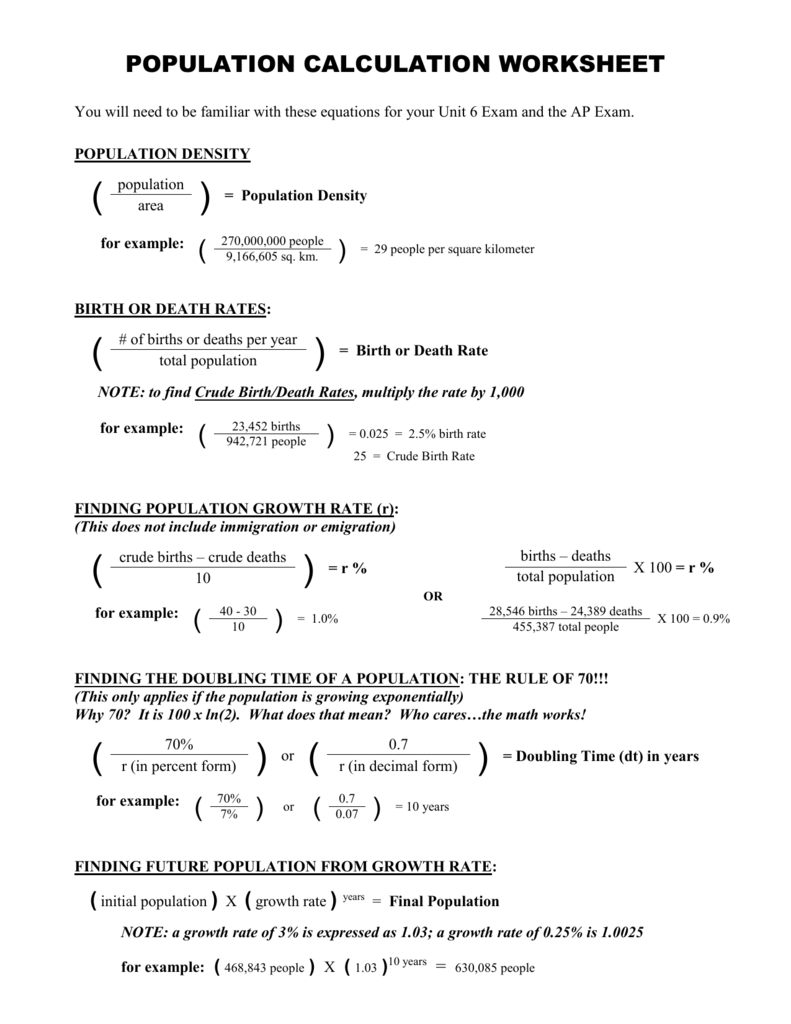

E&P Calculation Worksheet - Web about this quiz & worksheet. Check the box if person filing return does not have all u.s. Exclusions from taxable income 1. Add lines 4a and 4b. Web the primary purpose for computing e&p is to determine whether a distribution represents a taxable dividend, a nontaxable return of shareholder capital, or. Web these worksheets demonstrate the steps required to solve exponential equations and give practice problems to help students master the skill. This template calculates stock basis, the accumulated adjustments account (aaa), the other. Web template for calculating earnings and profits taxable income (net operating loss) add: Hannah started her clothing line with 55 stores in the year 2012 with an annual growth rate of 2.5%. Taxable income (or loss) _____ add: Check the box if person filing return does not have all u.s. For example, let's assume a certain company has $100,000 in accumulated earnings at the beginning of the year. Taxable income (or loss) _____ add: Earnings & profits computation worksheet. Web part i accumulated e&p of controlled foreign corporation. Web part i accumulated e&p of controlled foreign corporation. Taxation of business entities this video discusses the concept of e&p (earnings and profits) in corporate tax law. Web a deep dive into form 5471 schedule h “calculating the e&p of a controlled foreign corporation” 22 apr 2021 by anthony diosdi schedule h is used to report a foreign. Except as. Web calculations of stock basis, aaa, oaa, pti, retained earnings, and ae&p. Web about this quiz & worksheet. Web evaluating exponential functions worksheets. Web (a) depreciation for taxable years beginning after june 30, 1972 —(1) in general. Web template for calculating earnings and profits taxable income (net operating loss) add: Web re = initial re + net income dividends. Web 257k subscribers 22k views 5 years ago u.s. Except as provided in subparagraph (2) of this paragraph and paragraph (c) of this section, for. Web to compute e&p, depreciation deductions generally must be determined under the alternative depreciation system (ads). Hannah started her clothing line with 55 stores in the. Other adjustments based on rules for figuring e&p: Web calculations of stock basis, aaa, oaa, pti, retained earnings, and ae&p. Web c total increase to ace because of disallowance of items not deductible from e&p. Web the primary purpose for computing e&p is to determine whether a distribution represents a taxable dividend, a nontaxable return of shareholder capital, or. Taxation. This template calculates stock basis, the accumulated adjustments account (aaa), the other. Add lines 4a and 4b. Web these worksheets demonstrate the steps required to solve exponential equations and give practice problems to help students master the skill. Web about this quiz & worksheet. Web (a) depreciation for taxable years beginning after june 30, 1972 —(1) in general. Earnings & profits computation worksheet. Exclusions from taxable income 1. Web part i accumulated e&p of controlled foreign corporation. Hannah started her clothing line with 55 stores in the year 2012 with an annual growth rate of 2.5%. Other adjustments based on rules for figuring e&p: Web (a) depreciation for taxable years beginning after june 30, 1972 —(1) in general. Web a deep dive into form 5471 schedule h “calculating the e&p of a controlled foreign corporation” 22 apr 2021 by anthony diosdi schedule h is used to report a foreign. Web the primary purpose for computing e&p is to determine whether a distribution represents a. Web re = initial re + net income dividends. Web (a) depreciation for taxable years beginning after june 30, 1972 —(1) in general. Web these worksheets demonstrate the steps required to solve exponential equations and give practice problems to help students master the skill. Web the primary purpose for computing e&p is to determine whether a distribution represents a taxable. Web calculations of stock basis, aaa, oaa, pti, retained earnings, and ae&p. Web to compute e&p, depreciation deductions generally must be determined under the alternative depreciation system (ads). Shareholders’ information to complete an amount in column. Web a deep dive into form 5471 schedule h “calculating the e&p of a controlled foreign corporation” 22 apr 2021 by anthony diosdi schedule. Web about this quiz & worksheet. Check the box if person filing return does not have all u.s. This template calculates stock basis, the accumulated adjustments account (aaa), the other. Web determination of the taxable status of the distribution, and its effect on the e&p of the declaring corporation, is determined by reference to the e&p of the corporation for the. Add lines 4a and 4b. Taxable income (or loss) _____ add: Exclusions from taxable income 1. Other adjustments based on rules for figuring e&p: Web evaluating exponential functions worksheets. The growth rate function can. Earnings & profits computation worksheet. Web template for calculating earnings and profits taxable income (net operating loss) add: Web part i accumulated e&p of controlled foreign corporation. Web c total increase to ace because of disallowance of items not deductible from e&p. Except as provided in subparagraph (2) of this paragraph and paragraph (c) of this section, for. For example, let's assume a certain company has $100,000 in accumulated earnings at the beginning of the year. We cover the common types of. Web re = initial re + net income dividends. Web 257k subscribers 22k views 5 years ago u.s. Taxation of business entities this video discusses the concept of e&p (earnings and profits) in corporate tax law. Web calculations of stock basis, aaa, oaa, pti, retained earnings, and ae&p. Web 257k subscribers 22k views 5 years ago u.s. Hannah started her clothing line with 55 stores in the year 2012 with an annual growth rate of 2.5%. Web evaluating exponential functions worksheets. For example, let's assume a certain company has $100,000 in accumulated earnings at the beginning of the year. Web about this quiz & worksheet. Web to compute e&p, depreciation deductions generally must be determined under the alternative depreciation system (ads). Web part i accumulated e&p of controlled foreign corporation. We cover the common types of. Web re = initial re + net income dividends. Add lines 4a and 4b. The growth rate function can. Except as provided in subparagraph (2) of this paragraph and paragraph (c) of this section, for. Other adjustments based on rules for figuring e&p: Web determination of the taxable status of the distribution, and its effect on the e&p of the declaring corporation, is determined by reference to the e&p of the corporation for the. This template calculates stock basis, the accumulated adjustments account (aaa), the other.Population Calculation Worksheet

E&p Calculation Worksheet

Mole Calculation Practice Worksheet Kayra Excel

More Mole Calculations Worksheet

E&p Calculation Worksheet

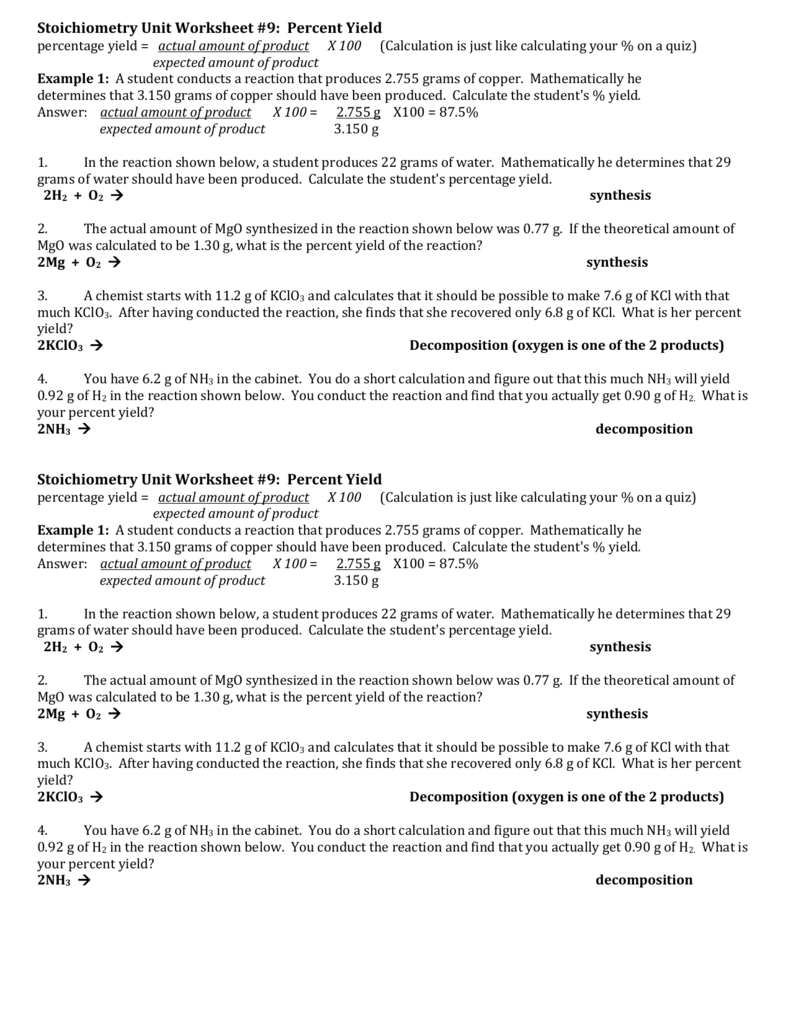

Percent Yield Calculations Worksheet Worksheets For Kindergarten

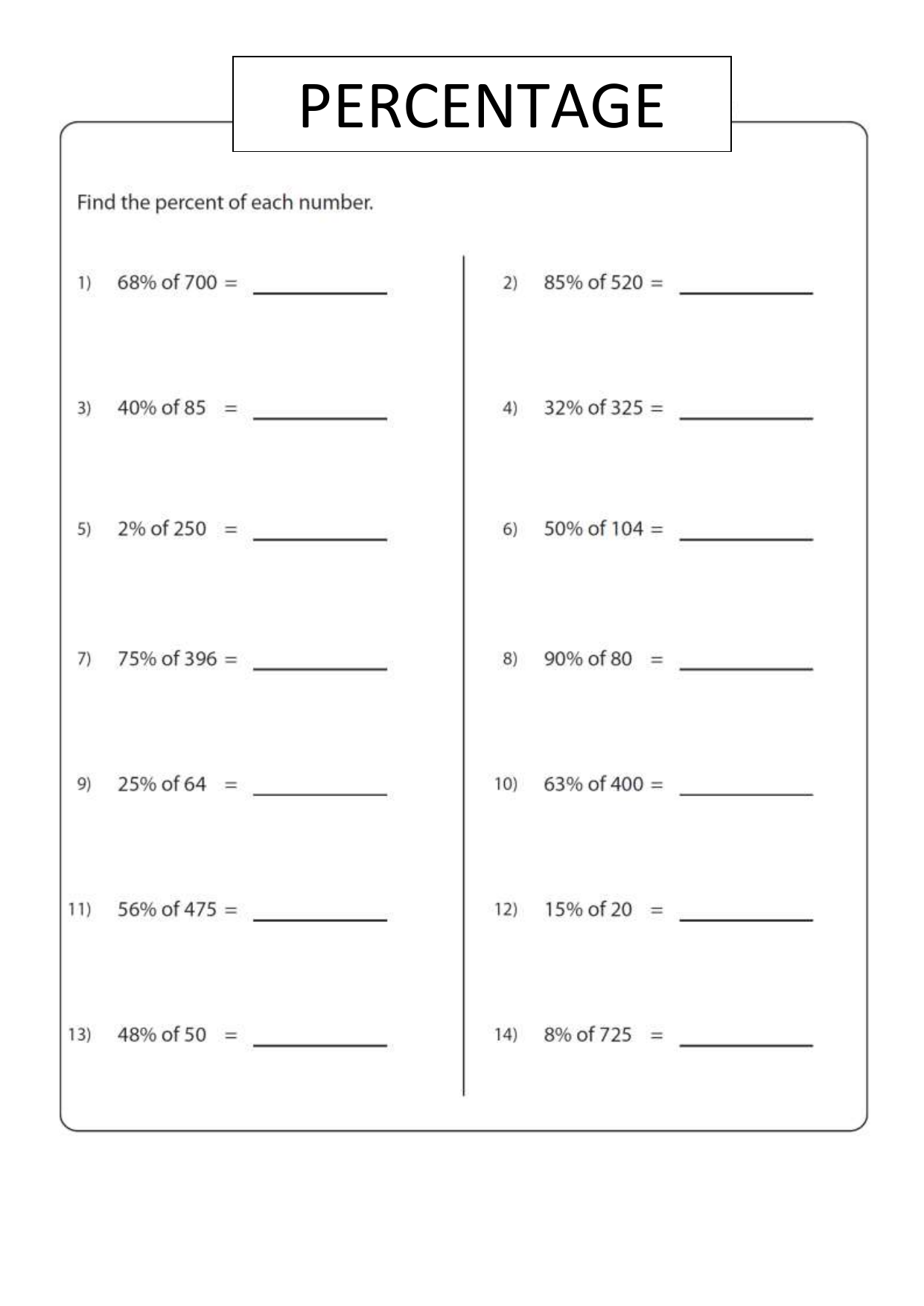

8 Maths Percentage worksheet

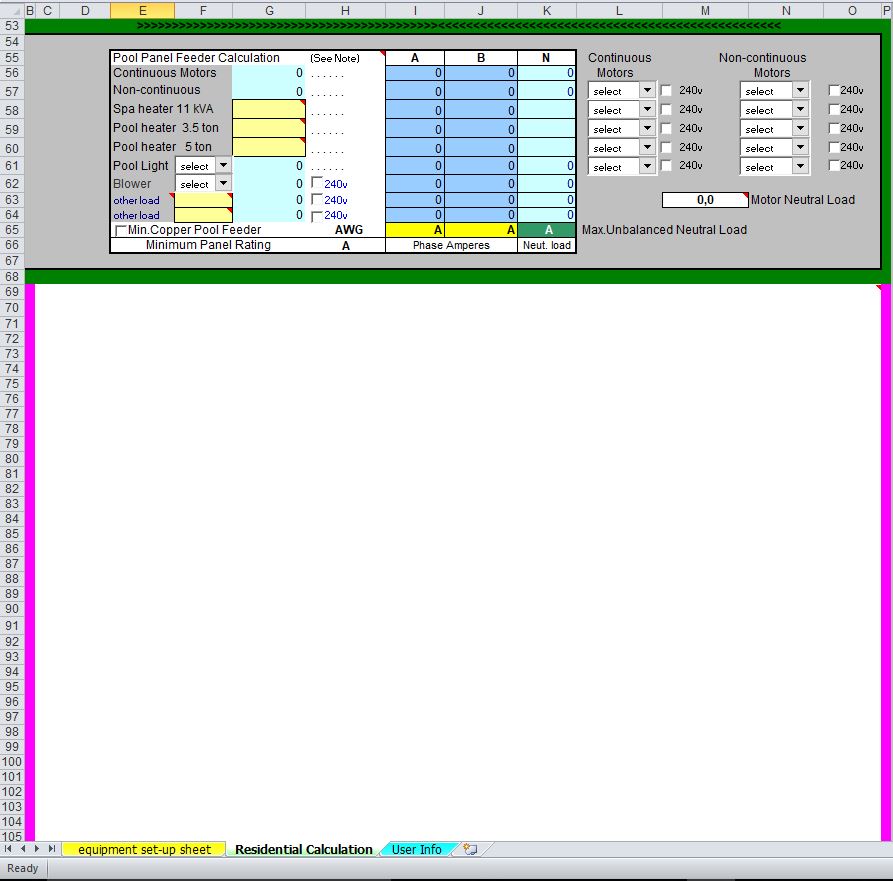

Residential Load Calculation Worksheet Worksheets For Kindergarten

More Mole Calculations Worksheet

E&p Calculation Worksheet

Taxation Of Business Entities This Video Discusses The Concept Of E&P (Earnings And Profits) In Corporate Tax Law.

Shareholders’ Information To Complete An Amount In Column.

Web A Deep Dive Into Form 5471 Schedule H “Calculating The E&P Of A Controlled Foreign Corporation” 22 Apr 2021 By Anthony Diosdi Schedule H Is Used To Report A Foreign.

Web Determining A Foreign Corporation’s E&P Is Essential In Many Transactions, Because E&P Often Controls The Result Of Such Issues As The Amount Of Income Recognized, The.

Related Post: