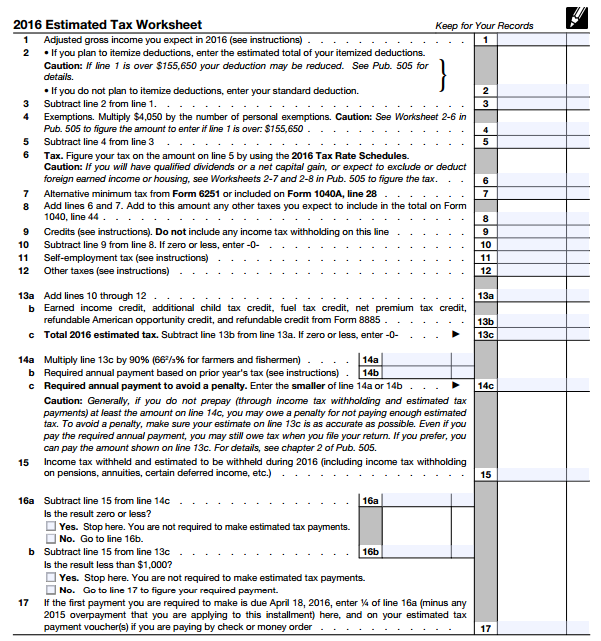

Employer's Worksheet To Calculate Employee's Taxable

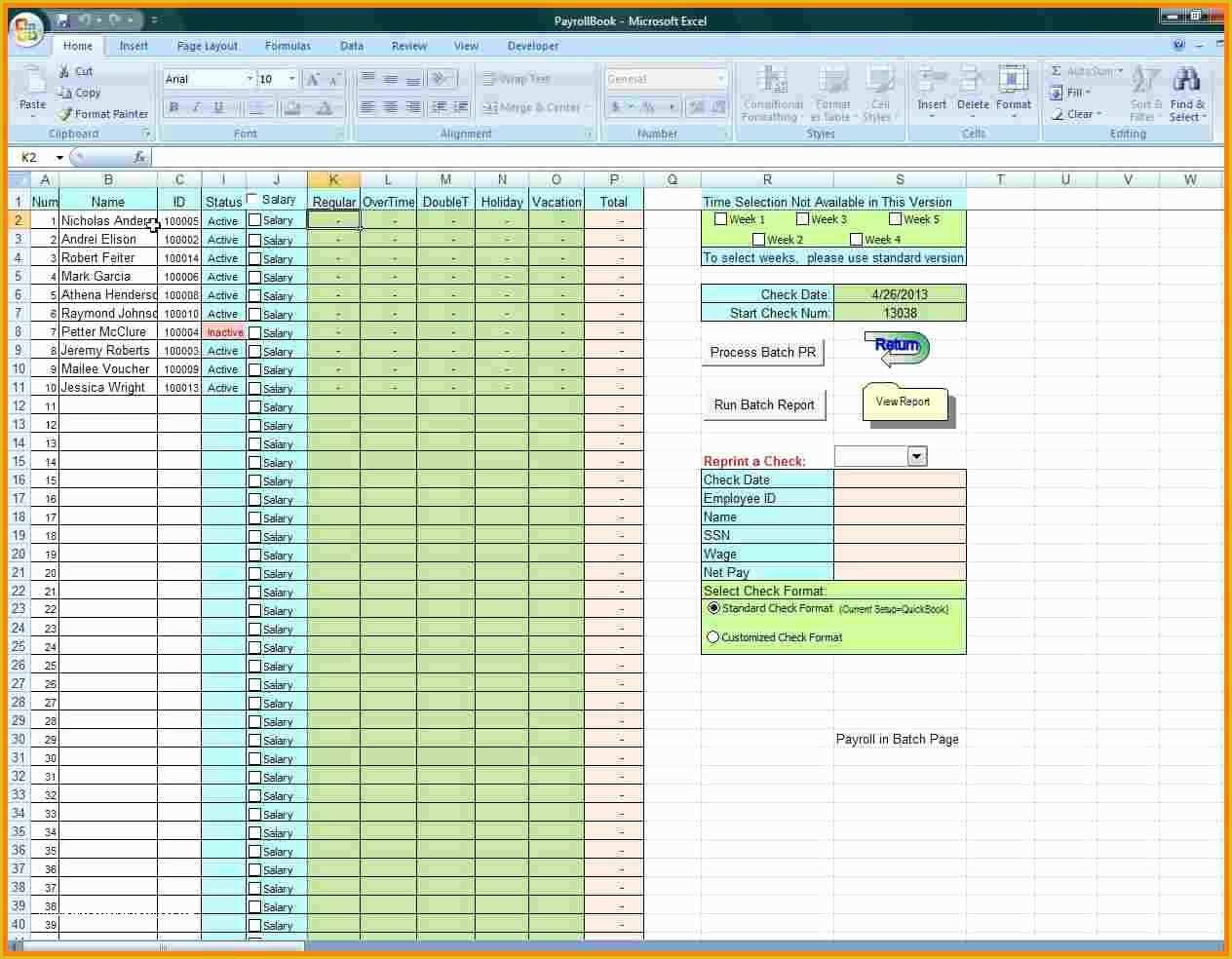

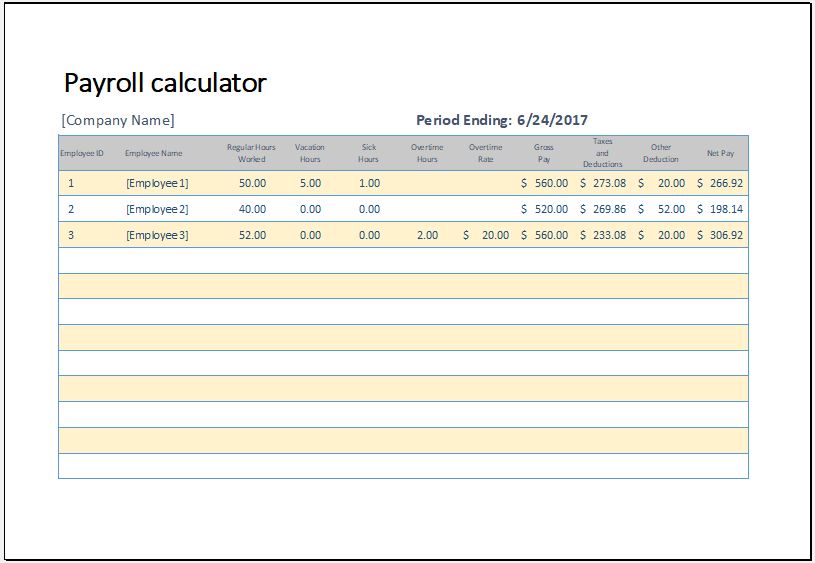

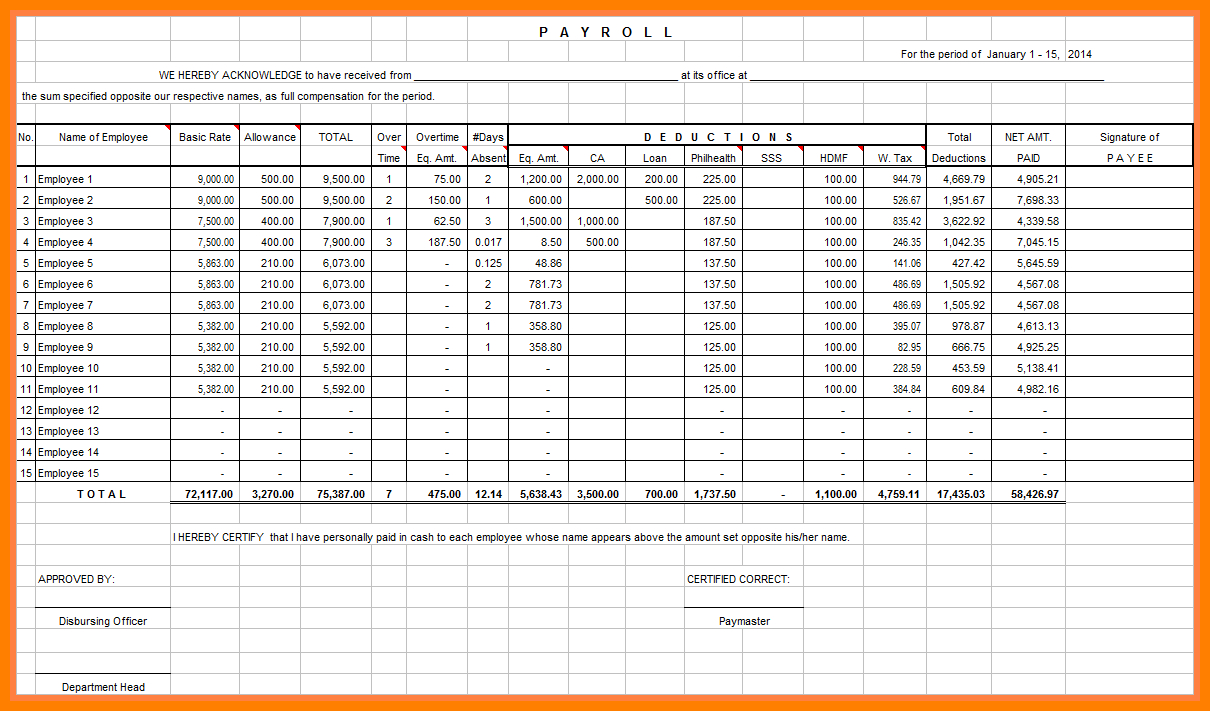

Employer's Worksheet To Calculate Employee's Taxable - Web an employee whose pay is $265,000 or more. Your income puts you in the 25% tax. Your taxes are estimated at $11,139. Web let us take david’s example to understand the taxable income tax calculation. California employer payroll tax account number. 1c) this should equal your employee’s. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the employee every week, they all calculate by divide by. Web find tax withholding information for employees, employers and foreign persons. Web the tax withholding estimator on irs.gov makes it easy to figure out how much to withhold. Web *the calculations provided should not be considered financial, legal or tax advice. Social security tax $— medicare tax $— futa $— total annual cost to hire this employee: Web *the calculations provided should not be considered financial, legal or tax advice. Or itemized deductions, on his or her tax return. 22%, 24%, 32%, 35%, and 37%. He is entitled to a gross salary of $50,000 annually and pays 6% interest on his. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the employee every week, they all calculate by divide by. • is age 65 or older, • is blind, or • will claim adjustments to income; Web the employer will use worksheet 3 and the withholding tables in section. Web dependent, if the employee: 22%, 24%, 32%, 35%, and 37%. Web find tax withholding information for employees, employers and foreign persons. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the employee every week, they all calculate by divide by. Social security tax $— medicare tax $—. • is age 65 or older, • is blind, or • will claim adjustments to income; He is entitled to a gross salary of $50,000 annually and pays 6% interest on his son’s education loan of. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the employee every. A control employee for a government. Web the tax withholding estimator on irs.gov makes it easy to figure out how much to withhold. Web up to $32 cash back 1a) this is the same as gross wages: California employer payroll tax account number. Web find tax withholding information for employees, employers and foreign persons. He is entitled to a gross salary of $50,000 annually and pays 6% interest on his son’s education loan of. A control employee for a government. Web the irs requires employers to provide certain information on their tax return with respect to the vehicles provided to employees. Web an employee whose pay is $265,000 or more. This online tool helps. Web the tax withholding estimator on irs.gov makes it easy to figure out how much to withhold. 22%, 24%, 32%, 35%, and 37%. 15.47% would also be your average tax rate. Web find tax withholding information for employees, employers and foreign persons. California employer payroll tax account number. 22%, 24%, 32%, 35%, and 37%. Web use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state and local taxes. Use worksheet a for regular withholding allowances. Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $160,200 in a given calendar year.. 22%, 24%, 32%, 35%, and 37%. 15.47% would also be your average tax rate. The withholding calculator can help you figure the right amount of. Social security tax $— medicare tax $— futa $— total annual cost to hire this employee: Web the irs requires employers to provide certain information on their tax return with respect to the vehicles provided. California employer payroll tax account number. 15.47% would also be your average tax rate. Web the credit is 50% of up to $10,000 in wages, meaning that it can be as high as $5,000 per employee in 2020 and as high as $21,000 per employee in 2021 (totaling. Web the irs requires employers to provide certain information on their tax. This information is also used to calculate the. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the employee every week, they all calculate by divide by. Your income puts you in the 25% tax. Web there are seven tax brackets in 2022 and 2023: Web an employee whose pay is $265,000 or more. This is 15.47% of your total income of $72,000. This online tool helps employees withhold the correct amount of tax. Web as an employer you’re responsible for the following taxes: Web *the calculations provided should not be considered financial, legal or tax advice. Web dependent, if the employee: Web let us take david’s example to understand the taxable income tax calculation. 22%, 24%, 32%, 35%, and 37%. Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $160,200 in a given calendar year. Your taxes are estimated at $11,139. 15.47% would also be your average tax rate. Social security tax $— medicare tax $— futa $— total annual cost to hire this employee: Use worksheet a for regular withholding allowances. Fica and federal withholding are taken out of adjusted gross pay, meaning. He is entitled to a gross salary of $50,000 annually and pays 6% interest on his son’s education loan of. California employer payroll tax account number. Web *the calculations provided should not be considered financial, legal or tax advice. Web the employer will use worksheet 3 and the withholding tables in section 3 to determine the income tax withholding for the nonresident alien employee. Or itemized deductions, on his or her tax return. Web dependent, if the employee: • is age 65 or older, • is blind, or • will claim adjustments to income; Fica and federal withholding are taken out of adjusted gross pay, meaning. A control employee for a government. Web let us take david’s example to understand the taxable income tax calculation. Use worksheet a for regular withholding allowances. Your income puts you in the 25% tax. He is entitled to a gross salary of $50,000 annually and pays 6% interest on his son’s education loan of. The withholding calculator can help you figure the right amount of. Web the employer will calculating the employee's pay period by how often they pay the employee such as if they pay the employee every week, they all calculate by divide by. Web the credit is 50% of up to $10,000 in wages, meaning that it can be as high as $5,000 per employee in 2020 and as high as $21,000 per employee in 2021 (totaling. Web there are seven tax brackets in 2022 and 2023: Web up to $32 cash back 1a) this is the same as gross wages:Payroll Tax Spreadsheet Template PDF Template

Enerpize The Ultimate Cheat Sheet on Payroll

Payroll contribution calculator RomanaiBaran

21 Images Tax Deduction Template

Excel Payroll Calculator Template Free Download Of 5 Free Payroll Excel

8 Payroll Tax Calculator Templates to Download Sample Templates

microsoft excel free download stashokregister

How to Pay Taxes for Side Hustles and Extra Young Adult Money

Top ten time sheets for excel jetbezy

Calculation of Federal Employment Taxes Payroll Services The

This Is 15.47% Of Your Total Income Of $72,000.

California Employer Payroll Tax Account Number.

Social Security Tax $— Medicare Tax $— Futa $— Total Annual Cost To Hire This Employee:

Web Use Smartasset's Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal, State And Local Taxes.

Related Post: