Enact Rental Income Worksheet

Enact Rental Income Worksheet - The worksheet on the reverse side should. Web calculate monthly qualifying rental income (loss) using step 2a: Prevent income errors redirect1 qc issues llpa changes with mi shut the door on fraud part i. Web rental income calculation worksheets reporting of gross monthly rent associated policies in conjunction with the policies in this topic, lenders must also. Security deposits a security deposit is not included in rental income when received if you plan to return it to the tenant at the end of the lease. Web marykay scully interviews enact's appaisal experts 58 min. The purpose of this written analysis is to determine the. Web download rental income depreciation if this is your first year with our firm, please provide a depreciation schedule for all property placed in service in prior years. Web the rental income worksheets are: Web please use the following calculator and quick reference guide to assist in calculating rental income from irs form 1040 schedule e. Web the rental income worksheets are: Web download rental income depreciation if this is your first year with our firm, please provide a depreciation schedule for all property placed in service in prior years. Web marykay scully interviews enact's appaisal experts 58 min. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and. It provides suggested guidance only and does. A1 enter total rents received. Web download rental income depreciation if this is your first year with our firm, please provide a depreciation schedule for all property placed in service in prior years. Security deposits a security deposit is not included in rental income when received if you plan to return it to. Web download rental income depreciation if this is your first year with our firm, please provide a depreciation schedule for all property placed in service in prior years. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental income (loss) reported on schedule. Use this job aid to. It provides suggested guidance only and does. The purpose of this written analysis is to determine the. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental. Web rental income calculation worksheets reporting of gross monthly rent associated policies in conjunction with the policies in this topic, lenders must also. Lease agreement. Web this rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Web rental income calculation worksheets reporting of gross monthly rent associated policies in conjunction with the policies in this topic, lenders must also. Web please use the following calculator and quick reference guide to assist in calculating rental income from irs. Lease agreement or fannie mae form 1007 or form 1025. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web to download the free rental income and expense worksheet template, click the green button. Web marykay scully interviews enact's appaisal experts 58 min. A1 enter total rents received. Web this rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Lease agreement or fannie mae form 1007 or form 1025. Web rental income calculation worksheets reporting of gross monthly rent associated policies in conjunction with the policies. Web the rental income worksheets are: Web the landlord would collect a prorated rent of $750 for half of december plus $1,500 rent for the month of january, for a total of $2,250. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental. Web this rental income brochure summarizes the most common. Web download rental income depreciation if this is your first year with our firm, please provide a depreciation schedule for all property placed in service in prior years. It provides suggested guidance only and does. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa. Lease agreement or fannie mae form 1007 or form 1025. Security deposits a security deposit is not included in rental income when received if you plan to return it to the tenant at the end of the lease. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental. It provides suggested guidance. Because the landlord operates on a cash. Net rental income (calculated to a monthly amount) 4 (sum of subtotal(s)divided by number of applicable months = net rental income) $ / =$ ii. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web net rental income = the sum of the subtotal(s) divided by the number of applicable months 1refer to section 5306.4(a)(i) for net rental income calculation requirements Web this rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Web rental income calculation worksheets reporting of gross monthly rent associated policies in conjunction with the policies in this topic, lenders must also. The purpose of this written analysis is to determine the. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Security deposits a security deposit is not included in rental income when received if you plan to return it to the tenant at the end of the lease. Lease agreement or fannie mae form 1007 or form 1025. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental. The worksheet on the reverse side should. Schedule e or step 2b: It provides suggested guidance only and does. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental income (loss) reported on schedule. A1 enter total rents received. Web please use the following calculator and quick reference guide to assist in calculating rental income from irs form 1040 schedule e. Web marykay scully interviews enact's appaisal experts 58 min. Web the landlord would collect a prorated rent of $750 for half of december plus $1,500 rent for the month of january, for a total of $2,250. Web calculate monthly qualifying rental income (loss) using step 2a: Prevent income errors redirect1 qc issues llpa changes with mi shut the door on fraud part i. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental. Net rental income (calculated to a monthly amount) 4 (sum of subtotal(s)divided by number of applicable months = net rental income) $ / =$ ii. Web marykay scully interviews enact's appaisal experts 58 min. Web download rental income depreciation if this is your first year with our firm, please provide a depreciation schedule for all property placed in service in prior years. Claiming the correct amount of depreciation. Security deposits a security deposit is not included in rental income when received if you plan to return it to the tenant at the end of the lease. It provides suggested guidance only and does. The worksheet on the reverse side should. Web net rental income = the sum of the subtotal(s) divided by the number of applicable months 1refer to section 5306.4(a)(i) for net rental income calculation requirements The purpose of this written analysis is to determine the. Lease agreement or fannie mae form 1007 or form 1025. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web this rental income brochure summarizes the most common forms of rental income, allowable expenses and their tax treatment. Web the rental income worksheets are: Because the landlord operates on a cash.Mgic Rental Worksheet Fill Online, Printable, Fillable, Blank

Rental Calculation Worksheet Fannie Mae Rental

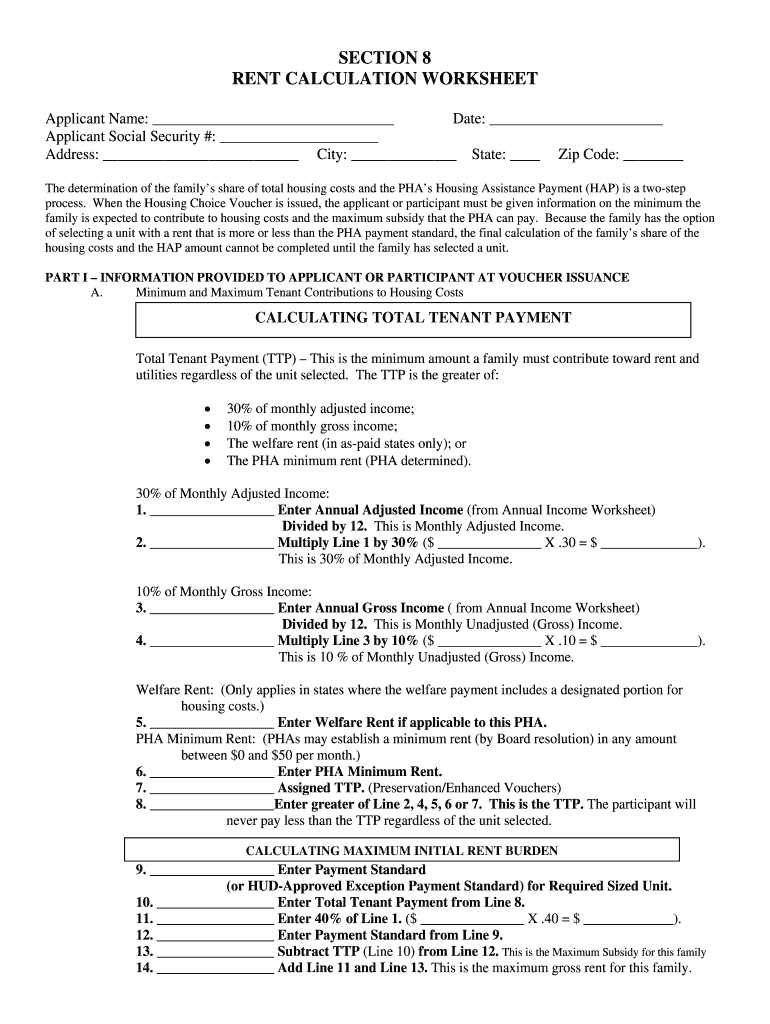

Section 8 Rent Calculation Worksheet Fill Online —

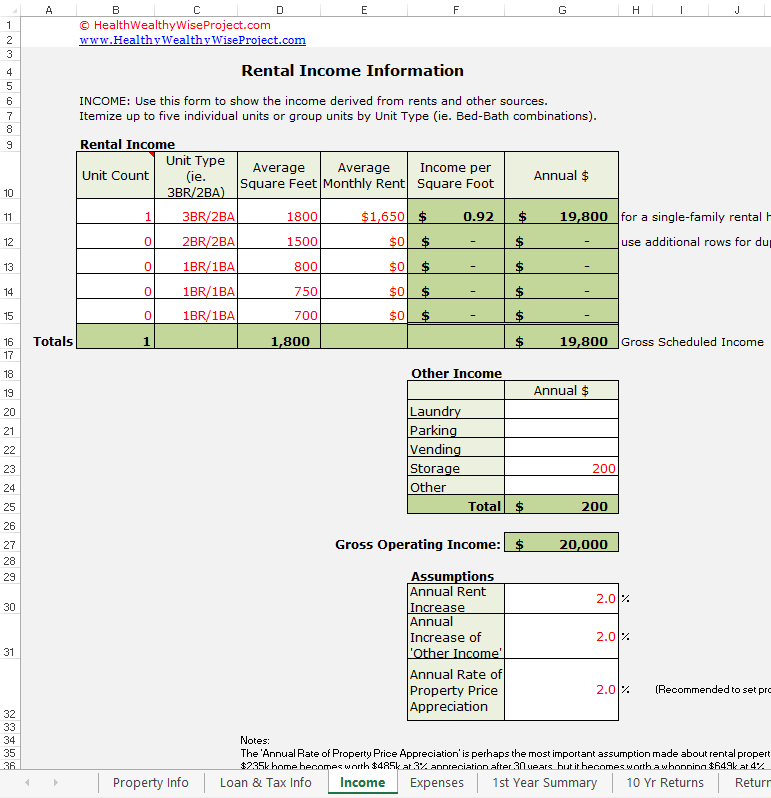

Rental Calculation Worksheet Along with Investment Property

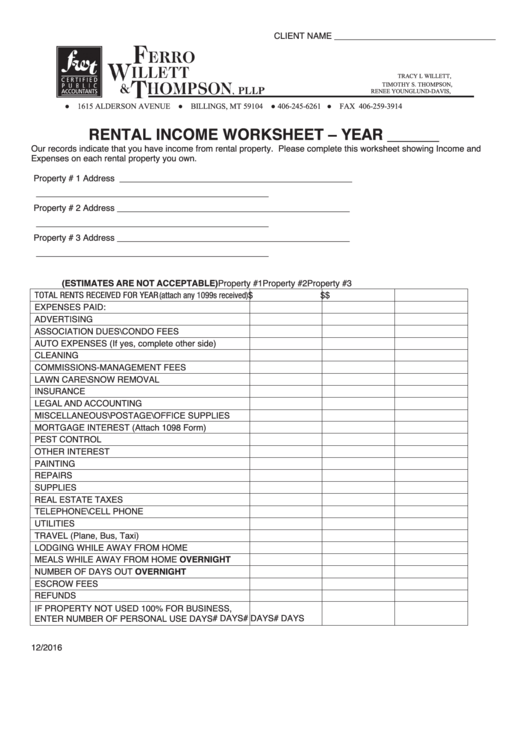

Rental Property and Expenses Worksheet for October 2021 ᐅ The

Fannie Mae Rental Worksheet Excel Promotiontablecovers

Schedule E Rental Worksheet Fill Online, Printable, Fillable

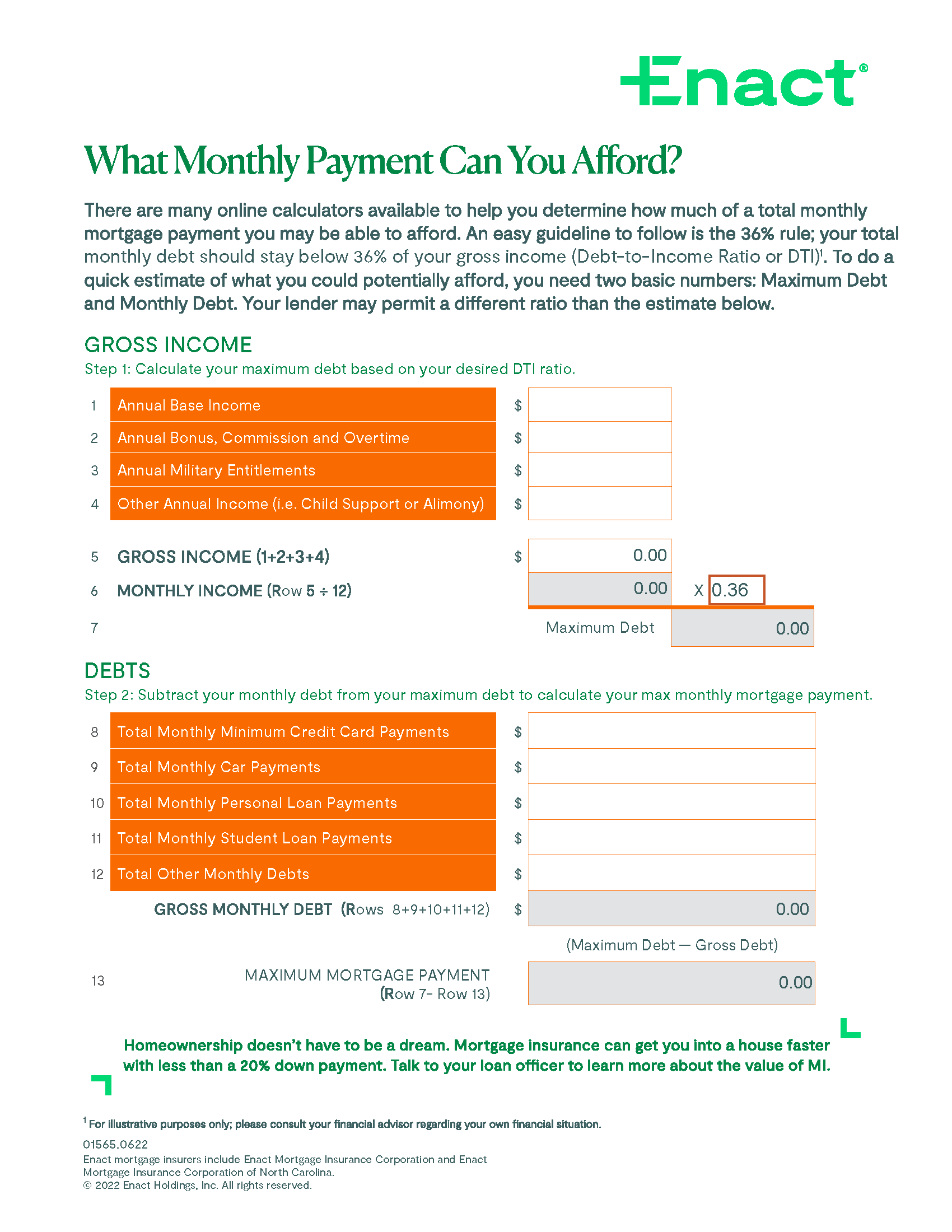

Help your FTHBs Avoid Financial Surprises The Affordability Worksheet

printable and expense worksheet

Free Rental And Expense Worksheet

Reporting Rental Income, Expenses, And Losses.

Schedule E Or Step 2B:

Web To Download The Free Rental Income And Expense Worksheet Template, Click The Green Button At The Top Of The Page.

Web Rental Income Calculation Worksheets Reporting Of Gross Monthly Rent Associated Policies In Conjunction With The Policies In This Topic, Lenders Must Also.

Related Post: