Erc Calculation Worksheet

Erc Calculation Worksheet - Web the following tools for calculating erc were submitted by pstap member, fred weaver, ea; Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds A blank form and a sample. Web employee retention credit guidance and resources. Section 9651 of the arp enacted section 3134 of. Web again, the credit for erc 2021 is 70% of qualified wages, capped at $10,000 in qualified wages per quarter (so the maximum credit is $7,000 per employee, per quarter. Our tax experts can help. Have you applied for ppp1 forgiveness? Web employee retention credit worksheet 1. Web 2020, and before july 1, 2021, and to modify the calculation of the credit amount for qualified wages paid during that time. Now you have your own version of the calculator. Web the irs has a worksheet within form 941 instructions that can help determine the erc amount once wage totals for the quarter have been calculated, on. Web employee retention credit guidance and resources. • draft 941 x’s for amended returns claiming. Increased the maximum per employee to $7,000 per employee. Web the irs has a worksheet within form 941 instructions that can help determine the erc amount once wage totals for the quarter have been calculated, on. Web calculate your erc using the rate applicable to that quarter. Maintained quarterly maximum defined in. Now you have your own version of the calculator. There’s an employee threshold you. They were created by the team at weaver accounting. Web 2020, and before july 1, 2021, and to modify the calculation of the credit amount for qualified wages paid during that time. Web employee retention credit estimate calculator. Maintained quarterly maximum defined in. Web again, the credit for erc 2021 is 70% of qualified wages, capped at $10,000 in qualified. Click file > make a copy at the top right hand of your screen; Web erc eligibility calculator 1. Increased the maximum per employee to $7,000 per employee per quarter in 2021. A blank form and a sample. • draft 941 x’s for amended returns claiming. Web maximum credit of $5,000 per employee in 2020. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified wages paid after june 30, 2021. Receive your credit by either getting an advance payment or claiming a refund when you file your form 941 quarterly. Web erc eligibility calculator 1.. Web employee retention credit guidance and resources. Web the following tools for calculating erc were submitted by pstap member, fred weaver, ea; How to calculate the employee retention credit for 2020, the employee retention credit is. Web employee retention credit estimate calculator. Maintained quarterly maximum defined in. Web 2020, and before july 1, 2021, and to modify the calculation of the credit amount for qualified wages paid during that time. Web the following tools for calculating erc were submitted by pstap member, fred weaver, ea; Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds Increased the maximum per. The employer retention credit is. Have you applied for ppp1 forgiveness? • if yes, did you use just wages for forgiveness? Web the credit for sick & family leave wages and employee retention credit (worksheet1) will show up if you've claimed a credit under the family first coronavirus. Now you have your own version of the calculator. Maintained quarterly maximum defined in. • draft 941 x’s for amended returns claiming. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified wages paid after june 30, 2021. Web use the tool and erc calculator below to quickly find your estimated employee retention credit. Section 9651 of the arp. Web use our tax credit estimator to calculate your potential erc amount. Web employee retention credit worksheet 1. Web the credit for sick & family leave wages and employee retention credit (worksheet1) will show up if you've claimed a credit under the family first coronavirus. Get a payroll tax refund & receive up to $26k per employee even if you. Now you have your own version of the calculator. Web erc eligibility calculator 1. How to calculate the employee retention credit for 2020, the employee retention credit is. Section 9651 of the arp enacted section 3134 of. Web employee retention credit guidance and resources. Web 2020, and before july 1, 2021, and to modify the calculation of the credit amount for qualified wages paid during that time. Web calculate your erc using the rate applicable to that quarter. Web let’s walk you through the main steps to make erc worksheet calculations. Maintained quarterly maximum defined in. The employee retention credit (erc) was created as part of the cares act to encourage businesses to continue paying. Web overview the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Web again, the credit for erc 2021 is 70% of qualified wages, capped at $10,000 in qualified wages per quarter (so the maximum credit is $7,000 per employee, per quarter. Our tax experts can help. Web use the tool and erc calculator below to quickly find your estimated employee retention credit. Talk to our skilled erc team about the employee retention credit. There’s an employee threshold you. Click file > make a copy at the top right hand of your screen; Web employee retention credit worksheet 1. Ad unsure if you qualify for erc? The employer retention credit is. Web washington — the internal revenue service today issued guidance for employers claiming the employee retention credit under the coronavirus aid, relief,. Ad unsure if you qualify for erc? Have you applied for ppp1 forgiveness? Section 9651 of the arp enacted section 3134 of. Web employee retention credit guidance and resources. Ad get up to $26k per employee from the irs with the erc tax credit. Web overview the employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll. Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds There’s an employee threshold you. Web let’s walk you through the main steps to make erc worksheet calculations. Web employee retention credit worksheet 1. Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they are qualified. • draft 941 x’s for amended returns claiming. Web the ey erc calculator: What is the erc tax credit? Receive your credit by either getting an advance payment or claiming a refund when you file your form 941 quarterly.ERC Calculator Tool ERTC Funding

Ertc Worksheet Excel

Employee Retention Credit (ERC) Calculator Gusto

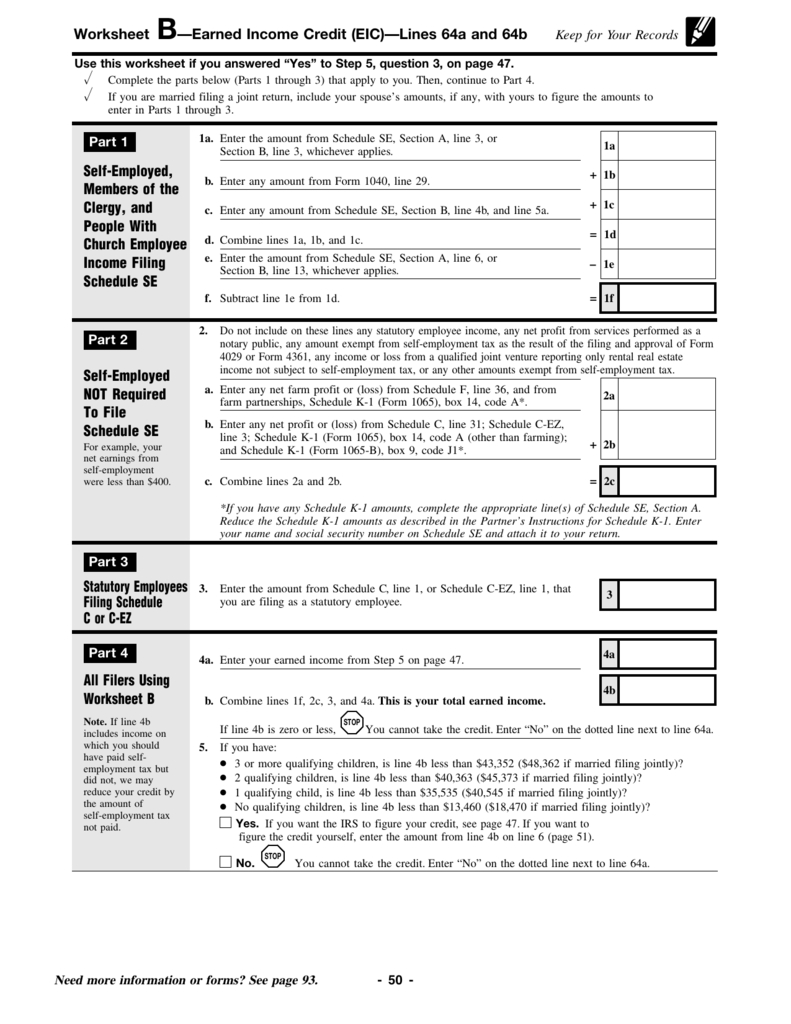

5 Printable EIC Worksheet /

Ertc Worksheet Excel

Qualifying for Employee Retention Credit (ERC) Gusto

ReadyToUse Employee Retention Credit Calculator 2021 MSOfficeGeek

Employee Retention Credit (ERC) Calculator Gusto

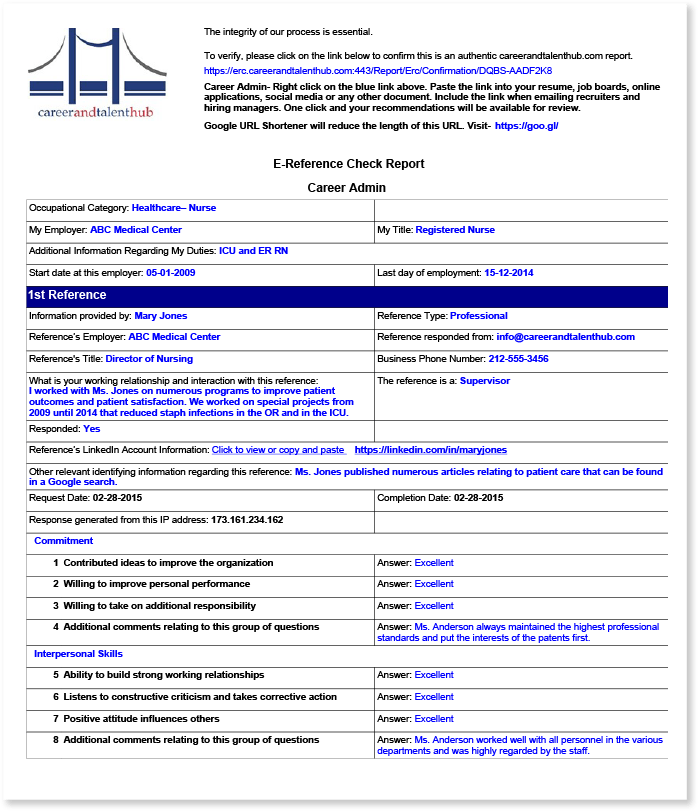

How does the ERC work? Career & Talent Hub

Ertc Worksheet Excel

Our Tax Experts Can Help.

Click File > Make A Copy At The Top Right Hand Of Your Screen;

Web Use The Tool And Erc Calculator Below To Quickly Find Your Estimated Employee Retention Credit.

The Worksheet Is Not Required By.

Related Post: