Erc Worksheet Excel

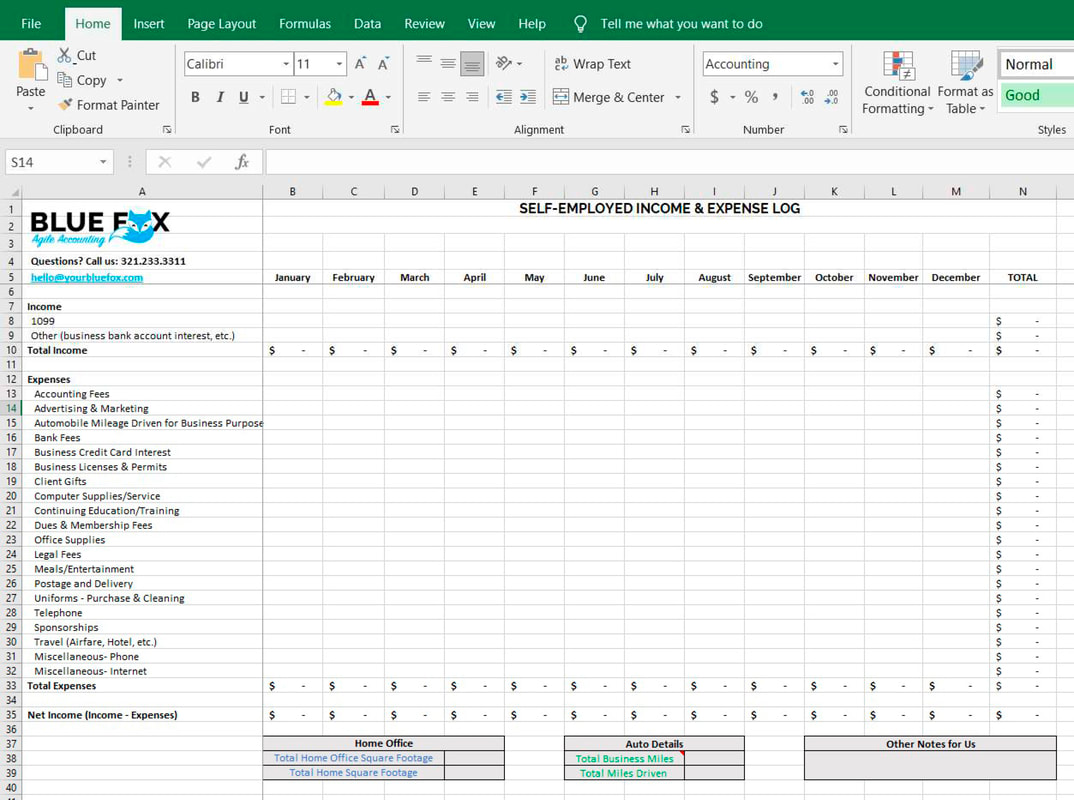

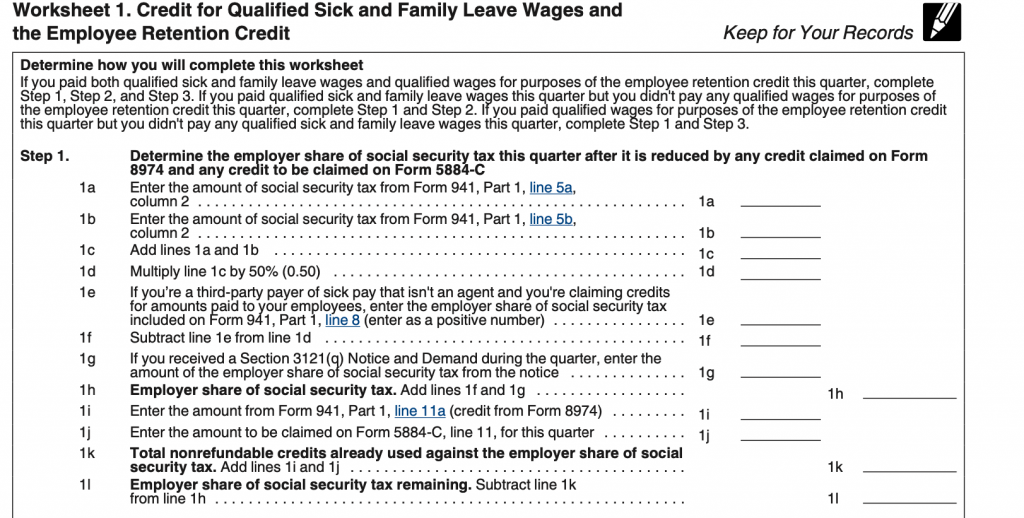

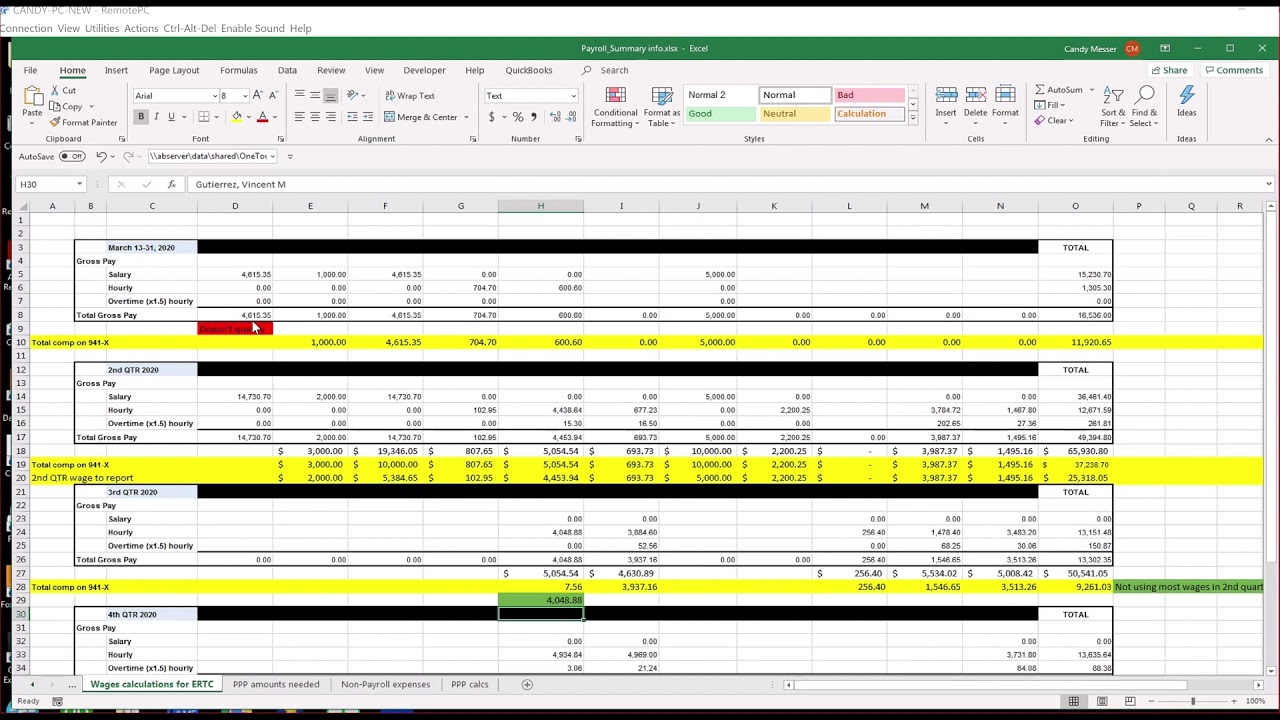

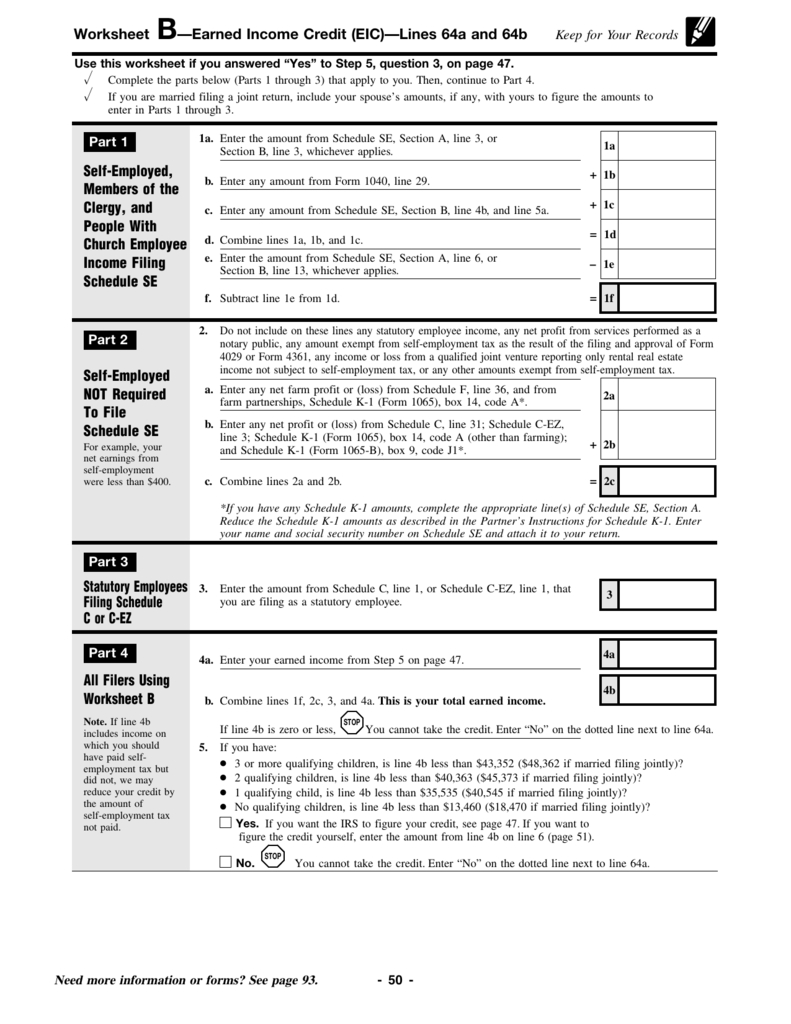

Erc Worksheet Excel - Adjusted employee retention credit for wages paid. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and staying within quarterly and overall caps for the. Create shortcut the rules to be eligible to take this. Adjusted credit for qualified sick and family leave wages for leave taken before april 1, 2021. Web the credit for sick & family leave wages and employee retention credit (worksheet1) will show up if you've claimed a credit under the family first coronavirus. Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their employees on the payroll and minimize the. This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc (ethics and religious culture) class. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified wages paid after june 30, 2021. Web process & worksheet for maximizing ppp1 and erc please note: A simple, guided tool to help businesses calculate their potential erc. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Each cwa client will need to determine if and at what level they qualify to claim the erc and receive 100%. Get a payroll tax refund & receive up to. No qualified sick leave nor family leave. Web the credit for sick & family leave wages and employee retention credit (worksheet1) will show up if you've claimed a credit under the family first coronavirus. Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds Please read the following notes on the erc. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. No qualified sick leave nor family leave. Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc) questions. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total. Please read the following notes on the erc spreadsheet: Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they are qualified. Web process & worksheet for maximizing ppp1 and erc please note: Web erc wages on line 21 n/a erc health plan expenses on line 22 n/a erc credits on. Please read the following notes on the erc spreadsheet: Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc) questions. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Web use worksheet 1 to figure the credit for leave taken before april 1,. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified wages paid after june 30, 2021. Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc) questions. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Get. This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc (ethics and religious culture) class. The worksheet is not required by. Each cwa client will need to determine if and at what level they qualify to claim the erc and receive 100%. Web enter your concern. Web the ey erc calculator: The worksheet is not required by. Adjusted credit for qualified sick and family leave wages for leave taken before april 1, 2021. Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds Web process & worksheet for maximizing ppp1 and erc please note: Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and staying within quarterly and overall caps for the. Web process & worksheet for maximizing ppp1 and erc please note: Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds The. The worksheet is not required by. Please read the following notes on the erc spreadsheet: Each cwa client will need to determine if and at what level they qualify to claim the erc and receive 100%. Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds Web enter your concern on the. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified wages paid after june 30, 2021. Web process & worksheet for maximizing ppp1 and erc please note: This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc (ethics and religious culture) class. Create shortcut the rules to be eligible to take this. Web erc worksheet 2021 was created by the irs to assist companies in calculating the tax credits for which they are qualified. Web an excel worksheet may be helpful in this, as each employee must be accounted for in terms of total wages and staying within quarterly and overall caps for the. Web the ey erc calculator: Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds Adjusted employee retention credit for wages paid. Please read the following notes on the erc spreadsheet: Web erc wages on line 21 n/a erc health plan expenses on line 22 n/a erc credits on line 11c* n/a erc credits on line 13d* n/a *sum of lines 11c and 13d reduce deductible wages on. No qualified health plan expenses 2. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. The worksheet is not required by. Web the credit for sick & family leave wages and employee retention credit (worksheet1) will show up if you've claimed a credit under the family first coronavirus. Adjusted credit for qualified sick and family leave wages for leave taken before april 1, 2021. Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds Answers to employee retention credit (erc) questions from the latest irs guidance to employee retention credit (erc) questions. Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their employees on the payroll and minimize the. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Web the ey erc calculator: Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Adjusted credit for qualified sick and family leave wages for leave taken after march 31, 2020, and before april 1, 2021. Web the credit for sick & family leave wages and employee retention credit (worksheet1) will show up if you've claimed a credit under the family first coronavirus. A simple, guided tool to help businesses calculate their potential erc. Each cwa client will need to determine if and at what level they qualify to claim the erc and receive 100%. Create shortcut the rules to be eligible to take this. Web the employee retention credit (erc) is a refundable tax credit intended to encourage business owners to keep their employees on the payroll and minimize the. This worksheet can be used at the end of each term to allow the students to reflect on what they have learned during erc (ethics and religious culture) class. Adjusted employee retention credit for wages paid. Web worksheet 4 follows the same format as worksheet 2, however, it is designed to calculate the erc for qualified wages paid after june 30, 2021. Get a payroll tax refund & receive up to $26k per employee even if you received ppp funds Web erc wages on line 21 n/a erc health plan expenses on line 22 n/a erc credits on line 11c* n/a erc credits on line 13d* n/a *sum of lines 11c and 13d reduce deductible wages on. Web process & worksheet for maximizing ppp1 and erc please note: Get a payroll tax refund & receive up to $26k per employee even if you received ppp fundserc form download romanholidayvannuys

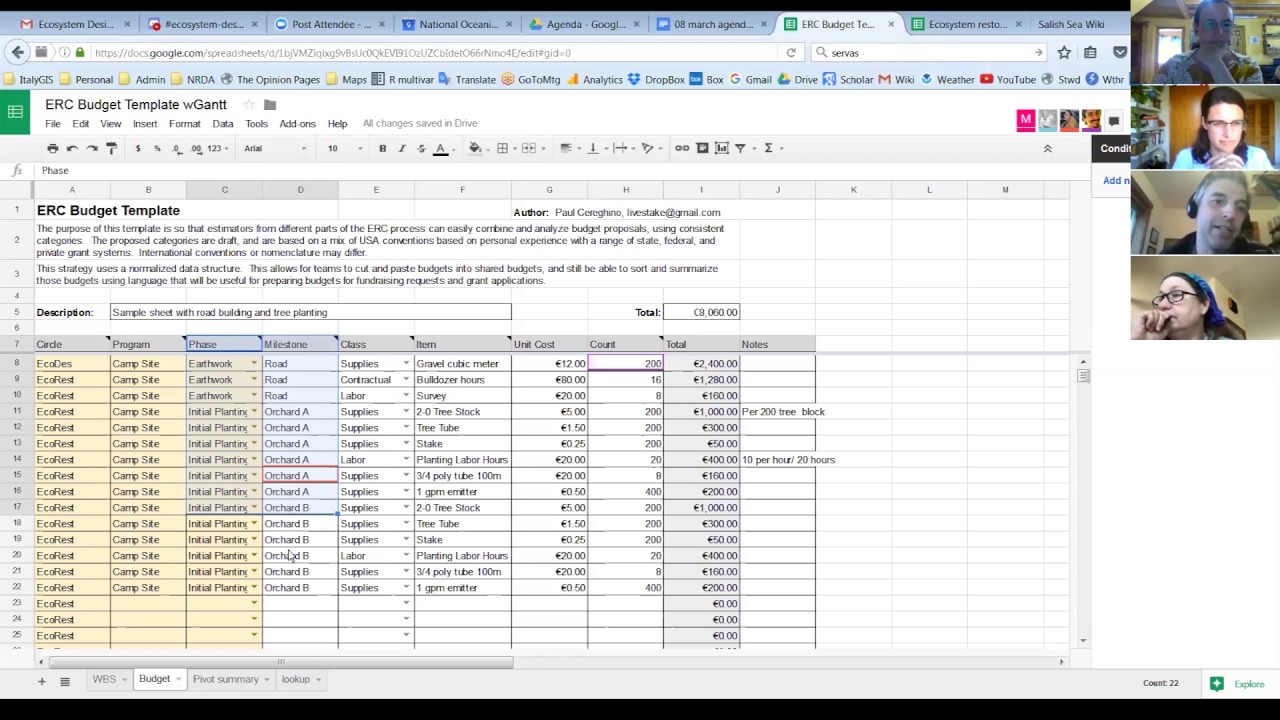

ERC Budget Template Proposal YouTube

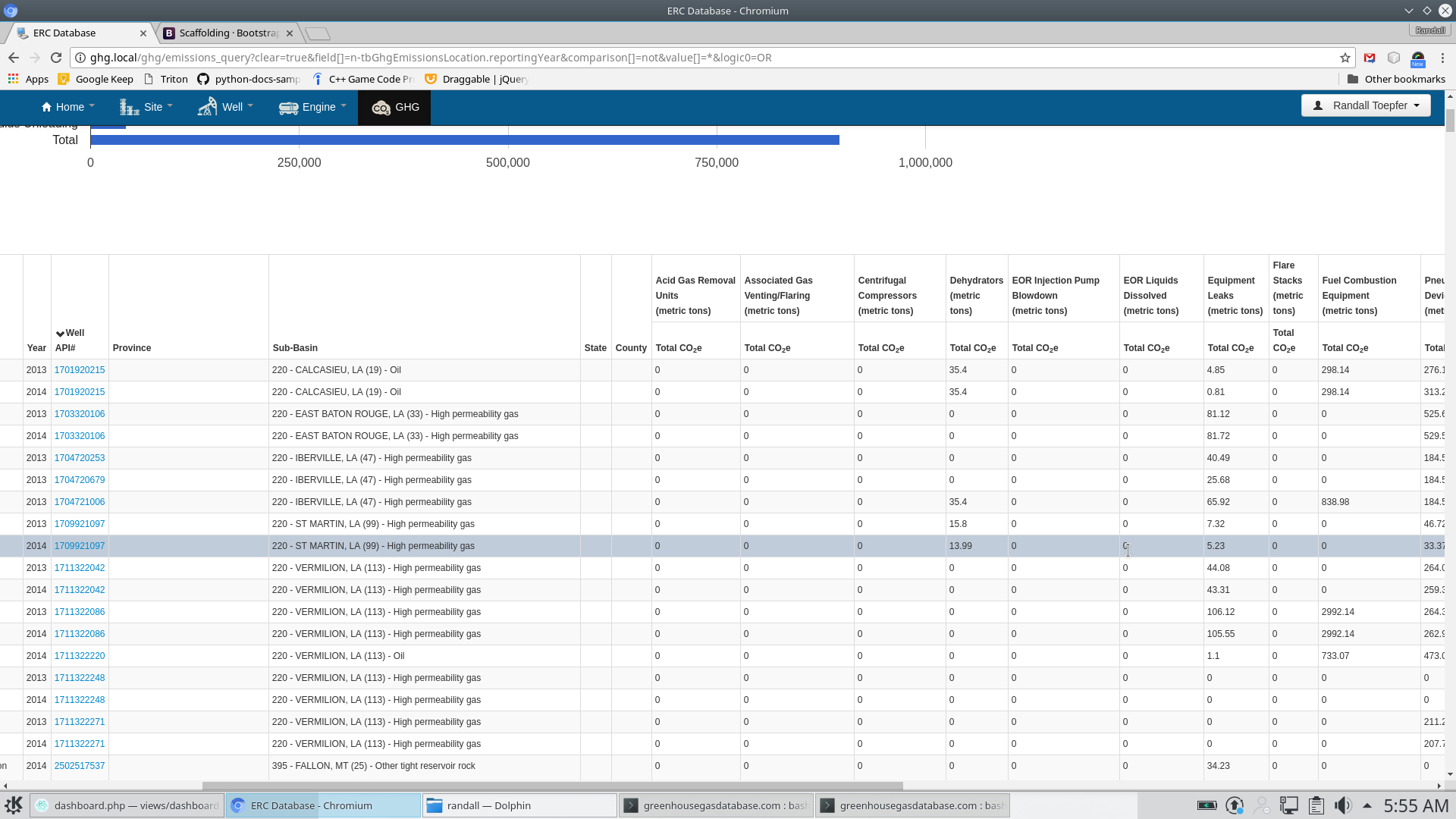

Epa Tanks Spreadsheet pertaining to Erc Database —

941 X Worksheet 1 Excel

Ertc Worksheet Excel

Employee Retention Credit (ERC) Calculator Gusto

erc form download romanholidayvannuys

Ertc Worksheet Excel

Ertc Worksheet Excel

Ertc Worksheet Excel

Web An Excel Worksheet May Be Helpful In This, As Each Employee Must Be Accounted For In Terms Of Total Wages And Staying Within Quarterly And Overall Caps For The.

No Qualified Sick Leave Nor Family Leave.

Web Enter Your Concern On The Tell Us More About Your Question Box, Like Worksheet 1 Won't Populate In My 941 Form. Click The Search Button, And Then Select.

No Qualified Health Plan Expenses 2.

Related Post: