Ertc Calculation Worksheet

Ertc Calculation Worksheet - Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients who can qualify for the credit but they did not take a. The #1 ertc calculator and calculation spreadsheet on the market today. Web what is it? Claim the employee retention credit to get up to $26k per employee. You could be eligible for a federal. Our experts will help you take advantage of the cares act’s employee retention tax credit Web download our ertc calculation worksheet to streamline your tax credit calculations. Ad our tax professionals can help determine if you qualify for the ertc from the irs. Web ertc is calculated based on the amount of qualified wages paid to employees. Web the following tools for calculating erc were submitted by pstap member, fred weaver, ea; A blank form and a sample. Web the ey erc calculator: Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. How to calculate the employee retention credit for 2020, the employee retention credit is. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax. Simply download the calculator and save one version for 2020 and one version for. Web this worksheet is to be used when reviewing payroll tax returns for the 2020 and 2021 calendar years. Askfrost.com has been visited by 10k+ users in the past month Smartbizloans.com has been visited by 10k+ users in the past month Web use our tax credit. The total qualified wages for 2020 are multiplied by a 50% cap to determine the tax credit amount. Askfrost.com has been visited by 10k+ users in the past month 3.1k views 3 months ago. Web this worksheet is to be used when reviewing payroll tax returns for the 2020 and 2021 calendar years. Ad our tax professionals can help determine. Smartbizloans.com has been visited by 10k+ users in the past month Ad our tax professionals can help determine if you qualify for the ertc from the irs. Web ertc is calculated based on the amount of qualified wages paid to employees. Our experts will help you take advantage of the cares act’s employee retention tax credit Claim the employee retention. Web you can use the ertc & ppp calculator to model 2020 expenses and 2021 expenses. Calculate the maximum ertc employee retention. The #1 ertc calculator and calculation spreadsheet on the market today. They were created by the team at weaver accounting. Web use our tax credit estimator to calculate your potential erc amount. Web this worksheet is to be used when reviewing payroll tax returns for the 2020 and 2021 calendar years. They were created by the team at weaver accounting. How to calculate the employee retention credit for 2020, the employee retention credit is. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp. Multiply each employee’s qualified wages, by quarter, by 50%. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Web use our tax credit estimator to calculate your potential erc amount. The total qualified wages for 2020 are multiplied by a 50% cap to determine the tax credit amount. Web this. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. The ertc is a refundable payroll tax credit. A blank form and a sample. Our experts will help you take advantage of the cares act’s employee retention tax credit They were created by the team at weaver accounting. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Web the ey erc calculator: Web employee retention credit worksheet 1 when will this form become available as part of the 941, i have clients who can qualify for the credit but they did not take a. Web this worksheet is. If paid salary, enter in the salary amount for the rate. Smartbizloans.com has been visited by 10k+ users in the past month Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. The #1 ertc calculator and calculation spreadsheet on the market today. Web ertc is calculated based on the amount. Web use our tax credit estimator to calculate your potential erc amount. Ad our tax professionals can help determine if you qualify for the ertc from the irs. Calculate the maximum ertc employee retention. You could be eligible for a federal. Claim the employee retention credit to get up to $26k per employee. Prior to final approval from you, we have. 3.1k views 3 months ago. Web download our ertc calculation worksheet to streamline your tax credit calculations. Web the federal government established the employee retention credit (erc) to provide a refundable employment tax credit to help businesses with the cost of keeping staff. Our experts will help you take advantage of the cares act’s employee retention tax credit The total qualified wages for 2020 are multiplied by a 50% cap to determine the tax credit amount. Web you can use the ertc & ppp calculator to model 2020 expenses and 2021 expenses. In 2021, the maximum credit per employee is. Save time and ensure accuracy as you work towards maximizing your savings. Ad our tax professionals can help determine if you qualify for the ertc from the irs. The result is the ertc applicable to the. Our experts will help you take advantage of the cares act’s employee retention tax credit Simply download the calculator and save one version for 2020 and one version for. For tax years beginning before january 1, 2023, a qualified small business may elect to. If paid salary, enter in the salary amount for the rate. Ad get a payroll tax refund & receive up to $26k per employee even if you received ppp funds. Multiply each employee’s qualified wages, by quarter, by 50%. The ertc is a refundable payroll tax credit. The #1 ertc calculator and calculation spreadsheet on the market today. Our experts will help you take advantage of the cares act’s employee retention tax credit They were created by the team at weaver accounting. Web the ey erc calculator: Ad our tax professionals can help determine if you qualify for the ertc from the irs. For tax years beginning before january 1, 2023, a qualified small business may elect to. The result is the ertc applicable to the. Web complete order total payment ertc calculator$27 all prices in usd want to determine if you qualify for the employee retention tax credit? Web ertc is calculated based on the amount of qualified wages paid to employees. Our experts will help you take advantage of the cares act’s employee retention tax credit Simply download the calculator and save one version for 2020 and one version for. In 2020, the maximum credit per employee is $5,000. Claim the employee retention credit to get up to $26k per employee.ERC Calculator Tool ERTC Funding

How To Setup the Calculator ERTC & PPP Expense Calculator

2022 PPP & ERTC Overlap Calculation Template DEMO YouTube

Ertc Worksheet Excel

Ertc Worksheet Excel

employee retention credit calculation spreadsheet 2021

Ertc Worksheet Excel

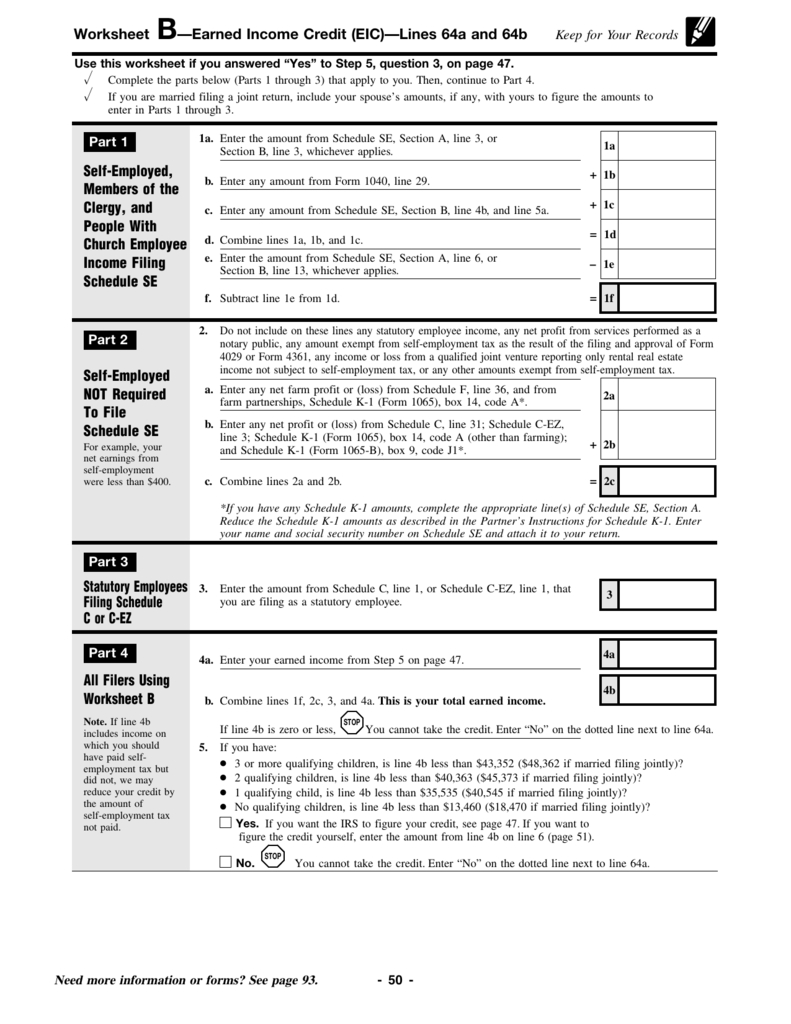

5 Best Images of Printable EIC Worksheet 2015 IRS Earned

Ertc Worksheet Excel

Ertc Worksheet Excel

Smartbizloans.com Has Been Visited By 10K+ Users In The Past Month

Web Calculate Credit And Request Refund Or Abatement.

Prior To Final Approval From You, We Have.

Web Use Our Tax Credit Estimator To Calculate Your Potential Erc Amount.

Related Post: