Fha Rental Income Calculation Worksheet

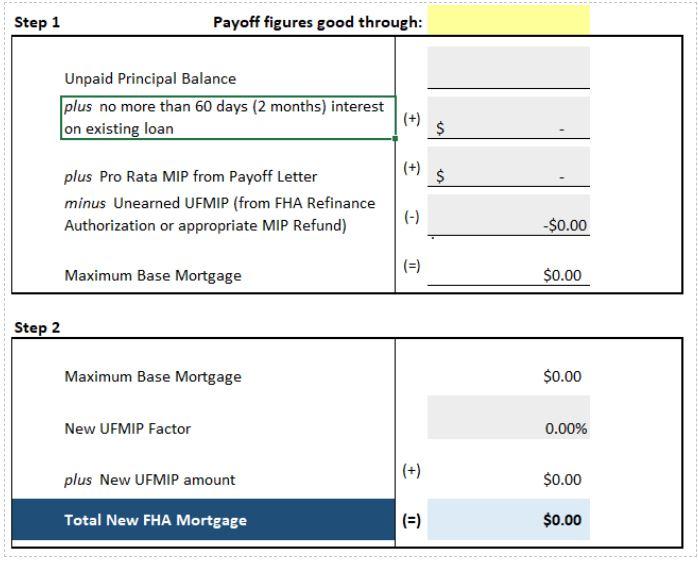

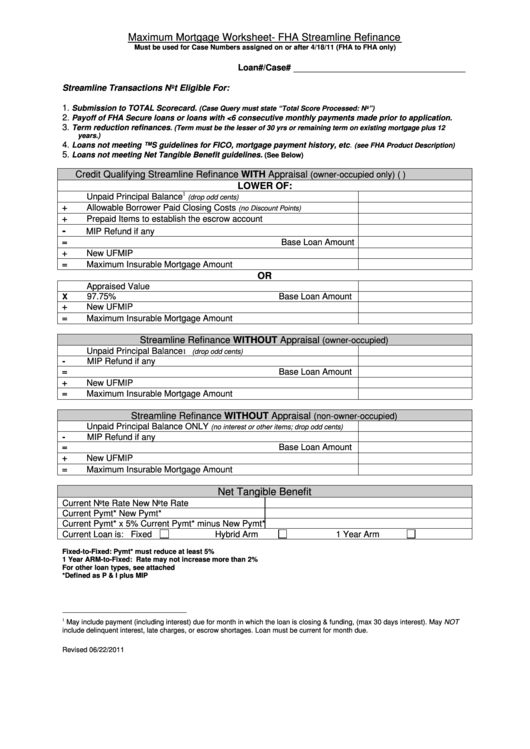

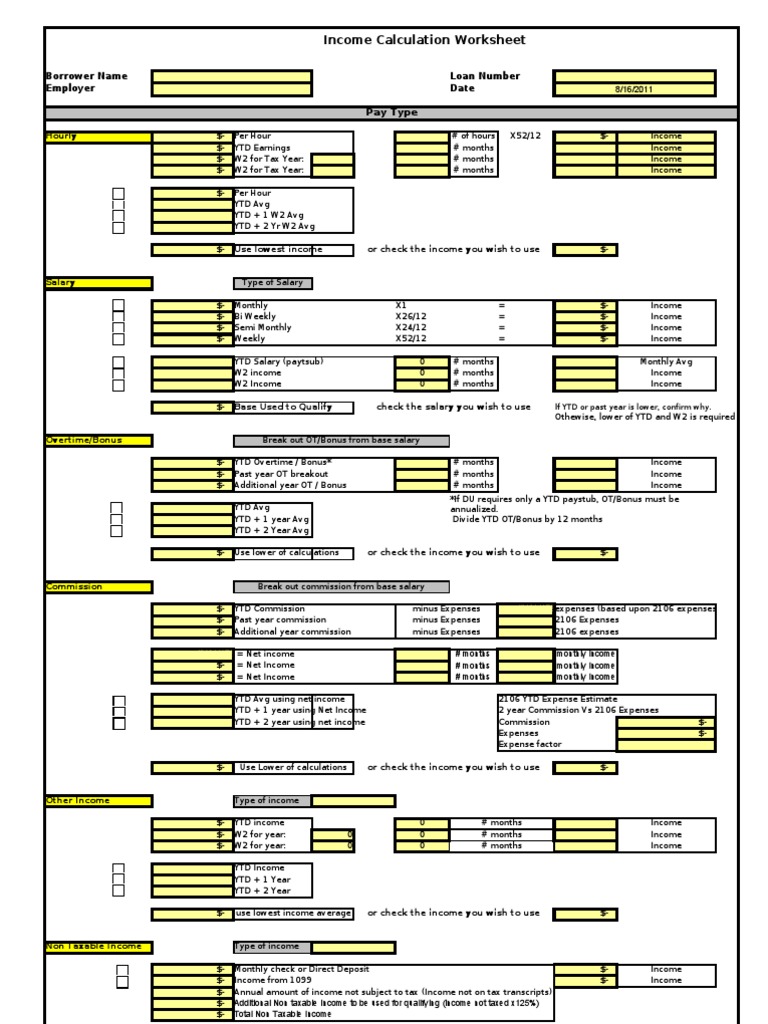

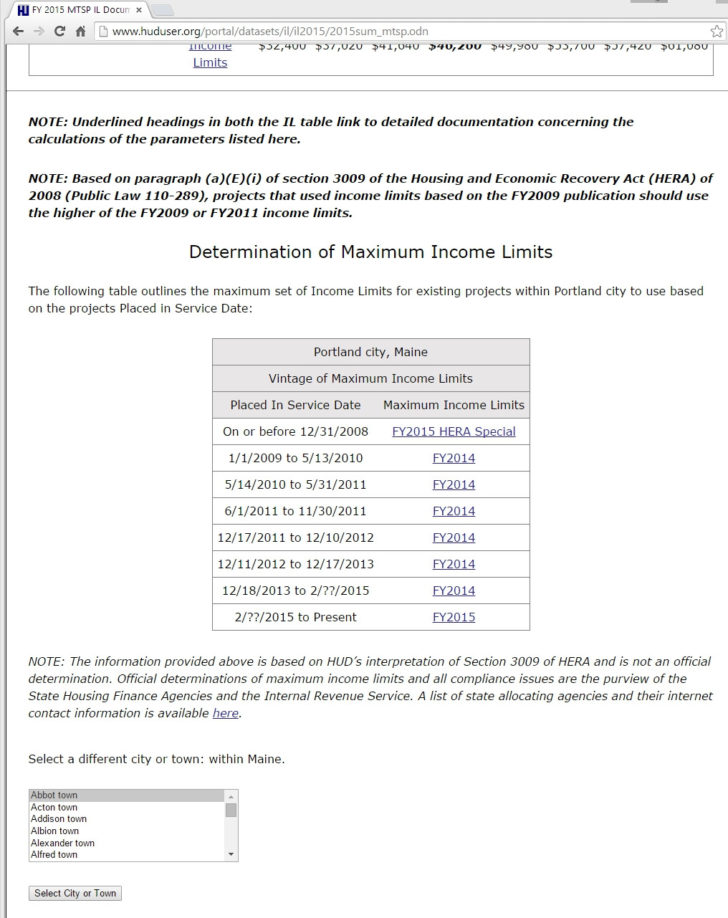

Fha Rental Income Calculation Worksheet - Why rent when you could own? (6) the full amount of student assistance paid directly to the student or to the educational institution; The rental income worksheets are:. A1 enter total rents received. Rental income please use the following calculator and quick reference guide to assist in calculating rental income from irs form 1040. Lease agreement or fannie mae form 1007 or form 1025. Web this form provides a format that can be used to assess assets and anticipated income and calculate part 5 annual income in a home program. Web 10% of the family’s monthly income welfare rent or welfare payment from agency to assist family in paying housing costs. Web this worksheet calculates the gross household income as well as providing for eligible adjustments to determine the amount of rent that the recipient will pay to the landlord,. Web to determine the annual income: Web this worksheet calculates the gross household income as well as providing for eligible adjustments to determine the amount of rent that the recipient will pay to the landlord,. Use of these worksheets is optional. Web 6 mortgage interest (line 12) + 7 taxes (line 16) + 8 other: Schedule e or step 2b: Web to determine the annual income: Why rent when you could own? With a low down payment option, you could buy your own home! The rental income worksheets are:. Web 10% of the family’s monthly income welfare rent or welfare payment from agency to assist family in paying housing costs. A1 enter total rents received. Web calculator and quick reference guide: Whether you subject the piti depends on if. Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30% of monthly adjusted income. A1 enter total rents received. The rental income worksheets are:. Savings, debt, and other expenses could impact the amount you want to spend on rent each. Lease agreement or fannie mae form 1007 or form 1025. Web fannie mae publishes worksheets that lenders may use to calculate rental income. (6) the full amount of student assistance paid directly to the student or to the educational institution; Web fhlmc allows use. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Web this worksheet calculates the gross household income as well as providing for eligible adjustments to determine the amount of rent that the recipient will pay to the landlord,. Or $25.00 minimum rent income and assets hud. With a. Web to determine the annual income: (hoa if applicable) + 9 annual rental income/loss = 10 number of months considered (line 2)* / 11 monthly. Web 6 mortgage interest (line 12) + 7 taxes (line 16) + 8 other: Use of these worksheets is optional. Rental income please use the following calculator and quick reference guide to assist in calculating. Track your rental finances by entering the. Borrowers must still qualify for the mortgage based on income, credit, cash to close, and the projected rents. Web use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up to 4 properties). Rental income please use the following calculator and quick reference. Web calculator and quick reference guide: Web to download the free rental income and expense worksheet template, click the green button at the top of the page. A1 enter total rents received. The rental income worksheets are:. (hoa if applicable) + 9 annual rental income/loss = 10 number of months considered (line 2)* / 11 monthly. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental. Web fhlmc allows use of the rental income using the moi (monthly operating income) on form 998 as the starting point. Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30%. Lease agreement or fannie mae form 1007 or form 1025. Schedule e or step 2b: Web this form provides a format that can be used to assess assets and anticipated income and calculate part 5 annual income in a home program. (hoa if applicable) + 9 annual rental income/loss = 10 number of months considered (line 2)* / 11 monthly.. Borrowers must still qualify for the mortgage based on income, credit, cash to close, and the projected rents. Web rental calculation fha loans rental calculation fha loans when calculating rental income for other real estate you may do it one of three ways: Web 10% of the family’s monthly income welfare rent or welfare payment from agency to assist family in paying housing costs. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Web fannie mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. (hoa if applicable) + 9 annual rental income/loss = 10 number of months considered (line 2)* / 11 monthly. Web 6 mortgage interest (line 12) + 7 taxes (line 16) + 8 other: Web to determine the annual income: Web fannie mae publishes four worksheets that lenders may use to calculate rental income. (6) the full amount of student assistance paid directly to the student or to the educational institution; Rental income please use the following calculator and quick reference guide to assist in calculating rental income from irs form 1040. This calculator shows rentals that fit your budget. A1 enter total rents received. Web calculator and quick reference guide: Savings, debt, and other expenses could impact the amount you want to spend on rent each. The rental income worksheets are:. Or $25.00 minimum rent income and assets hud. Why rent when you could own? Web calculate monthly qualifying rental income (loss) using step 2a: Why rent when you could own? (hoa if applicable) + 9 annual rental income/loss = 10 number of months considered (line 2)* / 11 monthly. Web calculate monthly qualifying rental income (loss) using step 2a: Web this worksheet calculates the gross household income as well as providing for eligible adjustments to determine the amount of rent that the recipient will pay to the landlord,. Rental income please use the following calculator and quick reference guide to assist in calculating rental income from irs form 1040. Web fannie mae publishes worksheets that lenders may use to calculate rental income. Savings, debt, and other expenses could impact the amount you want to spend on rent each. Web rental calculation fha loans rental calculation fha loans when calculating rental income for other real estate you may do it one of three ways: Borrowers must still qualify for the mortgage based on income, credit, cash to close, and the projected rents. Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30% of monthly adjusted income. (6) the full amount of student assistance paid directly to the student or to the educational institution; Use of these worksheets is optional. The rental income worksheets are:. Whether you subject the piti depends on if. Use this job aid to easily compare agency guidelines for determining when you can and cannot use rental. Schedule e or step 2b:Fha Streamline Worksheet 2019 Master of Documents

32 Interest Rate Reduction Refinance Loan Worksheet support worksheet

Rental And Expense Worksheet Pdf 2021 Federal Isaac Sheet

tax worksheet excel

Public Housing Rent Calculation Worksheet —

34 Rental Calculation Worksheet support worksheet

Rental Calculation Worksheet Along with Investment Property

Fha Rate And Term Refinance Worksheet Ivuyteq

15 Beautiful Hud Rent Calculation Worksheet

36 Rental And Expense Worksheet support worksheet

Web Fannie Mae Publishes Four Worksheets That Lenders May Use To Calculate Rental Income.

A1 Enter Total Rents Received.

Web 10% Of The Family’s Monthly Income Welfare Rent Or Welfare Payment From Agency To Assist Family In Paying Housing Costs.

Web Calculator And Quick Reference Guide:

Related Post: