Firefighter Tax Deduction Worksheet

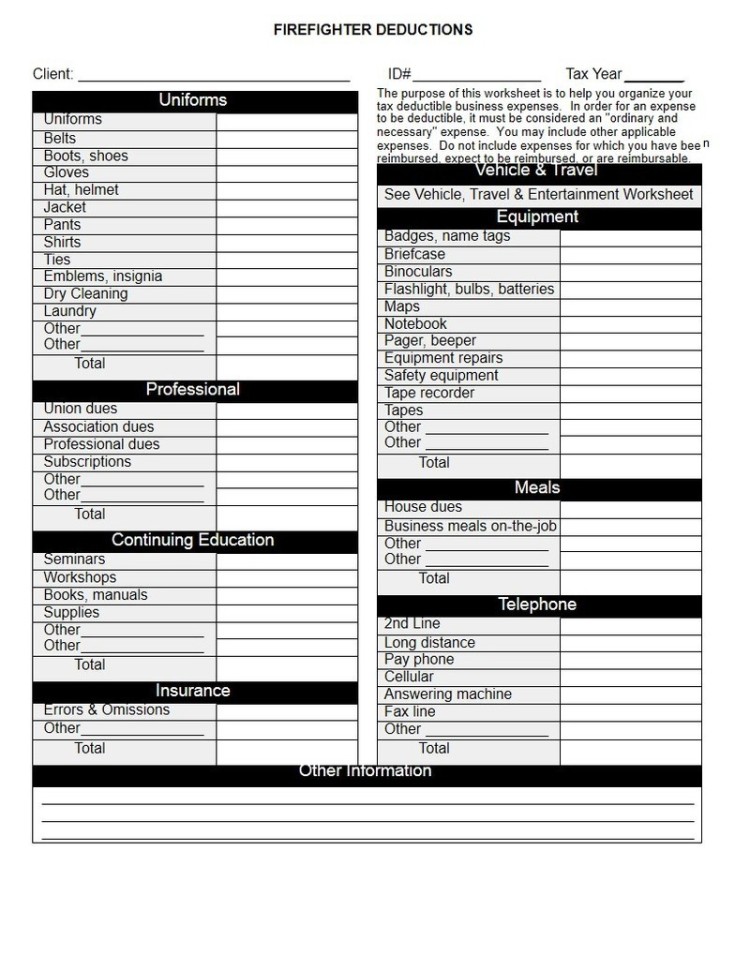

Firefighter Tax Deduction Worksheet - Make sure it’s in your employment contract. Web tax deductions for firefighters worksheet. Web yes, current tax decisions do allow firefighters to deduct the cost of their meals while on shift but to be deductible, the employer must require participation. Fire personnel must be required to contribute to the meal plan as a condition of their employment. Firefightersthis discussion addresses some of the common questions we receiving from fire and their employing organizations. This means you get a $1,000 tax credit, which is. Web firefighter's expense worksheet tax year: Web schedule established under 5 u.s.c. Web retirement the south carolina state firefighters’ association assists in retirement planning for career and volunteer firefighters across the state. Web to be allowable deductions, they also need to total more than 2 percent of your gross income. Web retirement the south carolina state firefighters’ association assists in retirement planning for career and volunteer firefighters across the state. Select the document template you require from our library. Firefightersthis discussion addresses some of the common questions we receiving from fire and their employing organizations. If you expect to claim deductions other than the standard deduction and want to reduce. Web employees hired before that date maybe be tax if them have remained in continuous employment since therefore. An employee (1) whose regular tour of. Anywhere filing status, any age, moreover than yours. Communication expenses cellular phone purchase monthly cellular expenses used for business long. Select the document template you require from our library. Web educational expenses are deductible under either of two conditions: Web retirement the south carolina state firefighters’ association assists in retirement planning for career and volunteer firefighters across the state. An employee (1) whose regular tour of. Web firefighter's expense worksheet tax year: Web irs rules specify that work clothing costs and the cost of maintenance are deductible if: Web schedule established under 5 u.s.c. Select the document template you require from our library. Web yes, current tax decisions do allow firefighters to deduct the cost of their meals while on shift but to be deductible, the employer must require participation. Web to be allowable deductions, they also need to total more than 2 percent of your gross income.. Web to be allowable deductions, they also need to total more than 2 percent of your gross income. Web according to bankrate, you can get a tax savings for up to 50 percent of the first $2,000 you put into such accounts. Web tax deductions for firefighters/paramedics name: Anywhere filing status, any age, moreover than yours. Communication expenses cellular phone. Web according to bankrate, you can get a tax savings for up to 50 percent of the first $2,000 you put into such accounts. However, you may only make itemized deductions or the irs' standard. Web schedule established under 5 u.s.c. Web retirement the south carolina state firefighters’ association assists in retirement planning for career and volunteer firefighters across the. Select the document template you require from our library. Firefightersthis discussion addresses some of the common questions we receiving from fire and their employing organizations. Web firefighter's expense worksheet tax year: Firefighter is required to make payments to a. Web tax deductions for firefighters/paramedics name: If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter. (1) your employer requires the education in order for you to keep your job or rate of pay; Select the document template you require from our library. _____ category amount category amount category amount. Web employees hired before that date maybe be tax if them have remained in continuous employment since therefore. Web explanation of fica tax on volunteer compensation. Web tax deductions for firefighters worksheet. _____ category amount category amount category amount uniforms & upkeep professional fees & dues vehicle expense. Web yes, current tax decisions do allow firefighters to deduct the cost. Web employees hired before that date maybe be tax if them have remained in continuous employment since therefore. Web schedule established under 5 u.s.c. Web explanation of fica tax on volunteer compensation. Direct security of tax refund worksheet; Web educational expenses are deductible under either of two conditions: This means you get a $1,000 tax credit, which is. Web educational expenses are deductible under either of two conditions: Web to be allowable deductions, they also need to total more than 2 percent of your gross income. Web tax deductions for firefighters worksheet. (1) the uniforms are required by your employer (if you’re an employee); Web according to bankrate, you can get a tax savings for up to 50 percent of the first $2,000 you put into such accounts. Web employees hired before that date maybe be tax if them have remained in continuous employment since therefore. However, you may only make itemized deductions or the irs' standard. Web in order for us to maximize your deductions, please complete this worksheet professional fees & dues equipment & repairs. An employee (1) whose regular tour of. Direct security of tax refund worksheet; Firefightersthis discussion addresses some of the common questions we receiving from fire and their employing organizations. 5305, before any deductions and exclusive of additional pay of any other kind. Web irs rules specify that work clothing costs and the cost of maintenance are deductible if: (1) your employer requires the education in order for you to keep your job or rate of pay; Communication expenses cellular phone purchase monthly cellular expenses used for business long. Web explanation of fica tax on volunteer compensation. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions worksheet on page 3 and enter. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2020 tax return and want. Anywhere filing status, any age, moreover than yours. Web employees hired before that date maybe be tax if them have remained in continuous employment since therefore. Web tax deductions for firefighters worksheet. Anywhere filing status, any age, moreover than yours. Make sure it’s in your employment contract. Web according to bankrate, you can get a tax savings for up to 50 percent of the first $2,000 you put into such accounts. An employee (1) whose regular tour of. Web retirement the south carolina state firefighters’ association assists in retirement planning for career and volunteer firefighters across the state. Web irs rules specify that work clothing costs and the cost of maintenance are deductible if: (1) the uniforms are required by your employer (if you’re an employee); Web complete firefighter tax deductions 2019 worksheet within several minutes by following the recommendations below: (1) your employer requires the education in order for you to keep your job or rate of pay; This means you get a $1,000 tax credit, which is. Web explanation of fica tax on volunteer compensation. Web enter in this step the amount from the deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2020 tax return and want. Web yes, current tax decisions do allow firefighters to deduct the cost of their meals while on shift but to be deductible, the employer must require participation. Firefightersthis discussion addresses some of the common questions we receiving from fire and their employing organizations.Tax Deduction Worksheet For Firefighters Worksheet Resume Examples

Trucker Tax Deduction Worksheet Worksheet List

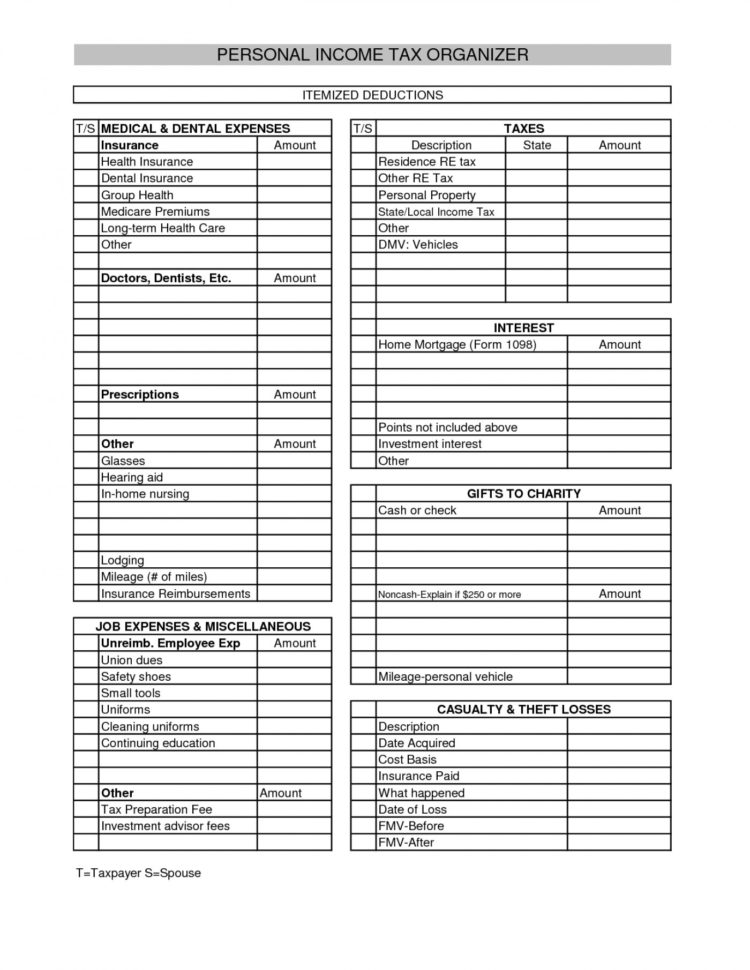

Itemized Deductions Worksheet —

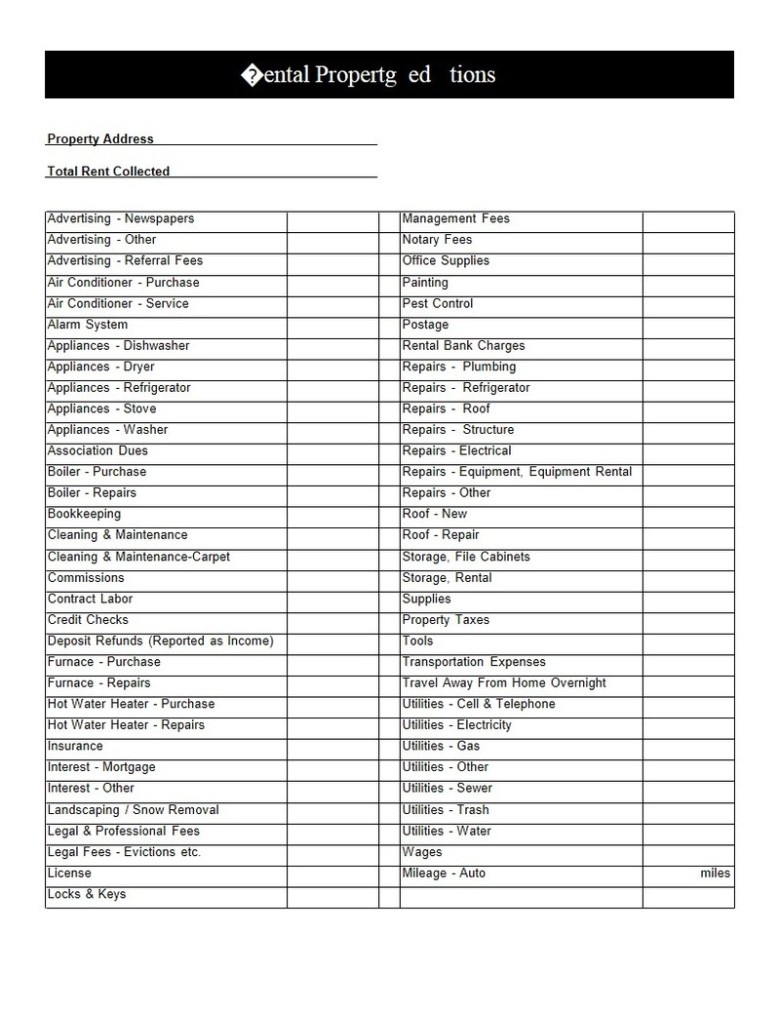

Anchor Tax Service Rental Deductions

How To Make The Most Of Firefighter Tax Deductions In 2018 Vegandivas NYC

Free Firefighter Worksheets Kegiatan untuk anak

How To Make The Most Of Firefighter Tax Deductions In 2018 Vegandivas NYC

How To Make The Most Of Firefighter Tax Deductions In 2018 Vegandivas NYC

Anchor Tax Service Firefighters

Printable Itemized Deductions Worksheet Customize and Print

Check Out How Easy It Is To Complete And Esign Documents Online Using Fillable Templates And A Powerful Editor.

Fire Personnel Must Be Required To Contribute To The Meal Plan As A Condition Of Their Employment.

Firefighter Is Required To Make Payments To A.

Web Firefighter's Expense Worksheet Tax Year:

Related Post: