Flight Attendant Tax Deductions Worksheet

Flight Attendant Tax Deductions Worksheet - We will need the completed “flight deduction organizer”. Last name (as on your ss card) uniform items purchased social security numberairlinebase transportation expenses enter the total amount of payroll. Uniform items transportation expenses computer & related expenses. The 75% of the remaining amount i.e. Web if you are new to flightax, below is a breakdown of the deductions we as flight attendants are allowed. Web flight attendant professional deductions proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) do not provide these to diamond financial;. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem. Income and allowance amounts you need to. United states (english) united states. Deductions allow us to reduce this tax bill slightly, which in turn. Web the airline reimbursed $6000 to you. Web there are two types of deductions for pilots and flight attendants. The second is the per diem. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. Web i am a flight attendant and receive a per diem from my employer. Web if you are new to flightax, below is a breakdown of the deductions we as flight attendants are allowed. However, airline crewmembers fail to take full advantage of thousands in. Web the airline reimbursed $6000 to you. The second is the per diem. The federal government doesn't offer a list of tax deductions specifically for flight attendants. I do not know where i would enter that information. Income and allowance amounts you need to. $1500 (2000*75%) will be allowable per diem deduction on your irs tax form 2106. United states (english) united states. Income and allowance amounts you need to. Web if you are new to flightax, below is a breakdown of the deductions we as flight attendants are allowed. Web flight deductions if you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. We will need the completed “flight deduction organizer”. However, airline crewmembers fail. We will need the completed “flight deduction organizer”. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. Web flight attendant professional deductions proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) do not provide these to diamond financial;. Web there are two types of deductions for pilots and flight attendants. The. I do not know where i would enter that information. Web flight attendant tax deductions worksheet the tax season is on us, and with it comes the search for deductions. Web (including footwear) with a few exceptions, clothing can’t be deducted as a work‐related expense. United states (english) united states. Deductions allow us to reduce this tax bill slightly, which. Web there are two types of deductions for pilots and flight attendants. Web tax deduction worksheet for pilots, flight attendants, & other airline personnel understand this worksheet provides a way for me to organize my deduction information. Web i am a flight attendant and receive a per diem from my employer. First is out of pocket expenses such as uniforms,. Web there are two types of deductions for pilots and flight attendants. Web flight attendant tax deductions worksheet the tax season is on us, and with it comes the search for deductions. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. Web flight attendant professional deductions proofs of expenses are required (receipts, credit or debit. Web flight attendant professional deductions proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) do not provide these to diamond financial;. Web the airline reimbursed $6000 to you. Uniform items transportation expenses computer & related expenses. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. Web tax deduction worksheet for pilots,. Web flight attendant professional deductions proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) do not provide these to diamond financial;. I do not know where i would enter that information. Web flight deductions if you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. You can’t claim the. I do not know where i would enter that information. Deductions allow us to reduce this tax bill slightly, which in turn. You can’t claim the cost to buy, hire, repair or clean conventional clothing you. Income and allowance amounts you need to. $1500 (2000*75%) will be allowable per diem deduction on your irs tax form 2106. Uniform items transportation expenses computer & related expenses. We will need the completed “flight deduction organizer”. However, airline crewmembers fail to take full advantage of thousands in. The second is the per diem. Web why choose crew taxes? The federal government doesn't offer a list of tax deductions specifically for flight attendants. Itemized deductions, also called a schedule a deduction, is the alternative a taxpayer has to using the standard deduction.itemized deductions are. Web flight deductions if you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. The 75% of the remaining amount i.e. Last name (as on your ss card) uniform items purchased social security numberairlinebase transportation expenses enter the total amount of payroll. Web transportation expenses enter the total amount of payroll deducted uniform items. Web list of flight attendant tax deductions. Web flight attendants and pilots have little awareness about tax deductions they are eligible for. The second is the per diem. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. Web flight attendants and pilots have little awareness about tax deductions they are eligible for. Itemized deductions, also called a schedule a deduction, is the alternative a taxpayer has to using the standard deduction.itemized deductions are. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. Web flight deductions if you live in al, ar, ca, hi, ny, mn or pa, your state will allow flight deductions. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. I do not know where i would enter that information. Uniform items transportation expenses computer & related expenses. Web there are two types of deductions for pilots and flight attendants. The second is the per diem. Web tax deduction worksheet for pilots, flight attendants, & other airline personnel understand this worksheet provides a way for me to organize my deduction information. Web there are two types of deductions for pilots and flight attendants. There are two types of deductions for pilots and flight attendants. Web (including footwear) with a few exceptions, clothing can’t be deducted as a work‐related expense. The second is the per diem. —you have the option of taking the standard deduction plus major purchases (auto, boat, rv, aircraft) or providing a total amount of sales tax.Pilot Taxes Pilot Tax Deductions Flight Crew Tax Flight Attendant

Firefighter Tax Deductions Worksheet

39 airline pilot tax deduction worksheet Worksheet Live

All Things Topics All Things Topics English travel vocabulary

321 Learn ESL vocabulary at the airport (Level B1)

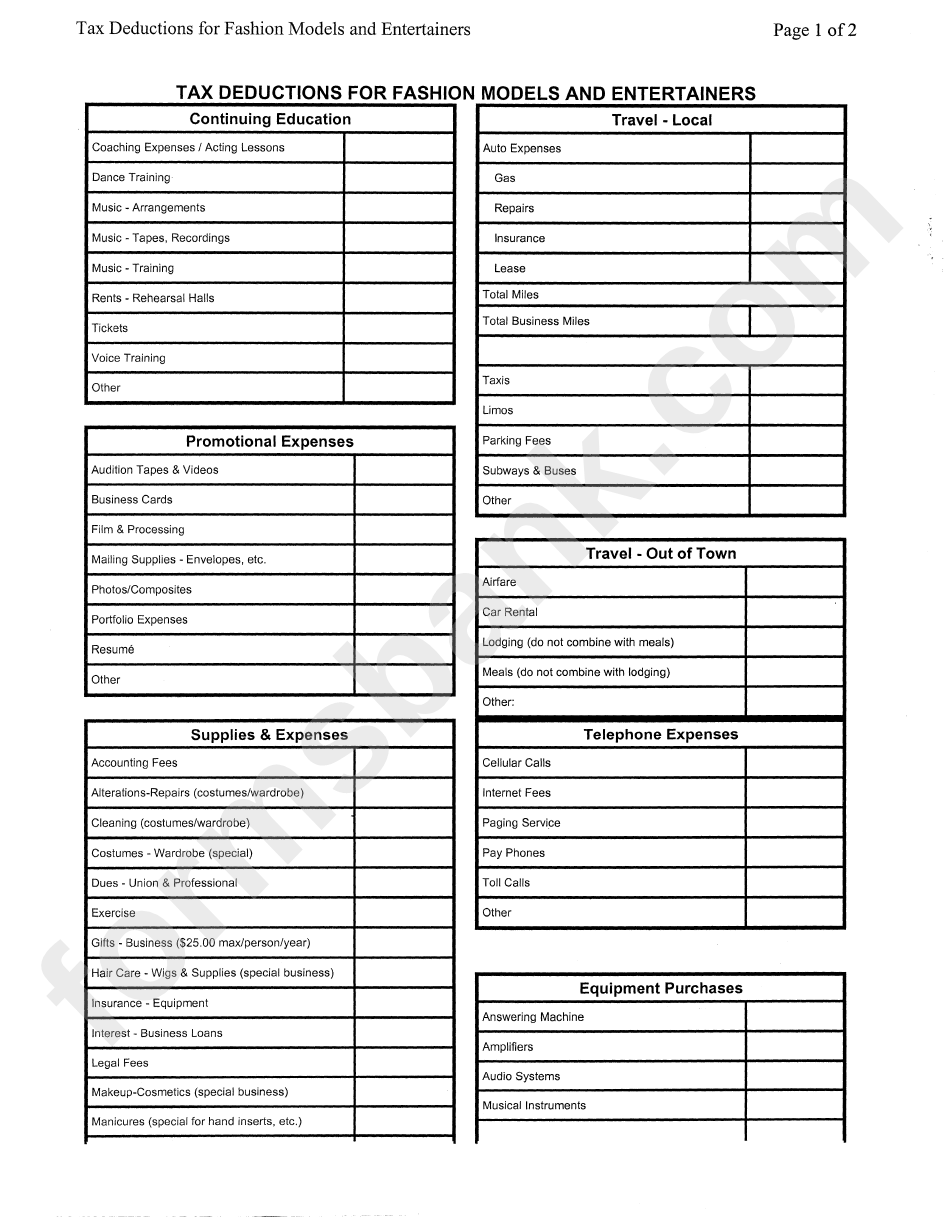

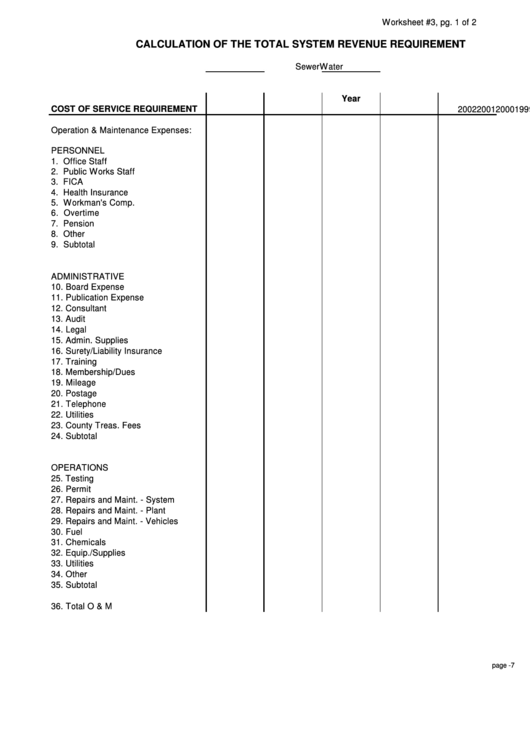

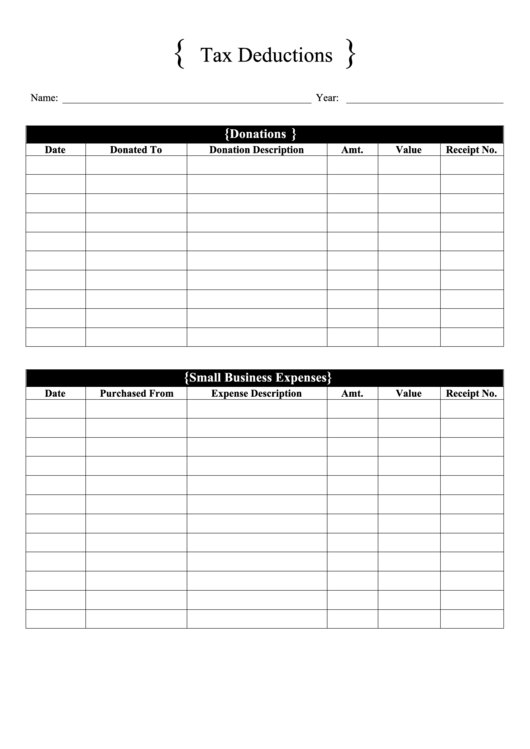

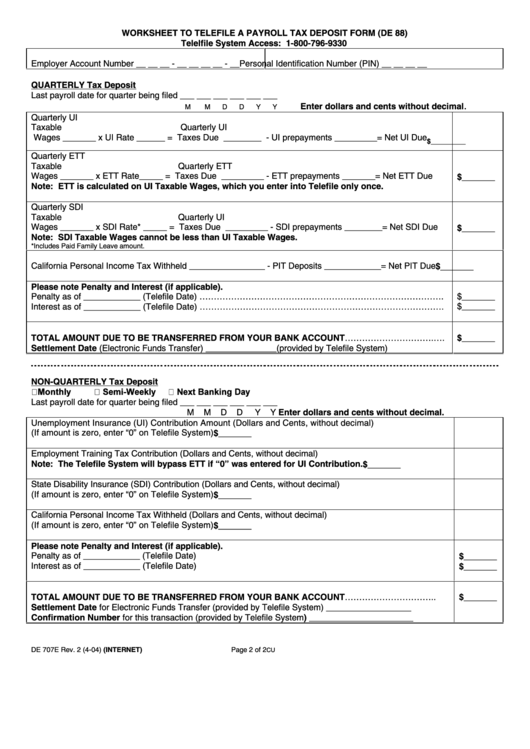

59 Tax Worksheet Templates free to download in PDF

Tax Deductions Tracking Spreadsheet printable pdf download

32 Flight Attendant Tax Deductions Worksheet Worksheet Database 0AE

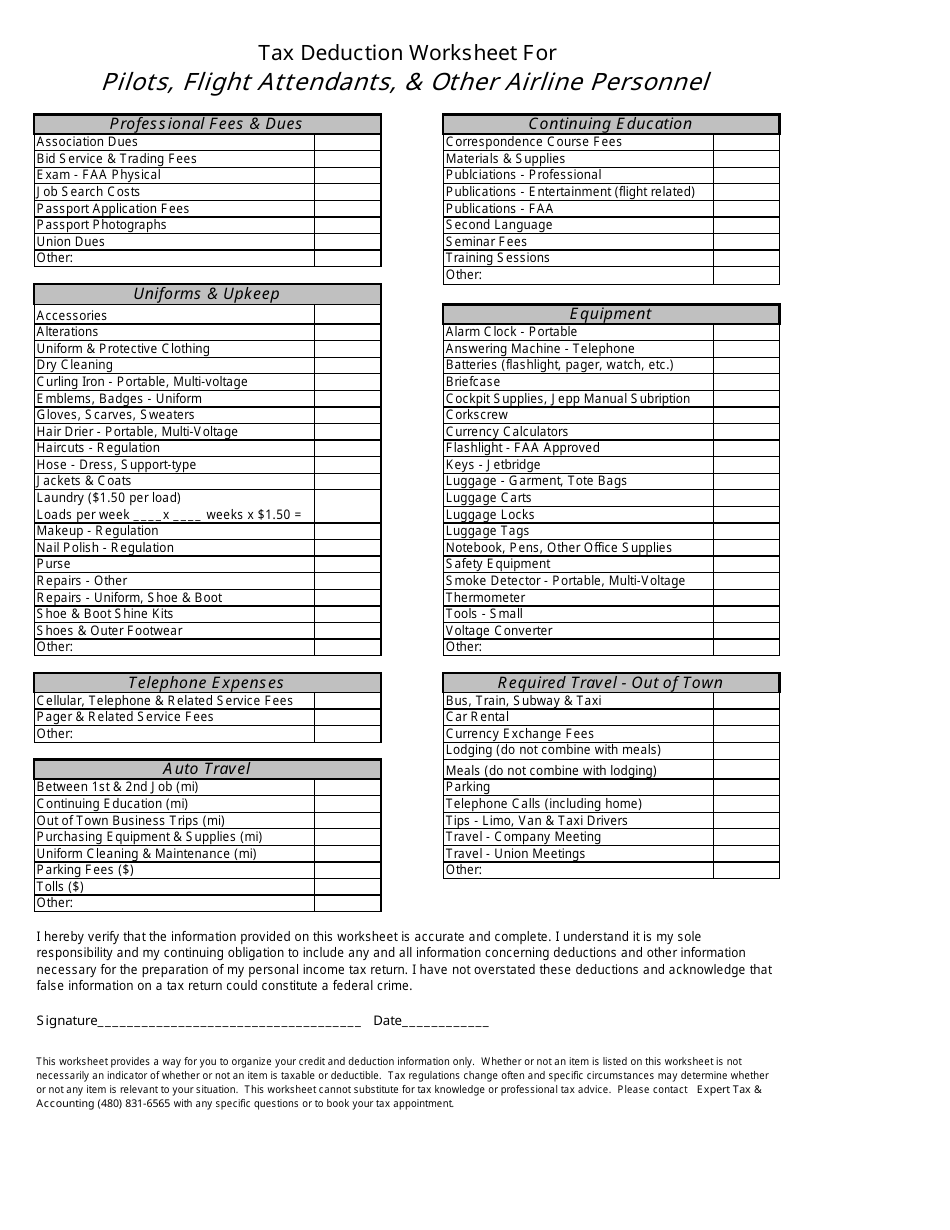

Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline

32 Flight Attendant Tax Deductions Worksheet Worksheet Database 0AE

Web Flight Attendant Tax Deductions Worksheet The Tax Season Is On Us, And With It Comes The Search For Deductions.

Income And Allowance Amounts You Need To.

Web If You Are New To Flightax, Below Is A Breakdown Of The Deductions We As Flight Attendants Are Allowed.

However, The Nature Of Your Employment.

Related Post: