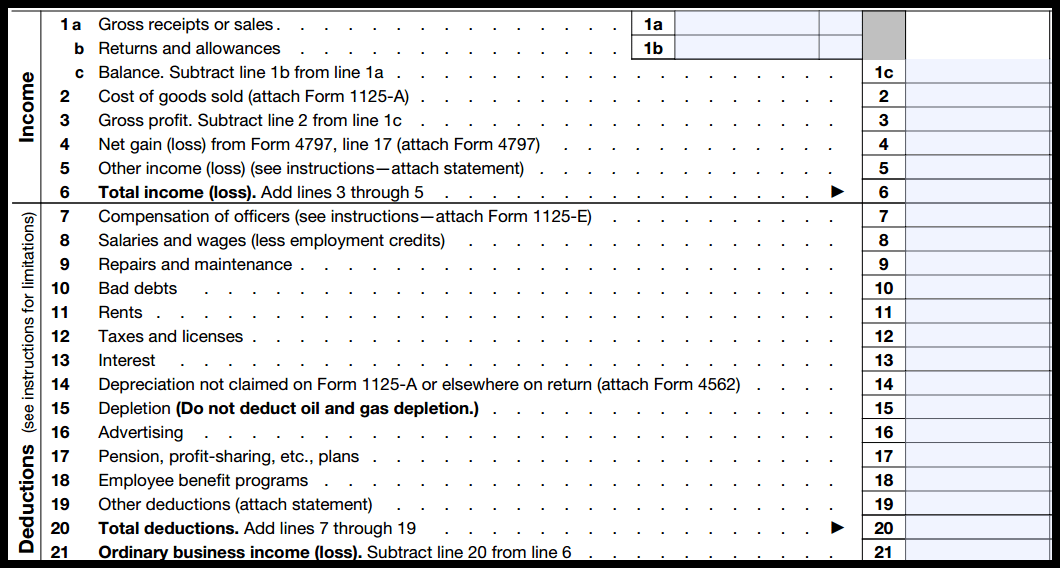

Form 1065 Line 20 Other Deductions Worksheet

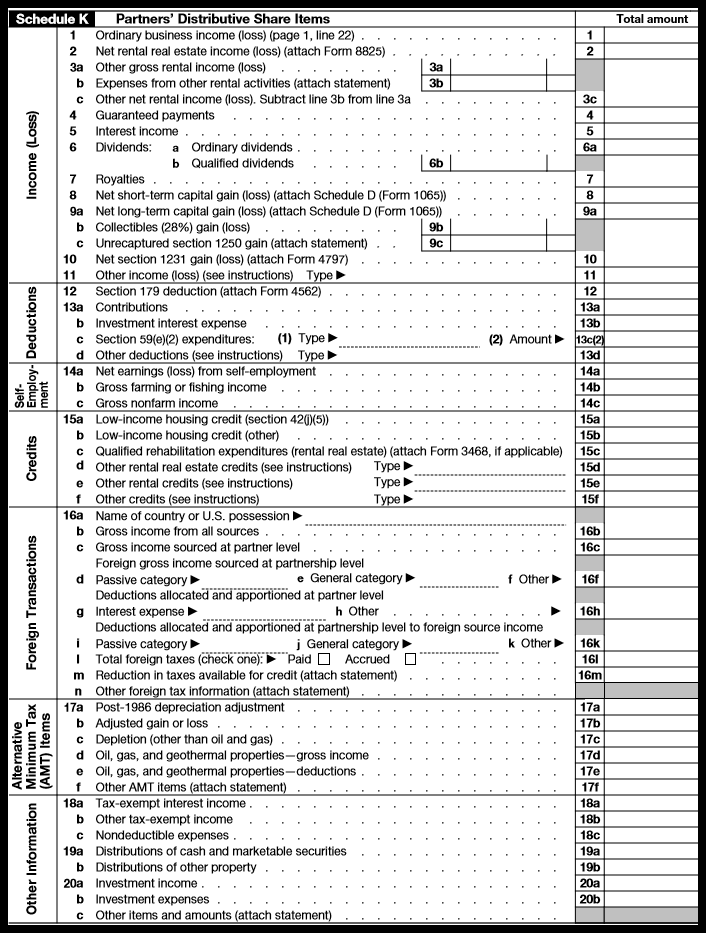

Form 1065 Line 20 Other Deductions Worksheet - Return of partnership income are reported on line 20. Other income reported on form 1065 generally represents income that is not directly related to business receipts. Web general instructions purpose of form who must file entities electing to be taxed as corporations. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. Web • deduction for energy efficient commercial buildings. Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Return of partnership income are reported on line 20. (loss) 28% rate gain worksheet, line 4 9c unrecaptured section 1250. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Return of partnership income are reported on line 20. Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Return of partnership income are reported on line 20. Enter. Web go to www.irs.gov/form1065 for instructions and the latest information. See the schedule 1 (form 1040). Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web • deduction for energy efficient commercial buildings. To enter this information in. Web other deductions or expenses that do not conform to the separate lines for deductions on the form 1065 partnership return are reported on line 20. Return of partnership income are reported on line 20. See the schedule 1 (form 1040). Return of partnership income are reported on line 20. (loss) 28% rate gain worksheet, line 4 9c unrecaptured section. Other income reported on form 1065 generally represents income that is not directly related to business receipts. Web go to www.irs.gov/form1065 for instructions and the latest information. To enter this information in. Attach your own schedule listing by type and amount all allowable deductions related to a trade or business activity only for which there is no. Web other deductions. Web • deduction for energy efficient commercial buildings. Enter the amount in (20b) investment expenses. Return of partnership income are reported on line 20. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. (loss) 28% rate gain worksheet, line 4 9c unrecaptured section 1250. Web general instructions purpose of form who must file entities electing to be taxed as corporations. Return of partnership income are reported on line 20. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. (loss) 28% rate gain worksheet, line 4 9c unrecaptured section 1250. Web other deductions or expenses. (loss) 28% rate gain worksheet, line 4 9c unrecaptured section 1250. Web general instructions purpose of form who must file entities electing to be taxed as corporations. • deduction for film, television, and theatrical production expenses. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership.. Web general instructions purpose of form who must file entities electing to be taxed as corporations. Return of partnership income are reported on line 20. Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Other income reported on form 1065 generally represents income that is not directly. Return of partnership income are reported on line 20. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Return of partnership income are reported on line 20. Web go to www.irs.gov/form1065 for instructions and the latest information. Attach your own schedule listing by type and amount all allowable deductions related. Web other deductions or expenses that do not conform to the separate lines for deductions on the form 1065 partnership return are reported on line 20. Other income reported on form 1065 generally represents income that is not directly related to business receipts. Web go to www.irs.gov/form1065 for instructions and the latest information. Web other deductions or expenses that do. Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Enter the amount in (20b) investment expenses. Other income reported on form 1065 generally represents income that is not directly related to business receipts. To enter this information in. Web general instructions purpose of form who must file entities electing to be taxed as corporations. Attach your own schedule listing by type and amount all allowable deductions related to a trade or business activity only for which there is no. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web go to www.irs.gov/form1065 for instructions and the latest information. Return of partnership income are reported on line 20. • deduction for film, television, and theatrical production expenses. See the schedule 1 (form 1040). (loss) 28% rate gain worksheet, line 4 9c unrecaptured section 1250. Web other deductions or expenses that do not conform to the separate lines for deductions on the form 1065 partnership return are reported on line 20. Return of partnership income are reported on line 20. Web • deduction for energy efficient commercial buildings. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation of a partnership. (loss) 28% rate gain worksheet, line 4 9c unrecaptured section 1250. Web go to www.irs.gov/form1065 for instructions and the latest information. Web payments made on your behalf to an ira, a qualified plan, a simplified employee pension (sep), or a simple ira plan. Web information from schedule k of form 1065 is separated by type of income, deduction, credits, or other information. Return of partnership income are reported on line 20. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web general instructions purpose of form who must file entities electing to be taxed as corporations. Web other deductions or expenses that do not conform to the separate lines for deductions on form 1065 u.s. Web • deduction for energy efficient commercial buildings. Other income reported on form 1065 generally represents income that is not directly related to business receipts. Attach your own schedule listing by type and amount all allowable deductions related to a trade or business activity only for which there is no. Web other deductions or expenses that do not conform to the separate lines for deductions on the form 1065 partnership return are reported on line 20. See the schedule 1 (form 1040). • deduction for film, television, and theatrical production expenses.IRS Form 1120S Definition, Download & Filing Instructions

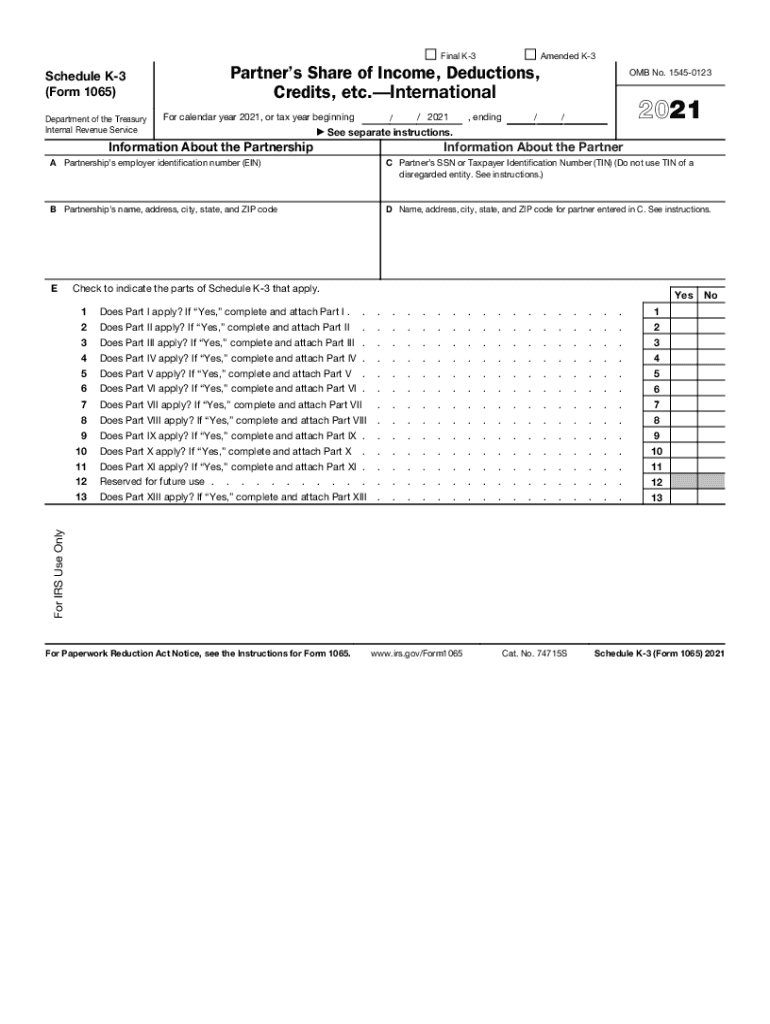

IRS 1065 Schedule K3 20212022 Fill and Sign Printable Template

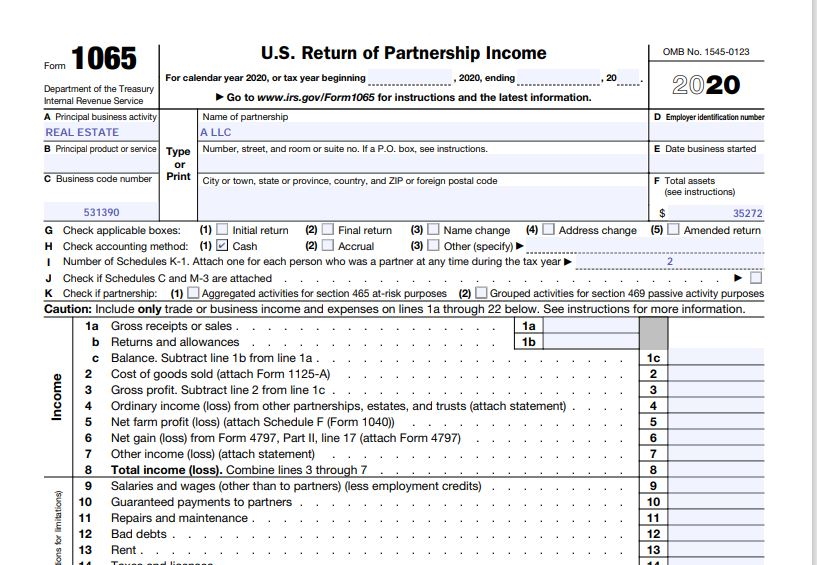

How To Complete Form 1065 US Return of Partnership

Form 1065 Line 20 Other Deductions Worksheet

Form 12 Line 12 12 Facts About Form 12 Line 12 That Will Blow Your Mind

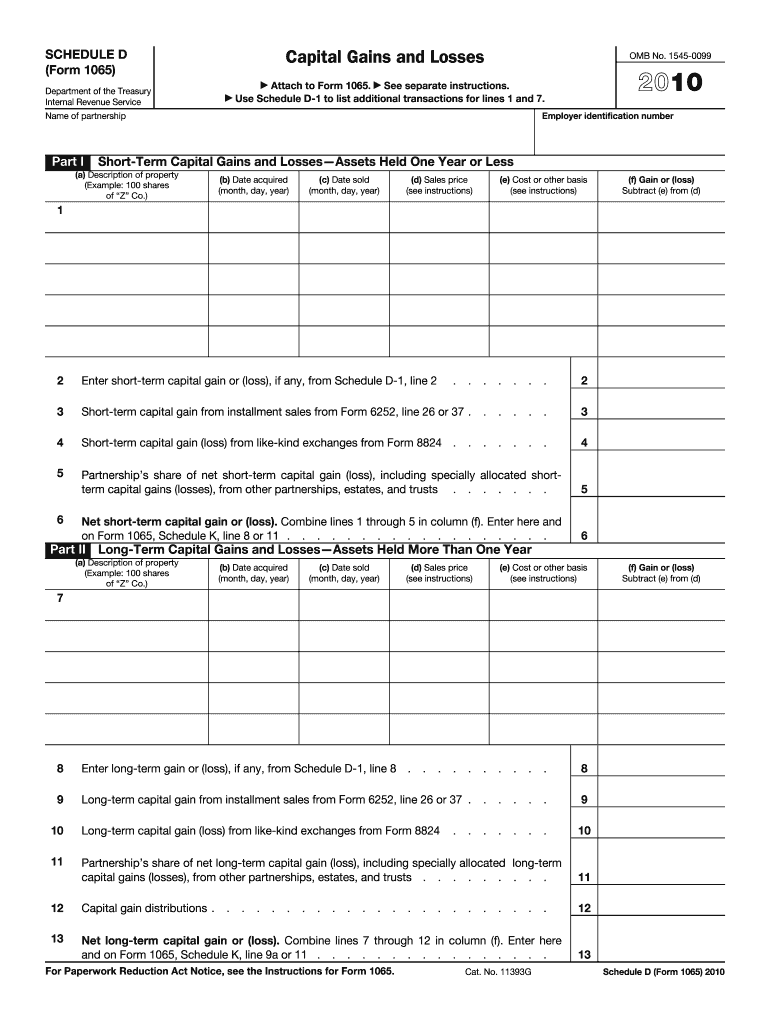

Schedule D Form 1065 Capital Gains and Losses Fill Out and Sign

How to Complete 2020 Form 1065 Nina's Soap

Form 1065 (Schedule D) Capital Gains and Losses (2014) Free Download

1120s Other Deductions Worksheet Promotiontablecovers

Form 1065 Line 20 Other Deductions Worksheet

Form 1065 Is An Information Return Used To Report The Income, Gains, Losses, Deductions, Credits, And Other Information From The Operation Of A Partnership.

Return Of Partnership Income Are Reported On Line 20.

Enter The Amount In (20B) Investment Expenses.

To Enter This Information In.

Related Post: