Form 5471 Worksheet A

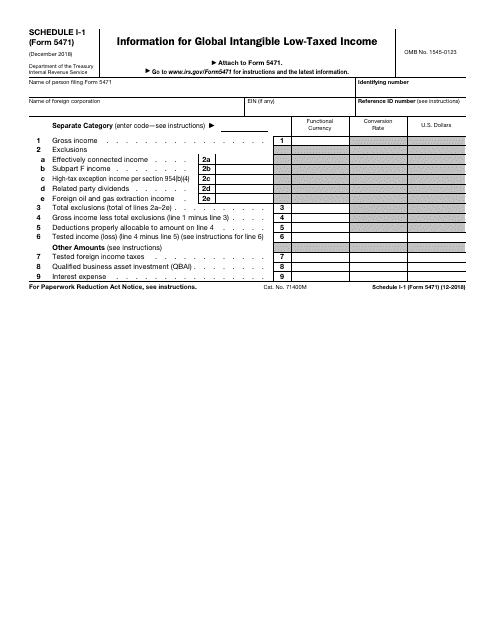

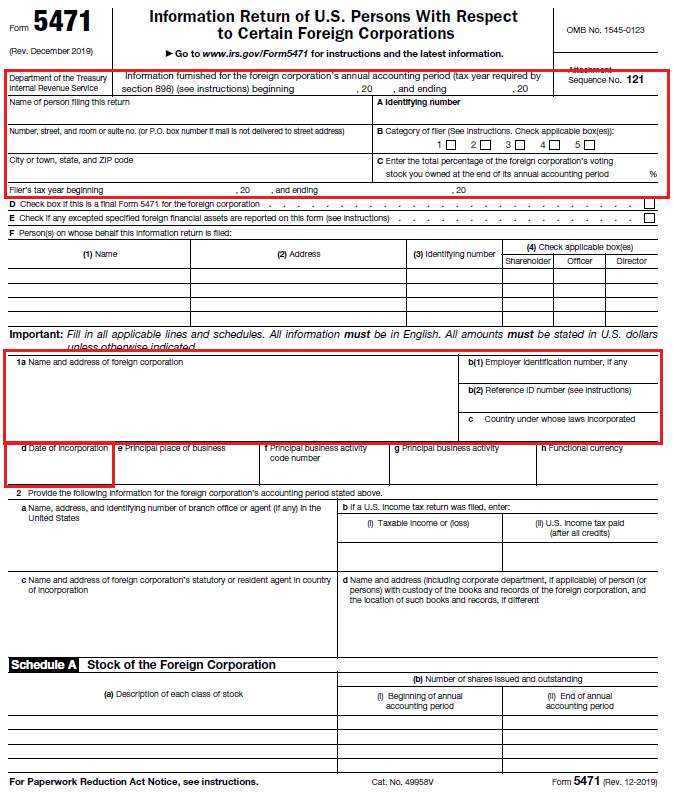

Form 5471 Worksheet A - Penalties for the failure to file a form 547. The form 5471 is becoming an increasingly important form for any us taxpayers in the world with interest in a foreign corporation. Enter all dollar amounts in this section in functional currency. Web today we're going to speak a little bit about the form 5471, which has to deal with foreign corporations and controlled foreign corporations. Web to generate form 5471: The form and schedules are used to satisfy. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b,. This is available in the following tax types:. Go to the section, miscellaneous forms, and then go to the screen, information of u.s. Web changes to form 5471. Persons with respect to certain foreign corporations. Ca health & safety code § 11471 (2017) property subject to forfeiture under this division may be seized by any. The form and schedules are used to satisfy. This is available in the following tax types:. Web form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b,. Web today we're going to speak a little bit about the form 5471, which has to deal with foreign corporations and controlled foreign corporations. Persons who are officers, directors. Web changes to. Web changes to form 5471. Web california health and safety code section 11471. Form 5471 is used by certain u.s. Persons who are officers, directors, or shareholders in certain foreign corporations. Web to generate form 5471: Use this section to enter information specific to worksheet a from the form 5471 instructions. This is available in the following tax types:. The form 5471 is becoming an increasingly important form for any us taxpayers in the world with interest in a foreign corporation. December 2021) department of the treasury internal revenue service. Enter all dollar amounts in this. Just to give a little bit of. Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. Web how do i produce form 5471 worksheet a in individual tax using interview forms? Click add to create a copy of the form where the information can be. Persons. Web california health and safety code section 11471. Web form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Web form 5471 form 5471: Just to give a little bit of. This is available in the following tax types:. Enter all dollar amounts in this section in functional currency. Persons with respect to certain foreign corporations. Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. Persons who are officers, directors, or shareholders in certain foreign corporations. Form 5471 is used by certain u.s. Web to generate form 5471: Web changes to form 5471. Use this section to enter information specific to worksheet a from the form 5471 instructions. Go to the section, miscellaneous forms, and then go to the screen, information of u.s. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and. Web form 5471 form 5471: Web today we're going to speak a little bit about the form 5471, which has to deal with foreign corporations and controlled foreign corporations. The form and schedules are used to satisfy. Persons who are officers, directors. Enter all dollar amounts in this section in functional currency. Persons with respect to certain foreign corporations. Use this section to enter information specific to worksheet a from the form 5471 instructions. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b,. Enter all dollar amounts in this section in functional currency.. Click add to create a copy of the form where the information can be. Form 5471 is used by certain u.s. Web today we're going to speak a little bit about the form 5471, which has to deal with foreign corporations and controlled foreign corporations. Persons with respect to certain foreign corporations. Web form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Penalties for the failure to file a form 547. Persons with respect to certain foreign corporations. Shareholder’s pro rata share of subpart f income of a cfc (see the. Ca health & safety code § 11471 (2017) property subject to forfeiture under this division may be seized by any. Persons who are officers, directors. This is available in the following tax types:. Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. Persons with respect to foreign corp worksheet. Web changes to form 5471. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a, 1b,. Web california health and safety code section 11471. Persons who are officers, directors, or shareholders in certain foreign corporations. Web form 5471 form 5471: Web to generate form 5471: It is completely illogical that proseries went to the huge trouble of implementing form 5471 without also implementing form 8992. Just to give a little bit of. The form 5471 is becoming an increasingly important form for any us taxpayers in the world with interest in a foreign corporation. This is available in the following tax types:. Web changes to form 5471. Persons who are officers, directors. Web form 5471 and appropriate accompanying schedules must be completed and filed by the following categories of persons: Web internal revenue service (irs) form 5471 is required by us person shareholders, directors, and officers of international/foreign corporations who have an ownership. December 2021) department of the treasury internal revenue service. Enter all dollar amounts in this section in functional currency. Web california health and safety code section 11471. Persons with respect to certain foreign corporations. Click add to create a copy of the form where the information can be. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Web form 5471 form 5471: The form and schedules are used to satisfy. Persons with respect to certain foreign corporations.form 5471 schedule i1 instructions Fill Online, Printable, Fillable

5471 Worksheet A

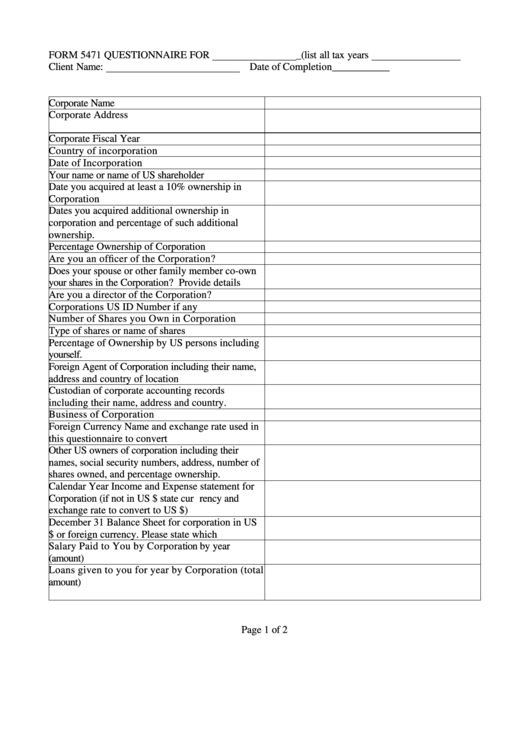

60 INFO FORM 5471 QUESTIONNAIRE CDR DOWNLOAD ZIP PRINTABLE DOCX

5471 Worksheet A

5471 Worksheet A

What is a Dormant Foreign Corporation?

5471 Worksheet A

Worksheet A Form 5471 Irs Tripmart

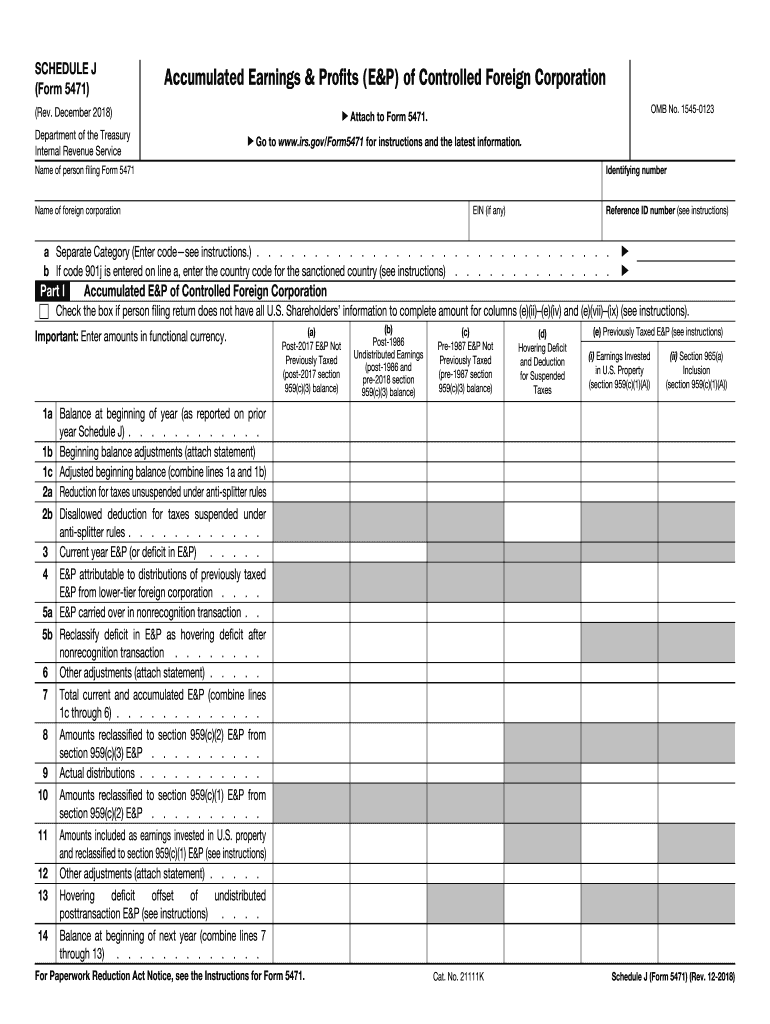

2018 Form IRS 5471 Schedule J Fill Online, Printable, Fillable, Blank

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Go To The Section, Miscellaneous Forms, And Then Go To The Screen, Information Of U.s.

Persons With Respect To Foreign Corp Worksheet.

Persons With Respect To Certain Foreign Corporations.

Web How Do I Produce Form 5471 Worksheet A In Individual Tax Using Interview Forms?

Related Post: