Form 8582 Worksheet

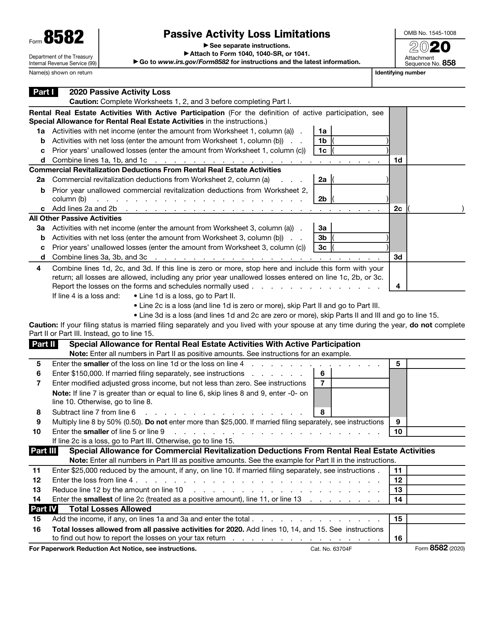

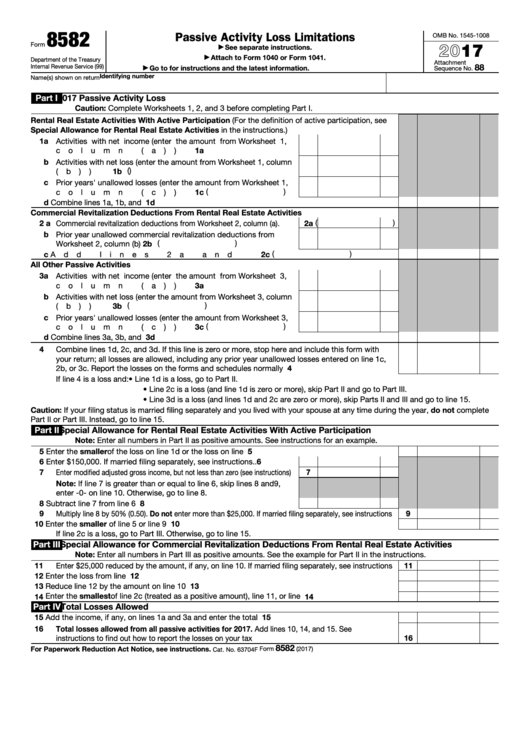

Form 8582 Worksheet - Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures for the wks magi, a worksheet that determines the modified adjusted gross. Medical examinations (conducted by a physician) in compliance with nfpa 1582. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. Web 5,565 bookmark icon view2 new member if you have an overall loss when you combine the income and losses, don’t use the worksheets or form 8582 for the activity. This article will help you: Enter name(s) as shown on tax return. $8,225 of activity b’s schedule e. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Web we last updated the passive activity loss limitations in december 2022, so this. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Enter the unallowed losses for the prior years for each activity. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). You can download or print current. Web up to $40 cash back fill now. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). $8,225 of activity b’s schedule. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Medical examinations (conducted by a physician) in compliance with nfpa 1582. Enter the unallowed losses for the prior years for each activity. This article will help you: $8,225 of activity b’s schedule e. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Medical examinations (conducted by a physician) in compliance with nfpa 1582. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Web up to $40 cash back fill now.. Web up to $40 cash back fill now. Enter name(s) as shown on tax return. This article will help you: Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see. $8,225 of activity b’s schedule e. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line. Enter name(s) as shown on tax return. An irs tax form used by organizations to report the sale or disposition of. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Enter name(s) as shown on tax return. Web 5,565 bookmark icon view2 new member if you have an overall loss when. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Enter the unallowed losses for the prior years for each activity. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line. Web form. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line. An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. Enter name(s) as shown on tax. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line. Web up to $40 cash back fill now. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Medical examinations (conducted by a physician) in compliance with nfpa 1582. Enter the unallowed losses for the prior years for each activity. Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). Web the only data entry point for form 8582 is the 8582 screen, which allows you to override figures for the wks magi, a worksheet that determines the modified adjusted gross. This article will help you: You can download or print current. Web 5,565 bookmark icon view2 new member if you have an overall loss when you combine the income and losses, don’t use the worksheets or form 8582 for the activity. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. $8,225 of activity b’s schedule e. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Enter name(s) as shown on tax return. Web form 8582 (2006) worksheet 1—for form 8582, lines 1a, 1b, and 1c (see pages 7 and 8 of the instructions.) current year prior years overall gain or loss (c) unallowed loss (line. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Enter the unallowed losses for the prior years for each activity. All forms individual forms information returns fiduciary reporting entity returns transfer taxes employment (payroll). This article will help you: Form 8582, passive activity loss limitations is used to calculate the amount of any passive activity loss that a taxpayer. Web form 8582 must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities. You find these amounts on worksheet 5, column (c), of your 2017 form 8582. An irs tax form used by organizations to report the sale or disposition of donated property to the irs and to. Web we last updated the passive activity loss limitations in december 2022, so this is the latest version of form 8582, fully updated for tax year 2022. Medical examinations (conducted by a physician) in compliance with nfpa 1582. Web worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). Web up to $40 cash back fill now. $8,225 of activity b’s schedule e.IRS Form 8582 Download Fillable PDF or Fill Online Passive Activity

Form 8582 Passive Activity Loss Limitations (2014) Free Download

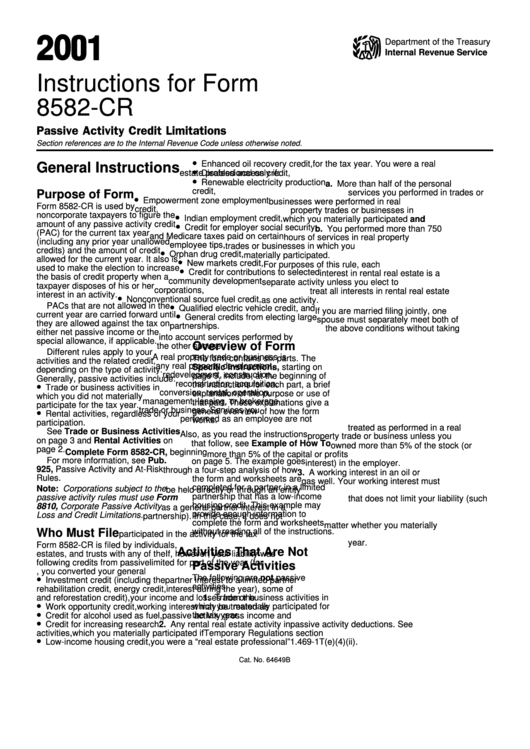

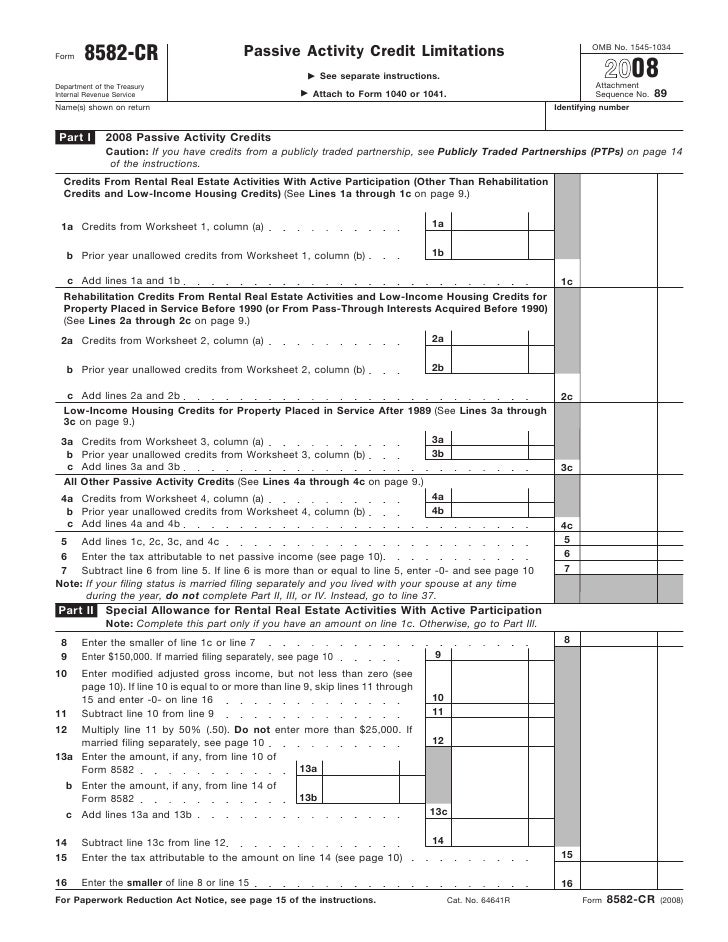

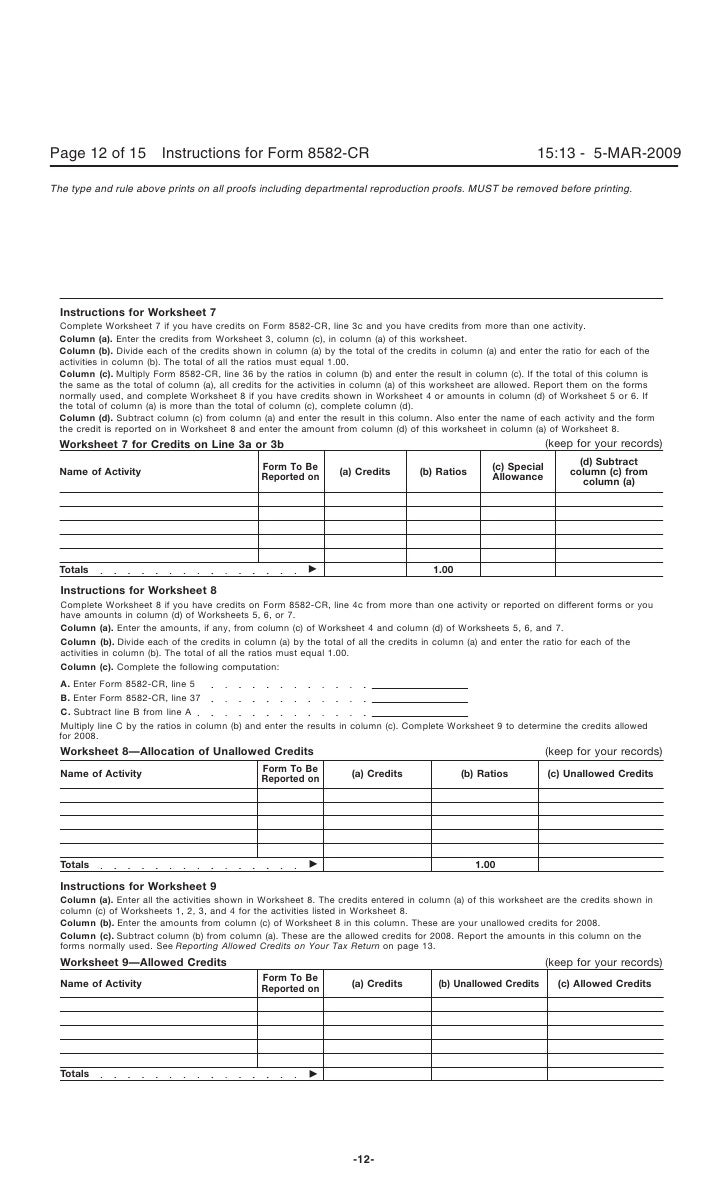

Instructions For Form 8582Cr Passive Activity Credit Limitations

Form 8582CR Passive Activity Credit Limitations (2012) Free Download

Instructions for Form 8582CR (12/2019) Internal Revenue Service

Form 8582 Passive Activity Loss Limitations (2014) Free Download

Fillable Form 8582 Passive Activity Loss Limitations 2017 printable

Form 8582Passive Activity Loss Limitations

Form 8582CR Passive Activity Credit Limitations

Instructions for Form 8582CR, Passive Activity Credit Limitations

Web The Only Data Entry Point For Form 8582 Is The 8582 Screen, Which Allows You To Override Figures For The Wks Magi, A Worksheet That Determines The Modified Adjusted Gross.

Web 5,565 Bookmark Icon View2 New Member If You Have An Overall Loss When You Combine The Income And Losses, Don’t Use The Worksheets Or Form 8582 For The Activity.

You Can Download Or Print Current.

Enter Name(S) As Shown On Tax Return.

Related Post: