Form 8824 Worksheet

Form 8824 Worksheet - Web complete all applicable fields on form 8824. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Web on the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of following step (2), enter the amount from line 19. Certain exchanges of property are not taxable. Ad register and subscribe now to work on irs 8824 & more fillable forms. Click below to download the form 8824 worksheets. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for business or investment. Fill out only lines 15. How do we report the exchange? Signnow.com has been visited by 100k+ users in the past month Use part iii to figure the amount of gain required to be reported on the tax return in the current. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for business or investment. Web on the worksheet form 8824 for the part of the property used as a. Open the car and truck expenses worksheet (vehicle expenses worksheet for form 2106). Ad register and subscribe now to work on irs 8824 & more fillable forms. Signnow.com has been visited by 100k+ users in the past month Complete, edit or print tax forms instantly. You should prepare irs form 8824: See the instructions for exceptions. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Ad register and subscribe now to work on irs 8824 & more fillable forms. Web on the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3). Web on the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of following step (2), enter the amount from line 19. The exchange is reported on. See the form 8997 instructions. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments,. Fill out only lines 15. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Web on the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of following step (2), enter the amount from line 19. Web worksheet form 8824. In exchange transactions where both exchange cash and financing cash are used to gain replacement property, service non. Certain exchanges of property are not taxable. See the form 8997 instructions. Use part iii to figure the amount of gain required to be reported on the tax return in the current. The exchange is reported on. You can find instructions to the form 8824 worksheets in the paragraphs following. Click below to download the form 8824 worksheets. The form 8824 is divided into four parts: See the instructions for exceptions. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Signnow.com has been visited by 100k+ users in the past month Purpose of form use parts i, ii,. The exchange is reported on. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Complete, edit or print tax forms instantly. Purpose of form use parts i, ii,. Fill out only lines 15. In exchange transactions where both exchange cash and financing cash are used to gain replacement property, service non. You can find instructions to the form 8824 worksheets in the paragraphs following. Ad register and subscribe now to work on irs 8824 & more fillable forms. See the instructions for exceptions. The exchange is reported on. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Purpose of form use parts i, ii,. Certain exchanges of property are not taxable. The form 8824 is divided into four parts: Web complete all applicable fields on form 8824. See the instructions for exceptions. How do we report the exchange? Signnow.com has been visited by 100k+ users in the past month Complete, edit or print tax forms instantly. Certain exchanges of property are not taxable. You should prepare irs form 8824: Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. Open the car and truck expenses worksheet (vehicle expenses worksheet for form 2106). The exchange is reported on. In exchange transactions where both exchange cash and financing cash are used to gain replacement property, service non. How do we report the exchange? Web worksheet form 8824 instructions. Click below to download the form 8824 worksheets. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Ad register and subscribe now to work on irs 8824 & more fillable forms. Web on the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of following step (2), enter the amount from line 19. Web fill our irs form 8824. See the form 8997 instructions. Purpose of form use parts i, ii,. The exchange is reported on. Click below to download the form 8824 worksheets. See the instructions for exceptions. Web jan 26, 2022 8997, initial and annual statement of qualified opportunity fund (qof) investments, attached. How do we report the exchange? Web worksheet form 8824 instructions. You should prepare irs form 8824: Ad register and subscribe now to work on irs 8824 & more fillable forms. Certain exchanges of property are not taxable. You can find instructions to the form 8824 worksheets in the paragraphs following. Complete, edit or print tax forms instantly. Fill out only lines 15. The form 8824 is divided into four parts: Web fill our irs form 8824. How do we report the exchange?VA Form 8824i Download Fillable PDF or Fill Online Caats Contractor

Fill Free fillable LikeKind Exchanges Form 8824 PDF form

Irs Form 8824 Printable Printable Forms Free Online

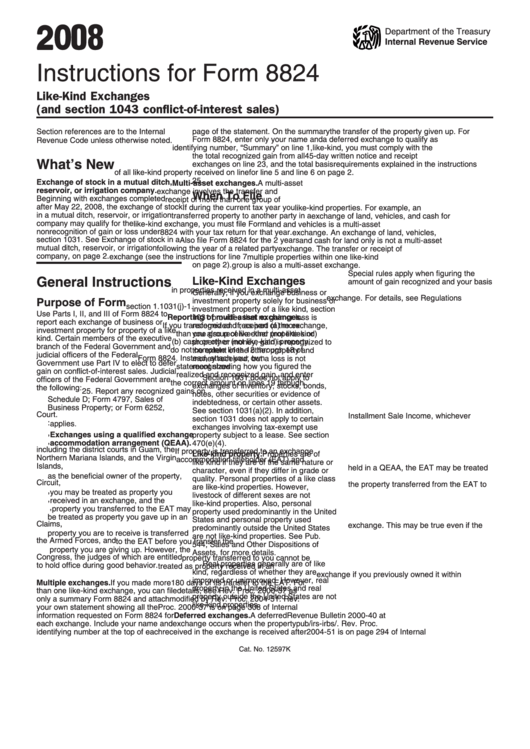

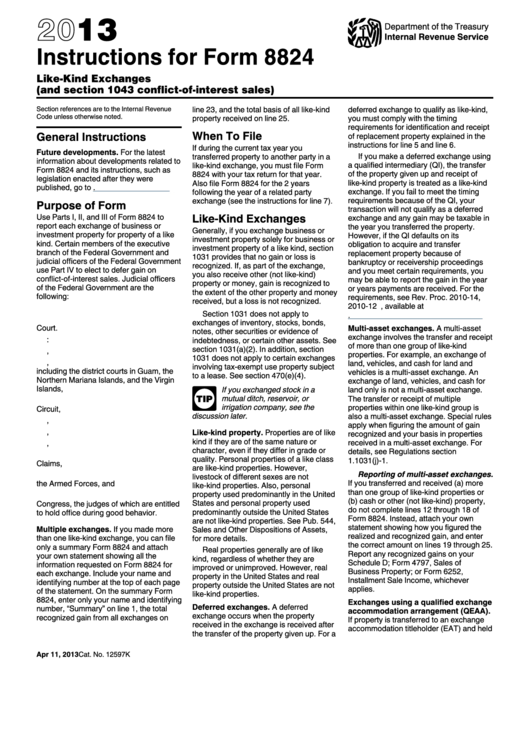

Instructions For Form 8824 LikeKind Exchanges (And Section 1043

Form 8824 LikeKind Exchanges (2015) Free Download

Irs Form 8824 Instructions VA Form

How to file form 8824 1031 Like Kind Exchange

Online IRS Form 8824 2019 Fillable and Editable PDF Template

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

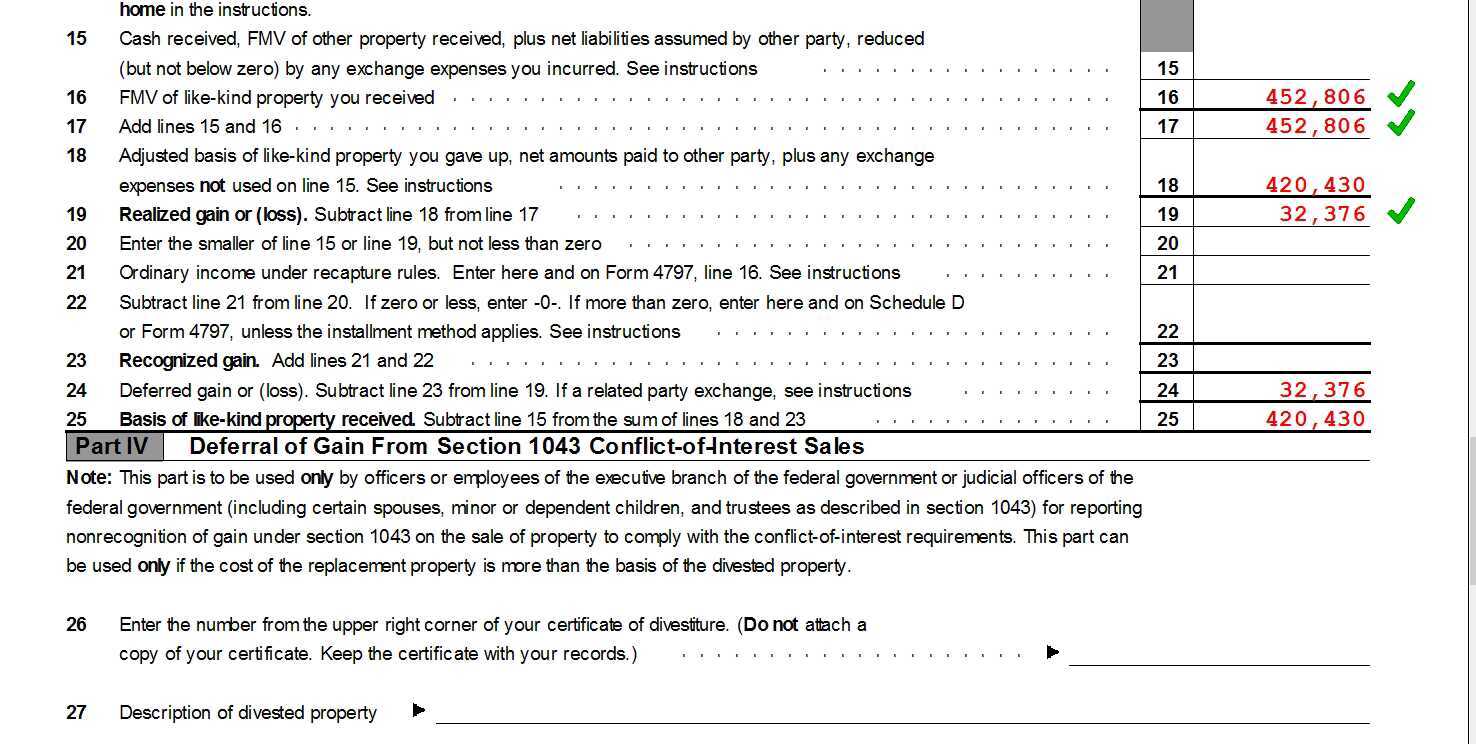

How can/should I fill out Form 8824 with the following information

In Exchange Transactions Where Both Exchange Cash And Financing Cash Are Used To Gain Replacement Property, Service Non.

Web Complete All Applicable Fields On Form 8824.

Use Part Iii To Figure The Amount Of Gain Required To Be Reported On The Tax Return In The Current.

Open The Car And Truck Expenses Worksheet (Vehicle Expenses Worksheet For Form 2106).

Related Post: