Form 8829 Line 11 Worksheet

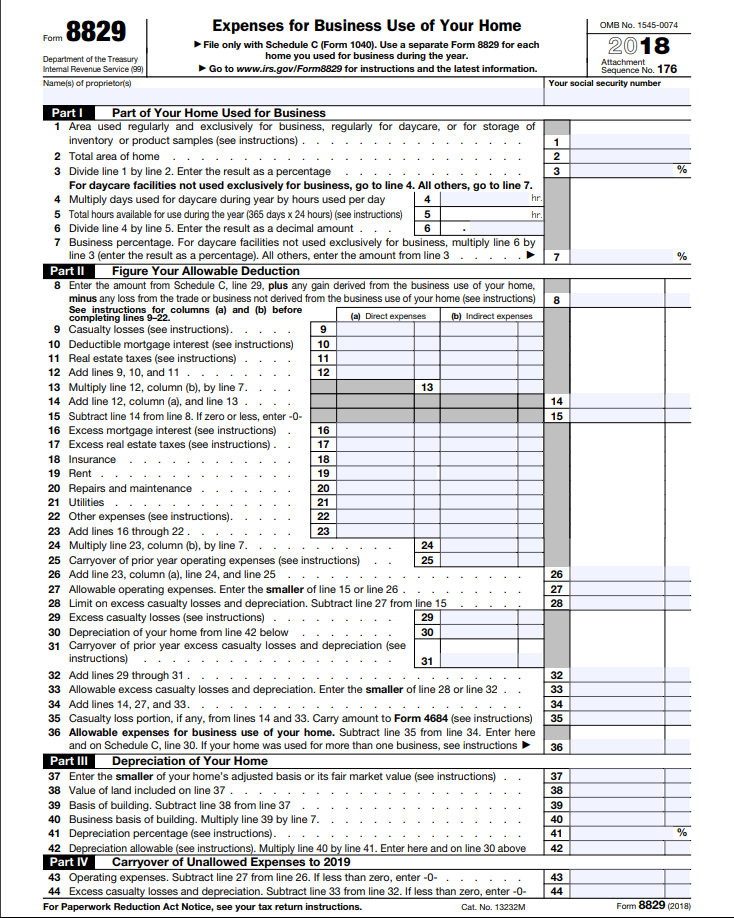

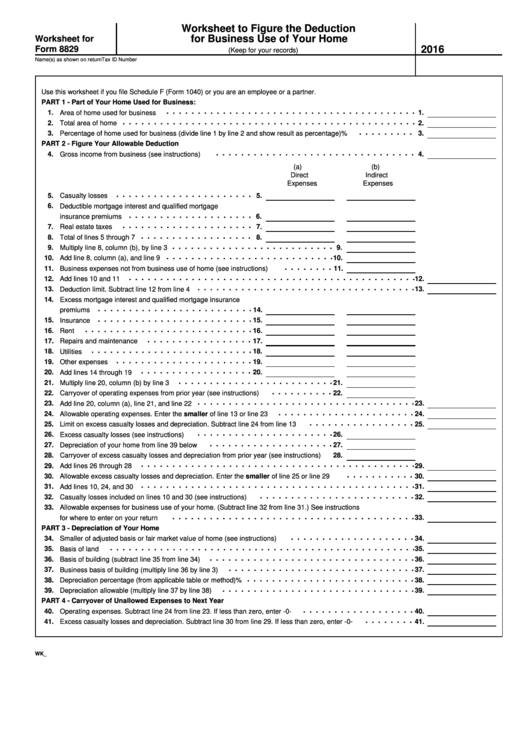

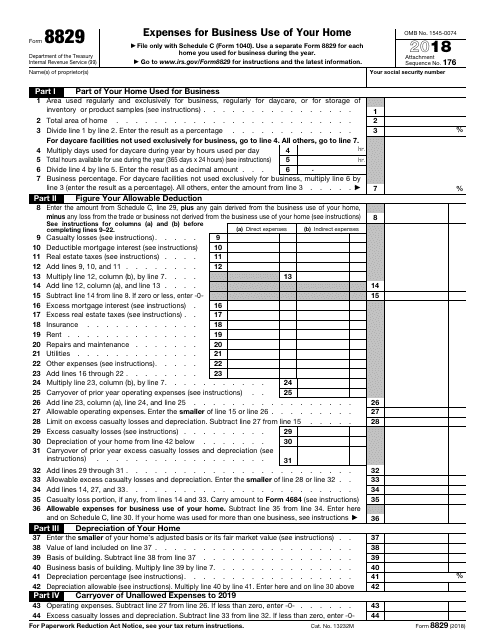

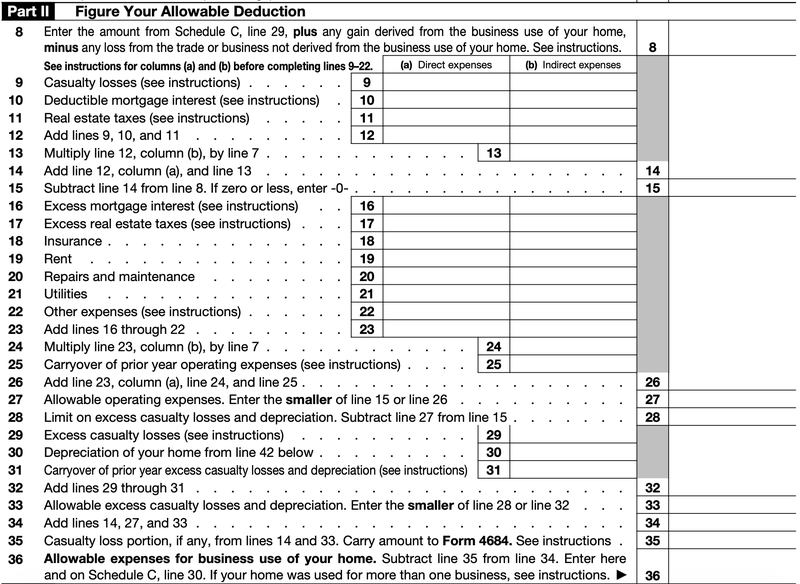

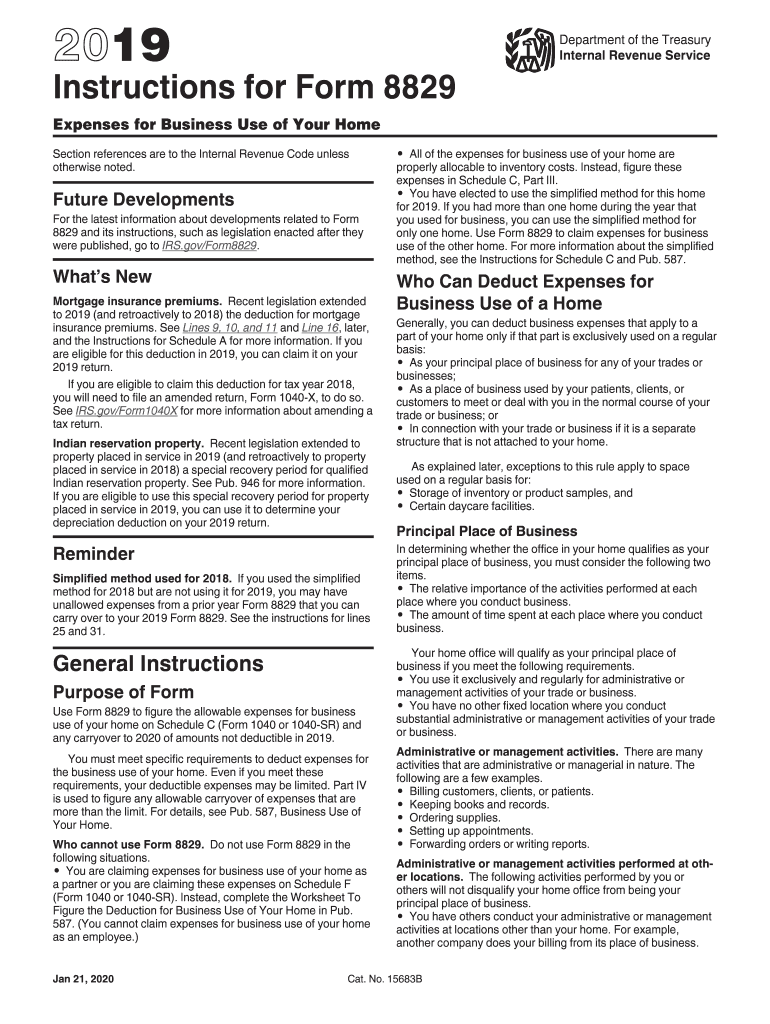

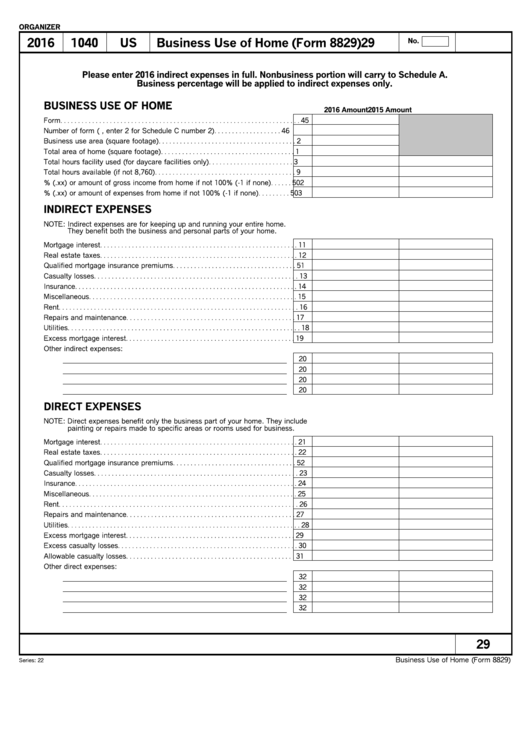

Form 8829 Line 11 Worksheet - It's a pain in the neck. Web you find the worksheet in the instructions to form 8829. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Choose the correct version of the editable pdf. Reminder simplified method used for 2017. Web home office (8829 worksheet) du jh & associates, pa www.mytaxhouse.com tel: Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Web print form 8829. Then you take the results and enter into lacerte where the diagnostic tells you to. The calculated amount will flow to the applicable schedule instead. Then you take the results and enter into lacerte where the diagnostic tells you to. It's a pain in the neck. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. The calculated amount will flow to the applicable schedule instead. If you used the simplified method. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess,. The irs determines the eligibility of an allowable home business space using two. Choose the correct version of the editable pdf. Use form 8829 to figure the. Enter home office expenses on the form or schedule as needed. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web print form 8829. Web irs form 8829 is the form used to deduct expenses for your home business space. Web remove the indirect expenses and use the form 8829 line 11 worksheet to determine the amount. Web you find the worksheet in the instructions to form 8829. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. The calculated amount will flow to the. The calculated amount will flow to the applicable schedule instead. Choose the correct version of the editable pdf. The irs determines the eligibility of an allowable home business space using two. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. The business use of home worksheet is prepared rather than. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. The irs determines the eligibility of an allowable home business space using two. Web print form 8829. Then you take the results and enter into lacerte where the diagnostic tells you to. It's a pain in the neck. Web remove the indirect expenses and use the form 8829 line 11 worksheet to determine the amount of real estate taxes to enter as direct real estate taxes and direct excess real. Web irs form 8829 is the form used to deduct expenses for your home business space. Use form 8829 to figure the. Choose the correct version of the. Then you take the results and enter into lacerte where the diagnostic tells you to. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web find and fill out the correct 2020 irs instructions form 8829. Department of the treasury internal revenue service (99) expenses for business use of your. Web find and fill out the correct 2020 irs instructions form 8829. If you used the simplified method for 2017 but are not using it for 2018, you may. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web use form 8829 to figure the allowable expenses for business use. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. If you used the simplified method for 2017 but are not using it for 2018, you may. Web home office (8829 worksheet) du jh & associates, pa www.mytaxhouse.com tel:. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Department of the treasury internal revenue service (99) expenses for business use of your home. Web you find the worksheet in the instructions to form 8829. Web irs form 8829 is the form used to deduct expenses for your home business space. Use form 8829 to figure the. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web find and fill out the correct 2020 irs instructions form 8829. Enter home office expenses on the form or schedule as needed. Web remove the indirect expenses and use the form 8829 line 11 worksheet to determine the amount of real estate taxes to enter as direct real estate taxes and direct excess real. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Reminder simplified method used for 2017. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Web print form 8829. If you used the simplified method for 2017 but are not using it for 2018, you may. Web reported on line 11 will be reported on new line 17. Web home office (8829 worksheet) du jh & associates, pa www.mytaxhouse.com tel: It's a pain in the neck. Then you take the results and enter into lacerte where the diagnostic tells you to. The irs determines the eligibility of an allowable home business space using two. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess,. Use form 8829 to figure the. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web remove the indirect expenses and use the form 8829 line 11 worksheet to determine the amount of real estate taxes to enter as direct real estate taxes and direct excess real. It's a pain in the neck. Web home office (8829 worksheet) du jh & associates, pa www.mytaxhouse.com tel: If you used the simplified method for 2017 but are not using it for 2018, you may. The calculated amount will flow to the applicable schedule instead. Web irs form 8829 is one of two ways to claim a home office deduction on your business taxes. Web find and fill out the correct 2020 irs instructions form 8829. Reminder simplified method used for 2017. Web print form 8829. Department of the treasury internal revenue service (99) expenses for business use of your home. Enter home office expenses on the form or schedule as needed. Web irs form 8829 is the form used to deduct expenses for your home business space. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web you find the worksheet in the instructions to form 8829.The New York Times > Business > Image > Form 8829

IRS Form 8829 Download Fillable PDF or Fill Online Expenses for

How to Complete and File IRS Form 8829 The Blueprint

8829 Line 11 Worksheet

Business Use Of Home (Form 8829) Organizer 2016 printable pdf download

8829 Simplified Method (ScheduleC, ScheduleF)

Irs 1040 Form C Checklist For Irs Schedule C Profit Of Loss From

Form 8829 Instructions Your Complete Guide to Expense Your Home Office

Va Tax Withholding Tables Elcho Table

8829 Line 11 Worksheet

The Irs Determines The Eligibility Of An Allowable Home Business Space Using Two.

Choose The Correct Version Of The Editable Pdf.

Then You Take The Results And Enter Into Lacerte Where The Diagnostic Tells You To.

Web Reported On Line 11 Will Be Reported On New Line 17.

Related Post:

:max_bytes(150000):strip_icc()/Screenshot58-cb1ceaa73b884957a1108ca88b1c2da8.png)