Form 8829 Worksheet

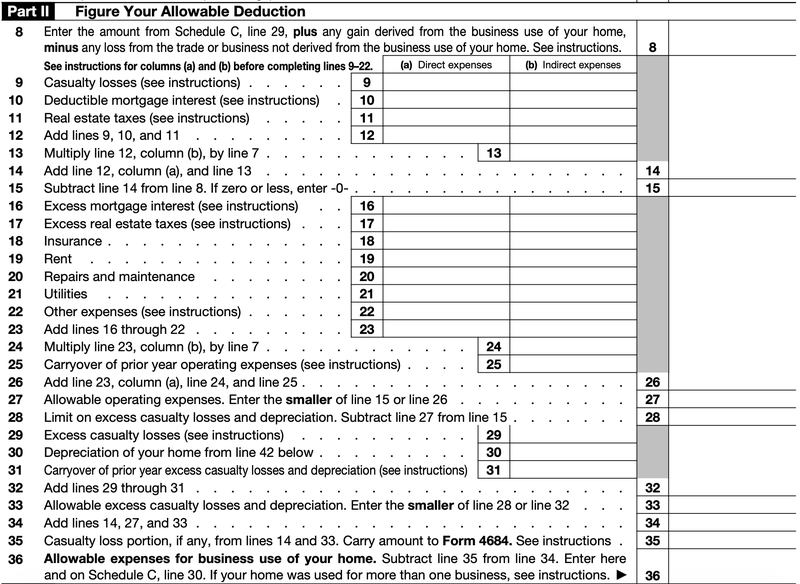

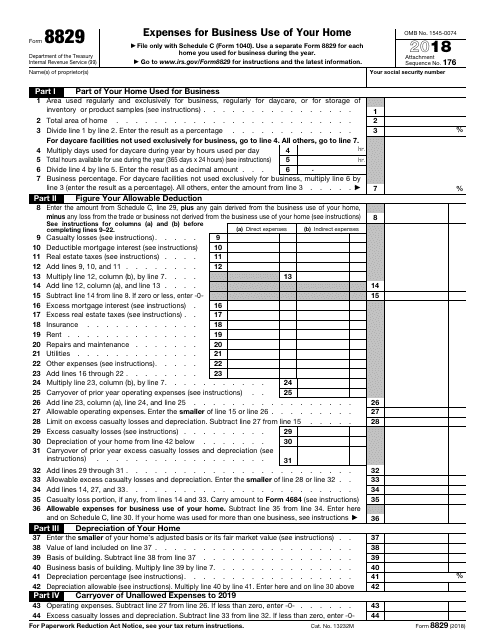

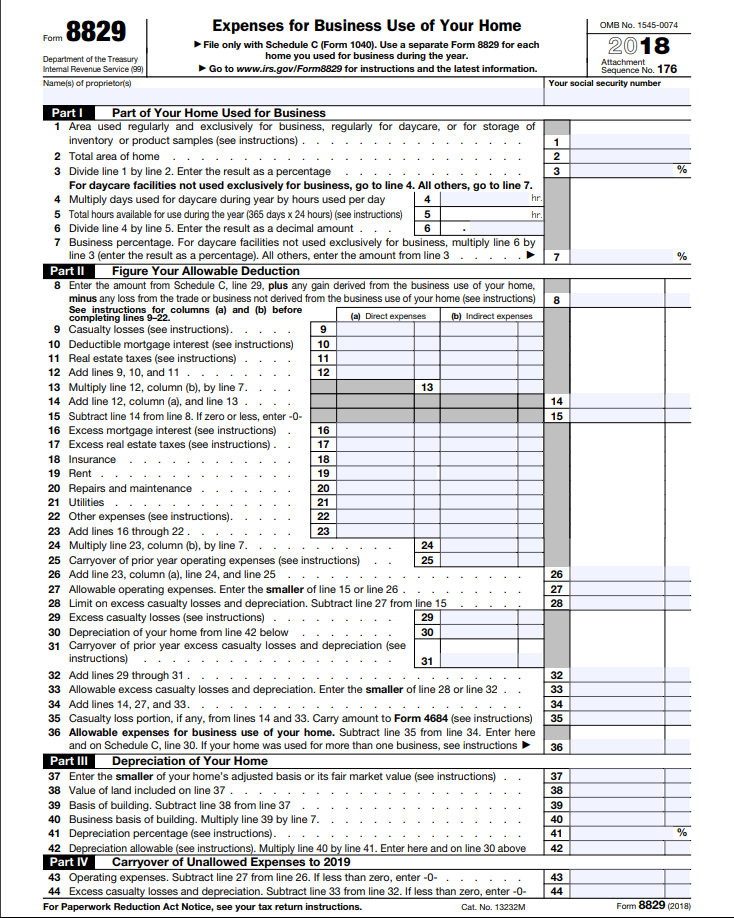

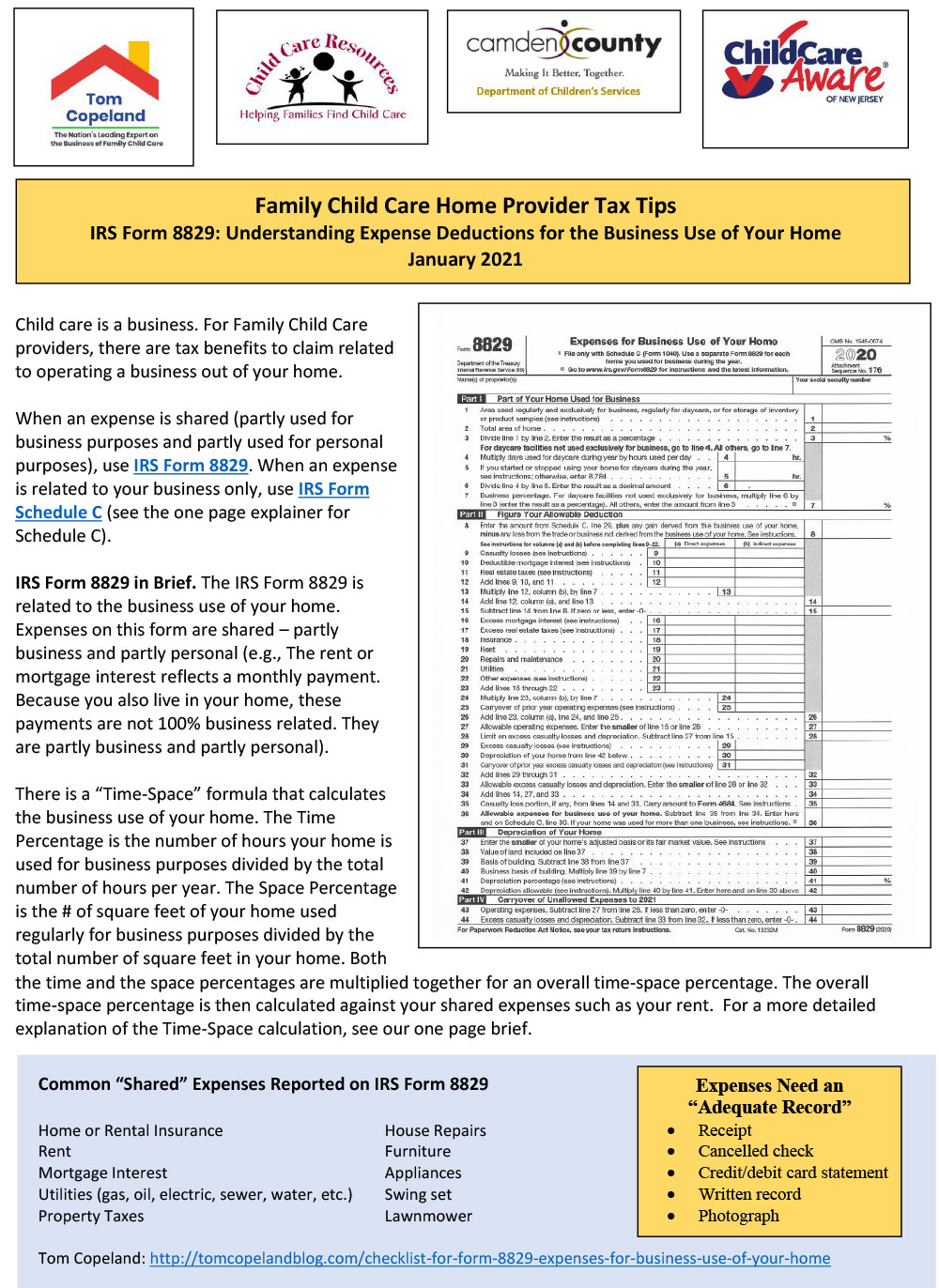

Form 8829 Worksheet - Department of the treasury internal revenue service (99) expenses for business use of your home. Take advantage of the tools we provide to submit your document. If you are taking home office expenses, depreciation on the house is part of those expenses. File only with schedule c (form 1040). Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the regular home office deduction.you file it with your annual tax. Background information on form 8829. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include: Tax advice form 8829, expenses for business. The calculated amount will flow to the applicable schedule instead. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of. Using the simplified method and reporting it directly on your schedule c,. Ad access irs tax forms. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. File only with schedule c (form 1040). Use form 8829 to figure the. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim. Web there are two ways to claim the deduction: Web taxpayers may use a simplified method when calculating the deduction for business use of their home for form 8829. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess,. Web common questions about form 8829 in proseries solved. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. The simplified method doesn't change the. Highlight relevant paragraphs of the. Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and. Tax advice form 8829, expenses for business. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the. Use form 8829 to figure the. Ad access irs tax forms. Department of the treasury internal revenue service (99) expenses for business use of. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Use form 8829 to figure the. Web there are two ways to claim the deduction: Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Web irs form 8829, titled “expenses. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include: The calculated amount will flow to the applicable schedule instead. Web common questions about form 8829 in proseries solved • by intuit • 28 •. Ad access irs tax forms. Department of the treasury internal revenue service (99) expenses for business use of your home. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Web taxpayers use form 8829, expenses for business use of your home, to claim expenses related to using the home for business purposes. Using. Get ready for tax season deadlines by completing any required tax forms today. File only with schedule c (form 1040). Web there are two ways to claim the deduction: Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the. The simplified. Get ready for tax season deadlines by completing any required tax forms today. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Web there are two ways to claim the deduction: Department of the treasury internal revenue service (99) expenses for business use of your home. File only with schedule c (form 1040). Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the. Web irs form 8829, titled “expenses for business use of your home,” is the tax form you use to claim the regular home office deduction.you file it with your annual tax. The simplified method doesn't change the. This form is for income earned in tax year 2022, with tax returns due in april. Web form 8829 is a tax form you fill out to claim your home office expenses (so if you work from home—this means you). Take advantage of the tools we provide to submit your document. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. Highlight relevant paragraphs of the. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess,. The calculated amount will flow to the applicable schedule instead. Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Use form 8829 to figure the. Background information on form 8829. Web find irs form 8829 instructions 2016 and click on get form to get started. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include: Web general instructions purpose of form use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of. The cost of the house. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total. Ad access irs tax forms. Web taxpayers may use a simplified method when calculating the deduction for business use of their home for form 8829. Take advantage of the tools we provide to submit your document. Web there are two ways to claim the deduction: Department of the treasury internal revenue service (99) expenses for business use of your home. Web find irs form 8829 instructions 2016 and click on get form to get started. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Highlight relevant paragraphs of the. Web when the taxpayer elects to use the simplified method, form 8829 is not produced; Web we last updated federal form 8829 in december 2022 from the federal internal revenue service. Tax advice form 8829, expenses for business. Web in this article, we’ll walk through the basics of this tax form and the home business deduction, to include: File only with schedule c (form 1040). Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. This form is for income earned in tax year 2022, with tax returns due in april.How to Complete and File IRS Form 8829 The Blueprint

IRS Form 8829 Download Fillable PDF or Fill Online Expenses for

2018 1040 form 8829 Fill Online, Printable, Fillable Blank form

Form 8829 Instructions Your Complete Guide to Expense Your Home Office

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Form_8829_explainer_PDF3 Camden County, NJ

Solved Trying to fix incorrect entry Form 8829

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Form 8829 Worksheet Fill online, Printable, Fillable Blank

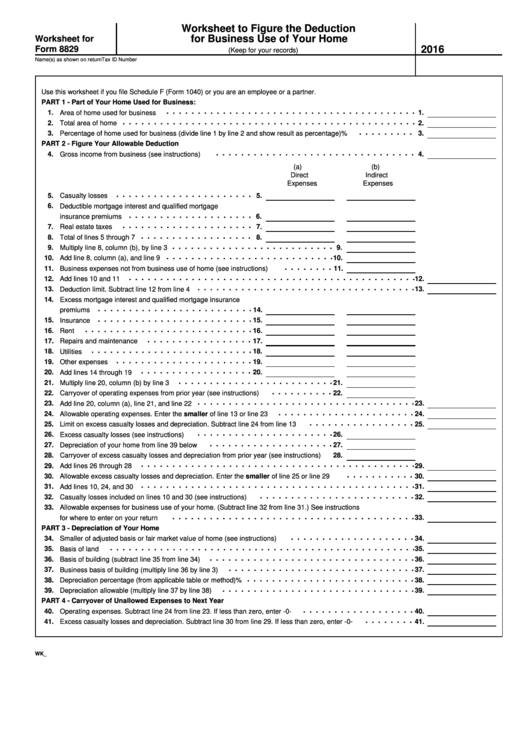

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Web Irs Form 8829, Titled “Expenses For Business Use Of Your Home,” Is The Tax Form You Use To Claim The Regular Home Office Deduction.you File It With Your Annual Tax.

Background Information On Form 8829.

Complete, Edit Or Print Tax Forms Instantly.

Web Common Questions About Form 8829 In Proseries Solved • By Intuit • 28 • Updated September 22, 2022 Electing The Simplified Method For Form 8829 What Is The.

Related Post: