Fringe Benefit Calculation Worksheet

Fringe Benefit Calculation Worksheet - The overtime fringe benefits are usually limited to the types indicated as applicable above in the overtime column. Web pk !“bç æ [content_types].xml ¢ ( ´wkoâ0 ¾¯´ÿ!òµjli‹v+ ‡v÷´úôvú«ë ä~èãrø÷; Web example, an employee has a taxable fringe benefit with a fmv of $300. The social security portion is fixed at. Web fema will continue to provide funeral assistance until sept. Besides helping employees, offering fringe. Contributions irrevocably made to a trustee or third party pursuant to a bona fide fringe benefit fund plan or program. Note that items and percentages will vary from one entity to another. Divide the number of hours of annual vacation time provided to the employee by 2080 (80 hours (2 weeks)/2080 = 3.85%). 1) it is preferable to record allocations at least monthly. Web example, an employee has a taxable fringe benefit with a fmv of $300. The overtime fringe benefits are usually limited to the types indicated as applicable above in the overtime column. Web health benefits life insurance benefits other (describe here) overtime % if the benefit is applied to the overtime fringe rate, select the proper box 6.20% 1.45% 7.65%.. For each employee, determine the average fringe benefit rate for both regular time wages and overtime wages. Web pk !“bç æ [content_types].xml ¢ ( ´wkoâ0 ¾¯´ÿ!òµjli‹v+ ‡v÷´úôvú«ë ä~èãrø÷; Web the following steps will assist in calculating the percentage of fringe benefits paid on an employee’s salary. Contributions irrevocably made to a trustee or third party pursuant to a bona fide. Smaller organizations often post allocations on an annual basis. Å è appÿ&¨„ý¡5âu ñ“ðá·ð4!|•ó ë oö.’ó. For each employee, determine the average fringe benefit rate for both regular time wages and overtime wages. Enter the percentage of extra costs that make up the employee’s salary. Web federal emergency management agency applicant's benefits calculation worksheet department of homeland security federal emergency. Find the documents you need to. Web awards of $50 or less are not included in computing the average. For each employee, determine the average fringe benefit rate for both regular time wages and overtime wages. The overtime fringe benefits are usually limited to the types indicated as applicable above in the overtime column. Besides helping employees, offering fringe. 30, 2025, to those who have lost loved ones due to this pandemic. Web federal emergency management agency applicant's benefits calculation worksheet department of homeland security federal emergency. Web fringe benefit percentage for vacation time: Web awards of $50 or less are not included in computing the average. The social security portion is fixed at. For each employee, determine the average fringe benefit rate for both regular time wages and overtime wages. 1) it is preferable to record allocations at least monthly. Enter the percentage of extra costs that make up the employee’s salary. Web health benefits life insurance benefits other (describe here) overtime % if the benefit is applied to the overtime fringe rate,. Web example, an employee has a taxable fringe benefit with a fmv of $300. Web fringe benefit rate = (total fringe benefits / annual salary ) x 100 when calculating the total fringe benefits, don’t forget to include unemployment insurance, health insurance,. Web awards of $50 or less are not included in computing the average. 30, 2025, to those. The social security portion is fixed at. Å è appÿ&¨„ý¡5âu ñ“ðá·ð4!|•ó ë oö.’ó. Divide the number of hours of annual vacation time provided to the employee by 2080 (80 hours (2 weeks)/2080 = 3.85%). Web fringe benefit percentage for vacation time: For each employee, determine the average fringe benefit rate for both regular time wages and overtime wages. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. The social security portion is fixed at. Web pk !“bç æ [content_types].xml ¢ ( ´wkoâ0 ¾¯´ÿ!òµjli‹v+ ‡v÷´úôvú«ë ä~èãrø÷; Web to calculate an employee’s fringe benefit rate, add up the cost of an employee’s fringe benefits for the year (including payroll taxes paid) and divide it by. Web fringe benefit percentage for vacation time: Web health benefits life insurance benefits other (describe here) overtime % if the benefit is applied to the overtime fringe rate, select the proper box 6.20% 1.45% 7.65%. 30, 2025, to those who have lost loved ones due to this pandemic. Enter the percentage of extra costs that make up the employee’s salary.. Web health benefits life insurance benefits other (describe here) overtime % if the benefit is applied to the overtime fringe rate, select the proper box 6.20% 1.45% 7.65%. Web pk !“bç æ [content_types].xml ¢ ( ´wkoâ0 ¾¯´ÿ!òµjli‹v+ ‡v÷´úôvú«ë ä~èãrø÷; Web the following steps will assist in calculating the percentage of fringe benefits paid on an employee’s salary. The overtime fringe benefits are usually limited to the types indicated as applicable above in the overtime column. Smaller organizations often post allocations on an annual basis. Å è appÿ&¨„ý¡5âu ñ“ðá·ð4!|•ó ë oö.’ó. Mtdc means all direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and subawards and subcontracts up to. Web fringe benefit percentage for vacation time: Web awards of $50 or less are not included in computing the average. The social security portion is fixed at. Web fema will continue to provide funeral assistance until sept. Besides helping employees, offering fringe. Enter the percentage of extra costs that make up the employee’s salary. B |8 œ¸´&€ q(0øtü 3ñž‡èçš~þ(ys†e ›ï ª îåjš@bùò¤ $± 프ôêwmð : Web fringe benefits fica/ medicare pension notes: 30, 2025, to those who have lost loved ones due to this pandemic. Web to calculate an employee’s fringe benefit rate, add up the cost of an employee’s fringe benefits for the year (including payroll taxes paid) and divide it by the. Divide the number of hours of annual vacation time provided to the employee by 2080 (80 hours (2 weeks)/2080 = 3.85%). Note that items and percentages will vary from one entity to another. Find the documents you need to. Web fringe benefit percentage for vacation time: Web health benefits life insurance benefits other (describe here) overtime % if the benefit is applied to the overtime fringe rate, select the proper box 6.20% 1.45% 7.65%. Contributions irrevocably made to a trustee or third party pursuant to a bona fide fringe benefit fund plan or program. Enter the percentage of extra costs that make up the employee’s salary. For each employee, determine the average fringe benefit rate for both regular time wages and overtime wages. Web pk !“bç æ [content_types].xml ¢ ( ´wkoâ0 ¾¯´ÿ!òµjli‹v+ ‡v÷´úôvú«ë ä~èãrø÷; 1) it is preferable to record allocations at least monthly. Note that items and percentages will vary from one entity to another. Besides helping employees, offering fringe. Web to calculate an employee’s fringe benefit rate, add up the cost of an employee’s fringe benefits for the year (including payroll taxes paid) and divide it by the. Web federal emergency management agency applicant's benefits calculation worksheet department of homeland security federal emergency. Web fema will continue to provide funeral assistance until sept. Web fringe benefit rate = (total fringe benefits / annual salary ) x 100 when calculating the total fringe benefits, don’t forget to include unemployment insurance, health insurance,. Web the following steps will assist in calculating the percentage of fringe benefits paid on an employee’s salary. B |8 œ¸´&€ q(0øtü 3ñž‡èçš~þ(ys†e ›ï ª îåjš@bùò¤ $± 프ôêwmð : Web fringe benefits fica/ medicare pension notes:[Solved] please answer type 2 fringe benefit calculation. Type 2 (Only

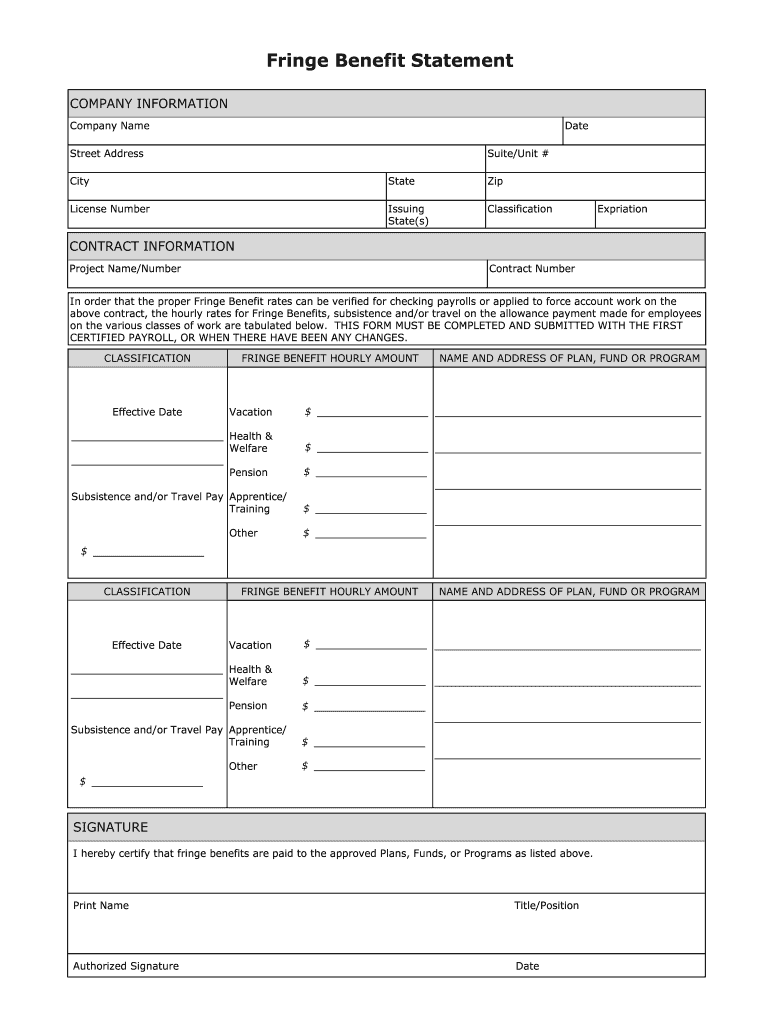

fringe benefit statement Fill out & sign online DocHub

fringe benefit statement Fill out & sign online DocHub

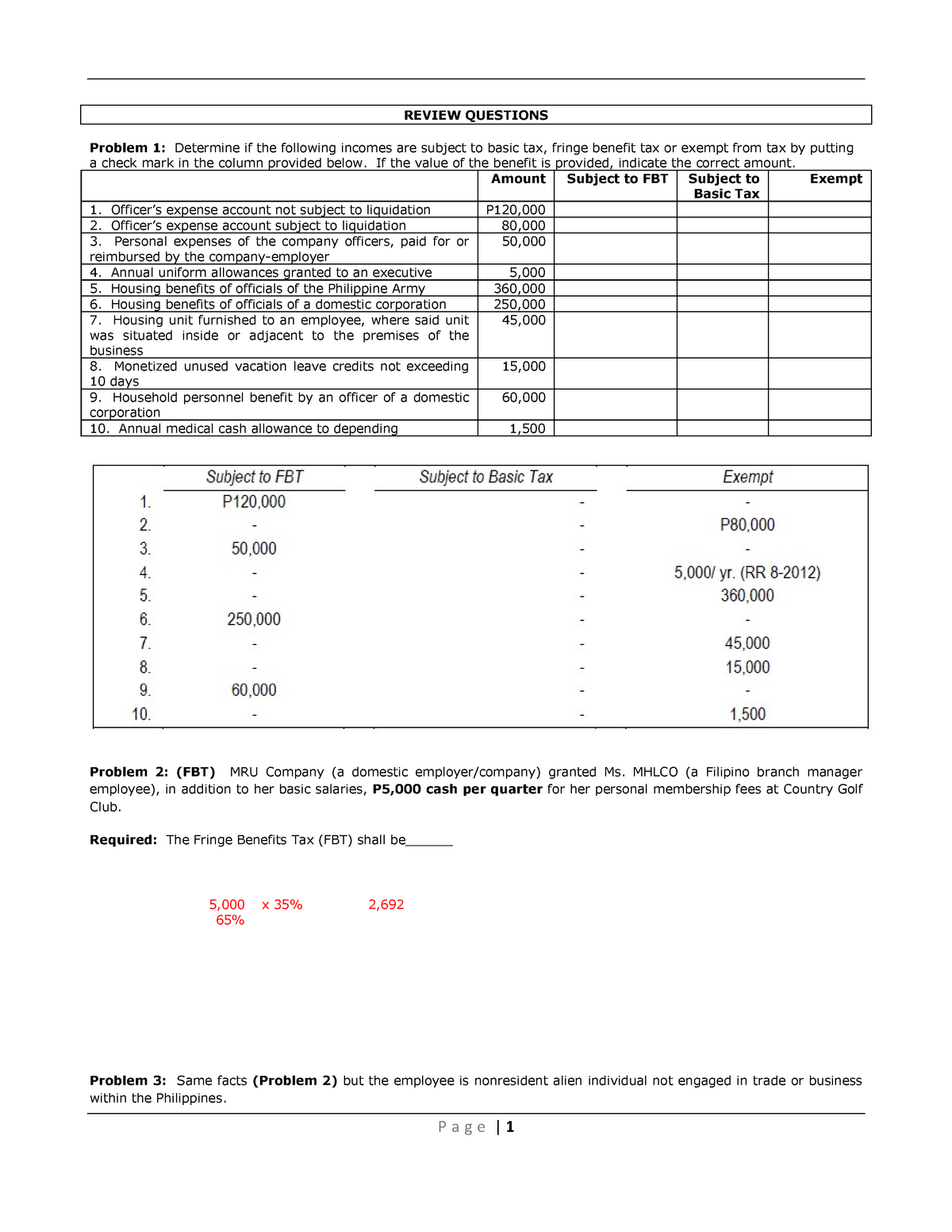

5. Fringe benefit tax (problems and solution) PSBA PSBA REVIEW

FRINGE BENEFITS TAX CALCULATOR The Fringe Universe

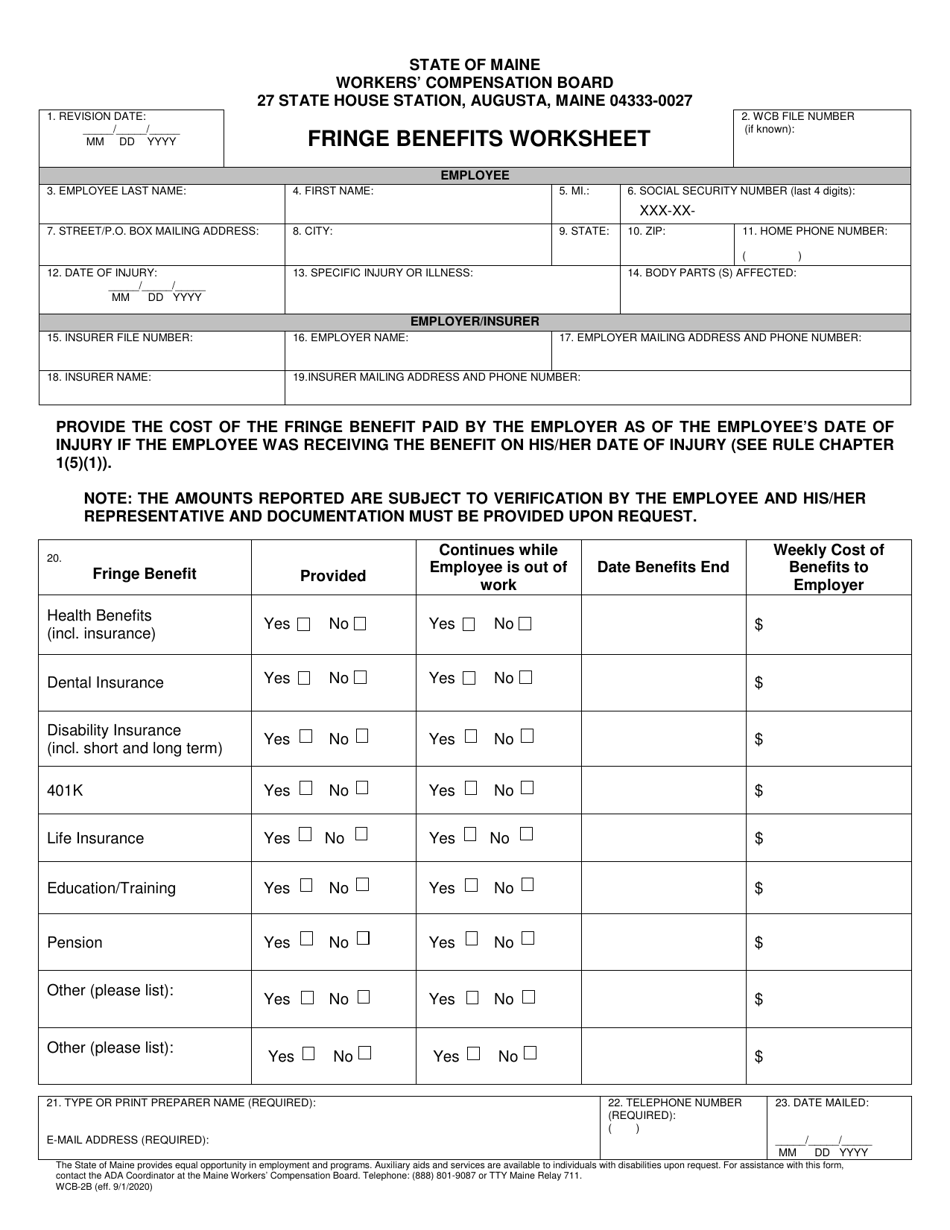

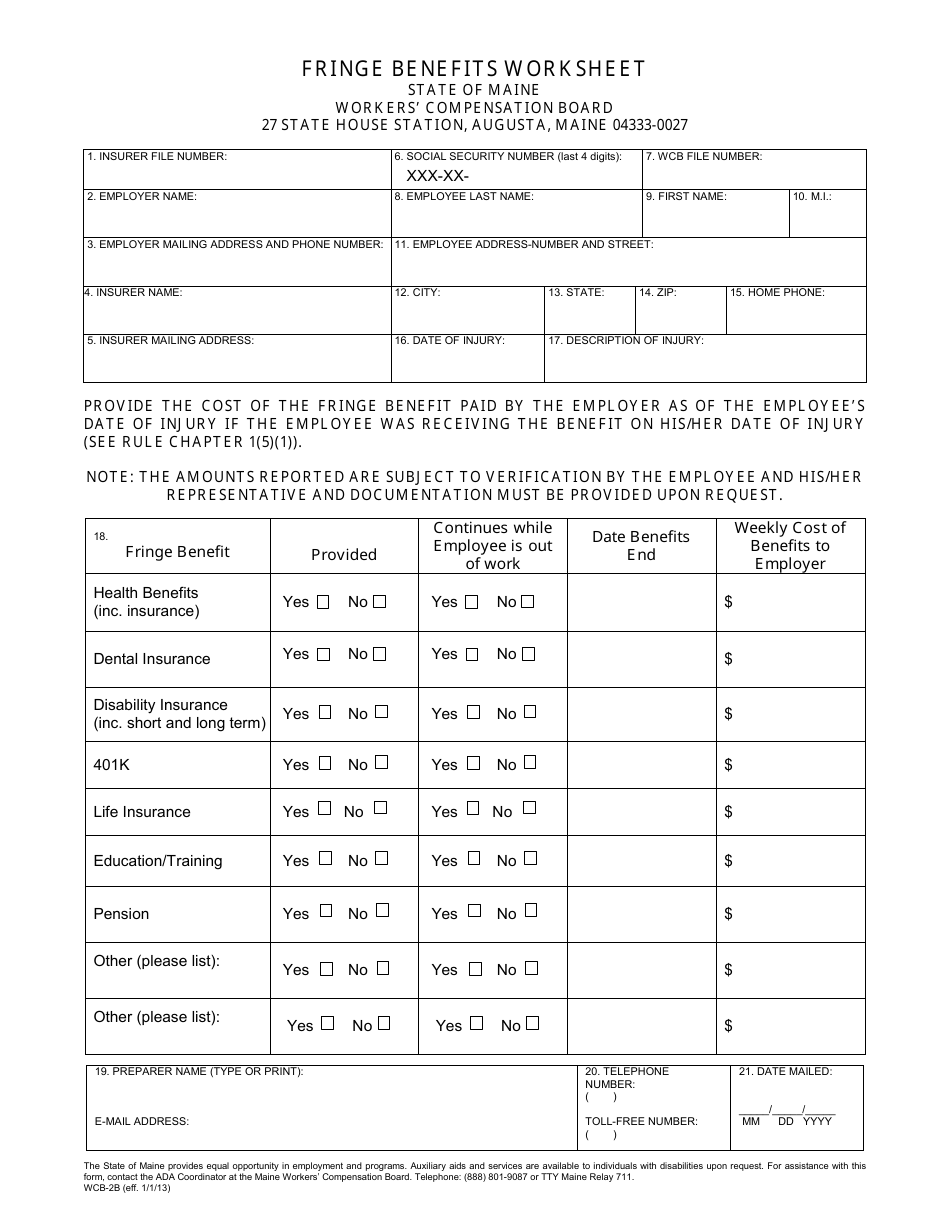

Form WCB2B Download Fillable PDF or Fill Online Fringe Benefits

PPT Electronic Filing and Forms Overview For Use With Forms Filing

fringe benefit calculation worksheet

Form WCB2B Download Fillable PDF or Fill Online Fringe Benefits

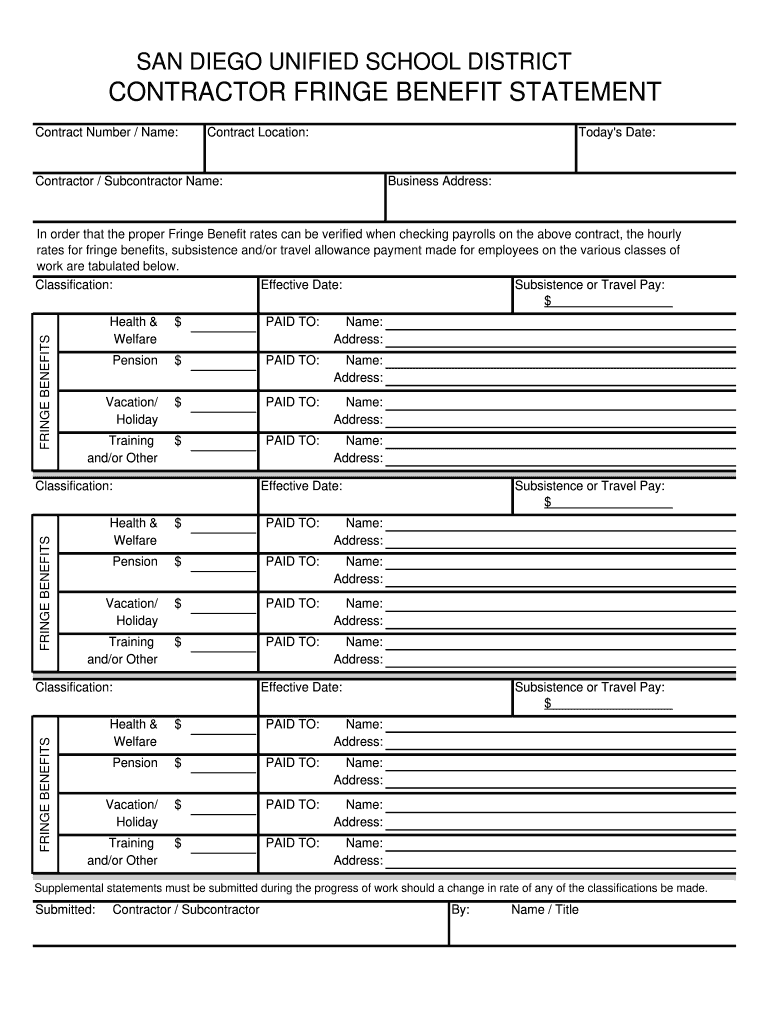

Contractor Fringe Statement Form Fill Online, Printable, Fillable

Find The Documents You Need To.

Web The Benefits Worksheets Provide The Calculation Of Taxable Fringe Benefits And/Or Any Employee Contribution Amounts Required To Be Offset Against The Taxable Fringe Benefits.

This Form Is Used To Calculate The Percentage That Must Be Added To An Employee’s Hourly Rate To Ensure The Applicant Is Reimbursed For The Applicant’s Total Employee Labor Costs.

If The Employee Pays $100 For The Benefit, The Taxable Fringe Benefit Is $200.

Related Post: