Fringe Benefit Compensation Value For Employer-Provided Auto Worksheet

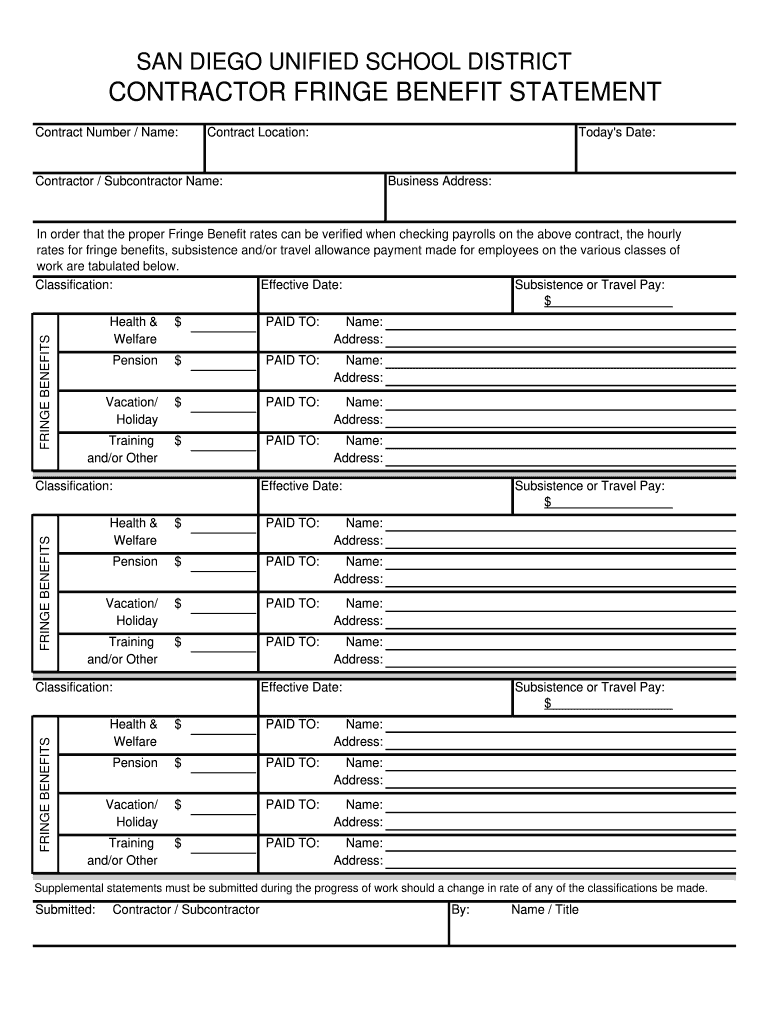

Fringe Benefit Compensation Value For Employer-Provided Auto Worksheet - Web web fair value is the purchase price of. This worksheet can be used to calculate the. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web fringe benefit compensation value for employer provided vehicles (a separate form should be completed for each vehicle used) covered period: In this presentation you’ll learn: Web web worksheet to calculate income from personal use of company vehicle (continued) annual lease value table for vehicles having a fair market value in excess of. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web you can use this rule if you: Web provide the cost of the fringe benefit paid by the employer as of the employee’s date of injury if the employee was receiving the benefit on his/her date of injury (see rule chapter. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web you can use this rule if you: These include health insurance, family and medical. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. These include health insurance, family and medical. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. A vehicle's annual lease value is based on the. Web federal income tax withholding on fringe benefit wage additions can be calculated as a. Web if the employee pays $100 for the benefit, the taxable fringe benefit is. Web web fair value is the purchase price of. Web web fringe benefit compensation value for employer provided vehicles (a separate form should be completed for each vehicle used) covered period: Web you can use this rule if you: If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web if the employee pays $100 for. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web for example, an employee has a taxable fringe benefit with a fair market value of $300. A vehicle's annual lease value is based on the. Web if, as an employer, you provided an employee with an automobile that is available to the employee. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web fair value is the purchase price of. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. This worksheet can be used to calculate the. Web for example, an employee has a taxable fringe benefit with a fair. In this presentation you’ll learn: Web web worksheet to calculate income from personal use of company vehicle (continued) annual lease value table for vehicles having a fair market value in excess of. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web if the employee pays $100 for the benefit, the taxable fringe benefit. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. This worksheet can be used to calculate the amount to be included in an employee's income. These include health insurance, family and medical. Web web fair value is the purchase price of. Web web for example, an employee has a taxable fringe benefit with a. A vehicle's annual lease value is based on the. Web federal income tax withholding on fringe benefit wage additions can be calculated as a. This worksheet can be used to calculate the amount to be included in an employee's income. Web web fringe benefit compensation value for employer provided vehicles (a separate form should be completed for each vehicle used). A vehicle's annual lease value is based on the. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web worksheet to calculate income from personal use of company vehicle (continued) annual lease value table for vehicles having a fair. This worksheet can be used to calculate the. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web for example, an employee has a taxable fringe benefit with a fair market value of $300. If the employee pays $100 for. Web for example, an employee has a taxable fringe benefit with a fair market value of $300. Web you can use this rule if you: This worksheet can be used to calculate the amount to be included in an employee's income. Web web worksheet to calculate income from personal use of company vehicle (continued) annual lease value table for vehicles having a fair market value in excess of. These include health insurance, family and medical. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web example, an employee has a taxable fringe benefit with a fmv of $300. Web federal income tax withholding on fringe benefit wage additions can be calculated as a. Web web for example, an employee has a taxable fringe benefit with a fair market value of $300. This worksheet can be used to calculate the. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. A vehicle's annual lease value is based on the. Web provide the cost of the fringe benefit paid by the employer as of the employee’s date of injury if the employee was receiving the benefit on his/her date of injury (see rule chapter. Web web for example, an employee has a taxable fringe benefit with a fair market value of $300. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web fringe benefit compensation value for employer provided vehicles (a separate form should be completed for each vehicle used) covered period: In this presentation you’ll learn: Web web fringe benefit compensation value for employer provided vehicles (a separate form should be completed for each vehicle used) covered period: Special valuation rules apply for. Web you can use this rule if you: A vehicle's annual lease value is based on the. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web example, an employee has a taxable fringe benefit with a fmv of $300. Web for example, an employee has a taxable fringe benefit with a fair market value of $300. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. This worksheet can be used to calculate the amount to be included in an employee's income. Web provide the cost of the fringe benefit paid by the employer as of the employee’s date of injury if the employee was receiving the benefit on his/her date of injury (see rule chapter. If the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. In this presentation you’ll learn: Web if the employee pays $100 for the benefit, the taxable fringe benefit is $200. Web web for example, an employee has a taxable fringe benefit with a fair market value of $300. Web if, as an employer, you provided an employee with an automobile that is available to the employee for personal use, the value of the fringe benefit provided is considered.Fringe Benefit Statement 2021 Fill Online, Printable, Fillable, Blank

Employee Transportation Fringe Benefit Worksheet PDF_fillable (1) goDCgo

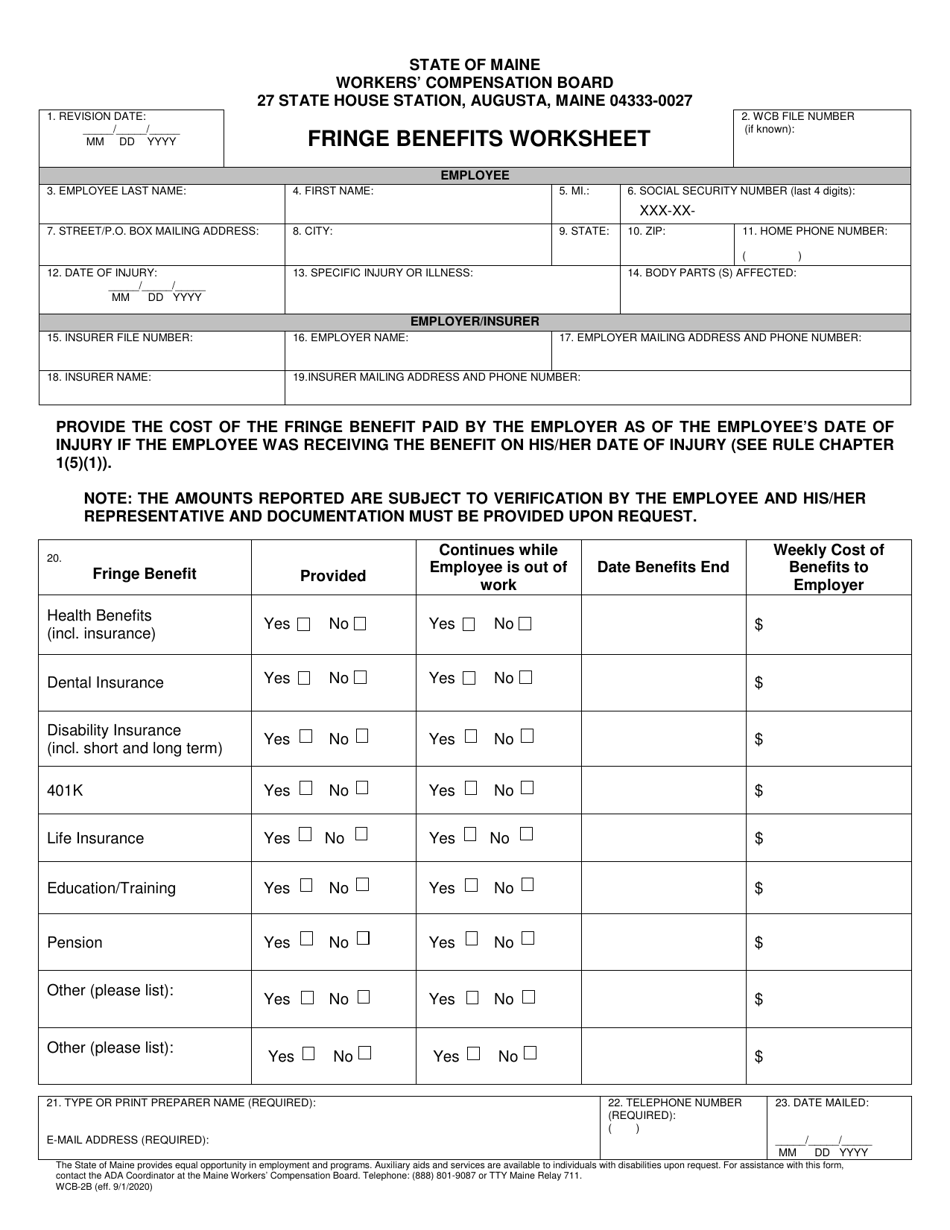

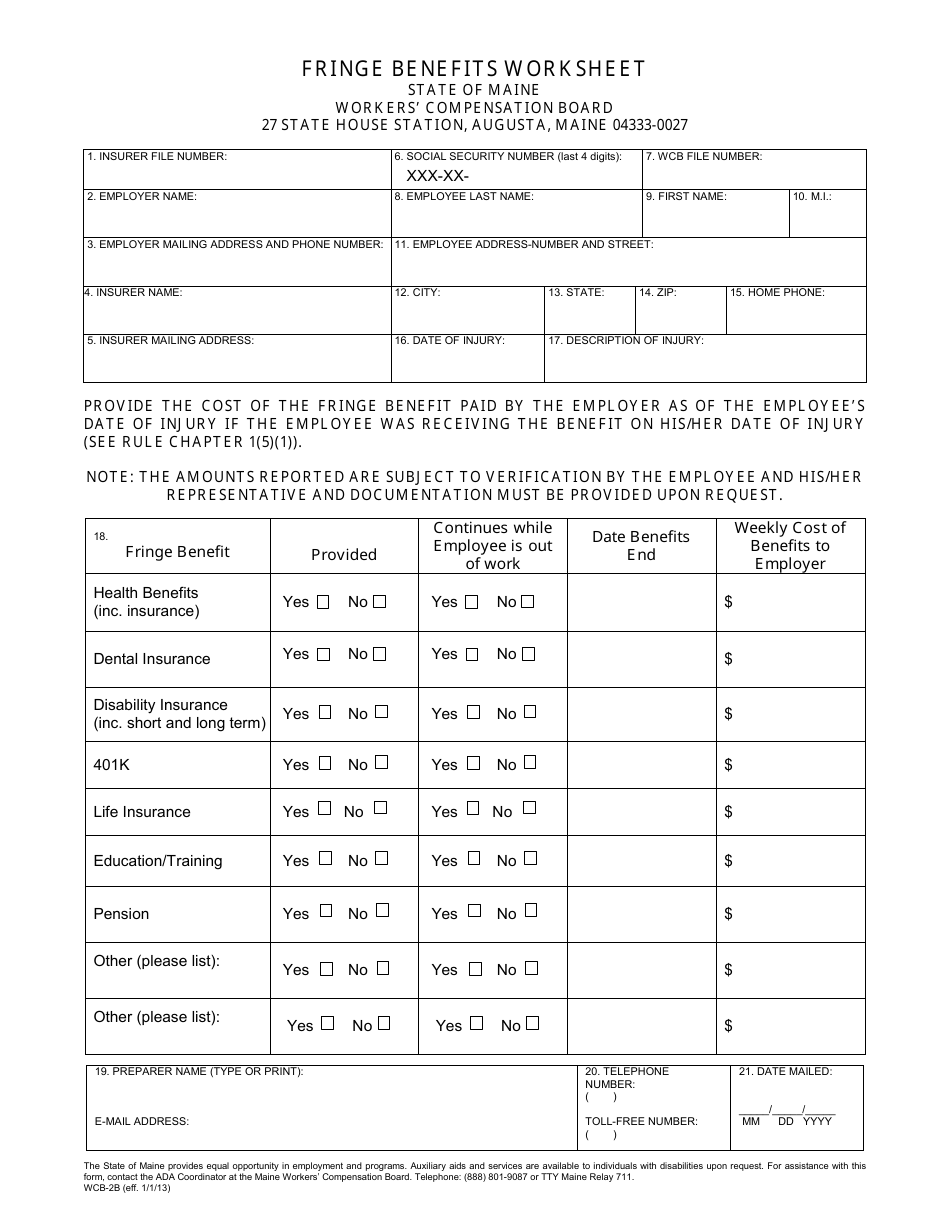

Form WCB2B Download Fillable PDF or Fill Online Fringe Benefits

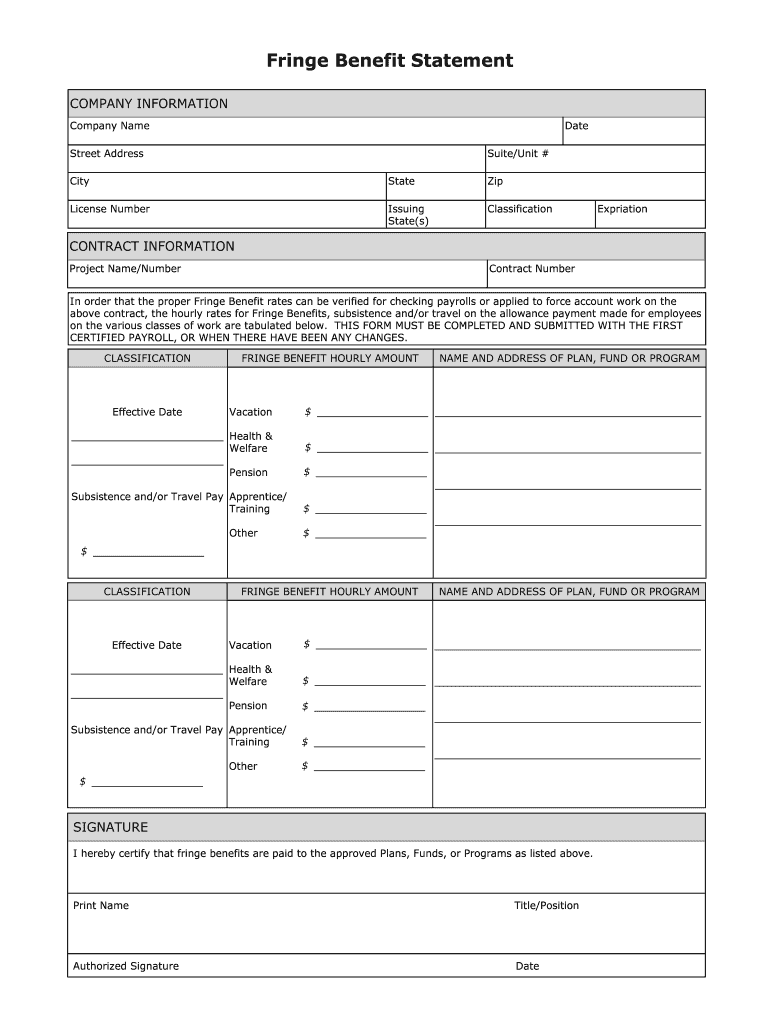

Fringe Benefits Form tropeano mcgrady

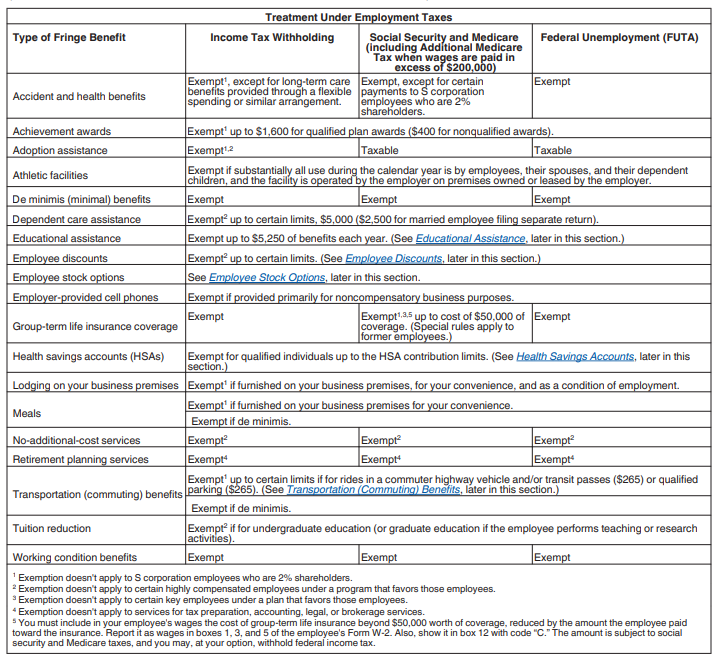

Employer’s Guide to Fringe Benefits

PPT Electronic Filing and Forms Overview For Use With Forms Filing

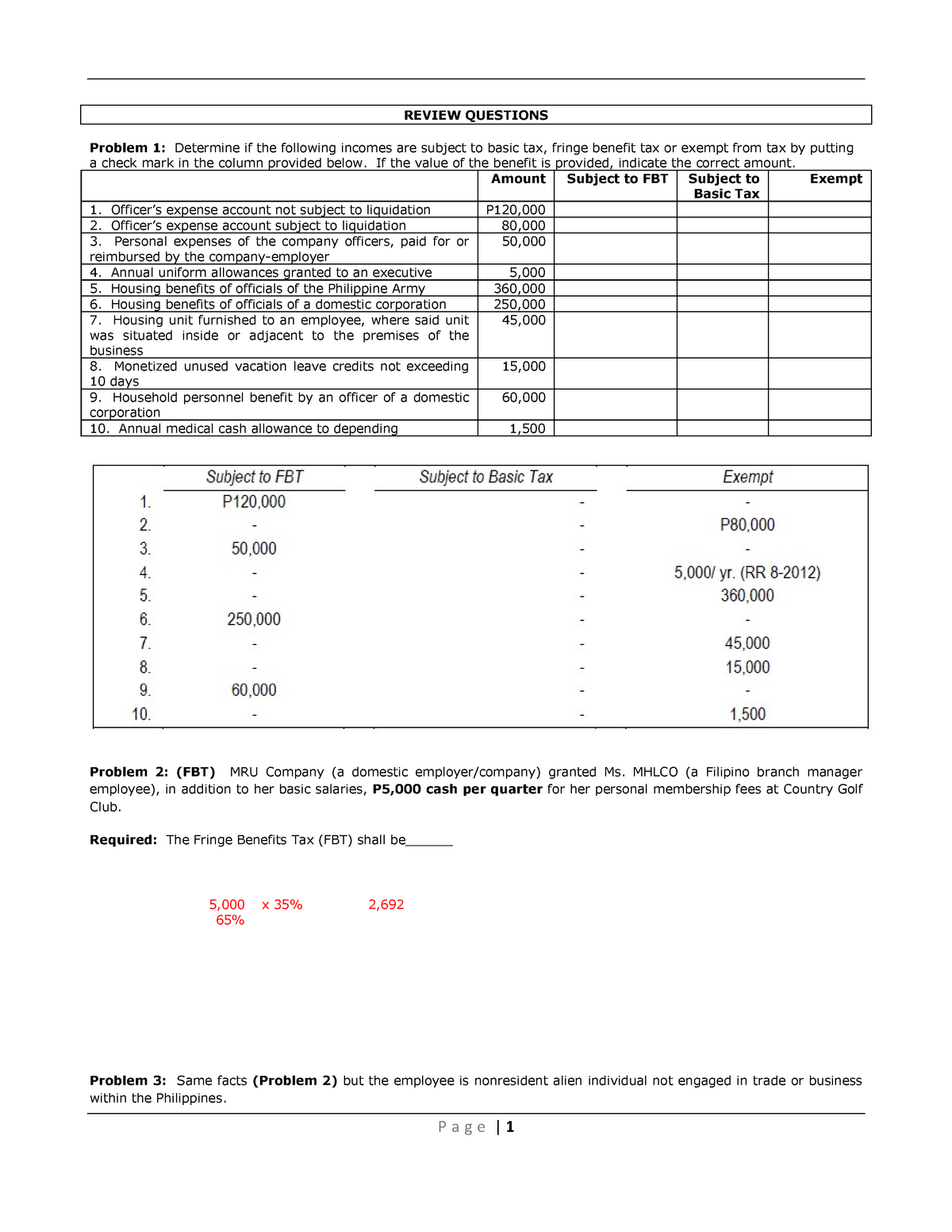

5. Fringe benefit tax (problems and solution) PSBA PSBA REVIEW

PPT Chapter 4 Payroll Benefit Basics Payroll Source FPC Review

Form WCB2B Download Fillable PDF or Fill Online Fringe Benefits

Free Benefitt Statement / 19+ Benefits Statement Templates in PDF DOC

Web Web For Example, An Employee Has A Taxable Fringe Benefit With A Fair Market Value Of $300.

This Worksheet Can Be Used To Calculate The.

Web Web Fair Value Is The Purchase Price Of.

Web If The Employee Pays $100 For The Benefit, The Taxable Fringe Benefit Is $200.

Related Post: