Funding 401Ks And Roth Iras Worksheet

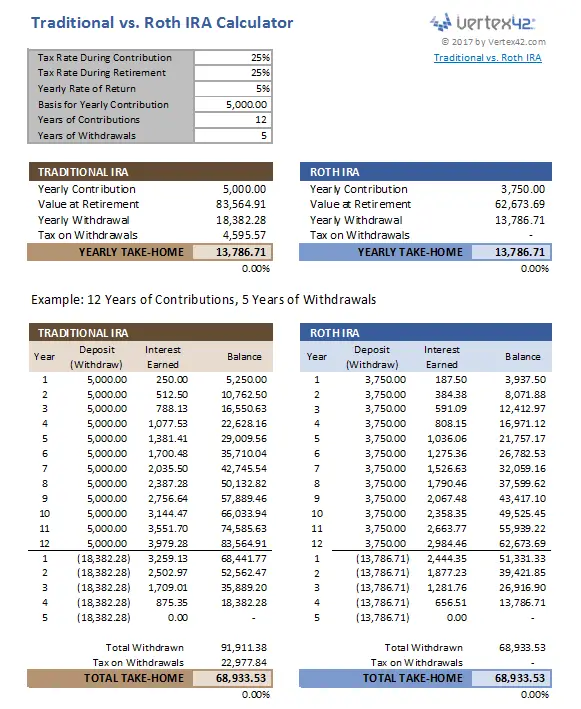

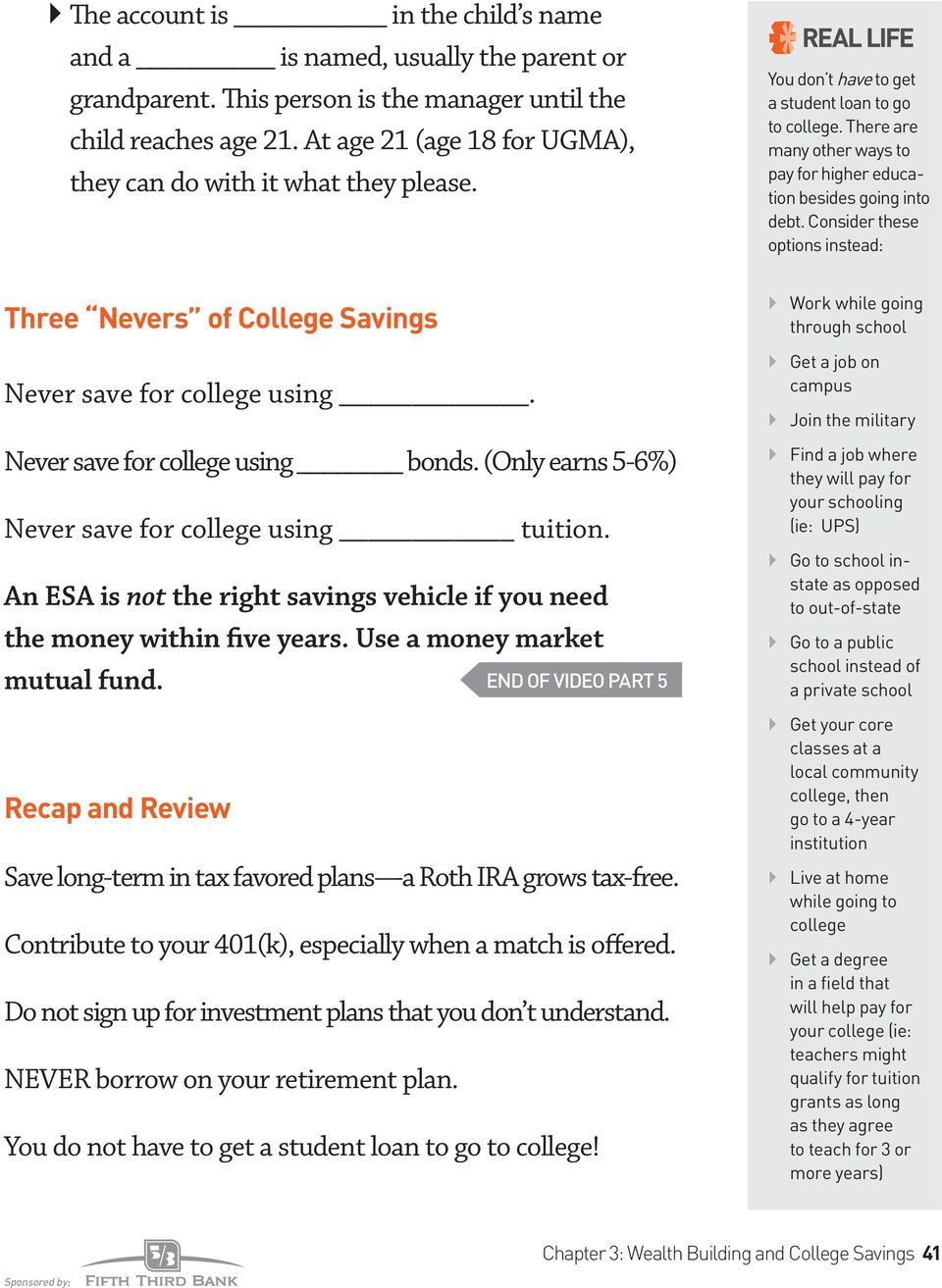

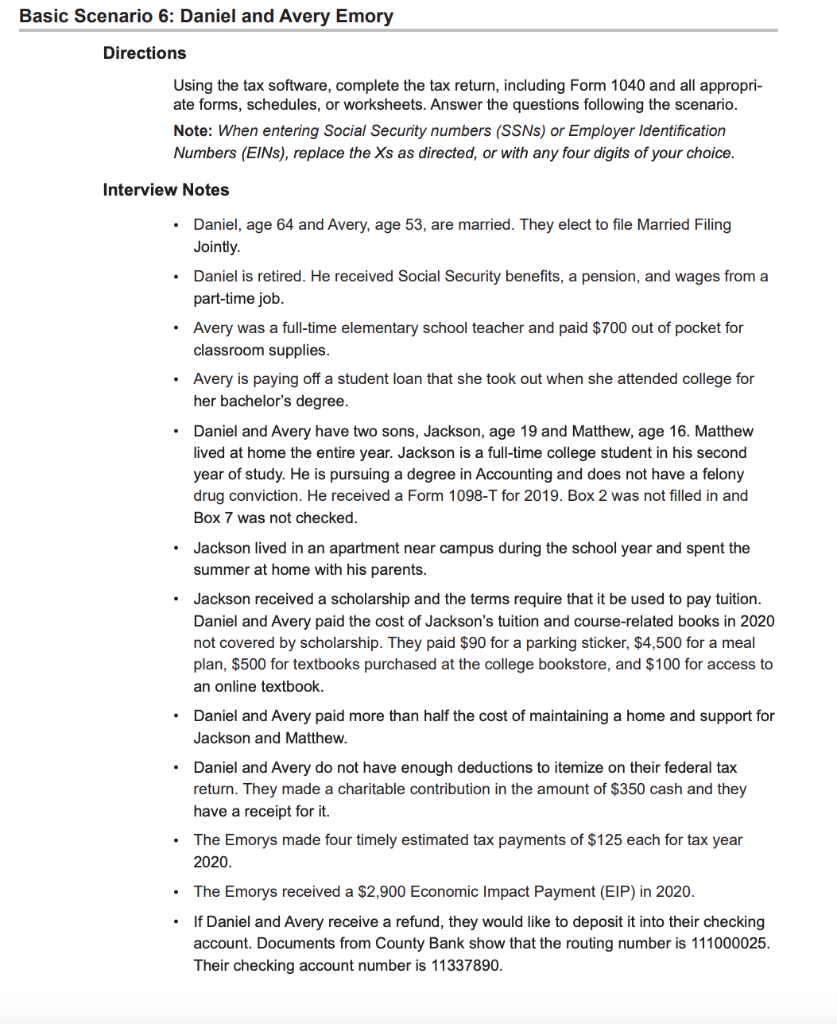

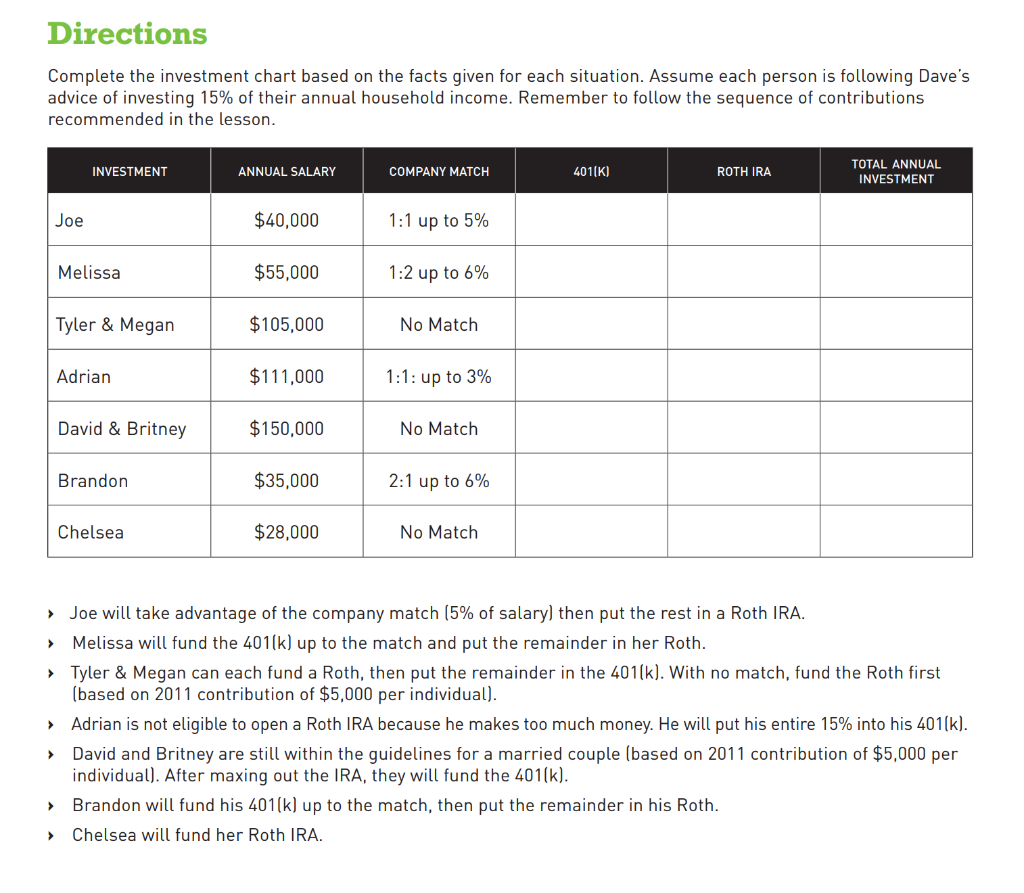

Funding 401Ks And Roth Iras Worksheet - Fund your 401 (k) & roth ira. Calculate the remaining balance into the roth ira column exceptions * if there is no match, put the maximum amount into the roth. Calculate the maximum match that can be contributed to the 401 (k) step 3: >>this is the total you want to invest in your retirement accounts. All of the people are following good sound advice and investing 15% (change to.15 to multiply by their annual salary to come up with their total. Web secure 2.0 provided added roth 401(k) advantages like allowing matching and other employer contributions to roth 401(k)s and eliminating rmds on roth 401(k)s (effective in 2024). An individual who doesn’t qualify to make pretax contributions to a traditional. Web funding 401 (k)s & roth iras directions: >>if so, fund your 401 (k) up to the matching amount. If your filing status is. Web follow these steps to. It's a traditional 401(k) plan covering a business owner with no employees, or that person and his or her. Web up to 24% cash back funding 401(k)s and roth iras directions complete the investment chart based on the facts given for each situation. Assume each person is following dave's advice of investing 15% of their. Fund your 401 (k) & roth ira. Employers may match contributions to roth 401 (k)s, while roth iras may have more investment options. Remember to follow the sequence of. Web up to 24% cash back funding 401(k)s and roth iras directions complete the investment chart based on the facts given for each situation. Web amount of roth ira contributions that. Funding 401(k)s and roth iras. Funding 401(k)s and roth iras. You cannot deduct contributions to a roth ira. Assume each person is following dave’s advice of investing 15% of their annual household income. 1 always take advantage of a match and fund 401(k). Distribution period from the table (table iii) for your age. Above the match, fund roth ira 4. 3 complete 15% of income by going back to. >>this is the total you want to invest in your retirement accounts. Calculate 15% of the total annual salary step 2: Distribution period from the table (table iii) for your age. And your modified agi is. Employers may match contributions to roth 401 (k)s, while roth iras may have more investment options. Assume each person is following dave’s advice of investing 15% of their annual household income. >>if so, fund your 401 (k) up to the matching amount. Remember to follow the sequence of. Calculate the maximum match that can be contributed to the 401 (k) step 3: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Funding 401(k)s and roth iras. Web secure 2.0 provided added roth 401(k) advantages like. Web simple 401 (k) plan employee notification. Above the match, fund roth ira 4. Web amount of roth ira contributions that you can make for 2022. Fund your 401 (k) & roth ira. Calculate target amount to invest (15%) 2. An individual who doesn’t qualify to make pretax contributions to a traditional. Funding 401 (k)s and roth iras directions complete the investment chart based on the facts given for each situation. Web review the steps to follow when funding a 401(k) and roth ira, located in the workbook: Employers may match contributions to roth 401 (k)s, while roth iras may. Web simple 401 (k) plan employee notification. Web amount of roth ira contributions that you can make for 2022. All of the people are following good sound advice and investing 15% (change to.15 to multiply by their annual salary to come up with their total. A roth ira is an ira that, except as explained below, is subject to the. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. Web amount of roth ira contributions that you can make for 2023 this table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth. Web review the steps to follow when funding a 401(k) and roth ira, located in the workbook: You can only invest up to $6,500 in a roth ira in 2023 (or $7,500 if you’re age 50 or older). Above the match, fund roth ira 4. Web assuming you are eligible to move the funds out of your 401 (k), you should first ask the company if it will allow you to do two separate direct rollovers. Calculate the remaining balance into the roth ira column exceptions * if there is no match, put the maximum amount into the roth. You can make contributions to your. The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. One would be from the 401 (k) to your traditional ira. Calculate the maximum match that can be contributed to the 401 (k) step 3: Funding 401 (k)s and roth iras directions complete the investment chart based on the facts given for each situation. Fund your 401 (k) & roth ira. Remember to follow the sequence of. Employers may match contributions to roth 401 (k)s, while roth iras may have more investment options. Web a backdoor roth ira is a way around irs income limits for both traditional and roth iras. Web web funding 401ks and iras worksheet and 10 ways to save for your retirement in your 30s gobankingrates a roth ira is the most common type of ira. Complete the investment chart based on the facts given for each situation. All of the people are following good sound advice and investing 15% (change to.15 to multiply by their annual salary to come up with their total. Web up to 24% cash back funding 401(k)s and roth iras directions complete the investment chart based on the facts given for each situation. Web amount of roth ira contributions that you can make for 2022. Web amount of roth ira contributions that you can make for 2023 this table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. Web lower contribution limits: Calculate target amount to invest (15%) 2. It's a traditional 401(k) plan covering a business owner with no employees, or that person and his or her. Funding 401 (k)sand roth iras directions complete the investment chart based on the facts given for each situation. Web funding 401 (k)s & roth iras directions: And your modified agi is. Remember to follow the sequence of. >>this is the total you want to invest in your retirement accounts. Web a backdoor roth ira is a way around irs income limits for both traditional and roth iras. Web review the steps to follow when funding a 401(k) and roth ira, located in the workbook: Web funding 401 (k)sand roth iras directions complete the investment chart based on the facts given for each. Web assuming you are eligible to move the funds out of your 401 (k), you should first ask the company if it will allow you to do two separate direct rollovers. Complete the investment chart based on the facts given for each situation. >>if so, fund your 401 (k) up to the matching amount. You can make contributions to your. You can only invest up to $6,500 in a roth ira in 2023 (or $7,500 if you’re age 50 or older).Funding 401k And Roth Ira Worksheet Universal Network

Funding 401ks And Roth Iras Worksheet

Funding 401ks And Roth Iras Worksheet

Funding 401ks And Roth Iras Worksheet Escolagersonalvesgui

How To Calculate Roth 401k Contribution On Paycheck

Funding 401ks And Roth Iras Worksheet

Funding 401 K S And Roth Iras Worksheet Answers —

Funding 401 K S And Roth Iras Worksheet Answers Roth ira, Money

Funding 401ks And Roth Iras Worksheet

Funding 401ks And Roth Iras Worksheet Worksheet List

Funding 401 (K)S And Roth Iras Directions Complete The Investment Chart Based On The Facts Given For Each Situation.

Calculate 15% Of The Total Annual Salary Step 2:

A Roth Ira Is An Ira That, Except As Explained Below, Is Subject To The Rules That Apply To A Traditional Ira.

Web Up To 24% Cash Back Funding 401(K)S And Roth Iras Directions Complete The Investment Chart Based On The Facts Given For Each Situation.

Related Post: