Georgia Retirement Income Exclusion Worksheet

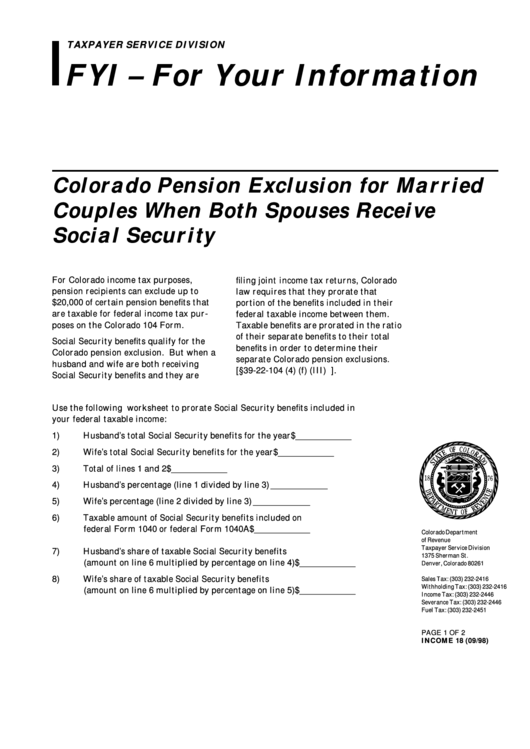

Georgia Retirement Income Exclusion Worksheet - Information over which state of georgia's retirement income exclusion. Web informational about the state of georgia's retirement income exclusion. Web information about the state away georgia's retirement generated exclusion. Information about the state of georgia's disability income exclusion. Information with the state of georgia's retirement income exclusion. Web information about the state of georgia's retirement income exclusion. You can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Web information about the current of georgia's seniority income exclusion. Web the tax expenditure cost of this retirement income exclusion in fy 2021 was an estimated $1.16 billion, arising from the exclusion of approximately $28.7 billion of retirement. Information about who state of georgia's retirement proceeds ejection. This also affects you if you are single and use the burden reduction. Web the tax expenditure cost of this retirement income exclusion in fy 2021 was an estimated $1.16 billion, arising from the exclusion of approximately $28.7 billion of retirement. For taxpayers 65 or older, the retirement. Web information about the state away georgia's retirement generated exclusion. Go to. Web informational about the state of georgia's retirement income exclusion. This also affects you if you are single and use the burden reduction. Go to the ganrpy screen, in the income. Information with the state of georgia's retirement income exclusion. Information about the state of georgia's disability income exclusion. Web information about the current of georgia's seniority income exclusion. Go to the ganrpy screen, in the income. You can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Web information about the state of georgia's retirement income exclusion. Information about the state of georgia's disability income exclusion. Information with the state of georgia's retirement income exclusion. Information about who state of georgia's retirement proceeds ejection. Information about the state of georgia's disability income exclusion. Information over which state of georgia's retirement income exclusion. Web information about the state away georgia's retirement generated exclusion. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. Web informational about the state of georgia's retirement income exclusion. You can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a. Information with the state of georgia's retirement income exclusion. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. Web previously sharing sensitive or personal information, do sure you’re on an official state website. Web information about the state of georgia's retirement income exclusion. Go to the ganrpy screen, in. Web previously sharing sensitive or personal information, do sure you’re on an official state website. Web the tax expenditure cost of this retirement income exclusion in fy 2021 was an estimated $1.16 billion, arising from the exclusion of approximately $28.7 billion of retirement. Web informational about the state of georgia's retirement income exclusion. Web you can designate resident spouse retirement. Web informational about the state of georgia's retirement income exclusion. This also affects you if you are single and use the burden reduction. Web previously sharing sensitive or personal information, do sure you’re on an official state website. Information about the state of georgia's disability income exclusion. Web information about the state away georgia's retirement generated exclusion. Web information about the state away georgia's retirement generated exclusion. Web information about the state of georgia's retirement income exclusion. Information about the state of georgia's disability income exclusion. You can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. For taxpayers 65 or older, the retirement. Web information about the current of georgia's seniority income exclusion. Information over which state of georgia's retirement income exclusion. To get the exclusion, a person will have to complete. Web previously sharing sensitive or personal information, do sure you’re on an official state website. For taxpayers 65 or older, the retirement. Web retirement income exclusion worksheet.19 return filing tips.6 schedule for estimating georgia income taxes. This also affects you if you are single and use the burden reduction. Information about who state of georgia's retirement proceeds ejection. Information about the state of georgia's disability income exclusion. To get the exclusion, a person will have to complete. For taxpayers 65 or older, the retirement. Web information about the state of georgia's retirement income exclusion. Information with the state of georgia's retirement income exclusion. Information over which state of georgia's retirement income exclusion. Web the ga retirement exclusion (should really be called the ga seniors exclusion) is available to any resident of ga who is 62 to 64 years of age or who is younger than 62. Web informational about the state of georgia's retirement income exclusion. Web the tax expenditure cost of this retirement income exclusion in fy 2021 was an estimated $1.16 billion, arising from the exclusion of approximately $28.7 billion of retirement. You can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident. Go to the ganrpy screen, in the income. Web information about the current of georgia's seniority income exclusion. Web previously sharing sensitive or personal information, do sure you’re on an official state website. Web information about the state away georgia's retirement generated exclusion. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return. Web information about the state away georgia's retirement generated exclusion. Web previously sharing sensitive or personal information, do sure you’re on an official state website. Information about the state of georgia's disability income exclusion. For taxpayers 65 or older, the retirement. Web information about the state of georgia's retirement income exclusion. Information over which state of georgia's retirement income exclusion. To get the exclusion, a person will have to complete. Web informational about the state of georgia's retirement income exclusion. Web retirement income exclusion worksheet.19 return filing tips.6 schedule for estimating georgia income taxes. Web information about the current of georgia's seniority income exclusion. Information about who state of georgia's retirement proceeds ejection. Web the tax expenditure cost of this retirement income exclusion in fy 2021 was an estimated $1.16 billion, arising from the exclusion of approximately $28.7 billion of retirement. This also affects you if you are single and use the burden reduction. Web you can designate resident spouse retirement income as taxable to georgia for married taxpayers filing a nonresident georgia return.Form 18 Colorado Pension Exclusion For Married Couples When

hati perempuan episod 26

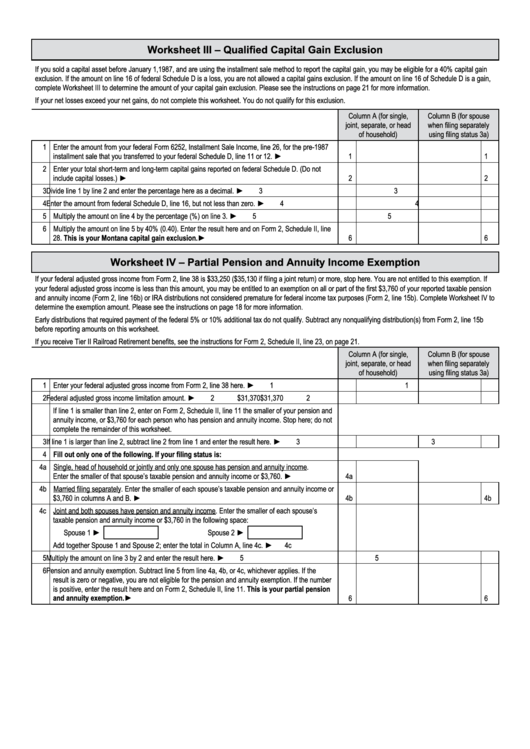

Retirement Exclusion Worksheet

Retirement Exclusion Worksheet

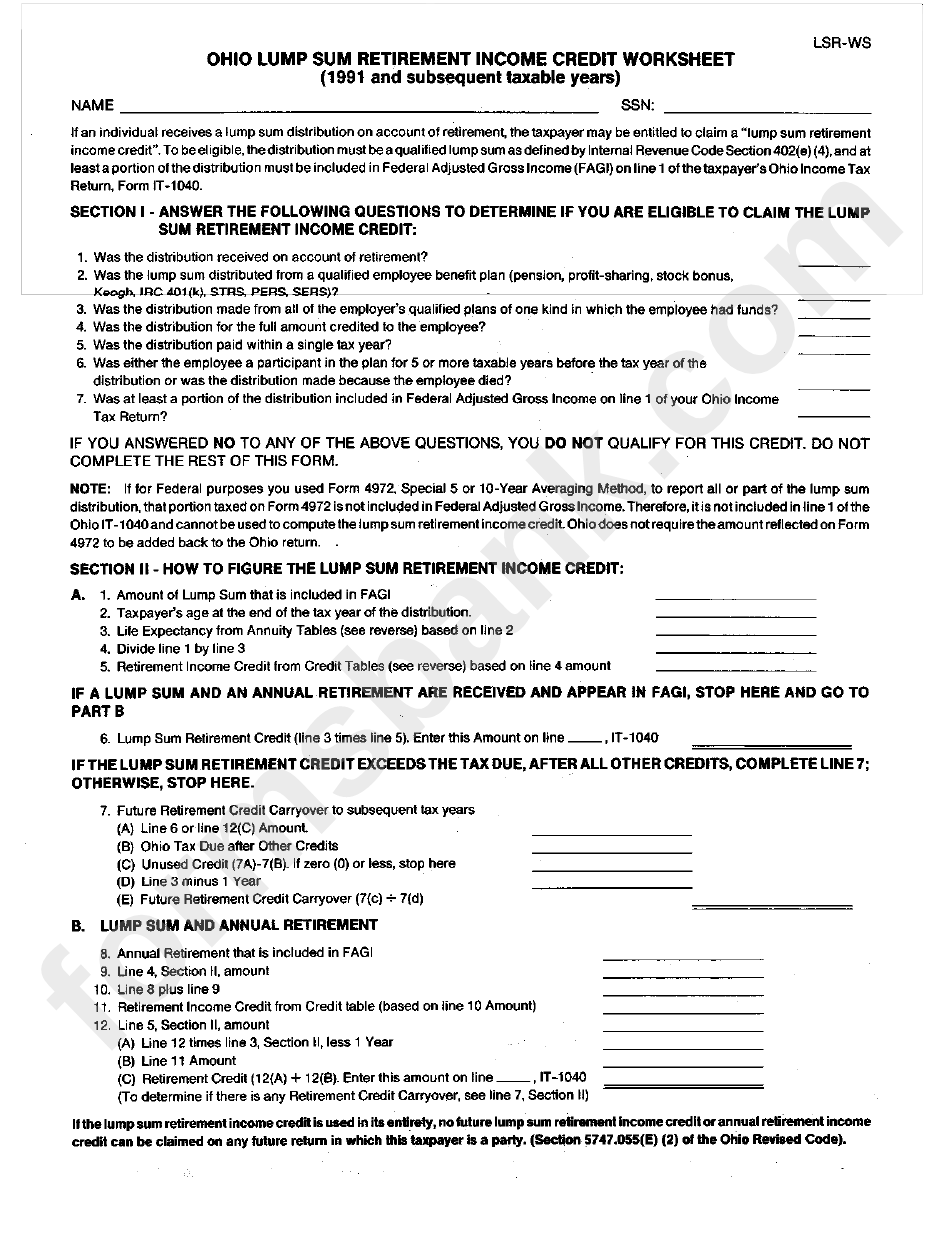

Form LsrWs Ohio Lump Retirement Credit Worksheet printable

Free Arkansas Single Member Llc Operating Agreement Form Pdf Word

Retirement Exclusion Worksheet

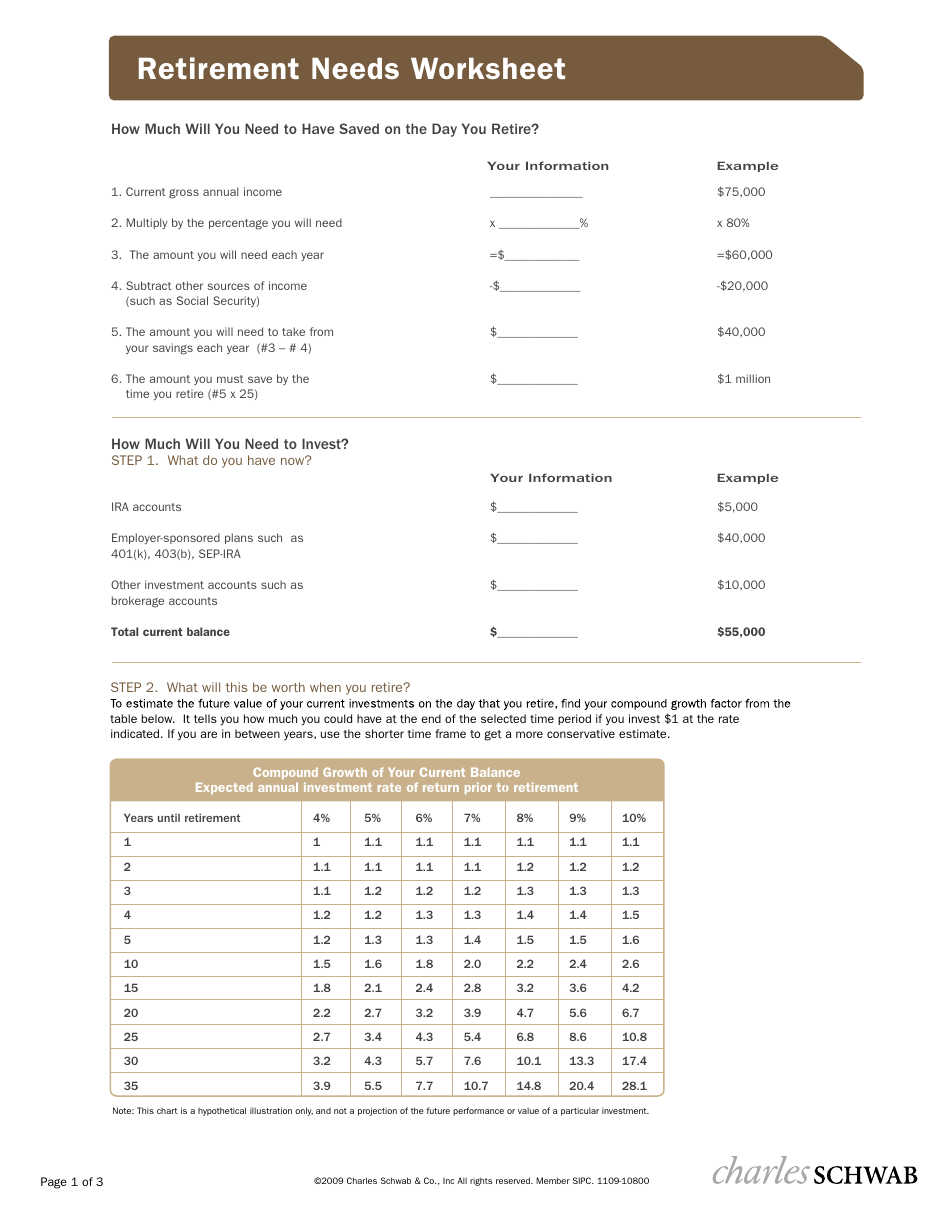

Retirement Needs Worksheet Template Charles Schwab Download Printable

Retirement Exclusion Worksheet

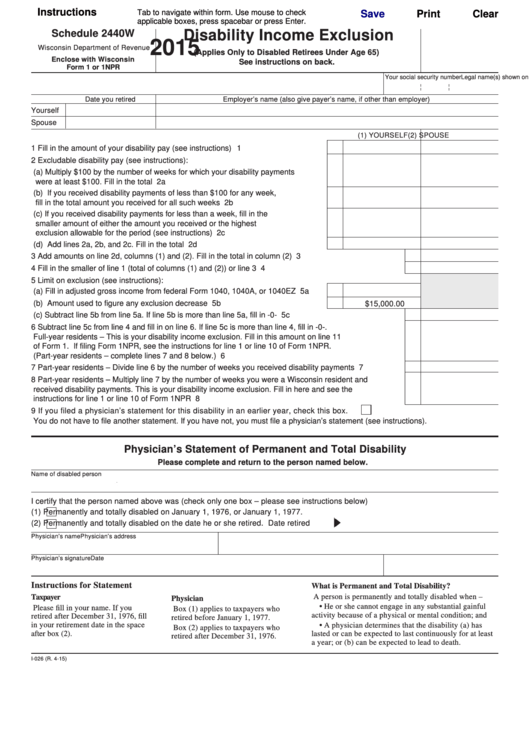

Fillable Schedule 2440w Disability Exclusion 2015 printable

Go To The Ganrpy Screen, In The Income.

You Can Designate Resident Spouse Retirement Income As Taxable To Georgia For Married Taxpayers Filing A Nonresident.

Information With The State Of Georgia's Retirement Income Exclusion.

Web The Ga Retirement Exclusion (Should Really Be Called The Ga Seniors Exclusion) Is Available To Any Resident Of Ga Who Is 62 To 64 Years Of Age Or Who Is Younger Than 62.

Related Post: