Home Office Worksheet

Home Office Worksheet - Direct expenses benefit the business part of your home. Web home office deduction worksheet there are two calculation methods to determine the home office deduction; Home office , deductions , worksheets worksheet for home office expenses fill out this worksheet if you are seeking deductions for your qualified home office. This worksheet will help you track direct and indirect expenses for the home office deduction. Easily create spreadsheets from templates or on your own and use modern formulas to perform calculations. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation for that area. Web form 2106 line 16b from both copies of the employee home office worksheet, when added together, must equal line 16a. Let excel learn your patterns, organize your data, and save you time. Web please use this worksheet to give us information about your home office for preparation of your tax returns. Web standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Web how to make work from home sheets. Web home office worksheet | famiglio & associates: Office home and student 2021 is for students and families who want classic office apps including word, excel, and powerpoint for windows 11 and windows 10. Web please use this worksheet to give us information about your home office for preparation of your tax. Use this spreadsheet to prepare for tax time or to show your costs for your employer! Check out the guidelines below to help you make one for yourself. Mortgage interest, real estate taxes). If your home office is larger than 300 square feet you have two options. Web home office deduction worksheet by michele cagan | mar 15, 2017 |. There are two versions of this worksheet; This worksheet will help you track direct and indirect expenses for the home office deduction. Office home and student 2021 is for students and families who want classic office apps including word, excel, and powerpoint for windows 11 and windows 10. Free interactive exercises to practice online or download as pdf to print.. For instructions and the latest information. Housework and asking for help grade/level: As a result, your maximum deduction amount is $15,000. There are 39 worksheets available on this page and they are all free and easy to download just like all the material here on busy teacher. According to a survey on the website, flexjobs, 74% of the participants believe. Web the essentials to get it all done. Use this spreadsheet to prepare for tax time or to show your costs for your employer! What is the simplified method for determining the home office deduction? The maximum square footage you can use is 300 square feet. Easily create spreadsheets from templates or on your own and use modern formulas to. The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. Housework and asking for help grade/level: As a result, your maximum deduction amount is $15,000. If your home office is larger than 300 square feet you have two options. See tutorial below home office blog post download the free. Unit 1, language, grammar, activity 2 grade/level: Getting to write off your housing costs. Web please use this worksheet to give us information about your home office for preparation of your tax returns. There are 39 worksheets available on this page and they are all free and easy to download just like all the material here on busy teacher. Exclusively. Web home office deduction at a glance. Check out the guidelines below to help you make one for yourself. Applies to us federal taxes. Use this worksheet to report your expenses for your home office. Office home and student 2021 is for students and families who want classic office apps including word, excel, and powerpoint for windows 11 and windows. Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. Check out the guidelines below to help you make one for yourself. There are two versions of this worksheet; No home depreciation deduction or later recapture of depreciation for the years the simplified option is. If your home office is larger than 300 square feet you have two options. No home depreciation deduction or later recapture of depreciation for the years the simplified option is used. If you use part of your home exclusively and regularly for conducting business, you may be able to deduct expenses such as mortgage interest, insurance, utilities, repairs, and depreciation. Applies to us federal taxes. Easily create spreadsheets from templates or on your own and use modern formulas to perform calculations. File only with schedule c (form 1040). A non‐fillable pdf (what you are viewing now) and an online digital form. According to a survey on the website, flexjobs, 74% of the participants believe that working from home has become the new normal. You need to figure out the percentage of your home devoted to your business activities, utilities,. Free interactive exercises to practice online or download as pdf to print. Web please use this worksheet to give us information about your home office for preparation of your tax returns. Web welcome to the section of the site that covers office related topics such as important vocabulary, completing applications, and telephone etiquette. Direct expenses benefit the business part of your home. The purpose of this publication is to provide information on figuring and claiming the deduction for business use of your home. Web du jh & associates, pa www.mytaxhouse.com tel: What is the simplified method for determining the home office deduction? Accurate square footage numbers can be found on your local property appraiser's. Web the essentials to get it all done. Web form 2106 line 16b from both copies of the employee home office worksheet, when added together, must equal line 16a. With so many distractions at home, the use of sheets will help you monitor your productivity. Use this worksheet to report your expenses for your home office. For instructions and the latest information. Web home office worksheet | famiglio & associates: As a result, your maximum deduction amount is $15,000. Web standard deduction of $5 per square foot of home used for business (maximum 300 square feet). Home office , deductions , worksheets worksheet for home office expenses fill out this worksheet if you are seeking deductions for your qualified home office. Expenses for business use of your home. Accurate square footage numbers can be found on your local property appraiser's. According to a survey on the website, flexjobs, 74% of the participants believe that working from home has become the new normal. File only with schedule c (form 1040). If your home office is larger than 300 square feet you have two options. This office worksheet was designed with intermediate. Web to calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. Unit 1, language, grammar, activity 2 grade/level: Use this spreadsheet to prepare for tax time or to show your costs for your employer! Check out the guidelines below to help you make one for yourself. Office home and student 2021 is for students and families who want classic office apps including word, excel, and powerpoint for windows 11 and windows 10. With so many distractions at home, the use of sheets will help you monitor your productivity. You need to figure out the percentage of your home devoted to your business activities, utilities,.JPG Home Office Design Color Worksheet Jones Paint and Glass

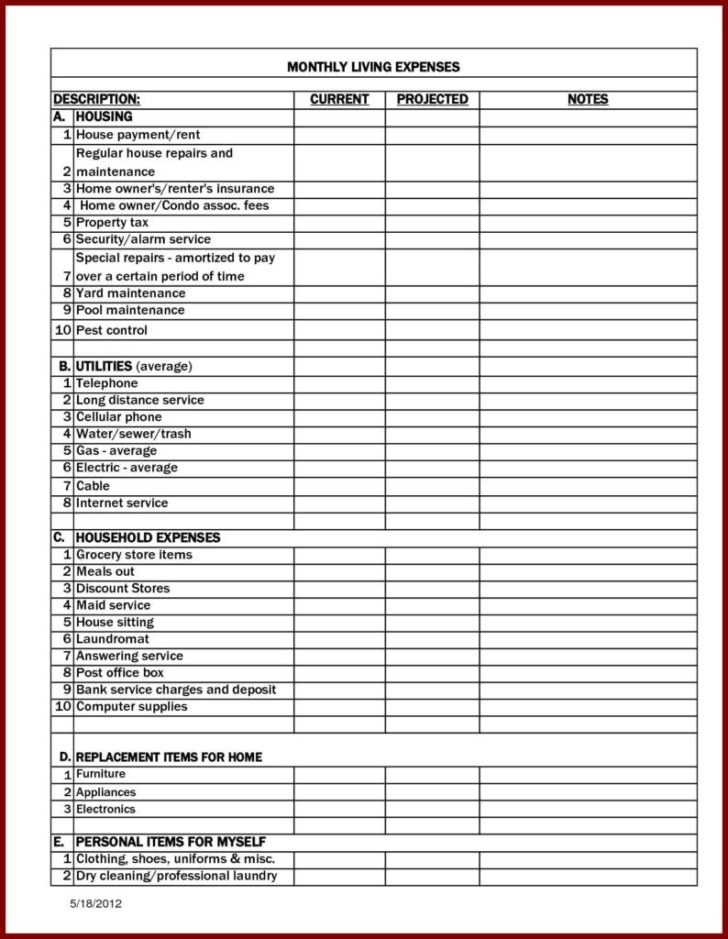

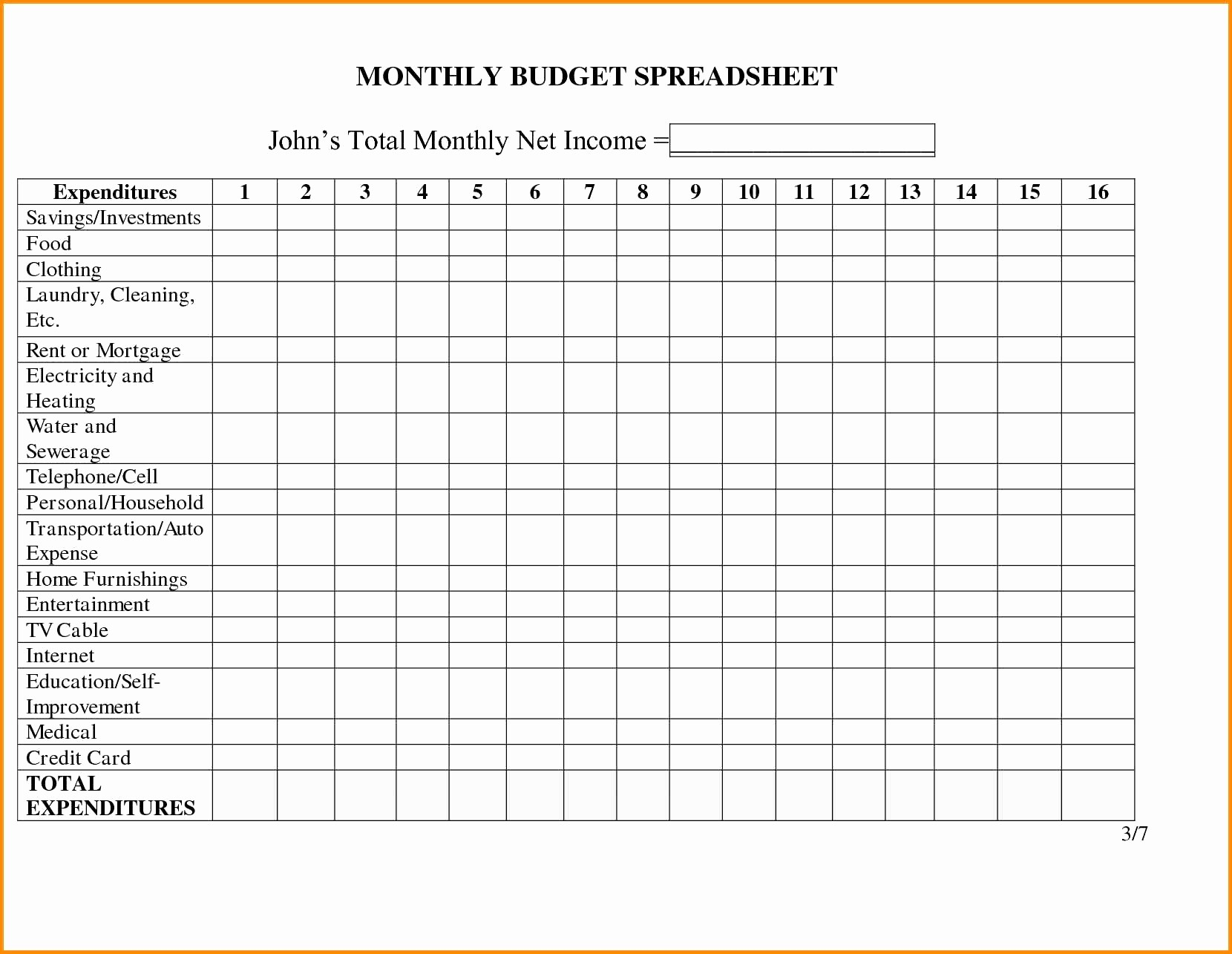

Home Office Deduction Worksheet —

home office worksheet

Home Office Deduction Worksheet HMDCRTN

Home Office Expense Spreadsheet Printable Spreadsheet home office tax

Fillable Online Home office worksheet Fax Email Print pdfFiller

CPA Prepared Home Office Deduction Worksheet Etsy

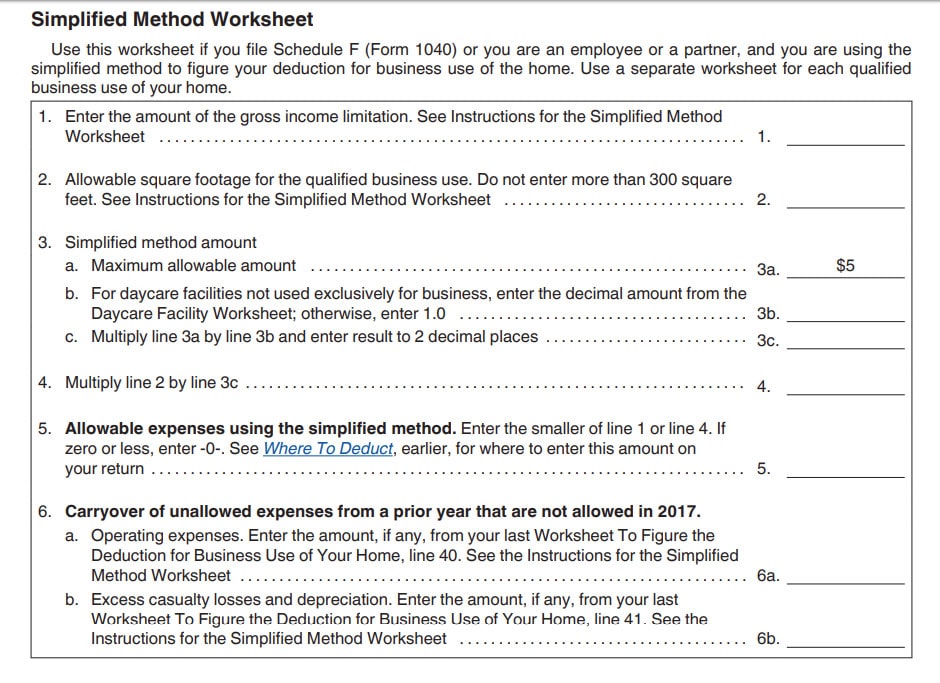

Simplified Method Worksheet 2021 Home Office Simplified Method

Sheet Printable Images Gallery Category Page 18

Home Office Tax Deduction What to Know Fast Capital 360®

The Purpose Of This Publication Is To Provide Information On Figuring And Claiming The Deduction For Business Use Of Your Home.

The Maximum Square Footage You Can Use Is 300 Square Feet.

See Tutorial Below Home Office Blog Post Download The Free Spreadsheet You Will Be Able To Choose An Excel

Cost Of Painting Or Repairs Made To The Specific Area Or Room Direct Expenses Indirect Expenses

Related Post: