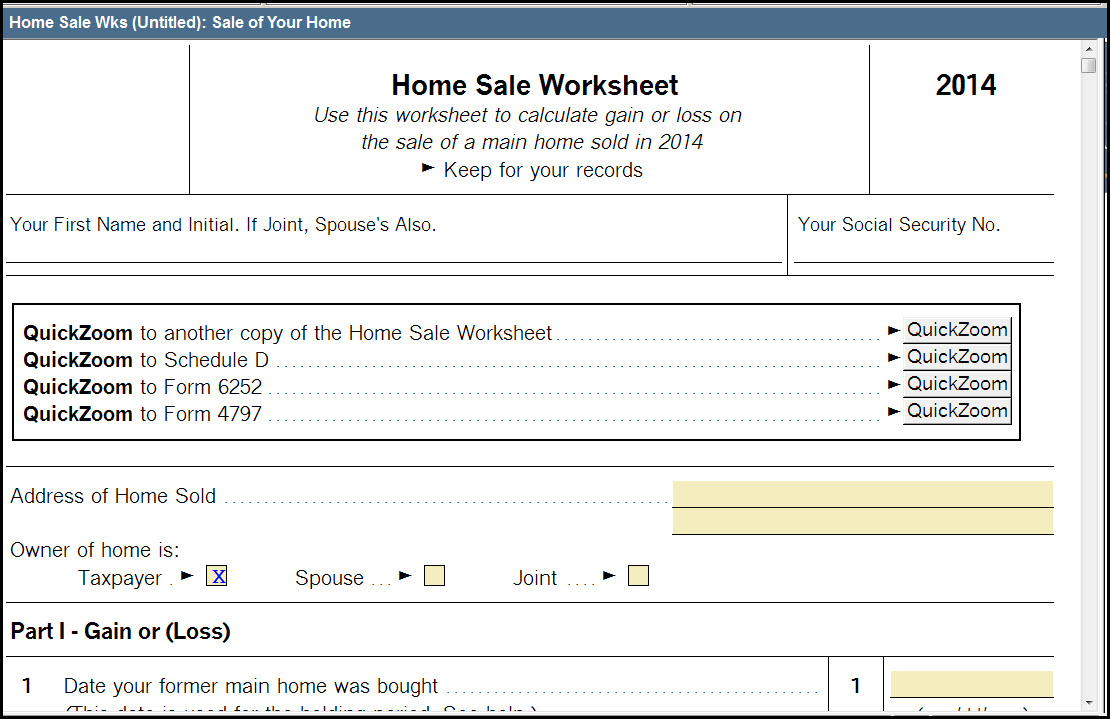

Home Sale Exclusion Worksheet

Home Sale Exclusion Worksheet - View pictures of homes, review sales history, and use our detailed filters to find the perfect place. Web according to the internal revenue service in topic 701 “sale of your home”, “you’re eligible for the exclusion if you have owned and used your home as your main. Browse houses for sale in yuba city today! Web you will then need to complete the taxable gain on sale of home worksheet in irs publication 523 to determine the portion of the gain that qualifies to be excluded from. If i take out the home sale worksheet, it counts the full amount as capital. Fees you may have paid when you bought your home: Web taxpayer’s only have to pay taxes on the gain on the sale of a home (and part of that gain may be excluded from taxation using part ii of the worksheet). Find your exclusion limit use this worksheet only if no automatic disqualifications apply, and take all exceptions into account. Use this worksheet only if no automatic. The gain is calculated as:. (sp) adjustments to the sale: Browse photos, see new properties, get open house info, and research neighborhoods on trulia. Web taxpayer’s only have to pay taxes on the gain on the sale of a home (and part of that gain may be excluded from taxation using part ii of the worksheet). Web worksheets are included in publication 523, selling your. Yuba city homes for sale (27) sort: Web gain from the sale of your home from your income and avoid paying taxes on it. Web you will then need to complete the taxable gain on sale of home worksheet in irs publication 523 to determine the portion of the gain that qualifies to be excluded from. Web check here if. Web search yuba city real estate property listings to find homes for sale in yuba city, ca. Web assets with disposition losses cannot be linked to. when i do the federal review. Web you will then need to complete the taxable gain on sale of home worksheet in irs publication 523 to determine the portion of the gain that qualifies. Web assets with disposition losses cannot be linked to. when i do the federal review. (sp) adjustments to the sale: Browse houses for sale in yuba city today! Web yuba city ca real estate & homes for sale. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the. Web you will then need to complete the taxable gain on sale of home worksheet in irs publication 523 to determine the portion of the gain that qualifies to be excluded from. Find your exclusion limit use this worksheet only if no automatic disqualifications apply, and take all exceptions into account. (sp) adjustments to the sale: Publication 523 (2017) page. 3120 live oak blvd unit 63, yuba city, ca 95991. (sp) adjustments to the sale: The gain is calculated as:. The exclusion is increased to $500,000 for a married couple filing jointly. Web taxpayer’s only have to pay taxes on the gain on the sale of a home (and part of that gain may be excluded from taxation using part. Use this worksheet only if no automatic. Browse photos, see new properties, get open house info, and research neighborhoods on trulia. Publication 523 (2017) page 7 Find your exclusion limit use this worksheet only if no automatic disqualifications apply, and take all exceptions into account. Web to view the schedule d home sale worksheet which shows the calculation of the. Web yuba city ca real estate & homes for sale. Web assets with disposition losses cannot be linked to. when i do the federal review. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Yuba city homes for sale (27) sort: Browse. If i take out the home sale worksheet, it counts the full amount as capital. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Adjusted basis of the home you sold gain (or loss) on the sale gain that you can. Web. Browse photos, see new properties, get open house info, and research neighborhoods on trulia. Web 72 single family homes for sale in yuba city ca. Web according to the internal revenue service in topic 701 “sale of your home”, “you’re eligible for the exclusion if you have owned and used your home as your main. 3120 live oak blvd unit. Browse photos, see new properties, get open house info, and research neighborhoods on trulia. The exclusion is increased to $500,000 for a married couple filing jointly. If i take out the home sale worksheet, it counts the full amount as capital. The gain is calculated as:. 3120 live oak blvd unit 63, yuba city, ca 95991. Web to view/print the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Web 107 homes for sale in yuba city, ca. Yuba city homes for sale (27) sort: Fees you may have paid when you bought your home: Web taxpayer’s only have to pay taxes on the gain on the sale of a home (and part of that gain may be excluded from taxation using part ii of the worksheet). Use this worksheet only if no automatic. Web assets with disposition losses cannot be linked to. when i do the federal review. (sp) adjustments to the sale: Web according to the internal revenue service in topic 701 “sale of your home”, “you’re eligible for the exclusion if you have owned and used your home as your main. Browse houses for sale in yuba city today! Web worksheets are included in publication 523, selling your home, to help you figure the: Web fill out the sale of main home worksheet in the schedule d, other menu to see if any of the gain from the sale of their main home can be excluded. View pictures of homes, review sales history, and use our detailed filters to find the perfect place. Adjusted basis of the home you sold gain (or loss) on the sale gain that you can. Web you will then need to complete the taxable gain on sale of home worksheet in irs publication 523 to determine the portion of the gain that qualifies to be excluded from. Publication 523 (2017) page 7 Fees you may have paid when you bought your home: View pictures of homes, review sales history, and use our detailed filters to find the perfect place. Web search yuba city real estate property listings to find homes for sale in yuba city, ca. Web 107 homes for sale in yuba city, ca. Web gain from the sale of your home from your income and avoid paying taxes on it. Web worksheets included in publication 523, selling your home can help taxpayers figure the adjusted basis of the home sold, the gain or loss on the sale, and. Web you will then need to complete the taxable gain on sale of home worksheet in irs publication 523 to determine the portion of the gain that qualifies to be excluded from. Web assets with disposition losses cannot be linked to. when i do the federal review. Web follow these steps to enter the sale of a home using the home sale worksheet: The gain is calculated as:. Web yuba city ca real estate & homes for sale. If i take out the home sale worksheet, it counts the full amount as capital. Browse houses for sale in yuba city today! Web taxpayer’s only have to pay taxes on the gain on the sale of a home (and part of that gain may be excluded from taxation using part ii of the worksheet). Web fill out the sale of main home worksheet in the schedule d, other menu to see if any of the gain from the sale of their main home can be excluded.Unusual homes for sale worksheet

Entering A Sale of Home With Section 121 Exclusion Accountants Community

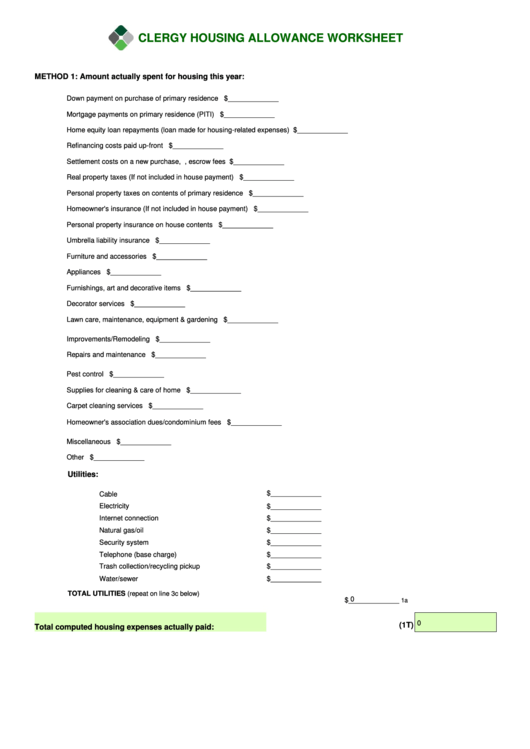

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

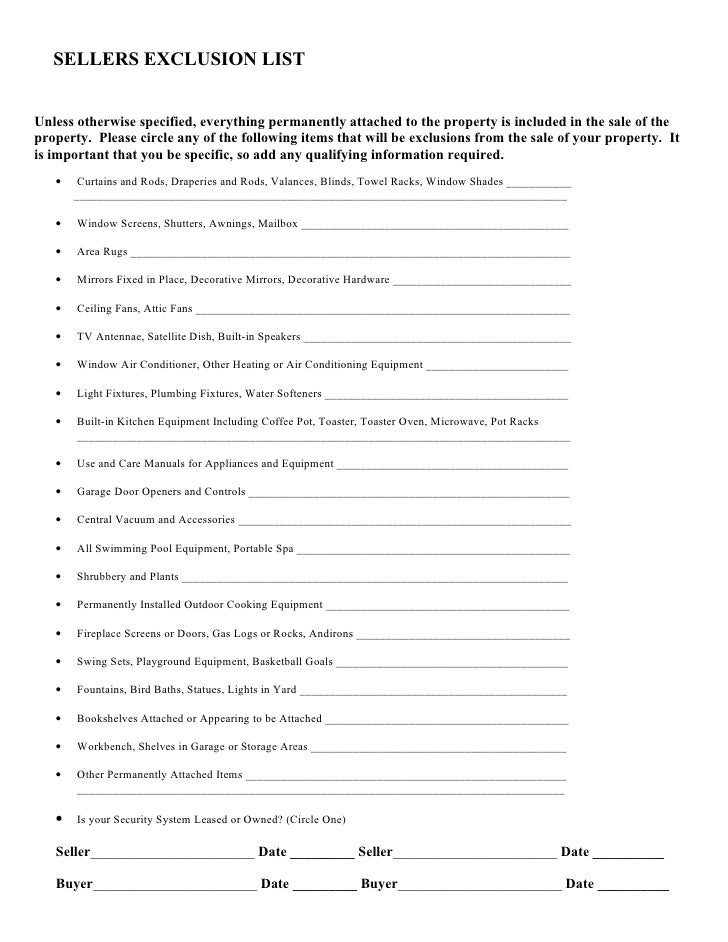

Seller Exclusion List

Schedule d Fill out & sign online DocHub

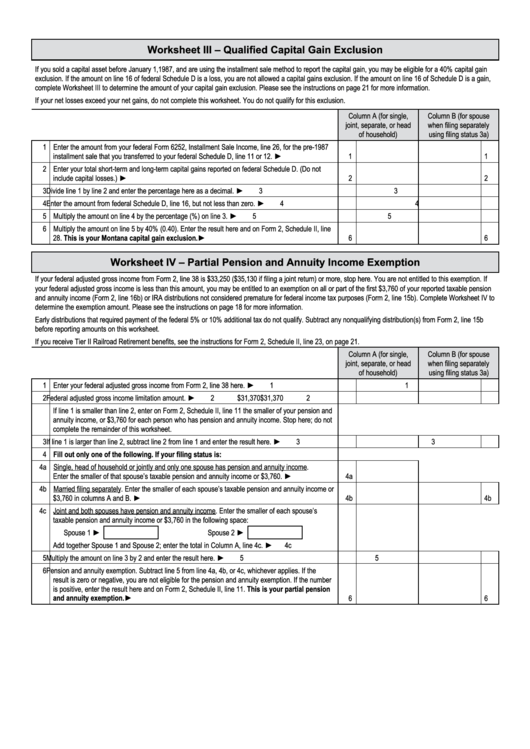

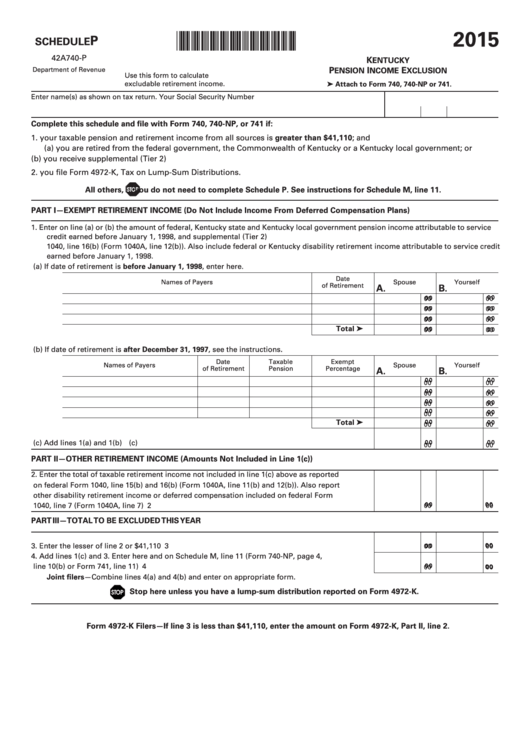

Retirement Exclusion Worksheet

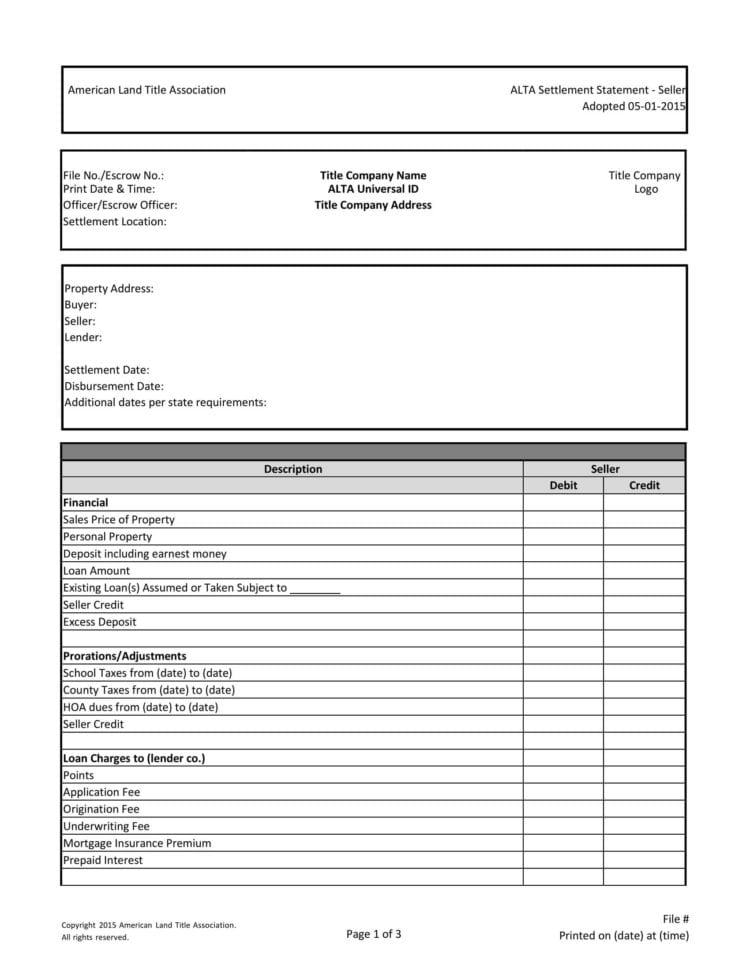

Sale Of Home Worksheet —

Retirement Exclusion Worksheet

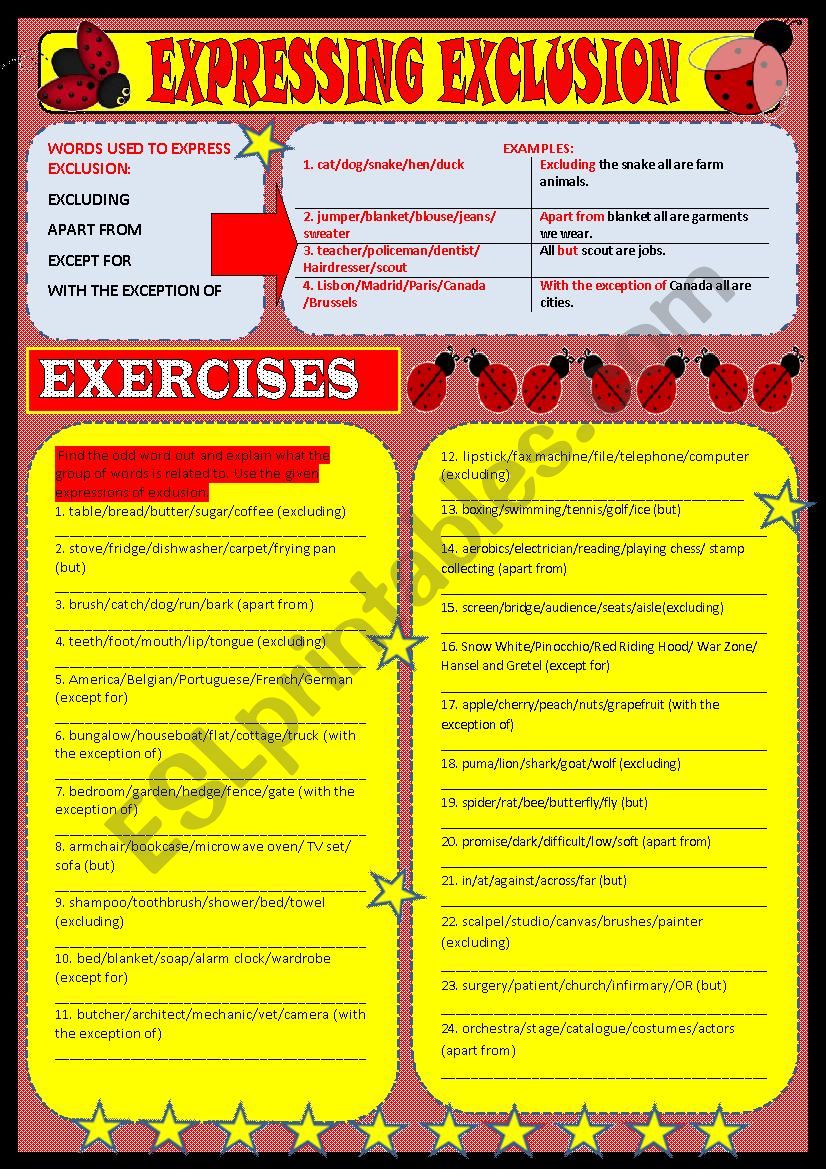

Expressing Exclusion ESL worksheet by Marília Gomes

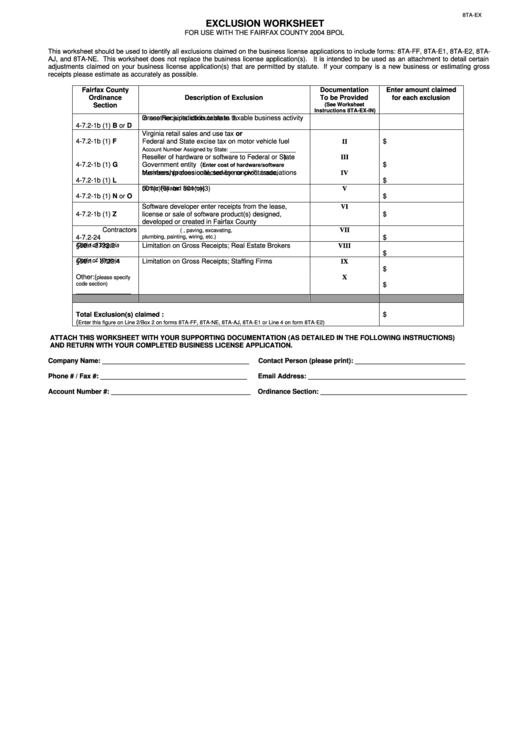

Form 8taEx Exclusion Worksheet For Use With The Fairfax County 2004

Web Worksheets Are Included In Publication 523, Selling Your Home, To Help You Figure The:

Find Your Exclusion Limit Use This Worksheet Only If No Automatic Disqualifications Apply, And Take All Exceptions Into Account.

3120 Live Oak Blvd Unit 63, Yuba City, Ca 95991.

Web To View The Schedule D Home Sale Worksheet Which Shows The Calculation Of The Gain/Loss, Exclusion And/Or Taxable Gain Of The Entries Made In The Return:

Related Post: